Deduction for your education per year. We receive a social tax deduction for training

Read also

According to the legislation of the Russian Federation (Article 219 of the Tax Code of the Russian Federation), when paying educational services You can count on a tax deduction or, to put it simply, get back some of the money you spent on training.

A tax deduction is the portion of income that is not subject to tax. Therefore, you can return the tax paid on expenses incurred for education. That is, if you officially work (and, accordingly, pay income tax) and paid for your education or the education of your children/brothers/sisters, then you can get back part of the money in the amount of up to 13% of the cost of education.

In what cases can you get a tax deduction for your own training?

You can take advantage of the social tax deduction for your own education and get part of your expenses back if:

- You paid for educational services in official educational institutions (for example, at a university, technical school, driving school or training courses).

- Are you officially working and pay income tax(all employees pay it);

The note: at tax deduction for your own education (unlike the deduction for the education of children), there are no restrictions on the form of education: money can be returned for full-time, part-time, evening or any other form.

Amount of tax deduction for personal training

The amount of tax deduction for personal training is calculated for the calendar year and is determined by the following factors:

- You can't get your head around more money than transferred to the budget income tax(about 13% of the official salary)

- You can return up to 13% of the cost of paid training, but not more than 15,600 rubles. This is due to the restriction on the maximum deduction amount of 120 thousand rubles. (120 thousand rubles * 13% = 15,600 rubles)

- The limit of 15,600 rubles applies not only to the deduction for education, but to all social deductions (except for expensive treatment and charity). The amount of all social deductions (training, treatment, pension contributions) should not exceed 120 thousand rubles. (Accordingly, you can return a maximum of 15,600 rubles for all deductions).

Example: In 2018, Ivanov A.A. paid for his own university education in the amount of 150 thousand rubles. At the same time, in 2018 he earned 250 thousand rubles and paid income tax of 31 thousand rubles. Since the maximum tax deduction amount is 120 thousand rubles. (which is less than 150 thousand rubles), then for 2018 (in 2019) Ivanov A.A. will be able to return only 120 thousand rubles. * 13% = 15,600 rub.

In what cases and in what amount can you receive a deduction for the education of your children?

You can receive a social tax deduction for the education of your children if the following conditions are met:

- the child is no more than 24 years old;

- child is studying full-time training ( kindergarten, school, full-time university, etc.);

- the agreement for payment for educational services is drawn up for you (or your spouse);

The maximum deduction per child is 50 thousand rubles. (RUB 6,500 to be returned)

Example: In 2018, Ivanov A.A. paid:

- correspondence education at a university for his daughter Katya in the amount of 30 thousand rubles;

- training in fee-paying school to his son Kolya in the amount of 40 thousand rubles;

At the same time, for 2018 Ivanov A.A. earned 250 thousand rubles and paid income tax 31 thousand rubles.

Since Katya is studying in the correspondence department, the money for her is A.A. Ivanov. can't return it. Therefore, for a maximum of 2018 (in 2019), he will be able to return 40 thousand rubles. * 13% = 5,200 rub.

More detailed information You can read about the deduction for children’s education (amount of deduction, restrictions, nuances of paperwork) in the article: Features of the tax deduction for children's education.

In what cases can you get a deduction for the education of your brothers/sisters?

You can receive a social tax deduction for the education of your brothers/sisters if the following conditions are met:

- brother/sister is no more than 24 years old;

- brother/sister is studying full-time (kindergarten, school, full-time university, etc.);

- the agreement for payment for educational services has been drawn up for you;

- actual payment documents (receipts, bills) must be drawn up in your name (or a power of attorney for the transfer of funds has been issued);

Amount of tax deduction for education of brothers/sisters

The amount of deduction for payment of educational services for brothers/sisters is calculated for the calendar year and is determined by the following factors:

- You cannot get back more money in a year than you transferred to the income tax budget (about 13% of the official salary)

- In total, you can return up to 13% of the cost of paid training, but not more than 15,600 rubles per year.

