What annual inflation rate is considered unacceptable? Types, causes and consequences of inflation. Economy

Read also

Inflation and its indicators

Inflation (“inflation” - from the Italian word “inflatio”, which means “inflation”) is a steady trend of growth in the general level of prices.

The following words are important in this definition:

- sustainable, which means that inflation is a long-term process, a stable trend, and therefore should be distinguished from a price jump;

- general price level. This means that inflation does not mean an increase in all prices in the economy. Prices for individual goods can behave differently: increase, decrease, or remain unchanged. It is important that the general price index increases, i.e. GDP deflator.

The process opposite to inflation is deflation - a stable tendency towards a decrease in the general price level. There is also the concept of disinflation, which means a decrease in the rate of inflation.

The main indicator of inflation is the rate (or level) of inflation, which is calculated as the percentage ratio of the difference between the price levels of the current and previous year to the price level of the previous year:

where P t is the general price level (GDP deflator) of the current year, and P t – 1 is the general price level (GDP deflator) of the previous year. Thus, the inflation rate indicator characterizes not the growth rate of the general price level, but the growth rate of the general price level.

An increase in the price level leads to a decrease in the purchasing power of money. Purchasing power (value) of money refers to the number of goods and services that can be purchased with one monetary unit. If the prices of goods rise, the same amount of money can buy fewer goods than before, so the value of money falls.

Types of inflation

Depending on the criteria, different types of inflation are distinguished. If the criterion is the rate (level) of inflation, then we distinguish: moderate inflation, galloping inflation, high inflation and hyperinflation.

Moderate inflation is measured in percentage per year, and its level is 3-5% (up to 10%). This type of inflation is considered normal for a modern economy and is even considered an incentive to increase output.

Galloping inflation is also measured in percentage per year, but its rate is expressed double digit numbers and is considered a major economic problem for developed countries.

High inflation is measured in percent per month and can reach 200-300% or more percent per year (note that the “compound interest” formula is used to calculate inflation for the year), which is observed in many developing countries and countries with economies in transition.

Hyperinflation, measured in percentages per week and even per day, the level of which is 40-50% per month or more than 1000% per year. Classic examples hyperinflation is the situation in Germany in January 1922-December 1924 when the growth rate of the price level was 1012 and in Hungary (August 1945 - July 1946), where the price level over the year increased by 3.8 * 1027 times with an average monthly increase of 198 times .

If the criterion is the forms of manifestation of inflation, then a distinction is made between explicit (open) inflation and suppressed (hidden) inflation.

Open (explicit) inflation is manifested in the observed increase in the general price level.

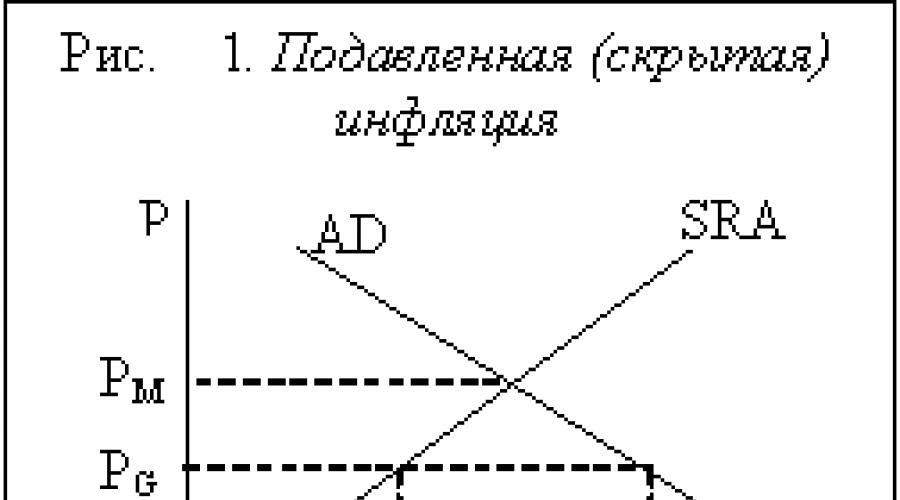

Suppressed (hidden) inflation occurs when prices are set by the state, and at a level lower than the equilibrium market level (established by the relationship between supply and demand on the commodity market) (Fig. 1). The main form of hidden inflation is the shortage of goods.

PM is the equilibrium market price at which demand is equal to supply, PG is the price set by the state, YS is the amount of total output (the amount of products that are produced and offered for sale by producers), YD is the amount of aggregate demand (the amount of products that people would like to buy consumers). The difference between YD and YS is nothing but deficiency. The main form of manifestation of hidden inflation is the shortage of goods. Deficit serves as a form of manifestation of inflation, since one of the characteristic features of inflation is a decrease in the purchasing power of money. Scarcity means that money has no purchasing power at all, since a person cannot buy anything with it.

Causes of inflation

There are two main causes of inflation:

1) an increase in aggregate demand and 2) a reduction in aggregate supply. In accordance with the reason that determined the increase in the general price level, two types of inflation are distinguished: demand inflation and cost-push inflation.

If the cause of inflation is an increase in aggregate demand, then this type is called demand-pull inflation.

An increase in aggregate demand can be caused either by an increase in any of the components of aggregate spending (consumption, investment, government and net exports) or by an increase in the supply of money.

Most economists (especially representatives of the school of monetarism) consider the main cause of demand-side inflation to be an increase in the money supply (money supply), arriving at this conclusion from an analysis of the equation of the quantity theory of money (also called the equation of exchange or Fisher's equation). As noted by the head of monetarism, the famous American economist, laureate Nobel Prize Milton Friedman: “Inflation is always and everywhere a purely monetary phenomenon.”

Let us recall the equation of the quantitative theory of money: M*V = P*Y, where M (money supply) is the nominal supply of money (the mass of money in circulation), V (velocity of money) is the velocity of circulation of money (a value that shows how much turnover on average per year is made by one monetary unit, for example, 1 ruble, 1 dollar, etc., or how many transactions one monetary unit serves on average per year), P (price level) - price level and Y(yield) - real output (real GDP).

The product of the price level and the value of real output (P * Y) represents the value of nominal output (nominal GDP). The velocity of circulation of money practically does not change and is usually considered a constant value, therefore an increase in the supply of money, i.e. growth of the left side of the equation leads to growth of its right side. An increase in the money supply leads to an increase in the price level both in the short term (since, in accordance with modern concepts, the aggregate supply curve has a positive slope) (Fig. 2.(a)), and in the long term (to which the vertical aggregate supply curve corresponds) (Fig. . 2.(b)). Moreover, in the short term, inflation is combined with an increase in real output, and in the long term, real output does not change and is at its natural (potential) level.

