Business valuation. Methods for estimating the value of an enterprise's business. Business valuation methods

Estimates of any asset: comparative (direct market comparison approach), profitable (income approach) and costly (cost approach) (see Diagram No. 1).

Diagram #1. Approaches to assessing the value of the company.

In Russia, valuation activities are regulated by the Law on Valuation Activities and the Federal Valuation Standards (FSO).

In each approach there are evaluation methods. So the income approach is based on 2 methods: the capitalization method and the discounted cash flow method. The comparative approach consists of 3 methods: the capital market method, the transaction method and the industry coefficient method. The cost approach relies on 2 methods: the net asset method and the salvage value method.

income approach.

Income approach - a set of methods for assessing the value of the object of assessment, based on the determination of expected income from the use of the object of assessment (clause 13 of the FSO No. 1).

In the income approach, the value of a company is determined on the basis of expected future income and discounted to the current value that the company being valued can bring.

The present value theory was first formulated by Martin de Azpilcueta, a representative of the Salamanca school, and is one of the key principles of modern financial theory.

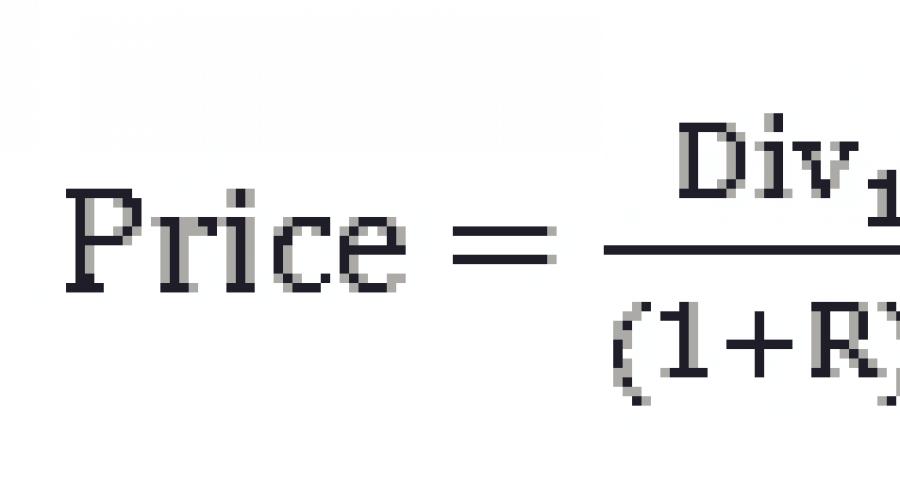

The discounted dividend model is fundamental to the discounted cash flow model. The discounted dividend model was first proposed by John Williams after the US crisis of the 1930s.

The DDM formula looks like this:

Where

Price - share price

Div - dividends

R - discount rate

g - dividend growth rate

However, dividend payments are currently very rarely used to measure the fair value of equity. Why? Because if you use dividend payouts to estimate the fair value of equity, then almost all stocks in the stock markets around the world will appear overpriced to you for very simple reasons:

Thus, the DDM model is now more used to estimate the fundamental value of a company's preferred shares.

Stephen Ryan, Robert Hertz and others in their article say that the DCF model has become the most common, as it has a direct connection with the theory of Modeliani and Miller, since free cash flow is a cash flow that is available to all holders of the capital of the company, as holders of debts and equity holders. Thus, with the help of DCF, both the company and the share capital can be valued. Next, we will show what the difference is.

The formula of the DCF model is identical to formula #2, the only thing is that free cash flow is used instead of dividends.

![]()

Where

FCF is free cash flow.

Since we have moved to the DCF model, let's take a closer look at the concept of cash flow. In our opinion, the most interesting classification of cash flows for evaluation purposes is given by A. Damodaran.

Damodaran distinguishes 2 types of free cash flows that must be discounted to determine the value of the company:

In order to move on, we already need to show the difference in the value of the company and the cost of equity capital. The company operates on invested capital, and invested capital may include both equity capital and various proportions of equity and debt capital. Thus, using FCFF, we determine the fundamental value of invested capital. In the literature in English, you can find the concept of Enterprise value or the abbreviation EV. That is, the value of the company, taking into account borrowed capital.

Formulas No. 4, No. 5 and No. 6 present free cash flow calculations.

Where EBIT is earnings before interest and income tax;

DA - depreciation;

Investments - investments.

Sometimes in the literature you can find another formula for FCFF, for example, James English uses formula #5, which is identical to formula #4.

Where

CFO - cash flow from operating activities (cash provided by operating activities);

Interest expense – interest expenses;

T is the income tax rate;

CFI - cash flow from investment activities (cash provided by investing activities).

Where

Net income - net profit;

DA - depreciation;

∆WCR - changes in required working capital;

Investments - investments;

Net borrowing is the difference between received and repaid loans/loans

Formula #7 shows how you can get the cost of equity from the value of the company.

Where

EV is the value of the company;

Debt - debts;

Cash - cash equivalents and short-term investments.

It turns out that there are 2 types of valuation based on DCF cash flows depending on the cash flows. In formula No. 8, the company's valuation model, taking into account debts, and in formula No. 9, the equity valuation model. To assess the fundamental value of a company or equity, you can use both formula No. 8 and formula No. 9 together with formula No. 7.

Below are two-stage evaluation models:

Where

WACC - weighted average cost of capital

g - the growth rate of cash flows that persists indefinitely

As you can see, we have WACC (weighted average cost of capital) and Re (cost of equity) instead of the abstract discount rate R in equations #11 and #12, and this is no coincidence. As Damodaran writes, “the discount rate is a function of the risk of expected cash flows.” Since the risks of shareholders and creditors are different, it is necessary to take this into account in valuation models through the discount rate. Next, we will return to WACC and Re and take a closer look at them.

