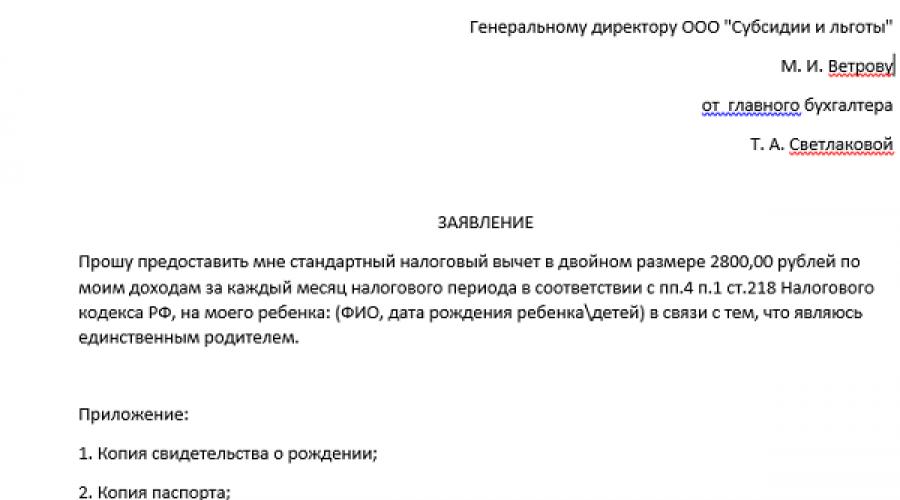

Application for personal income tax deduction form. Application for a standard personal income tax deduction for children

Design tax deduction V double size maybe one parent, it doesn’t matter whether the applicant is a woman-mother or a man-father. The main thing is that the applicant has the right to receive this compensation.

We will tell you how to correctly fill out an application for double personal income tax deduction for a single parent for a child or children, and give examples of correctly written documents.

Rules for writing and completing an application for a tax deduction

In order to obtain a double tax deduction for income tax, individual, acting as a mother, father - or parent of a child/children, must collect a documentation package and write a personal statement.

When submitting, please note that the application is divided into three parts:

- Introductory. It usually indicates the name of the organization to which the documents are being submitted, as well as information about the applicant.

- Contentful. This part usually indicates the reason for the request. In our case, a single mother or single father must state his request (to provide a standard tax deduction in double size) and the reasons for its implementation (it is stated that you are the only parent and Article 218 of the Tax Code of the Russian Federation is indicated, according to which the deduction must be provided) .

- The final one. It lists the list of documents that are attached to the application, the date of application and the signature of the applicant.

Follow these rules when writing an application for a double personal income tax deduction for a single parent:

- Place the document header on the right side, at the top of the document.

- Write without errors, typos, corrections. If there is an error or a crossing out, you should rewrite the application.

- The name of the document – Application – is required. The name is usually written without quotation marks, with a capital letter. There is no period at the end of the word.

- The initials of the child or children must be written as on the birth certificate.

- Indicate not only the child’s full name, but also the date of birth. As a rule, the date and year are written in numbers, and the month in letters.

- The list of documents must be formatted as in the sample. Every document is capitalized. Each line has a period at the end, not a semicolon or comma.

- There should be no grammatical errors in the application.

- Do not forget to indicate the date when you submit the document, put your signature and decipher it.

Ready-made form and sample application for double tax deduction for a child or children - examples of applications for double personal income tax deduction

From wages and other types of income. In the presented material you can find out which persons have the right to apply for standard deduction, and what documents are required to provide it.

Regulatory regulation

The procedure for registering any types of tax preferences and deductions is regulated by the rules Tax Code RF. The list of persons who may qualify for a standard tax deduction is listed in Art. 218 Tax Code of the Russian Federation:

- WWII participants;

- disabled people since childhood, as well as persons who have been officially diagnosed with disability of groups I and II;

- persons who have become ill as a result of radiation exposure during man-made disasters, liquidation of consequences of accidents, etc.;

- parents and spouses of persons who served in the Armed Forces and died defending the country.

Citizens have the opportunity not only to apply for this benefit for themselves, but also for. under the age of 18, as well as undergoing state accreditation.

Not regulated by law standard form application for a deduction, it can be filled out in any order. As a rule, registration of this benefit is carried out locally labor activity, therefore, the application form for employees is developed by the management of the enterprise.

- If citizens have several jobs, it is possible to submit an application to each employer (except for cases when an application is made for children). The amount of the deduction provided per employee will range from 300 to 500 rubles, and depends on the category of the applicant’s preferential status.