In the long term, the principle of money neutrality manifests itself, meaning that changes in the money supply do not affect real indicators (the value of real output did not change and remained at the level Y*) (Fig. 2.(b)) .

The exchange equation can be represented in tempo notation (for small changes in its constituent quantities):

where (deltaМ/М x 100%) is the growth rate of the money supply, usually denoted m, (deltaV/V x 100%) is the growth rate of the velocity of money circulation, (deltaP/P x 100%) is the growth rate of the price level, i.e. e. inflation rate pi, (deltaY/Y x 100%) – growth rate of real GDP, denoted by g.

Since it is assumed that the velocity of circulation of money practically does not change, rearranging the equation, we obtain: pi = m – g, i.e. the inflation rate is equal to the difference in the growth rates of the money supply and real output. From this we can draw a conclusion, which is called the “monetary rule”: in order for the price level in the economy to be stable, the government must maintain the growth rate of the money supply at the level of the average growth rate of real GDP.

The question arises: why do governments (especially in developing countries and countries with economies in transition) increase the money supply by imagining Negative consequences this process? The fact is that the emission of money is carried out in order to finance the state budget deficit, which is the explanation for the increase in the growth rate of the money supply and the main reason for high inflation in developing countries and countries with economies in transition.

If inflation is caused by a decrease in aggregate supply (which occurs as a result of an increase in costs), then this type of inflation is called cost-push inflation. Cost-push inflation leads to the already familiar situation of stagflation - a simultaneous decline in production and an increase in the price level (Fig. 3.)

As a result of the combination of demand inflation and cost inflation, an inflationary spiral arises (Fig. 4). Suppose that the central bank increases the supply of money, which leads to an increase in aggregate demand. The aggregate demand curve AD1 shifts to the right until AD2. As a result, the price level increases from P1 to P2, and since the rate wages remains the same (for example, W1), then real incomes fall (real income = nominal income/price level, so the higher the price level, the lower real incomes). Workers demand an increase in wage rates in proportion to the increase in the price level (for example, to W2). This increases firms' costs and causes the aggregate supply curve SRAS1 to shift leftward and upward to SRAS2. The price level will increase to P3. Real incomes will decline again (W2/P3

Workers will again begin to demand higher nominal wages. Workers usually initially perceive its increase as an increase in real wages and increase consumer spending. Aggregate spending increases, the aggregate demand curve shifts to the right to AD3, and the price level rises to P4. At the same time, firms' costs increase, and the aggregate supply curve shifts upward to the left to SRAS3, which causes an even greater increase in the price level to P5.

The fall in real incomes leads to the fact that workers again begin to demand higher wages and everything repeats itself again. The movement follows a spiral, each turn of which corresponds to a higher price level, i.e. higher inflation rate (from point A to point B, then to point C, then to point D, then to point F, etc.). Therefore, this process is called an inflationary spiral or a wage-price spiral. An increase in the price level provokes an increase in wages, and an increase in wages leads to an increase in the price level.

What are the real causes of inflation in the real economy in general and in Russian Federation in particular?

- Deficit and excessive.

- Militarization of the economy and the growth of state military spending.

- Monopolization of markets and monopolistic pricing.

- Low level of development and ineffective.

- Excessive credit expansion.

- Rising prices for exported and imported goods.

- Trade activity and inflow foreign currency, exchanged for national.

- Currency crises and currency devaluations.

- Excessive taxation.

- High inflation expectations.

1. Historically, the first cause of inflation was the deficit of state budgets and additional emissions paper money. Apparently, it is no coincidence that the term “inflation” was first used in North America during the period Civil War 1861-1865 And the rampant hyperinflation in the 20th century. was associated primarily with two world wars. By and large, the depreciation of the monetary unit is mainly a result of an increase in the money supply, as V.N. rightly notes. Shenaev, is typical for past inflation in countries with developed markets and for modern inflation in developing market economies. This state of affairs can be explained by the weak development of the credit system and credit relations in these countries, as well as the insufficient level of development of market relations. The depreciation of money in such conditions is caused by excessive emission associated with covering government expenditures, as a result of which prices rise. Therefore, the definition of inflation as a monetary phenomenon or the overflow of circulation channels with paper money corresponds to these conditions.

In the mechanism of inflation development in developed capitalist countries, an increase in the money supply plays an important, but not the main and, in any case, not the only and determining role. The depreciation of money occurs under the influence of other monetary factors, such as an increase in public debt, an increase in the velocity of money circulation, an increase in the share of non-cash payments, and the expansion of credit.

2. The militarization of the economy and the increase in state military spending are identified above as the second cause of inflation. Of course, it is inextricably linked with the state budget deficit. But we singled it out as an independent reason due to its enormous significance in the modern economy. The mechanism of the impact of the militarization of the economy on inflation is manifested, firstly, in the fact that the maintenance of the army, even in peacetime, absorbs enormous material, technical, financial and human resources, which pure form do not return production to the real economy. The cost per kilogram of weight of many types of modern military equipment higher than the cost of a kilogram of gold. Moreover, it quickly becomes obsolete and must be replaced by a new, even more advanced and, therefore, expensive one. Secondly, not only army personnel, but also employees working in the production of military equipment and weapons receive wages or allowances and show demand in the consumer goods market, while the results of their labor are destroyed at landfills, written off and give nothing material production, since the results of the conversion of military production, especially in Russia, are still very modest.

3. Monopolization of the economy and monopoly pricing. The causes of inflation are generated by specific subjects of a market economy - national and international corporations, including transnational, issuing and commercial banks, and the state. One of the most important causes of inflation is monopolistic pricing, and the engine of this process is monopolies. Monopolies in the modern economy cover all areas of the market, therefore they are very diverse - from housing and communal services enterprises and electricity suppliers in a certain region to such a monopoly as OPEC (Organization of Petroleum Producing Countries). By inflating prices for their products, they generate price increases even during periods of economic crises, giving rise to something unknown until the 1970s. phenomenon - stagflation.

For today's economic cycles The desire of monopolies, when a crisis approaches, to restrain the overproduction of goods in order to maintain the trend of rising prices has become characteristic.