The problem with the two-stage model is that it assumes that after a phase of rapid growth, stabilization immediately occurs and then incomes grow slowly. Despite the fact that, according to the author's observations, in practice, most analysts use two-stage models, it is more correct to use a three-stage model. The three-stage model adds a transitional stage from rapid growth to stable income growth.

Damodaran in one of his training materials very well shows graphically the difference between two- and three-stage models (see Figure #1).

Figure #1. two- and three-stage models.

Source: Aswath Damodaran, Closure in Valuation: Estimating Terminal Value. Presentation, slide #17.

Below are three-stage models for assessing the value of the company and equity:

Where

n1 - the end of the initial period of rapid growth

n2 - end of transition period

Let's get back to the discount rate. As we wrote above, for the purposes of discounting, WACC (weighted average cost of capital) and Re (cost of equity) are used in the valuation of a company or share capital.

The concept of the weighted average cost of capital WACC was first proposed by Modeliani and Miller in the form of a formula that looks like this:

Where

Re - cost of equity

Rd is the cost of borrowed capital

E - the value of equity

D - value of borrowed capital

T - income tax rate

We have already said that the discount rate shows the risk of expected cash flows, so in order to understand the risks associated with the company's cash flows (FCFF), it is necessary to determine the capital structure of the organization, that is, what share of equity in invested capital and what share occupies borrowed capital in inverted capital.

If a public company is analyzed, then it is necessary to take into account the market values of equity and borrowed capital. For non-public companies, it is possible to use the balance sheet values of own and borrowed capital.

After the capital structure is determined, it is necessary to determine the cost of equity capital and the cost of borrowed capital. To determine the cost of equity (Re), there are many methods, but the most commonly used is the CAPM (capital asset pricing model), which is based on the Markowitz portfolio theory. The model was proposed independently by Sharpe and Lintner. (see Formula No. 16).

![]()

Where

Rf is the risk-free rate of return

b - beta coefficient

ERP - equity risk premium

The CAPM model says that the expected return of an investor consists of 2 components: the risk-free rate of return (Rf) and equity risk premiums (ERP). The risk premium itself is adjusted for the systematic risk of the asset. Systematic risk is denoted by beta (b). Thus, if the beta is greater than 1, this means that the asset appears to be riskier than the market, and thus the investor's expected return will be higher. Well, if the beta is less than 1, this means that the asset is less risky than the market and thus the investor's expected return will be lower.

Determining the cost of borrowed capital (Rd) does not seem to be a problem, if the company has bonds, their current yield can be a good guideline at what rate the company can attract borrowed capital.

However, as you know, companies are not always financed by financial markets, so A. Damodaran proposed a method that allows you to more accurately determine the current cost of borrowed capital. This method is often referred to as synthetic. Below is the formula for determining the cost of borrowed capital by the synthetic method:

Where

COD - cost of borrowed capital

Company default spread – company default spread.

The synthetic method is based on the following logic. The coverage ratio of the company is determined and compared with publicly traded companies and the default spread (the difference between the current bond yield and the yield on government bonds) of comparable companies is determined. Next, the bersie rate of return is taken and the found spread is added.

To value a company using free cash flows to equity (FCFE), the cost of equity (Re) is used as the discount rate.

So, we have described a theoretical approach to assessing the value of a company based on cash flows. As you can see, the company's value depends on future free cash flows, discount rate and post-forecast growth rates.

Comparative approach

Comparative approach - a set of methods for assessing the value of the object of assessment, based on a comparison of the object of assessment with objects - analogues of the object of assessment, in respect of which information on prices is available. An object - an analogue of the object of assessment for the purposes of assessment is recognized as an object similar to the object of assessment in terms of the main economic, material, technical and other characteristics that determine its value (clause 14, FSO No. 1).

The assessment of a company based on a comparative approach is carried out by the following algorithm:

- Collection of information about sold companies or their blocks of shares;

- Selection of peer companies according to the criteria:

- Industry similarity

- Related Products

- Company size

- Growth prospects

- Management quality

- Conducting financial analysis and comparison of the company being valued and peer companies in order to identify the closest analogues of the company being valued;

- Selection and calculation of cost (price) multipliers;

- Formation of the final value.

The value multiplier is a ratio that shows the ratio of the value of invested capital (EV) or equity (P) to the company's financial or non-financial performance.

The most common multipliers are:

- P/E (market capitalization to net income)

- EV/Sales (company value to company revenue)

- EV/EBITDA (company value to EBITDA)

- P/B (market capitalization to book value of equity).

In a comparative approach, it is customary to distinguish three methods of evaluation:

- Capital market method;

- Transaction method;

- Method of branch coefficients.

The capital market method relies on the use of stock market analogue companies. The advantage of the method lies in the use of factual information. What is important, this method allows you to find prices for comparable companies on almost any day, due to the fact that securities are traded almost every day. However, it should be emphasized that with the help of this method, we evaluate the value of the business at the level of a non-controlling stake, since controlling stakes are not sold on the stock market.

The transaction method is a special case of the capital market method. The main difference from the capital market method is that this method determines the level of the cost of the controlling stake, as the company's analogues are selected from the corporate control market.

The method of industry coefficients is based on the recommended ratios between the price and certain financial indicators. The calculation of industry coefficients is based on statistical data for a long period. Due to the lack of sufficient data, this method is practically not used in the Russian Federation.

As mentioned above, the capital market method determines the value of a freely realizable minority interest. Therefore, if an appraiser needs to obtain a value at the level of a controlling interest and information is available only for public companies, then it is necessary to add a control premium to the value calculated by the capital market method. Conversely, to determine the value of a minority stake, the discount for non-controlling nature must be deducted from the value of a controlling interest that was found using the transaction method.

Cost approach

Cost approach - a set of methods for estimating the value of the object of assessment, based on the determination of the costs necessary for the reproduction or replacement of the object of assessment, taking into account wear and tear and obsolescence. The costs of reproducing the appraisal object are the costs necessary to create an exact copy of the appraisal object using the materials and technologies used to create the appraisal object. The cost of replacing the object of assessment are the costs necessary to create a similar object using materials and technologies in use at the date of assessment (clause 15, FSO No. 1).