- For a child, this benefit is 1,400 rubles; it applies to all minor children of an enterprise employee. When filling out an application for a disabled child, the deduction amount will be 12,000 rubles.

Note! A single parent (mother, father) will be given a double deduction until he enters into a family relationship.

The video below will tell you about receiving a deduction if standard returns were not provided:

Rules and nuances of its preparation

When filling out the specified form Special attention must be addressed for proper confirmation legal grounds, which make it possible to use this type deduction. Depending on the category of the beneficiary, the information in the application form will correspond to the following documents:

- certificate of participation in the elimination of radiation accidents;

- medical report on the presence of a disease resulting from exposure to radiation factors;

- WWII participant certificate;

- MSEC certificate confirming the disability group.

Note! Each reason must be documented. In addition, official certificates and documents are submitted to the employer’s accounting department.

Since the deduction is provided from the first day of receipt of monetary remuneration, the application form is issued to the newly hired specialist. If management has not issued such a document, the employee has the right to demand a deduction, including by filling out a written document in any form.

The principle of providing a deduction is to reduce taxable income monthly by the amount of the tax benefit. In some cases, citizens can take advantage of a similar benefit for previous calendar years, but in this case, they must contact the tax authority to complete the documents.

If a citizen is not a member labor relations with the enterprise, but receives officially confirmed income from other sources (for example, when carrying out activities as a business), he will be able to take advantage of the deduction when applying to the Federal Tax Service inspectorate. This procedure occurs at the time of filing, indicating income and personal income tax for the previous calendar year.

The application is accepted and preferences are taken into account according to the following rules:

- The employee himself is responsible for the accuracy of the submitted certificates and information; the employer is not obliged to check the authenticity of the certificates;

- if a taxpayer has submitted false or forged documents, he may be held liable for taxation;

- management is responsible for the accuracy and timeliness personal income tax calculation taking into account the issued deduction.

When moving to work for another employer, a citizen does not lose the right to deduction, but for this you will need to fill out new form applications addressed to the new manager.

Filling out an application for personal income tax deductions using 1C: Accounting - topic of the video below:

How to write an application for a standard tax deduction

Per child

The application form is filled out by the citizen himself; management is not obliged to do this. By signing the application, the citizen confirms that he has legal grounds for providing personal income tax benefits.

per child

Filling out an application for a deduction for a child is allowed only for one place of work. A violation of this requirement will be detected by the tax authority when reconciling information about the taxpayer.

Application for a standard child tax deduction (sample)

Application for double deduction

If you need to draw up a refusal in favor of the second parent, then use.

Waiver of deduction in favor of the second parent

Application for child benefit

Take three applications for personal income tax deductions from employees

Since January, standard children's personal income tax deductions have increased.

Provide children's deductions according to new sizes

Important detail- If the child is disabled, add up the children's deductions.

Last year, employees were entitled to receive standard child deductions until their year-to-date income reached RUB 280,000. ( subp. 4 paragraphs 1 art. 218 Tax Code of the Russian Federation). From January 1, 2016, this threshold was increased to RUB 350,000.

In addition, the child deduction for disabled children has increased fourfold: from 3,000 to 12,000 rubles. per month. For guardians, trustees and adoptive parents, the amount has been doubled - up to 6,000 rubles. The remaining values remain the same. We have given the amounts of all children's deductions in the table on this page.

If the child is disabled, the deductions must be summed up (letter of the Federal Tax Service of Russia dated November 3, 2015 No. SA-4-7/19206).

A company employee has three minor children, one of whom is disabled. Let's consider two situations.

Situation 1: the disabled child is the second in a row.

An employee has the right to the following personal income tax deductions for children:

— 13,400 rub. (1400 + 12,000) - for the second disabled child;

— 3000 rub. - for the third child.

The total deduction amount is RUB 17,800. (1400 + 13 400 + 3000).

Situation 2: the third disabled child.

An employee has the right to the following personal income tax deductions for children:

— 1400 rub. - for the first child;

— 1400 rub. - for the second child;

— 15,000 rub. (12,000 + 3000) - for the third disabled child.

The total deduction amount will be the same - 17,800 rubles. (1400 + 1400 + 15,000).

Employees now have the right to apply to the company for social deductions. And regarding property deductions, new clarifications have been released that are beneficial for employees. This means it's time to update the application forms for all three deductions.

Application for child benefit

The standard deduction for a disabled child has increased from 3,000 rubles. up to 12,000 rub. (Subclause 4, Clause 1, Article 218 of the Tax Code of the Russian Federation). Rework applications for children's deductions if the old amounts are there. New applications will also be needed if the previous ones mention 2015.