International monopolies play a special role in generating inflationary processes. This was most clearly manifested during the modern global financial and economic crisis, which began in 2008. In order to increase their profits, international oil monopolies inflated their prices in the period 2007-2008. oil prices, which caused an increase in the general level of world and national consumer prices.

Monopolistic pricing is an important generator of inflation in modern Russia.

4. One of the deepest causes of inflation in developing market economies, including Russia, is low level development and ineffective economic structure. This is manifested in high production costs, the lack of competitiveness of national commodity producers, and sometimes in their inability to produce high-tech products. For example, in the production of passenger aircraft, two concerns dominate the world today - the American Boeing and the Franco-German Airbus, and aircraft manufacturing in the Russian Federation has been dominated since the 1990s. has practically ceased to develop and, as an industry that had a high degree of competitiveness on the world market, has been lost by Russia forever.

5. An important cause of modern inflation is the excessive credit expansion of banks, especially not accompanied by an adequate expansion of material production. The fact is that state budget deficits today, as a rule, are covered not by additional emission of money, but through government borrowing and the issuance of debt obligations by the state. In certain periods, the state “eats” up to half or two-thirds of all national credit resources, “taking” them from producers, throwing money onto the market that is not backed by commodity values.

6. One of important reasons inflation is the rise in prices of imported and exported goods. As for imported goods, it is clear that an increase in prices for them increases the cost of enterprises, if we are talking about means of production, and the “consumer basket”, if we are talking about consumer goods. The impact of rising prices of exported goods on domestic inflation is more indirect. But we are all witnesses to these processes, when the rise in world prices for oil, gas and petroleum products pushes our exporters to increase prices for gasoline, gas and diesel fuel within the country. In 2007, the increase in world grain prices entailed almost double growth prices on the domestic Russian market. Therefore, at the request of the President of the Russian Federation, the government took urgent measures to protect the domestic market by increasing export duties on grain.

7. An important role in the development of inflation processes, especially in Russia, is played by the influx of foreign currency, primarily due to the active trade balance. This type of “imported” inflation is formed as a result of imbalances in commodity and cash flows. The trade balance asset indicates that instead of the amount of goods exported from the country, foreign currency came into the country for this amount, which the Central Bank buys by issuing the national currency into circulation.

A significant factor in inflation is currency crises and currency devaluations. In fact, devaluation is the result of the unfolding of deep-seated inflationary processes. Devaluation means a decrease in the value of the national currency in relation to international convertible currencies and international units of account (and until the 1970s, a decrease in the gold content of the monetary unit).

Currency devaluation can be official, open, i.e. recognized by the government, or hidden, creeping. In any case, devaluation means the depreciation of the national currency and an increase in prices not only for imported goods, but also for domestically produced goods.

9. Excessive taxation is also one of the important reasons for rising prices. This applies both to taxes included in production costs, and especially to indirect taxes (VAT, sales tax, etc.), which are fully and directly included in the price of goods sold and paid by the consumer.

10. An important factor in the inflation mechanism is inflation expectations. Price growth is laid down in program documents, in particular in the law on the state budget, and in fact, as a rule, it exceeds forecast indicators, forcing consumers to adapt their decisions to the expected growth, increase current demand to the detriment of savings and thereby stimulate price growth . This makes inflation expectations even more stable, stimulates self-reproduction of the inflation mechanism, which is dangerous for the economy, and prevents the growth of savings, investments, production and supply of goods. Sometimes inflation puts the buyer in a situation with no alternative.

Main causes of inflation

When considering the causes, economists distinguish between two types: buyer inflation (demand inflation) and seller inflation (cost inflation). In essence, these are two, as a rule, interrelated, but unequal causes of inflation: one - on the demand side (excess Money from buyers), the other - from the supply side (increasing production costs).

What is demand-pull inflation? This is a type of inflation generated by an excess of aggregate demand, which for one reason or another cannot be kept up with by production. Excess demand causes prices to soar.

An example of such inflation was the USSR in the late 80s and early 90s, when wages of the population grew, and the volume of production of consumer and other goods and services decreased. Another example could be modern China, where during the years of particularly rapid growth of the manufacturing industry, it lacks raw materials, energy, and transport capabilities, and therefore prices for goods and services in these industries rise rapidly, which provokes price outbreaks throughout the economy. Inflation can develop without additional stimulation of demand. The reason should be sought from the supply side. This is a different kind of inflation - cost inflation. The inflation mechanism begins to unwind due to the fact that costs are rising.

There are three possible starting points: costs begin to rise as a result of rising wages (pressure from trade unions, demands of workers) or due to rising prices for raw materials and fuel (rising import prices, changing production conditions, increasing transportation costs, etc.).

In addition to demand inflation and cost inflation, they often distinguish inflation expectations (inflation expectations). Inflation does not tend to die out instantly (with rare exceptions, when, for example, a new national monetary unit is introduced - the chervonets in Russia in 1922). Therefore, in their contracts for the supply of products in a year or more, manufacturers stipulate an increase in prices, bankers stipulate the depreciation of the ruble when providing long-term loans. As a result, consumer prices will rise by the end of the year, if only because this was planned (expected) by firms and banks.

When pursuing a policy of active fight against inflation (deflationary policy) the government usually strongly inhibits the growth of the money supply, which leads to a decrease in demand and, accordingly, a drop in GDP (absolute or growth rate). However, cost-push inflation and expectation inflation persist, and as a result, a decline in GDP may be combined with inflation, albeit a decrease. The combination of inflation with a decline in production creates stagflation.

Causes of inflation on the demand side

Demand side reasons cause inflation, unfolding according to the demand mechanism. Let's look at them in detail.

State budget deficit

Those. The excess of state expenditures over its income is the most common, almost universal cause of inflation in a market economy. The impact of the government budget deficit on inflation depends on the way it is financed.

Inflation expectations

Usually this reason coexists with another - the main one - since any expectations have some basis. The dissemination of information about an approaching crisis (banking, foreign exchange, fiscal, etc.) can cause rush demand in both the consumer and foreign exchange markets and provoke the depreciation of the domestic currency.

Under the influence of the expectations factor, the behavior of certain groups of the population may turn out to be inflationary, even in the absence of any shifts in the government’s monetary policy or the level of government spending. Changes that, at first glance, have nothing directly to do with inflation can give rise to inflationary psychology.

