A legal entity is required to agree on a cash balance limit. Cash limit

Read also

In order to ensure the safety of cash and facilitate its accounting, organizations and enterprises set a cash balance limit, that is, the maximum possible amount that remains at the end of the day.

The procedure for establishing a cash limit is regulated by the Regulations on the procedure for conducting cash transactions No. 373-P dated October 12, 2011, the appendix to which contains the relevant formulas. The regulation determines that payments should be made not only by legal entities, but also by entrepreneurs, including those without a bank account. One of the innovations is that the cash balance limit is set by enterprises and individual entrepreneurs themselves, and not by banks, as was the case before.

If the company has separate branches, the calculation is made taking into account the cash located in these divisions. The exception is divisions that have a bank account. They must have their own limit.

Limit calculation procedure

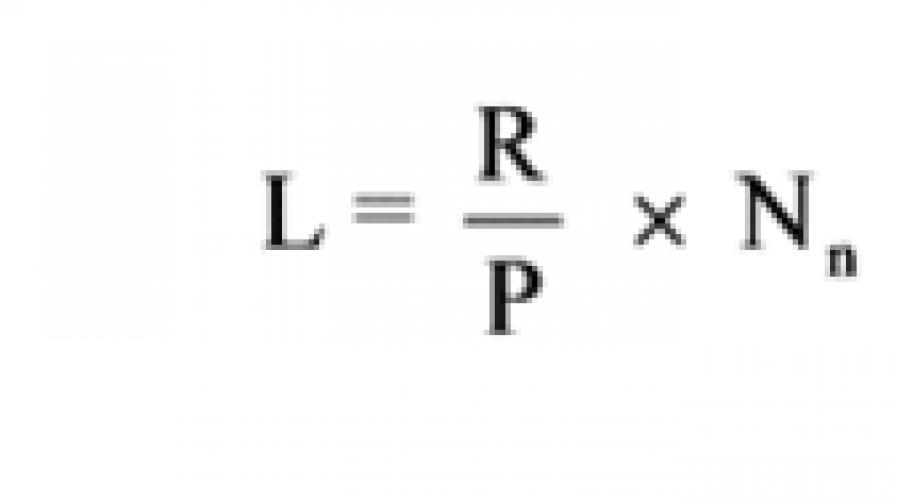

Legal entities and entrepreneurs whose activities require the receipt of cash for goods sold, work done, services rendered calculate the cash limit using the formula:

L = V/ T * Nc

L – limit (in rubles)

V – total cash receipts for billing period(for newly created enterprises - estimated revenue)

T – period for which the above cash receipt occurs (in working days)

Nc is the interval set by the head of the enterprise (in working days) between transfers of money to the bank.

Cash inflows should be determined based on the highs of previous years, taking into account the existing dynamics. The billing period can be any relevant period from the past, not exceeding 92 business days. The interval between the days of transferring cash to a bank or depositing it with an entrepreneur should not be more than seven working days, and in the absence of locality bank – fourteen working days

The meaning of the formula by which the cash balance limit is calculated is very simple. The average daily revenue is determined (usually the maximum possible) and multiplied by the number of days that this money will accumulate in the cash register before being transferred to a bank account.

Calculation procedure in the absence of revenue

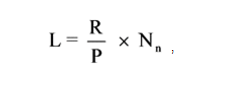

Organizations that do not have cash inflows calculate using a similar formula, in which instead of revenue, funds received from the bank for issuance are indicated:

L = R / T * Nn

L – cash register limit (in rubles)

R – volume of cash issued for the billing period

T – period during which this issue took place (maximum 92 working days)

Nn – interval (in working days) between receipt of funds for issuance by bank check or from individual entrepreneur without a bank account.

Here, as in the previous case, one should take into account past periods of maximum distributions, or expected distributions for newly created enterprises. The maximum allowable interval between receipts is the same – 7 (14) days.

For any calculation option cash limit The balance does not take into account cash received for payment of salaries, scholarships, benefits and other similar purposes, starting from the day these funds are received from the bank account. It should be remembered that according to the Regulations on Cash Operations, no more than five working days are allocated for the issuance of salaries and other benefits.

Another exception when it is permissible to exceed the balance of money in the cash register are weekends and holidays. This refers to days that are working days for the enterprise and days off for the bank.