It is better not to specify in the application the year for which the employee is asking for a deduction. This will save you from having to collect applications every year. But the amounts of deductions should be given to avoid confusion. If they change in 2017, the statements will need to be updated.

Application for social deduction

Since 2016, employees can receive a social deduction for treatment and training not only from the inspectorate, but also from the employer (Clause 2 of Article 219 of the Tax Code of the Russian Federation). Second option the more profitable it is that you don’t have to wait until the end of the year to claim a deduction. But there is also a drawback: you need to receive a notification from the inspectorate about the right to deduct and only then contact the company with an application. The notification form for social tax deduction was approved by order of the Federal Tax Service of Russia dated October 27, 2015 No. ММВ-7-11/473.

It is necessary to reduce an employee’s income for social tax deductions from the month in which he brings the notification and writes an application (clause 2 of Article 219 of the Tax Code of the Russian Federation). There is no need to require documents confirming expenses from him.

If an employee regularly spends money on treatment and training, then he can apply for notification at least every month. The inspectorate will issue a separate confirmation for each application. Another option is for an employee to accumulate expenses and receive notification for all expenses for the year at once. Maximum size social tax deduction for yourself - 120,000 rubles. in year. If an employee paid for the education of his children, then the deduction amount should not exceed 50,000 rubles. for each child in total for both parents.

.

Application for property deduction

At the end of 2015, the tax authorities finally officially agreed that a property deduction should be provided to the employee for the entire year. It doesn’t matter when this employee brought the notification from the inspectorate ( letter of the Federal Tax Service of Russia dated November 3, 2015 No. SA-4-7/19206). Previously, inspectors required that the company count deductions only from the month of receipt of the notice. But now claims for property deductions can be corrected so that they are beneficial to employees.

Maximum size property deduction is 2,000,000 rubles. Amount of deduction for interest on mortgage loans cannot exceed RUB 3,000,000. To receive it, you only need a notification and an application. The notification form was approved by order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11/3. When the employee brings it to you, check that everything is correct. First, make sure that the notice is issued for 2016. After all, an employee must confirm his right to a specific deduction amount every year. Secondly, the document must indicate the full name. employee and your company name.

.

When calculating personal income tax in accordance with the current provisions of legislative acts, tax deductions, including standard ones, can be applied under certain conditions. To receive such a benefit, for example, for a child, you need to draw up and submit an application for the standard child tax credit in 2018.

It represents a reduction in the base for calculating personal income tax for an individual by a set amount due to the fact that he has minor children. However, it must be remembered that this deduction can only be used in relation to amounts received by an individual, subject to a tax rate of 13%. However, the benefit cannot be extended to dividends and income received from operations with securities, equity participation, etc.

The right to apply for a standard personal income tax benefit for children is granted to every parent, guardian or other person in whose care there are minors. The age of the child is important. So, this deduction can be used only if he is under 18 years old or 24 and he is a student full-time studying at an educational institution.

When a child has one parent, the latter has the right to a double benefit. It will be valid until the parent remarries or the child reaches a certain age.

Using preferential deduction It is also necessary to take into account the amount of income a person receives. This is due to the fact that the state has established a restriction on benefits that applies only to income within 350,000 rubles.

Attention! Deductions are made either from your employer or through the tax authority.

If one of the spouses who has children is not currently employed, then he has the right to refuse personal income tax benefits in favor of the other. At the same time, in the package of documents when applying for a standard deduction, you must include a certificate from the spouse’s place of work, a certificate that he does not use the benefit and an immediate refusal.

Parents have the right to a standard deduction from the moment the child is born and, under certain conditions, until he turns 24 years old. The legislation stipulates that a deduction for a child is provided to parents until the end of the year in which he turns 18 or 24 years old.

Attention! It should also be taken into account that if a child dies or gets married, the right to the standard deduction for his parents ceases.

The employee himself must monitor and, if he reaches the established age, inform his employer that his benefit has ended.

What is the deadline for submitting an application?

The employer must provide the deduction to the employee after he has completed the required application. Usually, this happens when the person starts working in the organization. If the employee does not provide Required documents, then the employer, on his own initiative, does not have the right to establish a child deduction.

But a situation may arise in which the employee did not provide the deduction documents immediately, but much later. For example, in 2-3 months or by the end of the year. In this case, the benefit should be provided not from the moment of transfer of supporting documents, but from the beginning of the reporting year (or work in the company, if it began in the same year). This position is adhered to by the Ministry of Finance in its letter dated April 18, 2012 No. 03-04-06/8-118. In this case, the tax from the beginning of the period must be recalculated.