I would like to immediately note that the value of the enterprise based on the liquidation value method does not correspond to the value of the liquidation value. The liquidation value of the appraisal object based on paragraph 9 of FSO No. 2 reflects the most probable price at which this appraisal object can be alienated for the period of exposure of the appraised object, which is less than the typical exposure period for market conditions, in conditions when the seller is forced to make a transaction for the alienation of property. When determining the liquidation value, in contrast to determining the market value, the influence of extraordinary circumstances is taken into account, forcing the seller to sell the appraised object on conditions that do not correspond to market ones.

Used Books

- Lintner, John. (1965), Security Prices, Risk and Maximal Gains from Diversification, Journal of Finance, December 1965, 20(4), pp. 587-615.

- M. J. Gordon, Dividends, Earnings, and Stock Prices. The Review of Economics and Statistics

- Marjorie Grice Hutchinson,

- Sharpe, William F. (1964), Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk, The Journal of Finance, Vol. 19, no. 3 (Sep., 1964), pp. 425-442.

- Stephen G. Ryan, Chair; Robert H. Herz; Teresa E. Iannaconi; Lauren A. Maines; Krishna Palepu; Katherine Schipper; Catherine M. Schrand; Douglas J. Skinner; Linda Vincent, American Accounting Association's Financial Accounting Standards Committee Response to FASB Request to Comment on Goodwill Impairment Testing using the Residual Income Valuation Model. The Financial Accounting Standards Committee of the American Accounting Association, 2000.,

- Vol. 41, no. 2, Part 1 (May, 1959), pp. 99-105 (article consists of 7 pages)

- I.V. Kosorukova, S.A. Sekachev, M.A. Shuklina, Valuation of securities and business. MFPA, 2011.

- Kosorukova I.V. Lecture summary. Business valuation. IFRU, 2012.

- Richard Braley, Stuart Myers, Principles of Corporate Finance. Troika Dialog Library. Olymp-Business Publishing House, 2007.

- William F. Sharp, Gordon J. Alexander, Geoffrey W. Bailey, Investments. Publishing house Infra-M, Moscow, 2009.

Proposed New International Valuation Standards. Exposure Draft. International Valuation Standard Council, 2010.

Marjorie Grice-Hutchinson, The School of Salamanca Reading in Spanish Monetary Theory 1544-1605. Oxford University Press, 1952.

John Burr Williams, the Theory of Investment Value. Harvard University Press 1938; 1997 reprint, Fraser Publishing.

Capitalization of Apple on 4/11/2011.

Stephen G. Ryan, Chair; Robert H. Herz; Teresa E. Iannaconi; Lauren A. Maines; Krishna Palepu; Katherine Schipper; Catherine M. Schrand; Douglas J. Skinner; Linda Vincent, American Accounting Association's Financial Accounting Standards Committee Response to FASB Request to Comment on Goodwill Impairment Testing using the Residual Income Valuation Model. The Financial Accounting Standards Committee of the American Accounting Association, 2000.

Aswat Damodaran, Investment appraisal. Tools and methods for valuation of any assets. Alpina Publisher, 2010

Damodaran uses the term firm in his work, which is identical to our term company.

James English, Applied Equity Analysis. Stock Valuation Techniques for Wall Street Professionals. McGraw-Hill, 2001.

If the company has a minority interest, then the minority interest must also be subtracted from the value of the company to arrive at the cost of equity.

Z. Christopher Mercer and Travis W. Harms, scientific editors V.M. Ruthauser, Integrated Theory of Business Valuation. Publishing house Maroseyka, 2008.

M. J. Gordon, Dividends, Earnings, and Stock Prices. The Review of Economics and Statistics Vol. 41, no. 2, Part 1 (May, 1959), pp. 99-105 (article consists of 7 pages)

Z. Christopher Mercer and Travis W. Harms, scientific editors V.M. Ruthauser, Integrated Theory of Business Valuation. Publishing house Maroseyka, 2008.

Modigliani F., Miller M. H. The cost of capital, corporation finance and the theory of investment. American Economic Review, Vol. 48, pp. 261-297, 1958.

What methods (methods) are used to assess the value of a business? How is business valuation carried out by example and what are the goals for this? What documents are needed to assess the business of an enterprise?

Hello everyone who visited our resource! In touch Denis Kuderin is an expert and one of the authors of the popular HeatherBober magazine.

In today's publication, we will talk about what a business valuation is and why it is needed. The material will be of interest to present and future entrepreneurs, directors and managers of commercial companies and all those who are close to business and financial topics.

Those who read the article to the end will get a guaranteed bonus - an overview of the best Russian companies specializing in business valuation, plus advice on choosing a reliable and competent appraiser.

1. What is a business valuation and when is it needed?

Any business - whether it is a plastic cup manufacturing company or an automotive complex - strives to develop and expand its sphere of influence. However, it is impossible to correctly assess your prospects without a comprehensive analysis of the current state of affairs.

It is business valuation that gives owners and managers of existing commercial enterprises a real picture of the company's assets and its potential.

When does a business need an appraisal?

- sale of the entire enterprise or its shares in the form of shares;

- rent of an operating business;

- development of new investment directions in order to expand and develop the company;

- revaluation of funds;

- reorganization of the company - merger, separation of individual objects into independent structures;

- liquidation of the company as a result of bankruptcy or termination of activities;

- issue or sale of shares;

- optimization of production and business activities;

- changing the format of the company;

- leadership change;

- transfer of assets as collateral;

- transfer of shares of the enterprise to the authorized capital of a large holding;

- company insurance.

As you can see, there are many situations in which a business needs a professional assessment. But the main goal of such a procedure is always the same - a competent analysis of the financial efficiency of the enterprise as a means of making a profit.