Example: In 2018, Ivanov A.A. paid for my education sibling Ivanova V.A. at a university for full-time study in the amount of 80,000 rubles. At the same time, for 2018 Ivanov A.A. earned 250 thousand rubles and paid income tax 31 thousand rubles. Accordingly, for 2018 Ivanov A.A. will be able to return 80,000 * 13% = 10,400 rubles.

How to get a deduction?

The process of obtaining a deduction can be simplified by using our service. He will help you prepare the 3-NDFL declaration and other documents for deduction in 15-20 minutes, and will also give detailed instructions for submitting documents to the tax authorities. If you have any questions while working with the service professional lawyers We will be happy to advise you.

When should I submit documents and for what period can I get a tax refund?

To apply for a tax deduction, you will first need:

- declaration 3-NDFL;

- agreement with educational institution;

- documents confirming your expenses;

- documents confirming the paid income tax (certificate 2-NDFL).

When and for what period can I receive a tax deduction?

You can only get a refund for tuition for those years in which you paid directly. However, you can submit a declaration and return the money only in the year following the year of payment. That is, if you paid for training in 2018, you can return the money only in 2019.

If you did not apply for a deduction immediately, then you can do it later, but no more than three last year. For example, if you studied and paid for your studies at a university in 2014-2018 and did not receive a tax deduction, then in 2019 you can get your tax back only for 2016, 2017 and 2018.

The entire procedure for obtaining a deduction usually takes from three to four months (most of the time is spent checking your documents by the tax office).

The note: From January 1, 2016, the social tax deduction for training can be received through the employer, and there is no need to wait until the end of the calendar year. You can find details about receiving a deduction through your employer in our article:

In accordance with the current legislation Russian Federation In order to reduce the tax base, it is not enough for an individual to simply have the right to do so, but also needs to have a certain package of documentation.

Since today taxpayers are increasingly interested in how to receive monetary compensation for education expenses, this article will list all Required documents For .

For each individual who systematically pays 13% of his salary tax office, the right is provided in case of spending material resources on training.

general information

To understand what kind of documentation package an individual needs to prepare, it is worth taking into account several features regarding the return of income tax for studies:

- A tax discount of this kind can be accrued not only for paying for one’s own education, but also if the taxpayer spent cash for close relatives to study. The category of such relatives includes both own and adopted children, brothers and sisters.

- The institution to which individual transfers his money in exchange for knowledge, must have official permission to provide educational services.

- To receive a deduction, it is not at all necessary to study in an organization located on the territory of the Russian Federation, since a tax discount is also available for individuals receiving education abroad.

Please note that income tax refunds for education fall into the category, all necessary information about which is found in the second paragraph of Article 219 of the Tax Code.

List of documents

Today, there is a certain list of documentation required for any type of social expenditure, without which it is impossible to reduce the tax base in full. That is, regardless of what the taxpayer wants to return personal income tax for, he must have a specific list of documents available.

This list is the same both in the case of applying for an educational deduction and in situations of receiving, for donating material resources, as well as for paying some pension and insurance contributions:

Documents required for tax deduction for education

After an individual who wishes to return part of the money paid a little earlier for training has prepared a standard package of documentation required for any type social deduction, you can move on to collecting papers directly related to education costs. The taxpayer will need to prepare the following documents:

- An agreement concluded between an individual and an educational institution. When entering any educational institution, it is customary to enter into an agreement with a future student, which stipulates not only the conditions of study, but also its cost.

- License of the organization in which an individual acquires training skills for an appropriate fee. Since the accrual monetary compensation depends on the status of the educational organization, then in order to receive a social deduction, you must use the services of only those institutions that have the appropriate license.

- Documents that confirm that the tuition payment was actually made. All kinds of receipts and any other documents indicating that a certain amount of money was paid for studies must be kept and sent to the tax service along with all other papers.

