Application for a child benefit. Applications for personal income tax deductions (standard, property)

Standard deductions are benefits guaranteed to individual income tax payers if they meet the required conditions (⊕). In particular, from the day the child is born, the person who is supporting the newborn receives the right to a personal income tax deduction, the procedure for providing which is regulated by clause 4, clause 1, article 218 of the Tax Code of the Russian Federation. In this article we will tell you about the application for standard deduction for personal income tax for children, we will provide a sample form.

Features of providing a “children’s” deduction

The right to a benefit exists if the child’s age does not exceed 17 years. Also, the right is extended until the 24th, if the adult is studying full-time at a foreign or domestic educational institution. It doesn't matter whether the education you receive is paid or free.

The essence of the benefit is the absence of tax deduction, therefore income tax to withholding (13% of income), is calculated not from the amount accrued to the employee, but from the difference in income and deduction, which leads to a reduction in the tax burden on the individual.

The amount of the deduction is influenced by the order in which the child appears, the presence of a disability, as well as the status of the person raising the minor. The current amounts of the “children’s” deduction for 2017 are shown in the table.

| Who is it on? | Who gets | |

| Adoptive parents,parents and their spouses | Guardians (up to 14 years), trustees (after 14 years),adoptive parents and their spouses | |

| For a child born 1st or 2nd in the family | 1400 | 1400 |

| For a child born on the 3rd or subsequent | 3000 | 3000 |

| For a child with a confirmed disability 1 or 2 grams. | 12000 | 6000 |

Required documents for deduction

In order for the employer to take into account the required benefit when calculating personal income tax, it is necessary to inform him in in writing, confirming the claimed right with documents. Documents are submitted to the tax agent. If there are several employers, then one of them is selected.

The set of mandatory documentation includes:

- Application – drawn up by all applicants for the deduction;

- A birth certificate in the form of a copy is mandatory for every child in the family, even in cases where his age has exceeded the limit within which the benefit is provided, or he has died. This is necessary to determine the order of birth of those children for whom the applicant wishes to receive a “children’s” deduction.

In addition to the specified documents, the applicant may be required to:

- Documentary confirmation of adoption or registration of guardianship, trusteeship (court decision);

- Help from educational institution in the original – if the deduction is applied to a full-time student under 24 years of age;

- Certificate of disability group – if the applicant is applying for an increased deduction for a disabled child (at the end of the certificate’s validity period, disability must be confirmed with a new certificate);

- Application from the other parent if he refuses a guaranteed benefit - if the applicant wishes to receive a 2-fold increased deduction;

- Documentary evidence of maintaining a child alone - if the applicant is applying for double benefits;

- Marriage certificate if the applicant is the new spouse of the parent, as well as confirmation that the child is jointly dependent on both parents ( performance list, agreement, court decision on alimony, statement from the parent);

- 2-NDFL is required from an employee who has just found a job and previously received income this year elsewhere. A certificate is issued by the previous employer regarding annual taxable income. Read also the article: → “”.

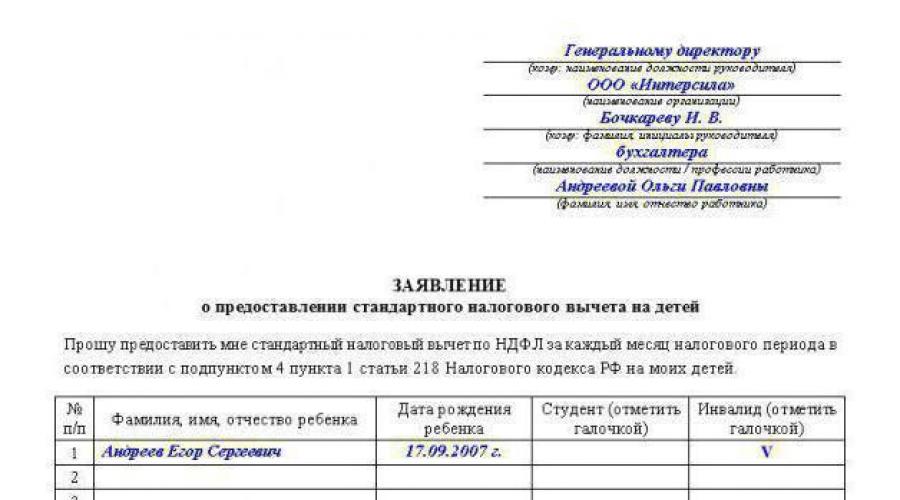

How to write an application for a deduction for children

The document is drawn up in writing on paper or a computer. The typewritten text is printed. The application must contain standard set details, the text is formulated in free form.