When initiating business valuation activities, stakeholders want to know what revenues a particular business structure is generating or will generate in the future. Sometimes the task of the assessment is even more specific - to answer the questions: develop or sell the company, liquidate it or try to reorganize, whether to attract new investors?

The value of a business is an indicator of its success and efficiency. The market price of a company consists of its assets and liabilities, the value of personnel, competitive advantages, profitability indicators for the entire period of existence or a specific time period.

Small business owners and individual entrepreneurs may have a question - is it possible to evaluate the enterprise on their own? Alas, the answer is no. Business is a complex and multifaceted category. You can get a rough estimate, but it is unlikely to be objective.

And one more important nuance - independently obtained data do not have an official status. They cannot be considered as full-fledged arguments and will not be accepted, for example, in court or as.

2. What are the goals of business valuation - 5 main goals

So, let's consider the main tasks that are solved during the business valuation procedure.

Goal 1. Improving the efficiency of enterprise management

Efficient and competent enterprise management is an indispensable condition for success. The financial status of the company is characterized by indicators of stability, profitability and sustainability.

Such an assessment is needed mainly for internal use. The procedure identifies excess assets that slow down production and undervalued industries that can bring profit in the future. It is clear that the first must be disposed of, the second - to develop.

Example

In the course of a business assessment in a trading company, it turned out that the use of rented warehouses for storing products is 20-25% cheaper than maintaining and maintaining their own premises, which are on the balance sheet.

The company decides to sell its warehouses and continue to use only leased space. There are cost savings and optimization of production processes.

Goal 2. Purchase and sale of shares in the stock market

The management of the company decides to sell its shares on the stock market. To make an economically viable decision, you need to evaluate the property and correctly calculate the share that is invested in securities.

Selling shares is the main way to sell a business. You can sell the company as a whole or in parts. Obviously, the cost of a controlling stake will always be higher than the price of individual shares.

At the same time, valuation is important for both stockholders and buyers. It is also desirable that the appraiser not only name the market price of the package, but also analyze the prospects for the development of the business as a whole.

Goal 3. Making an investment decision

Such an assessment is carried out at the request of a specific investor who wants to invest in an existing enterprise. Investment value is the potential ability of invested funds to generate income.

The appraiser finds out the most objective market value of the project from the point of view of the investment perspective. Take into account, for example, the prospects for the development of the industry in a particular region, the direction of financial flows in this area, the general economic situation in the country.

More information - in the article "".

Goal 4. Enterprise restructuring

The main goal of the owner ordering an appraisal during the restructuring of the company is to choose the most optimal approach to the processes of changing the structure of the company.

Restructuring is usually carried out in order to improve business efficiency. There are several types of restructuring - merging, accession, separation of independent elements. Evaluation helps to carry out these procedures with minimal financial costs.

With the complete liquidation of the object, the assessment is needed mainly for making decisions on the return of debts and the sale of property at free auction.

In the process of restructuring, it is often required to carry out, the current assets and liabilities of the company, complete.

Goal 5. Development of an enterprise development plan

Development strategy development is impossible without assessing the current status of the company. Knowing the real value of assets, the level of profitability and the current balance, you will rely on objective information when drawing up a business plan.

In the table, the assessment objectives and features are presented in a visual form:

| № | Objectives of the evaluation | Peculiarities |

| 1 | Improving management efficiency | Results apply for internal use |

| 2 | Purchase and sale of shares | Valuation is important for both sellers and buyers |

| 3 | Making an investment decision | The object is evaluated in terms of investment attractiveness |

| 4 | Business restructuring | Evaluation allows you to change the structure, taking into account maximum efficiency |

| 5 | Development plan development | Evaluation allows you to draw up a competent business plan |

Method 3. Estimated by industry peers

It uses data on the purchase or sale of enterprises close in profile and volume of production. The method is logical and understandable, but you need to take into account the specifics of the company being valued and specific economic realities.

The main advantage of this method is that the appraiser focuses on actual data, not abstractions, and takes into account the objective situation on the sales market.

There are also disadvantages - the comparative approach does not always affect the prospects for business development and uses average indicators of industry peers.

Method 4. Estimated cash flow forecast

The assessment is carried out taking into account the long-term prospects of the company. Specialists need to find out what profit a particular business will bring in the future, whether investments in the enterprise are profitable, when the investments will pay off, in what directions the funds will move.

4. How to assess the value of the business of an enterprise - a step-by-step instruction for beginners

So, we have already found out that only professionals can competently evaluate a business. Now consider the specific steps that business owners need to take.

Step 1. Choosing an appraisal company

The choice of an appraiser is a responsible and important stage of the procedure. The final result depends entirely on it.

Professionals are distinguished by the following features:

- solid experience in the market;

- use of up-to-date technologies and methods, modern software;

- availability of a functional and convenient Internet resource;

- a list of well-known partners who have already used the services of the company.

The specialists themselves, who will carry out the assessment, must have permits and insurance of their professional liability.

Step 2 We provide the necessary documentation

In the appraisal firm, of course, they will explain in detail what documents you need to provide, but if you collect the package in advance, this will save time and immediately set the appraiser on a business wave.

Clients will need:

- title documents of the company;

- company charter;

- registration certificate;

- a list of real estate, property, securities;

- accounting and tax reports;

- list of subsidiaries, if any;

- certificates of debt on loans (if there are debts).

The package is supplemented depending on the goals and features of the procedure.

Step 3 We coordinate the business valuation model with the contractor

Usually the customer knows for what purpose he conducts the assessment, but is not always aware of which methodology is best to apply. During the preliminary conversation, the expert and the client work together to develop an action plan, determine the methods of evaluation and agree on the timing of its implementation.

Step 4 We are waiting for the results of industry market research by experts

To begin with, appraisers need to analyze the situation in the industry segment of the market, find out current prices, trends and development prospects for the area under study.