If an employee submits documents in the next calendar year, then he has the right to return the tax for the missed period independently by collecting the necessary package of documents and submitting it to the tax office along with the 3-NDFL declaration.

Attention! There is no need to write an application annually if the following conditions are met. Initially, the Tax Code does not contain such a requirement. But if the form indicated a specific year during which it is necessary to issue a deduction, then after its expiration this document will need to apply again.

In addition, you will need to fill out applications again if changes have been made to the Tax Code, and as a result the amount of the deduction has changed. Since the application usually indicates the amount for each child, it will be necessary to rewrite it taking into account the changes that have occurred.

Download a sample application for deduction

How to correctly write an application for the standard child tax credit in 2019

There is no special form for this document. Typically, the accountant provides ready-made template, in which the employee needs to write down his data. If this is not the case, then the document is drawn up as shown in the following example.

At the top of the sheet in its right corner, first write down for whom the application is being drawn up - the name of the manager’s position, the name of the organization, full name. director. This information must be provided in dative case.

Then in the middle new line The name of the form is written - “Application”.

The main part of the application must contain a request to the employer to provide the standard tax deduction for existing children. The text of the document must contain a reference to the corresponding paragraph from the Tax Code - for example, “in accordance with paragraph 4, paragraph 1, Article 218 of the Tax Code of the Russian Federation.”

The next step in the document is to list all the children for whom benefits are requested. It is advisable to do this in the following format: “Full name of the child, date of birth, amount of the requested benefit.”

Next, you need to list copies of documents that will be attached to the application to confirm the requested benefits. Such forms include birth certificates, a document on adoption or guardianship, a document on disability, etc.

Attention! If the employee’s employment does not occur from the beginning of the current year (and this happens quite rarely), and previous place work, he has already enjoyed benefits, then he definitely needs to provide a report from there. It must also be recorded as an attachment to the application.

The application is completed by affixing the date and signature of the employee. Sometimes you can also decrypt it.

The state, in order to support the ongoing demographic policy enshrined in tax legislation a unique benefit: a personal income tax deduction for children. Why is personal income tax taken? income tax? Because this is exactly the obligation that almost all citizens fulfill to the state Russian Federation With the exception of pensioners, income is not withheld from pensions.

Application for tax deduction for children: sample

Like all other benefits, tax deductions are provided exclusively through an application from the applicant. It must be written to the accounting department of the enterprise where the parent is officially employed. The tax deduction is equally provided to both father and mother in a single amount established by tax legislation. If one parent is raising a child, then the deduction based on the submitted application will be provided in double amount.

A standard sample application for a tax deduction for children can be obtained from the accounting department. Otherwise, the application can be drawn up in free form, indicating the following details and personal data:

- name of the enterprise (tax agent) where the parent works;

- surname, name, patronymic of the parent;

- surnames, first names, patronymics of children for whom a tax deduction should be provided;

- children's age;

- for students over 18 years of age - the name of the educational institution where the child is studying full-time;

- date and signature of the applicant.

Attention! Applications for deductions are written annually! A deduction is not provided for a child over 24 years old, even if they continue to study full-time!

Supporting documents

The parent must attach a package of supporting documents for the child tax deduction to the application. These will be:

- photocopies on paper of birth certificates of all children;

- for students over 18 years of age - original certificate from educational institution which the child attends;

- a copy of the death certificate of the spouse (for single parents raising children). Single mothers with supporting documents marital status not required - information about it was provided to the employer (tax agent) during employment;

- if any of the children has a disability - the original certificate from the doctors about its presence.

How much benefit will be provided?

Various deduction amounts:

- for the first and second child - monthly 1,400 rubles per child to each parent;

- for the third and all subsequent children - monthly 3,000 rubles per child to each parent;

- if the child has a disability - 12,000 rubles monthly until he turns 18 years old. If he studies full-time, then until he is 24 years old;

- if a child with a disability is adopted, then 6,000 rubles a month.

I would like to note that these tax benefits are provided not only to biological parents, but also to any legal representative: guardian, foster parent, adoptive parent.

In order to determine the amount of deduction for the second or third child, do not forget that all born and adopted children are taken into account, regardless of age. If the oldest of three children is already 25 years old, then who, for example, is 16 years old, will be provided with 3,000 rubles. Therefore, it is important for applicants to include all children (regardless of age) on their Child Tax Credit application. The sample may not contain such information.

Finally

So, summarizing all of the above, we note the following:

- Tax legislation provides certain benefits to families with children.

- Samples of an application for a tax deduction for children can be obtained from the accounting department or found independently on the Internet.

- To be able to take advantage of the benefit, all children must be indicated in the application.