It is enough to submit the application once; it does not need to be repeated annually. The document is addressed to the employing organization, which acts as a tax agent. If the tax agent changes, the application is written again. This is possible when joining another company or during a reorganization and change of name at the current employer.

The reason for re-writing the application may be the birth of a new child.

The application form must contain:

- Details of the tax agent and his representative (name of the company, position of the manager or other person, his full name in the dative declension);

- Details of the applicant (position and full name in the genitive, written after the preposition “from”);

- Title of the paper and its title;

- Text;

- List of attached documents (for each document details are provided in the form of name, date, number);

- Date of submission of the application paper;

- Author's signature (personal, handwritten by the applicant for deduction).

The main attention should be paid to the text of the application, in which the employee needs to include the following information:

- A request from the first person (on behalf of the employee) to provide a deduction for a child (for children, if there are several of them);

- Reference to the paragraph of the Tax Code of the Russian Federation, indicating the presence of the right to a benefit (you need to refer to paragraph 4, paragraph 1, article 218);

- The year for which the employer is required to provide a deduction;

- List of all children for whom a deduction is required. For each child, write down the full name, year of birth, size required deduction. You can additionally enter the details of the certificate issued by the registry office (about birth). If you want to double deduction, then the reason for this should be indicated. If the child is 18 years of age or older, then the reason for the right to the benefit is explained, that is, the student’s status and place of study are indicated.

(click to enlarge)

What to do if the deduction is not received

You can take advantage of the benefit from the moment the child is born. You can submit documents to your employer for a deduction directly in the month in which the birth was recorded. In this case, the employer is obliged to take into account the standard deduction from this month when withholding income tax on payments to the employee.

If the employee provided documentation for the deduction later, the employer is obliged to recalculate the personal income tax from the month when the right to the benefit became available.

If the newborn was born in February 2017, and the documents were submitted in May 2017, then the employer must recalculate income tax for the period from February to April. If the birthday occurred in the previous year, then the recalculation is performed from the beginning of the year.

Answers to frequently asked questions

Question No. 1. Where to write an application if an individual works part-time?

If the applicant for the deduction works simultaneously in several companies, then he can declare his right to any of them at his own discretion.

Question No. 2. In what cases is the application for deduction written again?

If the employee’s grounds for receiving benefits do not change, then there is no need to write the application again to the same tax agent. The application will need to be rewritten if:

- The grounds for granting a deduction change - a new child is born;

- The name of the tax agent changes due to reorganization;

- The place of work changes.

Question No. 3. Are there rights to double deduction if the 2nd parent is deprived of parental rights?

Only the person who supports the child can receive a standard benefit. If one of the parents is deprived of parental rights, then according to the RF IC he automatically loses the right to all benefits and allowances for persons with children, but he is not released from the obligation to support the child and pay alimony. It turns out that the child is still supported by the parent who has been deprived of parental rights.

The standard “children’s” deduction is regulated by the tax code, therefore the provisions of the family code do not apply to the procedure for its provision.

A double deduction is given to the parent who has the status of “single”, which is possible in the absence of the 2nd parent due to his death or disappearance, which must be confirmed court decision. The fact that one of the parents was deprived of the rights to the child does not assign the status of “only” to the second.

Therefore, there is no right to double size in this situation. A double deduction is possible if the parent who has lost parental rights voluntarily renounces the right to benefits and draws up a corresponding application.

For the 3rd and subsequent children, the deduction amount increases by more than 2 times. Therefore, it is necessary to correctly determine what type of child a child is in the family. Birth order must be taken into account; no matter how old the children born earlier are, they should also be taken into account. Moreover, we must also take into account those children who have already died.

If there are 3 children in a family: the first is 32 years old, the second is 22 years old and is studying full-time at a university, the third is 10 years old, then the parents have the right to such deductions.

The standard personal income tax benefit in the form of a child deduction is provided at the place of work. To apply it, the employee is required to provide his management with a statement with a corresponding request. A sample application current for 2018 can be downloaded from the article below.

There are many nuances and features in the design of children's deductions. All questions have been answered, the information is relevant for 2017.

An application from an individual with a request to apply to his income a standard deduction for personal income tax, due in the case of the presence of children in the family suitable age- this is the main document that the worker must present to his employer to use the benefit.