Step 5 We follow the business risk analysis

Risk analysis is a necessary stage of business assessment. The information obtained in the course of such an analysis is necessarily used in the preparation of the report.

Step 6 We control the determination of the development potential of the enterprise

Professional appraisers always take into account the prospects for business development, but it is desirable for clients to control this stage of the study and be aware of the results. It is always good to know what potential your enterprise has.

Step 7 We receive a report on the work done

The final stage of the procedure is the preparation of the final report. The finished document is divided into separate positions and contains not only bare figures, but also analytical conclusions. The report, certified by signatures and seals, has official force in resolving property disputes and in litigation.

How to conduct an assessment as competently and safely as possible for your company? The best option is to involve independent lawyers as consultants at all stages. This can be done by using the services of the site Lawyer. The specialists of this portal work remotely and are available around the clock.

Most of the consultations on the site are free. However, if you need more in-depth assistance, the services are paid, but the amount of the fee is set by the customer.

5. Professional assistance in business valuation - an overview of the TOP-3 valuation companies

No time, desire or opportunity to look for an appraiser yourself? Don't worry, take advantage of our expert review. The top three Russian appraisers include the most reliable, competent and trusted companies. Read, compare, choose.

It doesn’t matter for what purpose you are conducting an assessment - buying and selling, lending on collateral, improving management, reorganization - KSP Group specialists will carry out the procedure professionally, promptly and in accordance with all the rules.

It doesn’t matter for what purpose you are conducting an assessment - buying and selling, lending on collateral, improving management, reorganization - KSP Group specialists will carry out the procedure professionally, promptly and in accordance with all the rules.

The company has been operating on the market for more than 20 years, has about 1,000 regular customers, is well versed in the realities of Russian business, and provides free consultations to customers. Among the permanent partners of the company are well-known companies, small and medium-sized businesses.

The organization has membership in the Self-Regulatory Organization ROO (Russian Society of Appraisers) and liability insurance for 5 million rubles.

The company was founded in 2002. The company guarantees prompt work (the term for business assessment is 5 days) and offers adequate prices (40,000 for a standard assessment procedure). In its methods, the organization adheres to the principles of "Ethical Business" - transparency, honesty, openness, compliance with the terms of the contract, responsibility.

The company was founded in 2002. The company guarantees prompt work (the term for business assessment is 5 days) and offers adequate prices (40,000 for a standard assessment procedure). In its methods, the organization adheres to the principles of "Ethical Business" - transparency, honesty, openness, compliance with the terms of the contract, responsibility.

Yurdis employs 20 professional appraisers, members of the largest Russian SROs. Each of the specialists has liability insurance in the amount of 10 million rubles, diplomas and certificates confirming high qualifications. Among the well-known clients of the company are Gazprombank, Sberbank, Svyazbank, Center for Organization of Military Mortgage.

3) Atlant Grade

The company has been doing business in the appraisal market since 2001. Works with tangible and intangible assets, develops and predicts ideal schemes for increasing income, cooperates with enterprises in all regions of the Russian Federation.

The company has been doing business in the appraisal market since 2001. Works with tangible and intangible assets, develops and predicts ideal schemes for increasing income, cooperates with enterprises in all regions of the Russian Federation.

The list of advantages includes the reference accuracy of estimates, competent legal execution of reports, a clear understanding of the goals and objectives of customers. The firm is accredited by commercial and state banks of the Russian Federation, uses an extended methodological base in its work, and applies its own technological and scientific developments.

And a few more tips on choosing a competent appraiser.

Reputable companies have a well-designed and flawlessly functioning website. Through the Internet resource of such companies, you can get free consultations, order services, talk with managers and representatives of the support service.

Conversely, one-day firms may not have a network portal at all, or it may be designed as a cheap one-page site. No additional information, analytical articles, interactive features.

Tip 2. Refuse to cooperate with broad-based companies

Organizations that position themselves as universal firms do not always have the appropriate level of competence.

At the present stage of development of the business market and the world economy, the valuation of intangible assets and intellectual property has become no less important than tangible ones. The role of objective analysis and accurate determination of business value has increased. This procedure is simply necessary for those who are planning to invest, buy or sell enterprises. An independent valuation of the company's value in such situations becomes an important management tool that will enable you to make the right choice, avoid many risks and get the maximum profit. It will not even be able to fully function and expand without a qualitative assessment at one of the stages of development.

What is a business valuation?

Business valuation is a procedure for determining the market value of an enterprise (taking into account tangible, intangible assets, financial condition, expected profit), which is carried out by official bodies or experts. Any property in conjunction with a package of rights to it can become the object of assessment. The meaning of the term "business valuation" is slightly different. It implies the definition in monetary terms of the value of the enterprise, which includes (apart from assets) its utility and the costs incurred to obtain it.

The main purpose of the appraisal is to establish for the client the value of the market value of the assets being appraised. The customer initiates a business valuation, as a rule, in the event of a sale or purchase of a company, equity interest, lending, project financing, improving the efficiency of enterprise management, etc. Often there are situations when several reasons are combined.

When do you need a business valuation?

An increase in the value of a business is one of the important indicators of the growth of its profitability, a decrease indicates the need for changes in the management system and development strategy. Both the owner of the enterprise and a third party may be interested in conducting an objective assessment.

The value of a business is determined by:

- assessment of management effectiveness;

- corporatization;

- reorganizations;

- use of mortgage lending;

- taxation upon inheritance, donation;

- participation in the activities of the stock market;

- assessment of allocated business shares in the event of a merger in the form of consolidation and expansion;

- partial or complete liquidation;

- issuance of new shares, etc.