In all other cases, excess is unacceptable. If this happens, you must immediately submit cash to a bank (or individual entrepreneur). Another option would be to issue a certain amount for reporting to one of the employees. Monitoring compliance with the cash limit at the cash desk is carried out using cash book 0310004 after the balances are withdrawn at the end of the working day.

Order to establish a cash limit

The accepted cash limit is issued in the form of an order from the head of the enterprise or individual entrepreneur. The appendix to the order contains a calculation, which should contain:

- selected period for calculation (month, quarter or other period)

- volume of revenue (issue) for this period

- selected interval for cash delivery (receipt)

- the resulting calculation result (rounded to the nearest whole number of rubles).

The order can establish any period of validity of the limit, from one month to several years. With possible changes in cash flow, the limited cash balance can be recalculated at any time. In the absence of an order establishing a cash limit, it is taken equal to zero, i.e. at the end of the working day there should be no cash in the cash register.

Regulatory authorities may verify compliance with the balance limit. In case of excess, penalties are applied to the enterprise.

State employees, like everyone else economic entities those carrying out cash transactions are required to conduct. When maintaining budgetary cash flow accounting, you should be guided by:

- Orders of the Ministry of Finance No. 157n dated 012.2010, No. 174n dated 12.16.2010.

- Instructions of the Central Bank of Russia No. 3210-U dated March 11, 2014.

- Order of the Treasury of the Russian Federation No. 8n dated October 10, 2008.

- Law “On CCP” dated May 22, 2003 No. 54-FZ.

For violation of the procedure for conducting cash transactions, administrative liability is provided in the form of fines:

- for an official - up to 5,000 rubles,

- on entity- up to 50,000 rubles (Article 15.1 of the Administrative Code).

Cash balance limit for 2019

The maximum permissible amount of cash that can be stored in specially equipped premises for cash transactions in a government institution after completion work shift and displaying the balance in the cash book is called the cash balance limit.

The organization independently determines the cash balance limit, this is enshrined in clause 2 of the Central Bank Instructions No. 3210-U. But this does not mean that the head or other official of a government agency has the right to set any amount of money.

The correct calculation of the cash balance limit must be carried out in a certain order, otherwise the organization may be punished. Moreover, the calculations made will have to be consolidated in local act budgetary institution. Also, responsible persons must be appointed at the disposal of the manager, usually a cashier and a chief accountant.

The approved maximum permissible amounts can be recalculated at any time, or not recalculated at all, this is stated in paragraphs 8, 9 of the Letter of the Central Bank of the Russian Federation dated February 15, 2012 No. 36-3/25. What does it mean? If the organization’s cash flow increases, then the recalculation can be made at any day. Conversely, if the organization notices a decrease in cash flow, then it is not necessary to reduce the limit.

How to calculate the cash balance limit

The calculation procedure is set out in the Appendix to the CBR Directives No. 3210-U. The algorithm provides for two types of calculations: by receipts or by disposals. In order for an organization to make correct calculations, it must determine which operations are larger.

For example, state-financed organization The Museum accepts payment for tickets in cash. 90% of the organization's expenses are made by non-cash payments. Therefore, the maximum allowable amount of cash must be calculated in the first way - based on receipts. Or vice versa, a government institution " Rural school» issues cash to employees on account (travel allowances, purchase of fuels and lubricants, spare parts, household and stationery). There are no income from business activities. In this case, you need to calculate based on disposals.

The cash balance limit in the cash register is set according to formulas. Let's look at each one separately.

Calculation of the balance limit by receipts

- V is the total indicator of cash receipts from the sale of goods/works/services in rubles for a specific billing period.

- Nc is the period of time between the days of delivery of cash received from sales to the bank.

Calculation of the limit on disposals

- L is the determined maximum allowable amount of cash balance.

- R is the total indicator of cash outflows for a specific billing period. Exception: payments wages, scholarships, state benefits and other similar payments.

- P - number of days in the billing period. The period is set by the institution independently, and cannot be less than 1 working day and no more than 92 working days.

- Nn - the period of time between the days of receiving cash on checks in a banking organization, with the exception of funds for paying wages, scholarships, and benefits.

Indicators Nn and Nc cannot be more than 7 days. Exception: organization budgetary sphere is located in an area where there are no banking organizations, then the indicators cannot be more than 14 days.