Its compilation is not strictly regulated and no standard form has been developed. The employee must take Blank sheet paper and draw up the text in the petition and notification form with your own hand.

The application must be accompanied by documents that can confirm what is stated in the paper. Depending on the situation, the set of attached documentation may vary.

In the simplest case, it is enough to provide copies of birth certificates. If the child is disabled, then a medical certificate is attached. The single parent claims a double deduction.

If a minor is adopted, taken under guardianship or trusteeship, has exceeded the threshold of 18 years and is studying full-time, as well as in some other situations, additional documents are required. A copy is made of everyone and attached to the application.

It is enough to write an application once and submit it to management. There is no need to update the form annually. A new spelling is possible if anything has changed in the amount of the standard personal income tax benefit for of this employee, for example, he had another child, or the husband (wife) renounced his right to a deduction, giving the second spouse the opportunity to receive double the amount.

How to write correctly in 2018

The form of the text is free, but it is necessary to include information sufficient for the employer about the size of the standard tax benefit, number and age of children, attached documents.

In particular, the text should read:

- please provide standard deduction;

- Full name of each child, his age, details of the birth certificate (children of all ages are listed, regardless of whether they are entitled to a deduction or not, the employer needs this information to correctly calculate the amount of the personal income tax benefit);

- size - indicated in relation to those children for whom such a right exists;

- a list of documents that are submitted along with the application;

- link to the clause of the Tax Code of the Russian Federation, which states the possibility of a standard deduction (clause 4, clause 1, Article 218 of the Tax Code of the Russian Federation).

You need to address the application to your management, which is noted in the upper right part of the paper sheet.

You need to certify the text with your personal signature indicating the date it was affixed.

If the application for a deduction for children is submitted late, then the employer will return income tax for the months of the current year, and for the months of the previous year for personal income tax refund you need to contact the Federal Tax Service.

The state, in order to support the ongoing demographic policy enshrined in tax legislation a unique benefit: a personal income tax deduction for children. Why is personal income tax or income tax taken? Because this is exactly the obligation that almost all citizens fulfill to the state Russian Federation With the exception of pensioners, income is not withheld from pensions.

Application for tax deduction for children: sample

Like all other benefits, tax deductions are provided exclusively through an application from the applicant. It must be written to the accounting department of the enterprise where the parent is officially employed. The tax deduction is equally provided to both father and mother in a single amount established by tax legislation. If one parent is raising a child, then the deduction based on the submitted application will be provided in double amount.

A standard sample application for a tax deduction for children can be obtained from the accounting department. Otherwise, the application can be drawn up in free form, indicating the following details and personal data:

- name of the enterprise (tax agent) where the parent works;

- surname, name, patronymic of the parent;

- surnames, first names, patronymics of children for whom a tax deduction should be provided;

- children's age;

- for students over 18 years of age - the name of the educational institution where the child is studying full-time;

- date and signature of the applicant.

Attention! Applications for deductions are written annually! A deduction is not provided for a child over 24 years old, even if they continue to study full-time!

Supporting documents

The parent must attach a package of supporting documents for the child tax deduction to the application. These will be:

- photocopies on paper of birth certificates of all children;

- for students over 18 years of age - original certificate from educational institution which the child attends;

- a copy of the death certificate of the spouse (for single parents raising children). Single mothers with supporting documents marital status not required - information about it was provided to the employer (tax agent) during employment;

- if any of the children has a disability - the original certificate from the doctors about its presence.

How much benefit will be provided?

Various deduction amounts:

- for the first and second child - monthly 1,400 rubles per child to each parent;

- for the third and all subsequent children - monthly 3,000 rubles per child to each parent;

- if the child has a disability - 12,000 rubles monthly until he turns 18 years old. If he studies full-time, then until he is 24 years old;

- if a child with a disability is adopted, then 6,000 rubles a month.

I would like to note that these tax benefits are provided not only to biological parents, but also to any legal representative: guardian, foster parent, adoptive parent.

In order to determine the amount of deduction for the second or third child, do not forget that all born and adopted children are taken into account, regardless of age. If the oldest of three children is already 25 years old, then who, for example, is 16 years old, will be provided with 3,000 rubles. Therefore, it is important for applicants to include all children (regardless of age) on their Child Tax Credit application. The sample may not contain such information.

Finally

So, summarizing all of the above, we note the following:

- Tax legislation provides certain benefits to families with children.

- Samples of an application for a tax deduction for children can be obtained from the accounting department or found independently on the Internet.