A business valuation may be needed not only by a potential investor or owner of an enterprise, but also by other market participants, such as insurance companies (to determine the amount of risk, confirm compliance with a risk sharing agreement between a client and an insured), credit organizations (to assess solvency, determine the optimal amount of the maximum loan), as well as government agencies, shareholders, suppliers, manufacturers, intermediaries. The end result of the evaluation can be presented in one report in several sections or in two different documents. The assessment of the enterprise is carried out in accordance with the goal, which is formulated by the customer when drawing up the Contract and the Assignment for assessment. They must necessarily comply with the Federal Law "On Appraisal Activities in the Russian Federation", the provisions of the "National Code of Ethics of Appraisers of the Russian Federation" and the Federal Appraisal Standards.

Business valuation methods

Before investing or acquiring a business, the buyer first of all evaluates its usefulness for himself. It must meet his individual income needs. It is the latter indicator, taking into account costs, that is the basis of the market value that the appraiser calculates. The principles, methods and approaches to its definition are chosen based on the specifics of a business as a “commodity”: investment (money is invested in it, expecting to make a profit in the future), consistency (it can be sold as a system or individual elements), need (depends on the situation inside production and in the environment). The appraisal process consists of several stages performed by a specialist appraiser to objectively determine the value of a business:

- conclusion of an appraisal agreement with the customer;

- determination of the characteristics of the object of assessment;

- market analysis;

- selection of assessment methods, calculations;

- generalization of the results obtained within the framework of each of the approaches, determination of the final value of the value of the object;

- preparing and submitting a report to the client.

At the fourth stage, the appraiser chooses one or more optimal approaches to enterprise valuation that will be most effective in a particular situation. Business valuation methods are universal, but they are selected individually in each situation.

costly

This approach implies a set of methods for assessing the cost of an object, which are aimed at determining the costs necessary for the restoration, replacement of the enterprise, taking into account costs, equipment wear and other factors. It allows you to track absolute changes in the balance sheet with its possible adjustment to the date of assessment (according to an independent expert appraiser) - data on current market prices for labor, materials and other costs are used.

Profitable

The income approach means a set of methods for assessing the value of an object, which are based on determining the amount of expected income from a business. In this case, the key factor determining the value of the object is income. The larger it is, the higher its market value. Here, experts apply the estimated principle of expectation, taking into account the period of receipt of potential income according to the plan, the number and degree of risks. For the analysis, capitalization ratios are used, which are calculated based on market data. This valuation method is considered the most effective and convenient for determining the value of a business (only in some cases, comparative or costly ones turn out to be more accurate). The approach is better to use if the company's income is stable.

Comparative

The comparative method of determining the value of an enterprise means a set of valuation methods that are based on a comparison of the object of assessment with competing objects (with similar characteristics, availability of information on transaction prices). Experts believe that it is he who gives the most accurate results (of course, subject to the active work of the market for properties similar in parameters). For this approach, market data for similar objects and the method of the capital market, transactions and industry coefficients are used (with elements - comparative analysis by benchmarks).

Important: it is worth noting that each approach makes it possible to emphasize and objectively analyze certain characteristics of the object of assessment, but they are all interconnected.

How to evaluate the value of a business?

The assessment of business and other objects is carried out by specialized companies. In order to assess the value of the enterprise, it is necessary to contact specialists, clearly indicate the purpose of determining the value and sign the Agreement. According to Decree of the Government of the Russian Federation of December 2007 No. 60, the assessment process should take place in several stages:

- Definition of the object (description, rights to it, date and basis of assessment, limiting conditions).

- Conclusion of an appraisal contract (determination and preliminary inspection of the object, selection of the type, sources of the necessary data, recruitment of personnel, development of an appraisal plan, drawing up and concluding a contract, payment for services).

- Determination of the characteristics of the object (collection and verification of data, determination of external and internal information).

- Market analysis (includes analysis of financial ratios, reports, adjustment of financial statements for evaluation purposes).

- Selection of methods within a specific approach (or several), carrying out the necessary calculations.

- Summarizing the results, determining the final cost of the object.

- Compiling and submitting a report to the customer.

Choosing an appraisal company

The appraisal company is the organizer of the appraisal project, assists the appraiser in his professional activities, provides marketing, financial and information support. It provides services not only to business owners, but also to legal entities, financial institutions (most often banks), insurance companies and government agencies. Valuation services are paid, as a rule, by the owner of the property, but often the second party puts forward certain requirements regarding the appraiser company. When choosing an appraisal company, it is necessary to collect as much objective information about it as possible and make sure of its competence and professionalism. Particular attention should be paid to the following factors:

- time on the market;

- customer reviews;

- business reputation;

- position in the ratings of independent specialized agencies and publications (but it is important to pay attention to the rating criteria, it should be formed from generalized indicators; you can use data, for example, from the banki.ru resource, which display the degree of customer satisfaction with the services of different banks, and see what ratings companies they cooperate with);

- documents (Certificate of state registration of a legal entity, copies or scans of constituent documents, etc.);

- awards, certificates, diplomas;

- the amount of liability insurance (the higher it is, the safer it is for the customer).

The valuation company must prove itself as an organization that gives the right results and offers the services of objective experts, not motivated by a third party.

Submission of necessary papers

To start the assessment process, the business owner must provide a package of documents. Its position depends on the purpose of the event, the form of ownership and the criteria for the formation of the assessment. Many appraisal companies have launched websites where you can apply online or by phone (but you only need to submit documents in person). The basic package includes the following papers:

- Registration Certificate or Articles of Association.

- For joint-stock companies - reports on the results of the issue of securities, an extract from the register of shareholders.

- Documents that reflect the organizational structure and activities of the facility.

- Financial statements for the last 3-5 years, sometimes an additional explanation is needed for some balance sheet items.

- Copies of patents, licenses.

- If necessary, documents confirming the ownership of real estate.

Advice: It is important to consider that each appraisal company has its own work methodology. Sometimes, in addition to the basic set of documents, additional papers are required from the customer, for example, a development plan for the next few years, an investment project, an auditor's report, an explanatory note from the owner describing the company and indicating the number of staff.