Calculation of the cash balance limit in the cash register of a separate institution in 2019

If there are separate divisions or branches, then the calculation of the maximum permissible cash balance should be made taking into account certain features.

First of all, we define independence separate division according to the following signs.

|

Option 1 |

Option 2 |

|

|---|---|---|

|

Receipt of cash to the cash desk of a separate division is carried out |

Through the cash desk of the parent organization |

Through the office of a banking organization |

|

Cash delivery is made |

To the head office cash desk |

To a current account opened with a banking organization |

|

Checking account |

Opened in the name of the parent organization |

Opened in the name of a separate division (independent current account) |

|

A specially equipped place for storing cash and carrying out cash transactions |

Suitable for cash flow transactions only |

Fully equipped |

If a branch or territorial department is characterized in accordance with the first option, then the calculated indicators for the division for the billing period should be included in the calculation of the cash balance limit. If the branch corresponds to the second option, for such a separate division you should make your own calculation of the cash limit, separate from the calculations of the parent government agency.

We generate an order to approve the cash limit

The legislation does not provide for a unified form for the manager’s instructions, as well as mandatory details. An order or instruction is formed in any order on the institution’s letterhead.

Most commercial enterprises constantly work with cash and undertake to transfer the profits received to the bank for safekeeping on time. At the same time, the manager cannot send every penny to the organization’s account - at the end of the work shift, a certain non-transferable amount remains, which will be needed to carry out subsequent operations (giving change to the buyer), paying salaries and bonuses, meeting business needs, etc. However, there are restrictions on storing cash - the amount allowed is agreed upon in writing in advance. It is called . For whom does it apply, how to calculate it and formalize it correctly?

Are you switching to an online checkout? We will select a cash register for your business in 5 minutes.

How to properly set up a balance limit?

The cash balance cannot be anything - it is a strictly regulated amount. At the same time, legislators give the entrepreneur the right to independently determine its size. To the owner of the subject economic activity or an authorized manager must:

- calculate the permissible limit;

- approve the calculation results with the chief accountant and director of the enterprise;

- sign the appropriate order for its introduction;

- attach the calculation results to the order.

It is recommended to prepare the calculation on the company’s letterhead, although this is not necessary. An order may be drawn up in free form- the document must refer to normative act, regulating the requirement to introduce a cash limit for an enterprise, indicate the amount of the non-carrying balance, set the validity period of the introduced restriction and attach an approved calculation to it. Responsible person a chief accountant is appointed or CEO enterprises.

The validity period of the assigned cash balance limit is determined by the entrepreneur himself. It depends on several factors: the characteristics of the type of activity, the amount of turnover and the amount of cash profit of the company.

Business entities that have only recently completed registration carry out calculations using approximate initial data, and later recalculate and adjust them taking into account the average profit received. At the same time, enterprises have the right not to adjust calculations as long as the order is valid, even if the initial indicators have changed dramatically.

The maximum permissible amount is calculated in two ways, and the choice of a specific method depends on the specifics of the organization of the company’s work. The calculation takes into account:

- profit received in cash from goods or services sold during the billing period;

- the total amount of money that is spent on various needs (salaries, household expenses), if the company makes payments exclusively by bank transfer.

In this case, the business owner has the right to choose the appropriate calculation method at his own discretion. If an organization has branches and covers several business processes, the maximum possible balance is calculated for each of them separately. Formulas for calculation are given in the Appendix to the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U.

Enterprise limit: who is exempt and who is not?

How to determine whether a company needs to implement cash limits? From 06/01/2014, individual entrepreneurs and small businesses may not install it. Belonging to small business entities is legally predetermined and assessed according to the following parameters:

- the amount of revenue received during the year is no more than 800 thousand rubles (excluding VAT);

- the number of staff of the enterprise is up to 100 people;

- equity participation of Russian and foreign companies in the authorized capital of the organization - no more than 49%, charitable and government organizations- no more than 25%.

Such entities sign an order not to apply the cash limit at the cash register and keep the money in unlimited quantity. Large LLCs with high incomes and a large staff of employees cannot refuse to limit the remaining money and undertake to set a limit on the amount of the non-carrying balance on a general basis.