Increase in unexpected government spending

Increase in unforeseen government spending including military, emergency, caused by man-made and environmental disasters, natural disasters, ethnic conflicts, etc.

On the one hand, an increase in aggregate spending leads to the development of “demand inflation”. On the other hand, you have to distract internal resources for non-productive or restoration activities, and, therefore, the scale of production of civilian products is reduced, and inflation of this type develops not only according to the demand mechanism, but also according to the supply inflation mechanism.

Issue by central bank(including by joint decision with the government) problem, unsecured loans individual industries and areas of activity.

At the beginning of market reforms in the Russian economy, the Bank of Russia issued similar loans to the fuel and energy complex, agriculture, bankrupt enterprises. And this was one of the important reasons for inflation. During financial crisis 2008-2009 for supporting banking system The Bank of Russia has become very active in distributing unsecured loans to banks and has expanded the list of bank refinancings. At the same time, the agent of the Government of the Russian Federation - the Development Bank (Vnesheconombank of the Russian Federation) provided subordinated loans commercial banks, which are long-term borrowings equated to banks’ own capital, increasing their ability to attract borrowed money. The expansion of lending to the economy by the central bank and government agent is equivalent to the use of the credit channel of money emission, which, in conditions of full employment or close to it, contributes to rising prices in the country.

Faster growth of nominal incomes compared to the growth of domestic production. In itself, an increase in personal income does not necessarily cause inflation, especially when these incomes are obtained as a result of an increase in the physical volumes of national production. They become inflationary dangerous if their growth is associated with an increase in export prices relative to import prices, i.e. by “improving conditions foreign trade" In case of favorable price conditions in foreign markets, the income of the exporting country becomes inflationary. They become especially dangerous if the country maintains a trade surplus, i.e. exports exceed imports. When converting foreign exchange earnings from foreign trade into the national money supply, the inflationary effect moves into the economy of a given country. This effect can be counteracted by: 1) a depreciation of foreign currency, which reduces the income of exporters in domestic currency; 2) capital outflow abroad, i.e. into external savings, which reduces the very scale of conversion into the national money supply.

So, the central bank has three main channels for issuing money at its disposal: 1) credit channel - issuing loans to the government and commercial banks; 2) stock channel - purchase of government, less often corporate, securities; 3) currency channel - acquisition of foreign currency by him. Each of these channels, under certain circumstances, can lead to emission of money, unsecured mass of goods, which can be considered some common cause demand inflation.

Causes of inflation on the supply side

Supply side reasons cause inflation, which unfolds according to the cost mechanism.

Monopoly, low level of competition in markets

Monopolization of factor markets creates a greater inflationary danger than monopolization of markets for finished goods and services. The threat of inflation increases when the cost of these production factors constitute a significant part of firms' costs.

Low levels in domestic markets are a significant cause of inflation. In countries with administrative-command economies (including the USSR), there were enough big number enterprises - “artificial” monopolists operating within the framework of the “single national economic complex of the country.”

Currently, the situation in Russia has changed - the main provocateurs of inflation are enterprises are natural monopolists. A natural monopoly is a situation where the effective existence of only one company in the market provides the entire sales volume of a given product or service. This occurs due to the so-called positive (or, what is the same thing, increasing) returns to scale. Positive returns to scale are a situation where expansion of the enterprise leads to a decrease in average costs (costs per unit of output). Positive returns to scale are often associated with the networked nature of the delivery of goods. True, in economic theory, a resource monopoly is sometimes also considered a type of natural monopoly - one when a firm has exclusive access to some resource.

In Russia, natural monopolist enterprises include federal companies: JSC Federal Grid Company of the Unified Energy System of Russia (JSC FGC UES), JSC Gazprom, JSC Russian railways", a joint-stock company for transport)" oil "Transneft", FSUE "Russian Post". In local markets, the natural monopolists are water utilities and utility companies.

Natural monopolists periodically receive government permission to significantly increase tariffs; they factor into this increase both the accumulated change in prices and advanced inflation. The services of natural monopolies are in mass demand and have no substitutes, so their rise in price causes an increase in costs and a chain increase in prices in almost all sectors of the national economy.

Rising production costs

The reasons for rising costs and rising prices for products may be natural disasters, crop failures, breaks in economic ties, deterioration of access to world markets for factors of production, including due to the introduction of a trade embargo against the country. These extraordinary circumstances cause so-called supply shocks. Long-term factors contributing to the rise in prices of products are: depletion of rare resources, obsolescence of the production structure, costs of updating it. The latter fits into inflationary process of cyclical origin. Finally, an increase in the price of products may be a consequence of an increase in administrative costs (in the case of increased government regulation), costs of protecting property rights, and an increase in entertainment expenses. It causes inflationary process of institutional origin.

Tax increases

Taxes have a mixed effect on inflation. The impact of direct and indirect taxes is different. From the course of microeconomics it is known that indirect taxes (excise taxes, VAT, natural payments) are partially or completely transferred to the price of products, and, therefore, directly affect inflation. At the same time, direct taxes (income tax, personal income tax) reduce total disposable income and suppress demand-side inflation.

External causes of inflation

These reasons occur in countries with open economy, i.e. a large share of exports and (or) a large share of imports in the country's gross domestic product. Conventionally, they can be divided into three groups:

1. increase in world prices for imported goods. In the short term, with a constant exchange rate of the national currency relative to the currencies of the countries exporting these goods, an increase in world prices for imported goods causes an automatic rise in the price of imported goods in the domestic market, as well as an increase in the prices of goods and services produced using them. In addition, demand shifts to domestic substitute goods, and as a result, their prices also rise. This inflation is called imported. The lower the elasticity of import substitution by domestic production, the greater the impact of imported inflation on national inflation;

2. reduction in the exchange rate of national money. It is equivalent to an internal rise in price of imported goods, i.e. increase domestic prices on them. The depreciation of the national currency occurs due to various reasons: due to the depletion of foreign exchange reserves of the state, an increase in payments on domestic or external debt, a decrease in the trade balance as a result of an increase in imports or

3. unfavorable situation on the market for exported goods. As in the case of imported inflation, rising prices for imported goods cause domestic prices to adjust with some delay.

Thus, we have listed the causes of inflation, which are usually studied in domestic and foreign literature. Within different directions Economic thought has its own theories and concepts of inflation, which interpret its origin differently, giving preference to one or another of its causes. These theories also differ in their views on the consequences and effects of inflation in the short and long term, as well as on the issue of regulating inflation processes in the economy.