Appraisal model alignment

The dynamic economic situation in the country and the world makes it necessary to develop an individual model for each assessment. The study of the same object is rarely repeated, but in this case it is impossible to reproduce the same assessment. Appraisers use generally accepted models as a basis. Their choice must be agreed with the client based on the goals and objectives of the project. The optimal model should take into account not only the financial aspect, but also help in assessing the level of corporate governance, have the potential and act as an independent method for assessing the value of a business.

Basic business valuation models:

- Economic value added (EVA).

- Market value added (MVA).

- Equity value added (Shareholder value added - SVA).

- Total shareholder return (TSR).

- Added cash flow (Cash value added - CVA).

Getting a report with results

Business valuation - example

The business valuation report can be submitted both in text format and in the form of tables or with their active use. For example, consider the valuation of an enterprise using the net asset value method (cost approach). It is most often used if the company has significant tangible assets (or very few of them), the percentage of total costs in the cost of a product or service is negligible, cash flow has been subject to significant fluctuations in recent years, and if the company does not have fully depreciated assets, which are currently bring income.

Consider an example based on a table:

Save the article in 2 clicks:

Business valuation is necessary not only for conducting purchase and sale transactions, calculating the collateral value, but also for other purposes, for example, to determine the effectiveness of management. In the course of performing the assigned task, the expert takes into account, in addition to the costs of creating an enterprise, market factors that may affect the cost, and also uses technological, organizational and financial analyzes. Valuation activity is the most important part of any developed state, because the results of valuation become the basis for making important economic and managerial decisions in the private and public sectors.

In contact with

Business valuation and its goals

Entrepreneurial activity, based on the production of products and services, is reduced to obtaining the maximum possible profit in constantly changing market conditions. In addition to creating economic benefits, enterprises can provide services for marketing, storage and their sale to the final consumer.

The real sector of the economy, which is formed from enterprises of various industries, is the basis for the stability of the national economic system. Business links the state and the population. At the same time, it provides large cash receipts to the budget, as well as meets the needs of society in certain products and services.

The object of economic activity itself can be the subject of transactions. Even for its own owner, an enterprise is primarily a means of investing, with a subsequent return.

An entrepreneur may face various tasks that require him to know the real value of his own company. Among them are:

- preparation for the sale of the enterprise, in case of its bankruptcy;

- pricing for the issue of securities;

- collection of data for the calculation of insurance premiums and payments;

- business lending;

- non-monetary settlements with other companies;

- making managerial decisions based on mathematical and statistical calculations;

- determination of the strategic and tactical activities of the facility.

Modern market conditions require the entrepreneur to make informed decisions. Conducting a business assessment allows you to identify and eliminate weaknesses in the activities of the enterprise. In addition, appraisal activity covers not only accounting data, but also determines the influence of market factors on the object, thereby calculating accurate final results.

Business Valuation Methods

For business valuation, an outside expert or company is usually hired to ensure independence of opinion and the absence of bias in the work being done. There are several fundamental approaches to calculating the value of a company. Let's consider each of them:

- If the company has gone bankrupt, is at the stage of liquidation, or its profitability is negative, the cost method of calculation is used. It is based on determining the value of all assets and liabilities of the enterprise, and the value is calculated as the difference between them. Data on fixed and circulating assets, the cost of marketable products according to accounting data or at the average market value are evaluated. The calculation includes long-term investments and contributions to bills of exchange.

- The method based on the calculation of the amount of income and benefits brought by the object is called profitable. It is based on two approaches, when capitalization is calculated, or the cost of cash flows, taking into account their discounting. The assessment considers the financial condition of the enterprise at the current moment, as well as the value of its property complex. As a rule, the essence of the method is to make a forecast of income for future periods. It allows you to determine the current state of the enterprise and its development trends.

- The comparative method is based on comparing the company's value with similar enterprises on the market, taking into account their property. In practice, it is quite difficult to obtain accurate data, as market information about competitors may be unavailable or distorted. In addition, competition forces entrepreneurs to act outside the box, which in turn shapes the specifics of each business. Comparison in this case becomes ineffective.

Remark 1

All of these methods have their strengths and weaknesses. Often, the assessment is carried out using a comprehensive analysis of the economic activity of the object, which includes several methods at once.

Business Valuation Formulas

After the appraiser completes the collection of information about the object under study and determines the choice of assessment methods, he proceeds to mathematical calculations. To determine the value of the enterprise, depending on the methods chosen, different calculation formulas are used.

Factor analysis of an enterprise can be carried out according to the DuPont method, introduced into financial analysis by the company of the same name. The essence of the calculation is to determine the effectiveness of the enterprise in the market, that is, to determine its profitability, taking into account various factors. The profitability indicator allows you to determine the development trends of the company and calculate its future profitability. The beauty of this model lies in its simplicity. There are two-factor, three-factor and five-factor calculation models. The formula for the five-factor model is given below:

Figure 1. Five-factor model formula. Author24 - online exchange of student papers

where $TB$ is the tax rate, $IB$ is the interest rate, $ROS$ is the return on sales, $Koa$ is the turnover rate, $LR$ is the capitalization rate.

Remark 2

The disadvantage of the calculation is that accounting data is not always accurate.

Business growth trends can be determined by the formula:

$DC = DC_1 / (1 + r)_1 + DC_2 / (1+r)_2 + ... + DC_n / (1+r)_n$, where

$DC$ – cost of capital by years $i$.

$r = r (1 –T) L / (L + E) + dE / (L+E)$ , where

$r$ - loan rate, $T$ - income tax, $L$ - bank loans, $E$ - capital, $d$ - interest on dividends.

Then the trends in the cost of capital can be calculated using the formula:

$DC = (Pik – r) E$

where $Pik$ is the return on capital.

One of the important calculation indicators is the goodwill of the business. This value is important for the sphere of trade and services. It shows how much the value of the entire business exceeds the value of tangible assets.