Cash limit for individual entrepreneurs

According to Directive No. 3210-U dated March 11, 2014, small businesses may not set a limit on the balance of money at the end of the shift. However, this must be formatted correctly. The refusal is confirmed by an internal order, which is certified by the entrepreneur. This document remains with the individual entrepreneur - there is no need to transfer it to the Federal Tax Service and additionally support it with a notary’s signature. When checking, tax authorities may ask to review the order, and if one is not available, cash register There should not be a single banknote. In such a situation, any remaining cash is considered above the limit, and the individual entrepreneur will suffer administrative punishment for the fact that at the end of the working day the cashier’s cash drawer was not left empty.

The abolition of cash limits in the cash register for individual entrepreneurs is a benefit, but not a rule. Despite the fact that the restriction can be waived, each business entity must keep records of incoming and outgoing transactions and support this with documentation. At the end of each shift, it is necessary to record the cash balance - this figure must exactly correspond to the actual amount of cash remaining with the cashier at the end of the shift. If the entry does not correspond to reality, and there is more money than recorded, this will become a reason for quibbles from tax inspectors.

Cash desks for individual entrepreneurs on OSN. We will install and register in 1 day.

Leave your phone number, we will call you back and answer your questions!

In what cases is it permissible to exceed the established limit?

Accumulation of excess funds is not in all cases regarded as a violation. The law identifies a number of circumstances that allow you to exceed the established amount. Restrictions may be violated:

- on the days of payment of salaries, social benefits, scholarships;

- on holidays and weekends.

Thus, the director can independently determine the period for calculating salaries and other payments and enter it into payroll. You can store cash for no more than 5 days in a row - during this time compensation, bonuses, salaries and other payments must be made.

Credit and financial institutions are closed on weekends and holidays, so you can deposit accumulated funds only on weekdays. Due to the fact that certain categories of entrepreneurs cannot stop their work, the restriction does not apply on such days.

Is it possible to refuse to apply the cash balance limit and how to do it correctly?

Small LLCs and individual entrepreneurs enjoy preferences in relation to limiting cash flow. In 2014, they were legally allowed not to set limits on cash balances. However, small business entities undertake to properly formalize this.

Despite the fact that small businesses are officially allowed not to introduce a set cash limit, this fact must be confirmed by an appropriate internal order. The document is drawn up in any form and includes the following information:

- date of lifting of the limit;

- the number of the order in accordance with which the allowable balance was established earlier;

- rejection reason;

- signatures and full name of the manager and responsible person.

For example, the reason for refusal is that the organization is a small business. This order recommends that the manager provide one or more employees with the opportunity to independently deposit cash at the bank. If this moment is missed, the problem of cash withdrawal subsequently arises.

If you carefully read Directive No. 3210-U, it becomes obvious: the conditions of the limitation are such that no one is exempt from it by default. Individual entrepreneurs and small organizations are not allowed to set restrictions on storing cash in a cash register, but this must be supported by documentation.

For example, if the profit of an enterprise has increased significantly, but restrictions have not been established or lifted, this may raise questions among tax office. Comments are unlawful only if there is a corresponding order to cancel them with reference to regulations. If there is no order to implement the limit, the balance amount is automatically equal to zero, which means that the presence of any amount at the end of the shift is a violation and is punishable in accordance with the law.

Responsibility for exceeding the cash limit in

It is impossible to accumulate cash and not transfer it to a bank account for a long time. In accordance with Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, if an excess amount is detected, fines are imposed on the organization and responsible officials in the amount of:

- 40 - 50 thousand rubles. - collected from the organization itself;

- 4 - 5 thousand rubles. - paid by the director, chief accountant or other responsible employee mentioned in the order.

It is not only the presence of excess funds that is considered a violation. Failure to comply with the rules for setting and canceling a limit also entails penalties. The organization is responsible in the event of:

- absence or incorrect execution of an order to establish or cancel the cash balance;

- detecting an incorrect calculation of the cash limit in order to increase it.

If the amount of earned funds remaining in the cash register at the end of the working day is exceeded, the entrepreneur has two ways to solve this problem:

- Hand over cash using the services of cash collectors.

- Distribute excess funds among employees, issue them for reporting, and return them at the beginning of the next shift as unused advances.

Of course, the second method is the most optimal for the director. There shouldn’t be any inconvenience - if you think through and formalize the transfer of funds correctly, you don’t have to return them later, but leave them to the employees as a salary payment. However, tax inspectors are familiar with such methods, and if abuse is detected, they can reprimand the official.