Inflation (from the Italian “inflatio”, which means “inflation”) is a steady trend of growth in the general level of prices. Two concepts play an important role in this definition:

- stable rising prices. That is, inflation is a long-term process extended over time, so any short-term price jumps do not apply here;

- general price level. That is, we are not talking about an increase in all prices. The cost of certain groups of goods may remain unchanged or even decrease. We can talk about inflation if it increases general price index.

If we talk about the types of inflation, we distinguish: moderate, galloping, high, hypertrophied forms.

Types and types of inflation

Depending on the criteria, several groups of types of inflation can be distinguished.

For example, if you select the inflation rate as a criterion, the list will be as follows:

- moderate. The inflation rate is no more than 10%, usually 3-5% per year. Normal level for a modern economy;

- galloping. The rate of this type of inflation is expressed in double-digit percentages. Considered a major economic problem;

- high. Can be 200-300% or more. Typical for developing countries and countries with economies in transition;

- hyperinflation. Can reach more than 1000% per year.

If we choose the form of manifestation of inflation as criteria, we can distinguish such varieties as:

- Open. It manifests itself in the rise in prices, which we clearly see;

- Depressed. It manifests itself in the form of a shortage of goods when the government sets prices at a level below the equilibrium market level.

Open inflation

Open inflation is one of the types of inflation that manifests itself in overall growth prices The open form does not introduce an imbalance into market mechanisms: rising prices in some markets are offset by their decline in others. This can be explained by the continued operation of market mechanisms that send price signals to the economy, stimulate the expansion of supply and production, and push investments.

Open inflation is a completely natural phenomenon in the world economy, which contributes to the development of markets, so there is no need to fight open inflation, but it must be kept under control, since an uncontrolled increase in the price level can weaken the economy.

Consequences of inflation

The consequences of inflation are manifested in both the economic and social spheres.

- In conditions of inflation, real incomes of the population decrease. People with a fixed income receive a particularly strong “blow,” since the same amount can buy fewer and fewer goods every month.

- Inflation leads to a decrease in real savings in the form of money, depreciating personal savings.

- Inflation contributes to social stratification.

- In conditions of inflation, a phenomenon such as a “flight” from money is often observed, which is an accelerated materialization of finance (money is quickly transferred into services and goods), which, in turn, stimulates production and contributes to economic development.

Causes of inflation

There are two clear causes of inflation:

- increase in aggregate demand. In this case we are talking about demand inflation. Either an increase in any component of aggregate spending or an increase in the supply of money can lead to an increase in aggregate demand. The main reason for this type of inflation is an increase in the money supply;

- reduction in aggregate supply. It is the result of costs, which leads to stagflation, a simultaneous increase in the price level and a decline in production.

Hidden inflation

Hidden inflation is one of the types of inflation in which prices and incomes of the population remain unchanged, but there is an increase in the money supply or production costs. In other words, it is the gap between government-set and market prices.

Hidden inflation is a consequence of strict government control of markets. If the state sees that rising prices can lead to catastrophic consequences, it suppresses it: but in this case we are talking about eliminating the consequences, not the causes, and often ends in a shortage of goods: it is simply unprofitable for producers to produce and sell goods at prices below their adequate cost .

Commodity inflation

In most countries of the world, commodity inflation is the most important macroeconomic indicator that determines investment and consumer demand, interest rates, exchange rates, and many social aspects, including the quality and cost of living.

The state’s ability to keep inflation at an optimal level allows us to speak about the efficiency of the economy in the country, about sufficient high degree development of self-regulation mechanisms, dynamism and stability economic system. Inflation at an optimal level (up to 10% per year) is useful for the country’s economy, as it stimulates commodity-money relations, the production of various goods, and so on.

Economic inflation

Economic inflation is always accompanied by rising prices, but rising prices are not always a form of inflation. Prices may rise due to crop failure, cyclical fluctuations, energy crisis, and so on.

The reasons for inflationary price increases include monopolistic price races, covering the state budget deficit with the help of additional money issues, inflationary expectations, and so on.

In the global economy, two parameters are traditionally used to describe the level of inflation: the gross national product deflator and the consumer price index.

Types of inflation

As already noted, inflation is a decrease in the purchasing power of money, manifested primarily through the relative fast growth prices There are two main types of inflation: hidden and open. Both types are based on an imbalance between the value of the entire mass of goods and services in the opposing money supply.

1. Hidden inflation usually exists in a non-market economy, in which prices and wages are controlled and determined by the state. It manifests itself through commodity shortages, through deterioration in the quality of manufactured goods. A shortage of goods led to the fact that money ceased to fulfill its functions, so in order to buy some goods, it was not enough to have money; special coupons were also required.

2. Open inflation manifests itself mainly through rising prices for goods and services. Paper money depreciates, and an excess money supply arises that is not backed by an appropriate amount of goods and services.

At the same time, any price increase cannot be considered as inflation. On the contrary, price increases may be non-inflationary and occur under the influence of other reasons.

Types of inflation

Depending on the growth rate of inflation indicators, the following types of inflation are distinguished.

1. Creeping inflation - the rate of price growth is 10% per year. This is a moderate price increase that does not have a significant negative impact on economic life. Savings remain profitable (interest income is higher than inflation), risks when making investments almost do not increase, and the standard of living decreases slightly.

This type of inflation is typical for countries with developed market economies.

2. Galloping inflation - the rate of price growth - up to 300-500% per year, monthly growth rates are measured in double digits. Such inflation has Negative influence on the economy: savings become unprofitable (% of deposits are below the inflation rate), long term investment become too risky, the standard of living of the population is significantly reduced.

Such inflation is typical for countries with weak economies or countries with economies in transition.

3. Hyperinflation - growth rate of more than 50% per month. On an annualized basis, more than ten thousand percent. Such inflation has a destructive effect on the economy, destroying savings, the investment mechanism, and production as a whole. Consumers are trying to get rid of “hot money” by turning it into material assets.

4. Causes of inflation

The main differences in the approach to the theory of inflation lie in determining its causes, which include the excess of the money supply over the commodity supply, emission, discrepancy between the growth rates of labor productivity and wages, budget deficit, excess investment, excessive growth of wages and production costs, etc.