IMPORTANT! Providing a license is optional. This document required only in situations where the contract with an educational institution does not contain any information regarding its license.

You must submit originals or copies of documents

To take advantage of the opportunity to receive an income tax refund for studies, it is not at all necessary to send the original documents to the tax authority. Providing all required copies is also acceptable, but they must be properly certified. However, copies of some documents are still not accepted. This applies to declarations, applications and income certificates.

Documents in 2017

In 2017, requirements for the list of documents without which it is impossible to obtain tax discount for training, have become somewhat stricter. Now, when applying for a deduction for a relative, it is not allowed to provide a copy of the agreement with the educational organization; only the original document is required.

Documentation for paying for the education of relatives

Since you can claim an income tax refund not only if you pay for your own education, but also for the education of relatives, in such situations the following documents may additionally be required:

- Certificate. You need to have a copy of the birth certificate of the relative for whose education the taxpayer paid money. Sometimes you may need your own testimony.

- Translations of some documents. If the training takes place abroad, then the taxpayer will receive most of the business papers in a language other than Russian. In this regard, the documentation will need to not only be translated into the native language, but also confirmed with the help of a notary that the translation was carried out correctly.

If personal income tax refund is issued for the education of a child, for which one parent paid, but at the same time wants to give the deduction in favor of the other, in addition to all the above documentation, a marriage certificate will be required.

One of the social tax deductions is the education tax deduction. In our article, we will consider in detail the procedure and basis for providing a tax deduction for expenses on your own education, as well as on children, relatives, and siblings in 2019. Who is eligible for the study tax deduction? How is it calculated? Where and when to contact? These and other questions will be discussed below.

The legal basis for providing a tax deduction for education is enshrined in paragraph 2 of Article 219 Tax Code Russian Federation.

A complete list of tax deductions established in Russia can be found in the corresponding section.

Who is entitled to tax deduction for studies?

The Tax Code of the Russian Federation establishes the following categories of citizens who have the right to count on a tax deduction, that is, a refund of 13% of the amount spent on training:

- Persons receiving education in any form of education: full-time, part-time, evening or other, paying for it themselves;

- Persons who pay for the education of their own child or children. Moreover, the age of each child should not exceed 24 years and the form of education at the educational institution should be full-time;

- Persons who pay for the education of children other than their own, that is, guardians. The age of the child under guardianship must not exceed 18 years, and education must be carried out full-time;

- Persons who pay for the education of children for whom guardianship was previously exercised. IN in this case training must also be on a full-time basis, and the child’s age should not exceed 24 years;

- Persons who spent their own money to educate a full brother or sister (full brother - having the same father and mother). The age of the brother or sister must not exceed 24 years, education must be full-time. This rule This also applies to half-siblings (that is, having only a common father or mother).

It is important to know, that this social tax deduction can be provided only if the educational institution where the above listed categories of citizens study has state accreditation.

Types of educational institutions for which a tax deduction is provided for training

The Law “On Education” establishes the types and status of educational institutions, after studying in which, you can return through the tax authority an amount equal to 13% of total number spent funds. So, these institutions include:

- Children's preschool educational institutions (kindergartens);

- Municipal educational institutions secondary education (schools);

- Educational institutions for adults aimed at obtaining additional education. These could be advanced training courses, training centers foreign languages, driving schools, as well as centers operating on the basis of the employment service;

- Institutions, educational program which is of an additional nature. Meaning various schools arts, sport sections for children, music schools and other types of additional education.

- Secondary vocational and higher educational institutions (academies, institutes, universities, technical schools and others).

In all of the listed categories of educational institutions, the main condition that gives the right to apply to the tax service to process a 13% refund is a license or other document issued by the state, which gives the right to the educational institution to conduct its activities. Moreover, it is not necessary that the educational institution be state-owned. An educational institution can be private (commercial), but only if it has an appropriate license issued by the state.