Organizations can keep cash in the cash register only within the established limit. That is, no more than a certain amount can remain in the cash register every day. The size of such a limit is determined by the head of the organization. And it is with this value that we must compare the balance of cash in the cash register, derived from the cash book at the end of the working day. This procedure is established by paragraph 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014.

If there is more money in the cash register than the established limit, then the difference must be handed over to the bank. You have the right to determine yourself how often you will hand over excess proceeds. You only need to collect cash from the bank for those days when the cash balance in the cash register at the end of the working day exceeds the established limit. For example, if you hand over your proceeds once every five days, then this figure (5) is used in calculating the limit. It should not exceed seven working days. And if there is no bank in the locality - 14 working days. But if you deposit money into the bank every five days, and the limit was exceeded earlier, then you need to deposit cash without waiting for this period. If the limit is not exceeded, there is no need to visit the bank.

Determine the cash balance limit based on the volume:

- revenue receipts;

- spending cash.

At the same time, the most suitable way The organization has the right to choose how to calculate the limit independently. This follows from paragraphs 1 and 2 of the appendix to the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U.

Who must comply with the cash limit?

Organizations (with the exception of small businesses) must comply with the cash limit. In this case, the legal form and taxation system do not matter. This procedure is established by paragraph 2 of the Bank of Russia instruction dated March 11, 2014 No. 3210-U, paragraph 4 of Article 346.11 and paragraph 5 of Article 346.26 Tax Code RF.

A simplified procedure for conducting cash transactions has been established for small businesses and entrepreneurs. They may not set a cash balance limit. That is, keep any amount in the cash register. This benefit is provided for in paragraph 10 of clause 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014. The decision not to set a limit can be formalized by an appropriate order.

In the summer of 2015, the performance of small businesses changed. For example, the annual revenue limit has doubled. So check to see if your company has become a small business and can waive the limit.

Calculation of the limit based on the volume of revenue

Determine the cash balance limit for the billing period based on the volume of cash receipts for goods sold, work performed, services rendered using the formula:

In the billing period, include all days of work, but not more than 92 working days. If, for example, the store is open on weekends and non-working holidays, then to calculate the limit, also include these days in the calculation period. This procedure follows from paragraph 1 of the appendix to the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U.

The resulting limit value can be converted to full rubles - both according to the rules of mathematical rounding, and downward (letter of the Bank of Russia dated September 24, 2012 No. 36-3/1876, Federal Tax Service of Russia dated March 6, 2014 No. ED-4- 2/4116).

Example

LLC "Trading Company "Hermes"" calculates the cash balance limit based on accounting data, based on the volume of cash receipts for January, February and March of the previous year. Hermes has no separate divisions. The proceeds are deposited in the bank every fifth day.

Hermes is open seven days a week from 10 a.m. to 10 p.m. Therefore, the billing period is 90 working days (31 days + 28 days + 31 days).

The turnover in the debit of account 50 “Cash” in correspondence with the credit of account 90 “Sales”, as well as the credit of account 62 “Settlements with buyers and customers” in terms of cash advances received in the billing period, which were offset in the same period, amounted to 2 RUB 699,998:

- in January – 887,388 rubles;

- in February – 802,015 rubles;

- in March – 1,010,595 rubles.

RUB 149,999.89 (2,699,998: 90 days × 5 days).

Based on these data, the head of the organization, by his order, set a limit on the cash balance in the amount of 150,000 rubles.

No cash proceeds

If there is no cash proceeds (for example, there were only non-cash payments), then calculate the balance limit based on the amount of cash issued. The exception is amounts intended to pay salaries, scholarships and other payments to employees - do not take them into account when calculating the limit.

To calculate the limit if there is no cash proceeds, use the formula:

The billing period for which the cash balance limit is determined can be taken arbitrarily. This could be the period:

- which precedes the calculation (for example, calculate the limit for the third quarter based on data for the second quarter of the current year);

- in which the receipt of cash was maximum (for example, make the calculation based on the data of the fourth quarter of the previous year, in which there were maximum receipts of revenue);

- similar for previous years (for example, calculate the limit for the third quarter of 2014 based on the indicators of the third quarter of 2013).

In the billing period, include all days of work, but not more than 92 working days. If an entrepreneur or organization works on weekends and non-working holidays, then also include these days in the calculation period to calculate the limit.