However, inflation, although manifested in rising commodity prices, cannot be reduced only to a purely monetary phenomenon. This is a complex socio-economic phenomenon generated by imbalances in reproduction in various fields market economy. In general, the roots of such a phenomenon as inflation lie in the mistakes of the public policy. Typically, inflation is based not on one, but on several interrelated causes, and it manifests itself not only in rising prices. The causes of inflation can be both internal and external.

External reasons include, in particular, a reduction in revenues from foreign trade, a negative balance of foreign trade and balance of payments. For example, the inflationary process in Russia was intensified by the fall in prices on the world market for fuel and non-ferrous metals, which constitute an important item of our exports, as well as the unfavorable situation on the grain market in the context of significant grain imports.

Internal reasons are most often hidden in the wrong financial policy states.

The most important reasons for inflationary price increases are:

1. Disproportionality or imbalance of government revenues and expenditures.

This imbalance is reflected in the government budget deficit. If this deficit is financed by borrowing from the country's Central Bank of Issue, that is, by printing new money, then this leads to an increase in the mass of money in circulation and, consequently, to an increase in prices.

2 . Modern economic theory associates a general increase in the price level with a change in market structure.

The structure of the modern market is less and less reminiscent of the market structure of perfect competition, and largely resembles an oligopolistic one. And an oligopoly has the ability to to a certain extent influence the price. Thus, oligopolists are directly interested in strengthening the “Price Race”, and also, in an effort to maintain a high price level, are interested in creating a shortage (reducing production and supply of goods). Monopolists and oligopolists prevent the growth of elasticity of supply of goods and the connection with rising prices. By limiting the influx of new producers into the industry, the oligopoly maintains a long-term mismatch between supply and demand.

Inflation (from Latin inflation - swelling, swelling) - an increase in the general level of prices for goods and services, accompanied by a corresponding decrease in the purchasing power of money (depreciation of money) and leading to a redistribution of national income between economic sectors, commercial structures, population groups, the state and entities management.

Inflation is a continuous increase in the average price level in the economy, the depreciation of money, which occurs due to the fact that there is more of it in the economy than is needed, that is, the money supply in circulation “swells.”

A more strict definition of inflation, taking into account the causes and some consequences of the increase in the average price level in the economy, is as follows: inflation is an imbalance of supply and demand (a form of violation of the general equilibrium in the economy), manifested in rising prices and depreciation of money.

Inflation is one of the most serious macroeconomic problems. As an economic phenomenon, inflation appeared almost with the emergence of money, with the functioning of which it is directly related.

Inflation is inherent in any model economic development, where government revenues and expenses are not balanced, the central bank’s ability to conduct independent monetary policy is limited.

Not every price increase is an indicator of inflation. Prices may rise due to improved product quality, worsening conditions for the extraction of fuel and raw materials, and changes in social needs. But this will, as a rule, not be inflationary, but rather a logical, justified increase in prices for individual goods.

Inflation is a multifaceted and complex phenomenon, the causes of which lie in the interaction of factors in the sphere of monetary circulation and the sphere of production. Externally, inflation looks like a depreciation of money due to its excessive emission (increase in the money supply), which is accompanied by an increase in prices for all economic goods. However, this is only one of the forms of manifestation of inflation, but not at all its cause and deep essence.

Therefore, inflation should be viewed from several perspectives:

- as a violation of the laws of monetary circulation, which causes a breakdown of the state monetary system;

- as an obvious or hidden price increase;

- naturalization of exchange processes (barter transactions);

- decline in living standards of the population.

CAUSES OF INFLATION

Inflation is caused by monetary, structural and external factors. Monetarism believes that inflation is caused mainly by monetary factors, that is, by the financial policy of the state.

Monetary reasons:

- discrepancy between monetary demand and commodity supply, when the demand for goods and services exceeds the size of trade turnover;

- excess of income over consumer expenses;

- state budget deficit;

- militarization of the economy or excessive growth of military spending;

- overinvestment - the volume of investment exceeds the economic capacity;

- increase in the speed of circulation of money;

- faster wage growth compared to production growth and increased labor productivity.

Structural reasons:

- deformation of the national economic structure, expressed in the lag in the development of industries in the consumer sector;

- reduction in the efficiency of capital investment and curbing consumption growth;

- state monopoly on foreign trade;

- imperfection of the economic management system.

External reasons:

- global crises (raw materials, energy, food, environmental), which are accompanied by multiple increases in prices for raw materials, oil, and so on;

- banks’ exchange of national currency for foreign currency, which creates the need for additional issue of paper money;

- reduction in revenues from foreign trade;

- negative balance of foreign trade balance of payments.

Inflation can be caused by adaptive inflation expectations associated with the impact of political instability, with the activity of funds mass media, loss of trust in government. Against the backdrop of high inflation expectations and rising foreign exchange rates, the population prefers to keep their savings not in the national currency.

Inflation can be triggered by government tax policy. In conditions of inflation, the formation of budget revenues occurs on an inflationary basis - in the event of a decline in production, profit is generated mainly due to rising prices, and not due to the creation of real material assets. If a large part of the farm’s profits is withdrawn from the budget, the tendency to evade taxes increases and the possibilities for investment activity decrease. When production volumes fall, value added tax only aggravates inflation; it directly affects the increase in prices.

Inflation is influenced by trade union associations, which do not allow the market mechanism to establish a wage level worthy of the economy.

Inflation is also influenced by large monopolists, who get the opportunity to determine the price level for their goods. These are often representatives of the raw materials industry.

The underlying causes of inflation are found both in the sphere of circulation and in the sphere of production and are very often determined by economic and political relations in the country.

TYPES OF INFLATION

Depending on the criteria, different types of inflation are distinguished. If the criterion is the rate (level) of inflation, then the following types are distinguished: moderate, galloping, high and hyperinflation.

Moderate inflation is measured in percentage per year, and its level is 3-5% (up to 10%). A similar rate of price growth is observed in many Western countries. This type of inflation is not accompanied by crisis shocks. Moderate inflation stimulates demand and promotes production expansion and investment. It has become a familiar element of a market economy.

The acceptable rate of moderate inflation is not the same for various countries. For example, for Switzerland it should not go beyond 1%; for Greece, stable economic development is achieved within the range of 8 - 10% price growth.

Galloping inflation - prices are rising rapidly, increasing by 10 - 100% per year. At the same time, trade turnover is reduced, production declines, investments are reduced and there is an outflow of capital from the sphere of production to the sphere of circulation. This type of inflation is difficult to control; monetary reforms are often carried out, and the population invests money in material assets. All this indicates a sick economy leading to stagnation, that is, to economic crisis. Galloping inflation is considered a serious economic problem for developed countries.