- To be able to take advantage of the benefit, all children must be indicated in the application.

The article will discuss the application for a tax deduction for a child. Who has the right to claim this, what the form looks like, and how to fill it out correctly - below.

Dear readers! The article talks about standard methods solutions legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

In accordance with current legislation, every employee with children has the opportunity to receive a tax deduction. How to register it?

Basic moments

Every citizen has the right to receive certain tax benefits from the state. One of them is the child deduction.

Its size is influenced by certain factors. The list of required documentation required to obtain the right to .

The legislation defines the calculation procedure in accordance with the child’s age and state of health. There are also rules for the baby's caregivers.

In order for such a right to arise, the applicant must comply with certain conditions:

If there are several children, then one application is made for two. To receive the required benefits, you must provide the employer with an application and documents.

Mandatory certificates include a copy of the birth certificate. The additional package of documents includes:

- court decision on or registration of guardianship;

- certificate from the university (if the child is studying);

- (in the presence of);

- statement from the second parent in case of his refusal;

- confirmation of raising a child alone;

- – for those who have recently found employment.

The legislation does not contain direct instructions on the frequency of presentation of a certificate from the place of study.

The main thing is to confirm the fact of training. Accounting employees of an organization have the right to request a certificate twice - at the beginning of the calendar and academic year.

You can receive money in several ways:

- simultaneously with wages;

- at the tax authority at your place of residence.

The employer undertakes to submit documents to the tax service, calculate and accrue due payments. In relation to employees, he performs the duties of a tax agent.

The boss carries out all his actions on the basis of information provided by the employee.

If the employer performs his duties in good faith, and it later turns out that the employee provided incorrect information, he is the one who bears the responsibility.

The tax deduction for children will be calculated at the beginning of the year. It does not matter in which month it was submitted.

If a child turns 18 this year and is not studying at full-time department, then the deduction is due to him until the end of the year, regardless of the month of birth.

The deduction amount is 1,400 rubles for the first and second children, 3 thousand rubles for the third and subsequent children.

For a child with disabilities, the deduction amount reaches 6 thousand rubles (in the case of guardianship or trusteeship) and 12 thousand rubles (for legal parents or adoptive parents).

The deduction for a disabled child is summed up with a regular child's deduction. The benefit is not provided in the following cases:

- if the parent leads household and does not have an official place of work;

- the applicant is registered in the employment center;

- pays taxes, but the tax system does not provide for payment;

- the applicant is not a resident of the Russian Federation.

It will also not be possible to apply for a deduction for a child who was married before adulthood. The rules that allow the deduction to be applied not only during the period when the right to it arises, but also later, do not apply to all deductions.

The procedure for providing the deduction is based on the date of birth of the children. That is, the oldest will be first, regardless of whether a deduction was paid to him or not.

If an employee has twins, he independently determines their order.

Definitions

Who can receive

The following are entitled to receive a deduction every month:

- any of the parents who are officially married;

- divorced or unmarried;

- husband (wife) of the parent;

- adoptive parent, guardian, trustee;

- any of the adoptive parents, provided there are two of them.

If a child has one parent, then he has the right to receive a double deduction. It can be used until marriage. The right to is available until the child reaches 18 years of age.

Also, this right will last until the age of 24 if the child is a full-time student – it doesn’t matter whether it’s paid or free. This also applies to foreign higher education institutions.

The child deduction will be provided until the taxpayer’s profit does not exceed 350 thousand rubles for the year. If this amount is higher, no deduction is provided.

The following categories of citizens can count on a double deduction:

After a divorce, a woman is not considered single.

Current standards

Basic normative act regulating the issue of calculating deductions -. According to , income individuals, which are taxed at the insurance rate of 13%, can be reduced by tax deduction.

Sample of filling out an application for a tax deduction for a child

The form of the text is allowed to be made free, but it is necessary to enter into it as much as possible more information on the amount of tax benefits, number and age of children.

The text of the application must contain the following information:

The application also sets out a request to provide a deduction for the child. The application is sent to the management of the organization. The text is certified with a signature and date.

The application is submitted once; there is no need to submit a new one every year. The reason for drawing up a new application is the birth of another child or a change of job. Written and electronic formats are acceptable.

Video: filling out the 3-NDFL declaration

A sample application for a tax deduction for a disabled child can be found in tax service or on the Internet.The application must be kept in the company’s accounting department for the entire duration of the benefit. In case of dismissal of an employee or termination of the right to deduction, the application is placed in an archive and stored for 75 years.