In addition, the tax legislation of our country does not limit citizens in their choice educational institution within Russia. Education can also be obtained outside the Russian Federation.

Amount of tax deduction for education

The Tax Code of the Russian Federation established the amount at 50,000 rubles as the maximum amount of expenses for the education of each of their children or wards, which will be taken into account when calculating the amount of tax deduction.

Maximum spend amount for your own training , or the tuition of your brother or sister is 120,000 rubles annually.

Important. It should be noted that the amount of 120,000 rubles takes into account not only funds spent on studies, it may also include expenses for treatment and other services to which the possibility of obtaining a deduction is applicable.

To receive a deduction, you must submit documents confirming the fact of payment for education, which must be issued to the person who made the payment, and not to the person who received the education (if these are different people).

Example of student tax calculation

Let's look at the amount of 120,000 rubles using a specific example.

Let us assume that citizen Ivanov I.I. receives wages in the amount of 40,000 rubles monthly. At the same time, he is studying at an institute where the cost of training for 1 year is 100,000 rubles. Total term The training period is 3 years, therefore, the total amount for training will be 300,000 rubles.

And our student Ivanov decides to pay the entire amount for 3 years in one lump sum, after which he applies to the tax authority for a refund of 13% of the amount spent on training (he does not declare other types of expenses, which may also be subject to a tax deduction).

The amount eligible for the deduction is 120,000 per year. Ivanov paid more than the specified amount at a time, therefore the calculation is carried out in 120,000 rubles, and the deduction will be: 120,000 * 0.13% = 15,600 rubles. Having a salary of 40,000 rubles, the total personal income tax amount, which the employer paid for Ivanov for the year, will be: 40,000 * 12 * 0.13 = 62,400 rubles. Consequently, Ivanov can receive a tax deduction equal to 15,600 rubles.

But, if he paid for his education not in a lump sum, but once a year for 100,000 rubles, then annually he could receive a tax deduction in the amount of: 100,000 * 13% = 13,000 rubles, and the total amount of deductions for three years would be : 13,000 * 3 = 39,000 rubles.

That's why, when contacting the tax service and when paying for training, it is necessary to make a similar calculation in order to maximize the return of the funds spent.

The procedure for obtaining a tax deduction

A tax deduction for training can be obtained either from the tax authority or from the employer. However, you can receive a deduction from the tax authority only at the end of the tax period.

That is, when paying for training in 2018, to receive a tax deduction, you must contact the tax authority in 2019, when paying for training in 2019, the deduction can be obtained through the tax office in 2020, etc.

A tax deduction can be obtained before the end of the tax period by contacting the employer, having previously confirmed this right with the tax authority.

Required documents

In order to receive a tax deduction, you must submit a list of the following documents to the tax authority.

- Tax return in form 3-NDFL. You can read about typical errors when filling out the 3-NDFL declaration in the article at the link;

- Salary certificate in form 2-NDFL, indicating all types of accruals and deductions (obtained from the accounting department at work);

- A copy of your passport or identity document;

- A copy of the agreement concluded with the educational institution, indicating the details of the state certificate allowing educational activities. If such information is not reflected in the contract, then it is necessary to request it additionally. In addition, if the cost of training increases, it is necessary to provide the tax authority with a document confirming this (additional agreement to the contract);

- When paying for the education of your own child or a ward child (including a brother or sister), you must submit additional documents to the tax service:

- a document confirming full-time education, in the absence of such an entry in the training agreement;

- a photocopy of the child’s birth certificate;

- documents confirming the fact of guardianship or trusteeship;

- documents proving the fact of relationship with the brother or sister for whose education you are paying.