This procedure follows from paragraph 2 of the appendix to the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U.

The resulting limit value can be rounded to full rubles (letter of the Bank of Russia dated September 24, 2012 No. 36-3/1876, Federal Tax Service of Russia dated March 6, 2014 No. ED-4-2/4116).

Example

LLC "Trading Company "Hermes"" purchases recyclable materials from the population. Hermes has no separate divisions. Cash is withdrawn from the bank account every three days. The cash balance limit is calculated based on accounting data for January, February, March of the previous year.

Hermes has a five-day work week. Therefore, the billing period is 56 working days (15 days + 19 days + 22 days).

The turnover on the credit of account 50 “Cashier”, excluding payments to employees, amounted to 2,800,000 rubles:

- in January – 960,000 rubles;

- in February – 800,000 rubles;

- in March – 1,040,000 rubles.

The Hermes accountant calculated the permissible limit for the cash balance in the cash register:

150,000 rub. (RUB 2,800,000: 56 days × 3 days).

Based on these data, the head of the organization set by his order a limit on the cash balance in the amount of 150,000 rubles.

When can you store cash beyond the limit?

There are two cases when you can exceed your cash limit. The first is on the days of payment of salaries, benefits, scholarships, social payments and other payments that relate to the salary fund. Funds for these purposes can be kept in the cash register for five working days. After this period, hand over the excess cash to the bank.

And the second case is on weekends and holidays, if cash transactions are carried out on these days. Collect excess proceeds for such days no later than the first business day established for depositing excess proceeds to the bank.

This procedure is provided for in paragraph 8 of paragraph 2, paragraph 6.5 of the Bank of Russia Directive No. 3210-U dated March 11, 2014.

Example

ZAO Alfa has set a cash balance limit of 30,000 rubles. The organization issues salaries for March on April 5, 6 and 7. According to the payroll for March, the amount of salary to be paid is 100,000 rubles. Alpha received this amount in cash from the bank on April 5. Daily cash proceeds is 50,000 rubles. The organization delivers excess cash to the bank every day.

The accountant calculates the amount of excess cash as follows:

At the beginning of April 6, the cash desk should have an amount not exceeding the limit (30,000 rubles) and the balance of unpaid wages. At the beginning of the day on April 5, there was no cash in the cash register. Data on the issuance of salaries and cash flows at the cash desk are shown in the table:

|

date |

Credited to the cash register, rub. |

Issued as salary, rub. |

Cash balance at the end of the day (before depositing excess cash at the bank), rub. |

Over-limit cash to be deposited at the bank, rub. |

Cash balance at the beginning of the next day, rub. |

|

150 000 (50 000 + 100 000) |

90 000 (150 000 – 60 000) |

20 000 (90 000 – 30 000 – (100 000 – 60 000)) |

70 000 (90 000 – 20 000) |

||

|

90 000 (70 000 + 50 000 – 30 000) |

50 000 (90 000 – 30 000 – (40 000 – 30 000)) |

40 000 (90 000 – 50 000) |

|||

|

80 000 (40 000 + 50 000 – 10 000) |

50 000 (80 000 – 30 000 – (10 000 – 10 000)) |

30 000 (80 000 – 50 000) |

What are the risks of exceeding the limit?

If you exceed the cash balance limit and do not deposit the difference in a timely manner to the bank, then administrative liability will follow. The fine in this case ranges from 40,000 to 50,000 rubles. for organizations. An official, for example, the head of an organization or an entrepreneur, will pay from 4,000 to 5,000 rubles for such a violation. This procedure is established by Articles 2.4 and 15.1 of the Code of the Russian Federation on Administrative Offenses.

By general rule an offense is recognized as a guilty action (inaction) of an organization or official(Article 2.1 of the Code of Administrative Offenses of the Russian Federation). Consequently, liability for violating the cash balance limit occurs only if the guilt of the organization and (or) its leader is proven (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Guilt may be expressed in the fact that the organization and (or) its leader:

- sought to accumulate an excess balance (Clause 1, Article 2.2 of the Code of Administrative Offenses of the Russian Federation);

- foresaw the accumulation of an excess balance, but did not prevent it (clause 2 of article 2.2 of the Code of Administrative Offenses of the Russian Federation);

- did not expect the accumulation of an excess balance, although they should have and could have foreseen it (clause 2 of article 2.2 of the Code of Administrative Offenses of the Russian Federation).