Goodwill = Valuation of a business for sale – Valuation of a business not for sale

That is, it is determined by the price that the buyer is willing to pay in excess of the value of his assets according to market data.

If the capitalization method is used, then the calculation is made according to the formula:

Cost = Profit / Capitalization Ratio

If a multiplier or value factor is used, obtained by comparison with similar companies, then the value will be calculated as:

Cost = Profit $\cdot$ Multiplier

Multiplier = 1 / Capitalization rate

In practice, the Gordon model is often used to calculate the value of a company and its investment attractiveness. The essence of the formula is to predict the discounting of cash flows in the long-term growth period:

$FV = CF(n + 1) / (DR - t)$, where

$FV$ – enterprise value in the future period, $CF(n + 1)$ – cash flow at the beginning of the billing period, $DR$ – discount factor, $T$ – long-term income growth trends

Remark 3

However, such a formula can only be applied in conditions of stability of the country's economy.

Liabilities included in the calculation include:

- Article of the third section of the balance sheet - targeted financing and receipts;

- Long-term liabilities for loans and credits and other long-term liabilities (fourth section of the balance sheet);

- Articles of the fifth section of the balance - short-term liabilities on loans and credits; accounts payable; debts to participants (founders) for payment of income; reserves for future expenses; other short-term liabilities.

2. Income approach

The valuation of an enterprise's business using the income approach is carried out on the basis of company income, those economic benefits that the owner receives from owning the enterprise.

The valuation is based on the principle that a potential buyer will not pay more for a share in an enterprise than it can generate future income.

The assessment of the future income of the enterprise is made taking into account the factor of change in the value of money over time - the income received at the present time is of greater value to the investor than the same income that will be received in the future.

The total value of the enterprise is calculated as the sum of the income streams from business activities in the forecast period, normalized to the current price level, plus the value of the business in the post-forecast period.

Within the framework of the income approach, two valuation methods are mainly used:

- direct capitalization method;

- method of discounting estimated income streams.

2.1. Direct capitalization method

The income approach considers the business as a long-term asset, profitable for the business owner. The direct capitalization method identifies a business with a certain kind of financial asset - a perpetual annuity. The features of this asset are:

- unlimited lifetime;

- cash flow stability (equal annual amounts or annual amounts increasing at a constant rate).

2.2. Method of discounting the estimated cash flows of income

This method of income approach is used to value enterprises that are in the stage of intensive business development, to value companies for which there is no reason to assume an unlimited life. The life of a business can be limited by lease agreements, a drop in demand for manufactured products, etc.

Under the discounted cash flow method, the value of an enterprise is based on future, forecasted income flows.

For established businesses duration of the forecast period corresponds to the remaining effective life of the enterprise and reflects the possibility of predicting the timing of receipt of income from the activities of the business with a reasonable degree of probability of their receipt, without additional, significant financial investments in the assessed business.

The remaining effective projected life can be limited by the economic life of the product, the economic life of the product, the obsolescence and physical wear and tear of equipment and production technologies, the lease terms for production and office space, and the prospects for the market in which the business being assessed operates.

The magnitude of the risk of income in the direction of increasing or decreasing is influenced by a number of factors. Taking into account the risks of investing in a business when determining the value of an enterprise using the income approach is carried out by selecting a capitalization or discount rate adequate to the risks used to determine the current value of the cash flows expected from the business.

The discount rate is a factor used to convert future payments or receipts into present value. That is, the discount rate is used to determine the amount that an investor would pay today for an investment asset in order to receive income in the future.

3. Estimating the value of a business using a comparative approach

The comparative approach to business valuation assumes that its value is determined by the amount for which it can be sold in the presence of a well-formed market. In other words, the most probable value of the valued business may be the real sale price of a similar enterprise, fixed by the market.

The main advantage of the comparative approach is that the appraiser focuses on the actual purchase and sale prices of similar enterprises, the method really reflects the supply and demand for a given object of assessment, since the price of an actually completed transaction takes into account the situation on the sales market of ready-made businesses as much as possible.

To determine the value of an enterprise using a comparative approach, reliable market information about purchase and sale transactions of ready-made businesses, and reliable financial information about sold businesses is required. On the market, this information is closed.

Comparable sales valuation has its limitations. The comparative approach to valuation does not take into account the prospects for the development of the business being valued, therefore it is advisable to use this approach to evaluate enterprises that have reached a stable profit, and in respect of which it can be assumed that in a realistically forecasted future their activities will not be terminated

4. Estimating the value of a business by the method of empirical rules

Rules of thumb allow you to look from the inside at the problems of the value of an enterprise, a company or a share in it, as well as issues of ensuring and reliability of a business. However, cost data obtained using rules of thumb should only play a decisive role in decision making if supported by other valuation methods.

Most of the rules of thumb are percentage of gross income(sales volume, the amount of paid bills for the year, the annual gross income, the annual amount of fees received, the annual revenue, all of which are equivalent in the sense of applying rules of thumb). Adjusted annual income in the case of applying the rule of thumb corresponds to the total cash flow, including the salary of the owner and the net income of the business itself. In other words, it is the amount of the revised, normalized return, which is often referred to as the seller's discretionary income or the company's cash.

Estimates of the enterprise's business obtained by the above methods may vary. The final element of the evaluation process is comparison of grades obtained on the basis of these methods, and the reduction of the obtained cost estimates to a single cost of the object. The coordination process takes into account the strengths and weaknesses of each method, determines how adequately they reflect the objective state of the market. The total market value of the enterprise is calculated as a weighted average.

The process of reducing estimates leads to the establishment of the final cost of the object, which achieves the goal of the assessment.

On our website you can find examples of our work on enterprise valuation, as well as with procedure for ordering and performing this work. Read about the possibilities cost optimization for this service in our article "The cost of conducting a business valuation" .

If you fill out this form, we will prepare offer

that takes into account the specifics of your task.