- Photocopies of payment receipts confirming the fact of payment for training;

Last updated March 2019

List of documents for registration of deductions

In order to apply for a tax deduction for education, you will need the following documents and information:

for teaching children

- copy child's birth certificate;

- , confirming the child’s full-time education (required if the contract does not indicate the form of education). Submitted to the Federal Tax Service original certificates

- copy of marriage certificate(required if the documents are issued for one spouse, and the other receives a deduction for the child’s education)

When filing a tax deduction for brother/sister additionally provided:

- copy own birth certificate;

- copy brother/sister birth certificate;

- certificate from an educational institution, confirming full-time study (required if the contract does not indicate the form of study). It is submitted to the Federal Tax Service original certificates

When applying for a tax deduction for studying abroad, the following are additionally provided:

- notarized translations all documents drawn up in a foreign language;

It should be noted that in order to avoid delays and refusals, you should contact the tax service with the most complete package of documents.

Preparation of documents using the "Return Tax" service

The "Return Tax" service will help you easily and quickly prepare a 3-NDFL declaration and an application for a tax refund, responding to simple questions. In addition, he will also provide you with detailed instructions on submitting documents to the tax authorities, and in case of any questions when working with the service, professional lawyers will be happy to advise you.

How to certify copies of documents?

By law, all copies of documents must be certified by a notary or independently by the taxpayer.

To certify yourself, you must sign every page(not every document) copies as follows: “Copy is correct” Your signature / Signature transcript / Date. Notarization is not required in this case.

The state, in the form of support for the population, establishes a lot of benefits and subsidies for low-income citizens. But there are support measures that affect everyone, such as the education tax credit. Let's figure out how to get it correctly and what we, in principle, have the right to.

Normative base

The social tax deduction for training is a type of compensation established at the state level, in which a person can return part of the material resources spent on training.

Types of tax deductions

The Tax Code of the Russian Federation provides for only 5 types of tax deductions:

- standard;

- social;

- investment;

- property;

- professional;

- when carrying forward losses from transactions with securities.

The tax deduction for education falls into the social category.

"Educational" articles

A tax deduction is a part of the income of an official working citizen that is not taxed. Only those who pay taxes can compensate for expenses on training, but the amount of compensation cannot exceed 13% of the cost of training, but not more than 50,000 rubles per year. This right The taxpayer is regulated by paragraph 2 of Article 219 of the Tax Code of the Russian Federation.

It should be noted that only an official working parent has the right to receive a tax deduction for education. But as for the educational institution itself, it can be either municipal or private. The status of educational institutions where such compensation can be issued is determined by the Law of the Russian Federation of July 10, 1992 No. 3266-1 “On Education”.

Important: deductions are issued only for training expenses. Payment for the hostel, travel and food is not included here. Also, the legislation is not limited to the territorial location of an educational institution - you can apply for such compensation even if the child studied abroad. But, in this case, all documents confirming this must be translated into Russian (i.e. official language) and notarized.

You should also pay attention to the following nuances:

- A taxpayer can apply to the Federal Tax Service only within three years after paying the specified amount, but unless otherwise provided by other articles of the Legislation of the Russian Federation regarding the payment of taxes and fees -.

- A refund of the tax deduction for a child’s education can only be obtained if at the time of registration of documents he is under 24 years of age and has not entered into a legal marriage. If the applicant acts as a guardian of a child, then the permissible age is reduced to 18 years.

Types of tuition deductions

The list of institutions covered by this law includes the following:

- preschool educational institutions, including kindergartens;

- lyceums, gymnasiums, secondary schools;

- sections and thematic clubs, but only on condition that they have a license established by the state, which gives the right to carry out educational activities;

- secondary specialized institutions;

- Universities of all levels of accreditation.

Advanced training courses, training that gives new skills are also included here. Therefore, you can also apply for a tax deduction for training in a driving school.

A tax deduction for a child’s education in 2019 can also be obtained when taking additional courses, but only if they take place in educational institutions that have the appropriate license. Whether it is private or municipal does not matter.