High inflation is measured in percentages per month and can reach 200 - 300 percent or more per year, which is observed in many developing countries and countries with economies in transition. The well-being of even the wealthy strata of society and normal economic relations are being destroyed. This type of inflation requires emergency measures. As a result of high inflation, real national output declines, unemployment rises, businesses close, and bankruptcy occurs.

With high inflation, money begins to lose its value, and economic agents tend to transfer it to commodity values, there is an intensive indexation of income and contract prices, speculative trends and inflation expectations are growing.

Hyperinflation, measured in percentages per week and even per day, the level of which is 40-50% per month or more than 1000% per year. Classic examples of hyperinflation are the situation in Germany in January 1922 - December 1924, when the rate of increase in the price level was 1012 and in Hungary (August 1945 - July 1946), where the price level over the year increased by more than 2300 times with an average monthly increase of 198 once.

Depending on the nature of the manifestation, the following types of inflation are distinguished:

1. Open - a positive increase in the price level in conditions of free, unregulated prices.

2. Suppressed (closed) - increasing commodity shortages, under conditions of strict government control over prices. This type of inflation occurs when prices are set by the state, and at a level lower than the equilibrium market level (set by the relationship between supply and demand on the goods market). The main form of manifestation of suppressed inflation is a shortage of goods.

From the point of view of factors of production, there are the following types of inflation: demand and supply (cost) inflation.

Demand-pull inflation is caused by an excess of demand over supply, which accelerates price increases. Increasing prices at constant costs ensures an increase in profits and cash income of workers. This determines the next round of increased demand, etc.

Demand inflation is caused by the “swelling” of the money supply. The main reason for its “swelling” is the growth of military spending, when the economy is focused on significant expenditures on weapons and for this reason the state has a growing budget deficit, which is covered by issuing money that is essentially not backed by commodity resources.

At the initial stage of accumulation of excess money supply, an increase in production and sales, a decrease in unemployment, prices, and, ultimately, the establishment of equilibrium are stimulated. Therefore, it is concluded that in minimum sizes inflation is even useful, since it guarantees against a crisis of overproduction and reduction in employment. Subsequently, when full employment spreads to all sectors of the economy and they can no longer respond to the increase in demand with additional supply of products, prices rise. Then factors begin to operate that cause a decline in production, a decrease in its efficiency and an exacerbation of inflation.

With demand inflation in the payment turnover, there is a certain “overhang” of excess money compared to the limited supply, which causes an increase in prices and depreciation of money.

Supply (cost) inflation is caused by an increase in production costs (due to rising wages and due to rising prices for raw materials and energy), which causes an increase in prices for goods and services and, as a consequence, leads to a reduction in production and employment, i.e. to a recession and further reduction in spending.

Supply inflation is usually considered from the standpoint of rising prices under the influence of rising production costs, primarily rising wage costs. Rising prices for goods reduce household incomes, and wage indexation is required. Its increase leads to an increase in production costs, a reduction in profits, and production volumes at current prices. The desire to maintain profits forces producers to raise prices. An inflationary spiral arises: rising prices require an increase in wages, an increase in wages entails higher prices - the theory of an “inflationary spiral” of wages and prices.

Supply inflation can only occur if unit costs increase and prices rise as a result. However, wages are only one of the elements of price and, as a rule, the production of goods becomes more expensive due to increased costs for the purchase of raw materials, energy resources, and payment for transport services. An increase in material costs around the world is a natural process due to the rise in the cost of production, transportation of raw materials and energy resources, and this will always affect the growth of production costs. The counteracting factor is the use of new technologies that reduce unit costs.

An increase in wages causes an increase in production costs and, accordingly, an increase in prices if there is a simultaneous increase in the main sectors of the economy, regardless of the increase in labor productivity. In real life, statewide wage growth always lags significantly behind price growth and full compensation is never achieved.

With supply inflation, the amount of money, taking into account the speed of its circulation, is “pulled up” to the increased price level caused by the influence of non-monetary factors on the part of production and supply of goods. If the mass of money does not quickly adapt to the increased price level, problems begin in money circulation - a shortage of means of payment, non-payments, and after this a recession, a stop in production, and a reduction in the supply of goods.

Based on the degree of divergence in price increases for different product groups, the following types of inflation are distinguished:

1. Balanced – prices of various goods relative to each other remain unchanged;

2. Unbalanced - the prices of various goods in relation to each other are constantly changing.

According to the criterion of the attitude of economic agents to inflation, it can be divided into two types:

1. Unexpected inflation - inflation with sudden price jumps, which are caused by the influence of inflationary expectations of the demand of commodity producers for means of production and raw materials, and of the population - for consumer goods.

2. Expected inflation – gradual, moderate inflation, which is forecast for a certain period. Often such inflation is the result of anti-inflationary actions on the part of the state.

Other types of inflation include:

1. Imported inflation - develops under the influence of factors of a foreign economic nature (increasing prices for imported goods, excess inflow of foreign currency into the country).

2. Stagflation - this type of inflation is accompanied by an increase in unemployment and prices, and at the same time stagnation of production.

Inflation is used to redistribute national income and social wealth in favor of the initiator of the inflation process, which in the vast majority of cases is the currency issuing center. Moreover, if the issue of national currency occurs due to the purchase of foreign currency by the central bank, a transnational redistribution of social wealth occurs.

Inflation models

Kagan's hyperinflation model is based on a model of dependence of the real demand for money only on inflation expectations, which are formed adaptively. At low values of the rate of adaptation of expectations and low elasticity of the demand for money according to inflation expectations, this model describes a virtually equilibrium situation when inflation is equal to the growth rate of the money supply (which is consistent with the quantity theory of money). However, at high values of these parameters, the model leads to uncontrollable hyperinflation, despite the constant growth rate of the money supply. It follows from this that in such conditions, reducing the level of inflation requires measures that reduce the inflationary expectations of economic agents.

Friedman's model is based on the real demand for money as a function of real income and expected inflation, and expectations are assumed to be extremely rational, that is, equal to actual inflation. For this model, it is possible to determine the level of inflation at which real seigniorage is maximum - the so-called. optimal inflation. Other things being equal, this level of inflation is lower, the higher the rate of economic growth. If actual inflation is higher than “optimal”, then additional money emission will only accelerate inflation and may lead to negative real seigniorage. Money emission is possible if actual inflation is lower than “optimal”.