When should you apply?

The application is submitted when the employee becomes entitled to a child deduction. If an employee is just getting a new job, he fills out an application at the moment.

Submit an application as needed. A request for a deduction must be submitted before the end of the calendar year.

Otherwise, it is served in tax office. The right to use the deduction is granted upon request:

- funds are paid not after drawing up an application, but after submitting documents;

- the deduction will be provided only if there is a written application;

- the deduction can be paid in the month the baby is born;

- They pay money monthly.

If deadlines are missed, deductions for previous periods can be obtained from the tax service.

Thus, each parent who pays taxes can expect to receive a deduction for their child(ren).

They have this right from the moment the baby is born. You can receive the payment from your employer or the tax office.

From wages and other types of income. In the material presented you can find out which persons are entitled to claim a standard deduction and what documents are required to provide it.

Regulatory regulation

The procedure for registering any types of tax preferences and deductions is regulated by the rules Tax Code RF. The list of persons who may qualify for a standard tax deduction is listed in Art. 218 Tax Code of the Russian Federation:

- WWII participants;

- disabled people since childhood, as well as persons who have been officially diagnosed with disability of groups I and II;

- persons who have become ill as a result of radiation exposure during man-made disasters, liquidation of consequences of accidents, etc.;

- parents and spouses of persons who served in the Armed Forces and died defending the country.

Citizens have the opportunity not only to apply for this benefit for themselves, but also for. under the age of 18, as well as undergoing state accreditation.

Not regulated by law standard form application for a deduction, it can be filled out in any order. As a rule, registration of this benefit is carried out locally labor activity, therefore, the application form for employees is developed by the management of the enterprise.

- If citizens have several jobs, it is possible to submit an application to each employer (except for cases when an application is made for children). The amount of the deduction provided per employee will range from 300 to 500 rubles, and depends on the category of the applicant’s preferential status.

- For a child, this benefit is 1,400 rubles; it applies to all minor children of an enterprise employee. When filling out an application for a disabled child, the deduction amount will be 12,000 rubles.

Note! A single parent (mother, father) will be given a double deduction until he enters into a family relationship.

The video below will tell you about receiving a deduction if standard returns were not provided:

Rules and nuances of its preparation

When filling out the specified form Special attention must be addressed for proper confirmation legal grounds, which make it possible to use this type deduction. Depending on the category of the beneficiary, the information in the application form will correspond to the following documents:

- certificate of participation in the elimination of radiation accidents;

- medical report on the presence of a disease resulting from exposure to radiation factors;

- WWII participant certificate;

- MSEC certificate confirming the disability group.

Note! Each reason must be documented. In addition, official certificates and documents are submitted to the employer’s accounting department.

Since the deduction is provided from the first day of receipt of monetary remuneration, the application form is issued to the newly hired specialist. If management has not issued such a document, the employee has the right to demand a deduction, including by filling out a written document in any form.

The principle of providing a deduction is to reduce taxable income monthly by the amount of the tax benefit. In some cases, citizens can take advantage of a similar benefit for previous calendar years, but in this case, they must contact the tax authority to complete the documents.

If a citizen is not a member labor relations with the enterprise, but receives officially confirmed income from other sources (for example, when carrying out activities as a business), he will be able to take advantage of the deduction when applying to the Federal Tax Service inspectorate. This procedure occurs at the time of filing, indicating income and personal income tax for the previous calendar year.

The application is accepted and preferences are taken into account according to the following rules:

- The employee himself is responsible for the accuracy of the submitted certificates and information; the employer is not obliged to check the authenticity of the certificates;

- if a taxpayer has submitted false or forged documents, he may be held liable for taxation;

- management is responsible for the accuracy and timeliness personal income tax calculation taking into account the issued deduction.

When moving to work for another employer, a citizen does not lose the right to deduction, but for this you will need to fill out new form applications addressed to the new manager.

Filling out an application for personal income tax deductions using 1C: Accounting - topic of the video below:

How to write an application for a standard tax deduction

Per child

The application form is filled out by the citizen himself; management is not obliged to do this. By signing the application, the citizen confirms that he has legal grounds for providing personal income tax benefits.

per childFilling out an application for a deduction for a child is allowed only for one place of work. A violation of this requirement will be detected by the tax authority when reconciling information about the taxpayer.

Application for a standard child tax deduction (sample)

Application for double deduction

If you need to draw up a refusal in favor of the second parent, then use.

Waiver of deduction in favor of the second parent