Regarding full-time and by correspondence, then the situation here is somewhat ambiguous. Thus, a tax deduction for distance learning can only be obtained for own receipt specialties in universities, vocational schools and other educational institutions that are licensed to provide educational services. But a deduction can be issued for your own child only if he is a full-time student. In-person and evening classes are also not included here ().

Right to deduction

The right to receive a deduction is an individual who pays income tax and falls into one of the following categories:

- had their own training on full-time, part-time, evening or individual basis;

- payment for education of a child or children, but only for full-time education up to 24 years of age and if the child is not legally married;

- payment for education of wards or the ward for full-time education, but only up to 18 years of age;

- payment for the education of your full-blood (both mother and father are common) or half-brother or sister under the age of 24 years in full-time education, and if the above persons are not married.

This list is regulated by Article 219, paragraph 1.2 of the Tax Code of the Russian Federation. In the same part legislative act it is indicated that the period of study also includes academic leave, if it is formalized in accordance with legislative norms.

At the same time, you should pay attention to situations in which the opportunity to receive a social deduction is lost:

- training is paid for through maternity capital;

- before the age of 24, a person enters into legal marriage (as stated above);

- the child or ward has switched to another form of education - correspondence, evening, individual;

- the individual is not a citizen of the Russian Federation;

- an individual has the status Individual entrepreneur and conducts its activities in a simplified or patent system taxation;

- if an individual works unofficially. This also includes the unemployed, who have only unemployment benefits from their official income.

It should also be noted that a parent will not be able to receive a deduction for his child’s education if the documents were issued in the latter’s name. But, if the contract and other title documents were drawn up in the name of the parent, and the payment was made by the child, then the right is retained. It is enough to attach a document indicating that the payment was made by the child on behalf of the parent/guardian.

Deduction amount

The maximum amount of social deduction will depend on whose training the individual paid for. Legislation () provides the following:

- own training – the amount of tax deduction for training cannot exceed the total limit on deductions of 120 thousand rubles for the tax period, that is, a year;

- payment for education for your child or children, if they have not reached 24 years of age and are full-time students - no more than 50 thousand rubles per year for each child;

- payment for education of the ward person or persons, if they have not reached 24 years of age and are studying full-time - no more than 50 thousand rubles for each person per calendar year;

- payment for education of a non-full or full brother/sister, if they have not reached 24 years of age and are studying full-time - no more than 120,000 rubles per year.

This can be visually represented in the form of the following table:

At the same time, it should be noted that the tax deduction is calculated cumulatively and the indicated amounts are the general limit. Therefore, only 13% needs to be deducted from the amount prescribed by law. Thus, you can get back no more than 15,600 rubles for your own education, and no more than 6,500 rubles per year of study for a child or ward.

In addition, if the taxpayer spent some money on medical expenses (for example) and filed a return for compensation for these expenses, and later filed a claim for the tuition deduction, then the amount will be combined and, therefore, the amount of the tuition deduction will be less.

To understand the situation, consider an example: Ivanov spent 100,000 rubles on his treatment. To reimburse the expenses, he submitted a declaration with the appropriate amount. At the same time, he underwent training and spent 120,000 rubles a year. Thus, the maximum allowable deduction for training will be 20,000 rubles.

The tuition deduction is calculated based on the following factors:

- the amount that a person can receive as compensation should not exceed the amount of income tax, that is, 13% of the official salary;

- the total amount of the deduction does not exceed 13% of training costs, but taking into account the above amounts for the year.

For an example of calculating the amount of tax deduction, consider an example situation:

- for a year of personal training, 150,000 rubles were given;

- 250,000 rubles were earned in a year;

- the annual deduction limit is 120,000 rubles, and 150,000 were spent. Therefore, if the limit was not spent on other types of deductions, then the amount is calculated as follows: 120,000 * 13% = 15,600 rubles.

The calculation itself is quite simple - you only need to subtract 13% from the amount spent. For example:

- for a sibling who is a full-time student, 95,000 rubles were paid;

- therefore – 95,000*13%=12,350 rubles.