The Bruno-Fischer model takes into account the dependence of the demand for money not only on inflation expectations, but also on GDP; more precisely, the same function is used as in the Kagan model, but for the specific (per unit of GDP) demand for money. Thus, in this model, in addition to the growth rate of the money supply, a (constant) GDP growth rate appears. In addition, the model introduces a budget deficit and analyzes the impact of the budget deficit and methods of financing it (pure emission of money or mixed financing through emission and borrowing) on the dynamics of inflation. Thus, the model allows us to deepen the analysis of the consequences of monetary policy.

The Sargent-Wallace model takes into account the possibility of emission and debt financing of the budget deficit, but proceeds from the fact that the possibility of increasing debt is limited by the demand for government bonds. The interest rate exceeds the growth rate of output, therefore, from a certain point, financing the deficit becomes possible only through seigniorage, which means an increase in the growth rate of the money supply and inflation. The model assumes that monetary policy is unable to influence the growth rate of real output and the real interest rate. The main conclusion of the model, which seems paradoxical at first glance, is that contractionary monetary policy today inevitably leads to an increase in the price level tomorrow and, moreover, it can lead to an increase in current inflation. This conclusion follows from the fact that economic agents expect that the government in the future will have to switch from debt financing to emission financing, and a low rate of money supply growth today means a high rate in the future, which will cause inflation. Expectations of future inflation can cause inflation in the present, despite contractionary monetary policy. Thus, inflation with debt financing can be even higher than with emission financing. The only reliable means is to achieve a budget surplus.

METHODS FOR MEASURING INFLATION

Inflation is measured using a price index. Exist various methods calculation of this index: consumer price index, producer price index, GDP deflator index. These indices differ in the composition of the goods included in the assessed set, or basket. In order to calculate the price index, it is necessary to know the value of the market basket in a given (current) year and its value in the base year (the year taken as the reference point).

In Russia federal Service state statistics publishes official consumer price indices that characterize the level of inflation. Additionally, these indices are used as correction factors, for example, when calculating the amount of compensation, damage, etc.

The most controversial point is the composition of the consumer basket, both in terms of content and variability. The basket can be guided by the actual consumption structure. Then it should change over time. But any change in the composition of the basket makes the previous data incomparable with the current one. The inflation index is distorted. On the other hand, if you do not change the basket, after a while it will no longer correspond to the real consumption structure.

The uneven rise in prices for different types of products complicates the process of obtaining a correct assessment of the economic situation in the country. Price indices will help you understand what inflation is, its presence or absence, and assess the depth of this phenomenon - these are relative indicators, they are designed to correlate the price level over time.

1. Ratio of prices to the base period. This method is called the consumer price index.

2. Significantly ahead in time of the previous method of calculating inflation using the producer price index method. It shows the cost of a country's entire production without taking into account added value and taxes.

3. It also clearly shows what inflation is and what its level is in the country, control over the excess of expenses over income. This method is called the living expenses index.

4. Study and analysis of rising asset prices. This producer asset price index demonstrates the direct impact of inflation on the enrichment of their owners. This occurs due to outstripping growth in asset prices, prices of consumer goods and monetary value.

5. GDP Deflator (GDP Deflator) - calculated as the change in price for groups of identical goods.

6. Purchasing power parity of the national currency and changes in exchange rates.

Consequences of inflation

Like any multifactor economic process, inflation has whole line consequences. It negatively affects the economic life of the country: economic ties are destroyed, investment process, imbalances and chaos in the economy are increasing. Moreover, capital from the sphere of production is poured into the sphere of circulation, mainly into speculative commercial structures, where they bring huge profits, or are moved abroad in search of even greater profits. During periods of inflation, corruption, the shadow economy and speculation always flourish in the country.

Consequences of inflation:

- decrease in real incomes of the population (with uneven growth of nominal incomes);

- depreciation of savings;

- deterioration of living conditions mainly among representatives of social groups with fixed incomes (pensioners, employees, students, whose income is generated from the state budget);

- redistribution of income between population groups, spheres of production, regions, economic structures, firms and the state;

- inflation forces you to spend money immediately, which increases the demand for goods;

- entrepreneurial activity decreases, because inflation does not allow us to calculate prices for the future and determine income from business activities;

- loss of interest among manufacturers in creating quality goods (production of goods increases Low quality, production of relatively cheap goods is reduced);

- volumes of lending and investment in the economy are declining, production is declining, unemployment is rising;

- increasing imbalances between the production of industrial and agricultural products;

- enterprises with long production cycles are shut down;

- depreciated money does not perform its role well, the dollar displaces the ruble, and as a result, the country’s monetary system is undermined;

- destabilization of foreign economic activity - the export of raw materials predominates, the import of imports predominates, the burden of debt increases;

- stimulates the development of the “shadow” economy.

Anti-inflationary policy

Anti-inflationary policy is a set of government measures to limit inflation by regulating monetary and other areas of the economy. It causes a reduction in government spending; slows down price growth; restrains aggregate demand.

Inflation regulation is carried out through specific measures of macroeconomic policies that make it possible to weaken the effect of pro-inflationary factors.

Regulation methods:

- credit incentives (change in discount rate, change in interest rate on long-term loans, changes in the required reserve ratio, purchase of securities on the open market);

- monetary stimulation (expansion of banknote and check issues, easing of restrictions on the growth of the money supply).

Types of anti-inflationary policies:

1. Deflationary policy - it is carried out through credit and monetary curbs on demand and increased tax pressure. The peculiarity of this policy is that it causes a slowdown in economic growth and, at the same time, crisis phenomena in the economy are growing, there is a decline in production, rising unemployment, and a drop in living standards.

2. Income policy is aimed at freezing wages, determining the limits of their growth, limiting demand and prices for products.

Types of income policies:

1. The policy of “dear money” is aimed at increasing interest rates, increasing the tax burden, and reducing government spending.

2. Tax incentive policy - direct incentives through tax cuts and indirect incentives, which increases household savings while reducing taxes on individuals.

3. The policy of slowing down the velocity of circulation - investment in the economy.

Monetary policy involves the use of the following tools:

- revaluation, which leads to a decrease in prices for imports and increases prices for exports, restraining the rise in prices within the country;

- limiting the influx of short-term capital from abroad, which restrains the expansion of the deposit base and accordingly reduces the money supply within the country.