It is legally determined that a business entity carrying out financial calculations using cash transactions, is obliged to perform regulatory requirements regarding the rules of cash circulation, documentation and compliance with the cash limit. Control over discipline is entrusted to the banking institution with which a service agreement has been drawn up and Tax Service.

Cash limit

The cash register limit is the norms independently established by the business entity for the amount of cash that must be in the cash register at the end of the day.

The value is the maximum permissible and cannot be exceeded. Exceeding the limit money is subject to return to the bank account. checking account companies.

Cash balance limit size

It is allowed to exceed the fixed balance in situations where payments are planned:

- wages;

- scholarships;

- social.

Violation of limit norms on holidays and weekends is not punishable if it is necessary to conduct financial transactions during this particular time period. Financial regulatory requirements make it possible to simplify monetary transactions by reducing the amount of cash in production turnover.

How is the cash limit set?

central bank Russian Federation by his instructions, he established methods for calculating the fixed balance at the end of the day. The cash balance limit in the cash register is set by the business entity independently, taking into account the legally approved procedure for conducting settlement transactions. The procedure allows you to approximate the parameter normative value to a convenient value for a specific business entity.

If the organization has not approved the limit values, then it is prohibited to store money in its cash register. If this rule is neglected, in the case of cash financial transactions, the entity is subject to administrative liability, which results in penalties.

Responsibility for violation

Responsibility for conducting financial transactions at the enterprise rests with its manager. Chief Accountant is responsible for the competence of calculating the amount of the fixed balance. To the company's service The banking institution is responsible for monitoring cash discipline.

Cash balance in the cash register at the end of a non-working day

Regulations require the bank to conduct an audit at least once every two years. If during the event a violation of the requirements of the document was revealed, then representatives banking institution are required to notify the Tax Service, which has the right to impose administrative liability and fines. In accordance with the norms of the Administrative Code of the Russian Federation, the amount of fines corresponds to:

- for an official – up to 5,000 rubles;

- for an enterprise – up to 50,000 rubles.

Read also: Groups of fixed assets

What is considered a violation

For execution purposes legal requirements it is important not only to comply with limit standards, but also to calculate them correctly, taking into account the total volume cash receipts to the company's cash desk for a certain time period. The following events are considered violations:

- No limit order.

- Storing cash that is not identified by receipt documentation.

- Above-limit funds intended for standard payments under the item of labor costs and social benefits, provided that their storage exceeds 3 working days.

The calculation of the available limiter can be made in two ways, differing in the value taken as the basis for the calculation. The Central Bank of the Russian Federation does not regulate the preference of a formula option for specific conditions of business activity, therefore business entities can independently choose the calculation method that, in their opinion, is most acceptable.

Calculation method 1

In the first method of calculation, the basis is data on cash turnover carried out through the cash register.

It is applicable to business entities with whom counterparties pay in cash for the sale of goods or provision of services.

The limit indicator is calculated as the product of the parameters:

- the private amount of cash that was received by the accounting department for a certain period of time and the number of days taken into account, not exceeding 92;

- the number of days on which money is transferred to the current account.

Calculation method 2

IN settlement transactions The second method takes into account information regarding the cash expenses of a business entity. It is suitable for organizations whose cash desk does not receive cash from counterparties.

According to the second method, the cash balance limit is set by multiplying the parameters:

- a private value corresponding to the amount of money issued from the cash register for a certain time period, and the estimated time;

- time period between receipts of cash at the bank.

Documentation

Each entity, having registered its business, planning financial transactions involving cash circulation, is obliged to install a cash limit. The enterprise must keep documentation that ensures compliance with the requirements of legislation in the field of financial turnover:

- limiter calculation developed by the chief accountant and approved by the head of the organization;

- order to set a financial limit.

Cash limit calculation carried out by the chief accountant

An order can be issued as an indefinite document that requires amendments only in cases provided for by law. If a document indicates its validity period, which is traditionally determined by a quarter, six months or a year, then after the specified time has expired it should be extended or a new one issued.

Order to set a limit

When to Reconsider a Criterion

If there are no changes cash flow at the cash desk, there is no reason to revise the calculation. It is recommended to update orders annually to reflect the extension of the current settlement period without making changes.