Step-by-step instructions for receiving a deduction

How to get a tax deduction for education? In order to receive this kind of compensation, you need to collect a package of documents and submit an application according to the norm established by law to the tax service. After the tax service verifies the authenticity and correctness of all documents provided, the money will be transferred to the taxpayer’s account.

List of documents

What documents are needed to apply for a tax deduction? You need to have the following with you:

- tax return in form 3-NDFL;

- internal passport of a citizen or document that identifies the taxpayer;

- income certificate in form 2-NDFL;

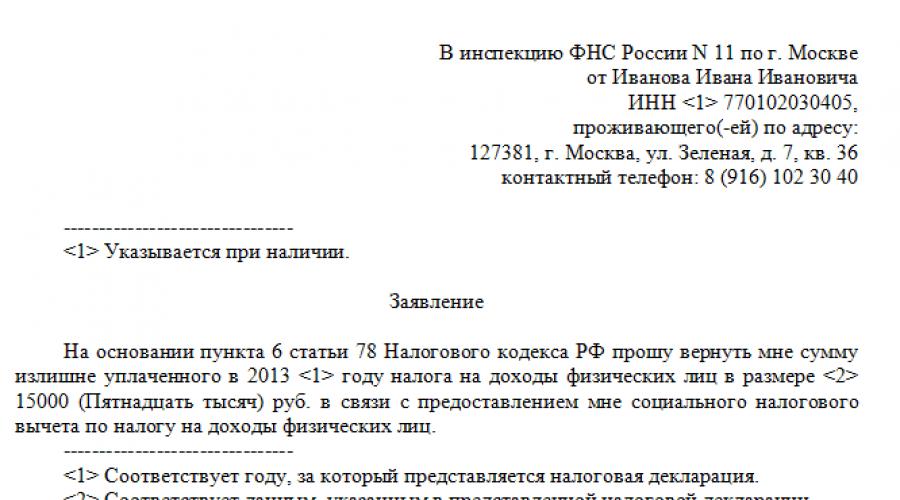

- application of the established form for a tax deduction for education (can be downloaded from our website);

- an agreement with an educational institution, which must indicate the amount. Please note that if the amount has increased since the conclusion of the contract, this must also be documented. In most cases, this is an annex to the contract;

- a certified copy of the educational institution's license;

- payment documents that confirm the fact of transfer of a certain amount to the account of the educational institution.

When submitting documents and filling out a tax deduction for education for a child, you additionally need to collect the following documents:

- a copy of the child/children's birth certificate;

- a certificate from an educational institution confirming that the child is studying full-time;

- a copy of the marriage certificate, but only if one spouse was indicated in the payment documents, and the other spouse is processing the deduction.

If you are collecting documents to receive a deduction for the education of your brother or sister, you need to have the following documents:

- a copy of your own birth certificate;

- a copy of the birth certificate of a relative;

- a certificate from an educational institution stating that the relative is a full-time student.

If a tax deduction is issued provided that the child/relative studied abroad, then all documents must have notarized translations.

Important - all copies of documents must be certified. You can do this yourself (write “Correct copy” on each copy and sign and date it), or do it through a notary. A declaration in form 3-NDFL when applying for a tax deduction for education must be required.

Preparation of the declaration

To receive a tax deduction for training, you must fill out a declaration in Form 3-NDFL. Filling out the declaration and application is the most difficult, but at the same time the most important stage.

The declaration consists of several sheets, on which, in addition to general information, you need to provide information regarding the amount of income and their source. Please note that you must put your signature on each sheet. The fields are filled in in block letters. You can also use the declaration form on our website.

You need to fill out the declaration very carefully - the slightest mistake or correction will make the document invalid. You can make this stage a little easier - using a special program on the website of the Federal Tax Service there is a special program for this.

Preparing an application

You can download applications for tax deductions for education from our website. The body of the application will need to provide the following information:

- Full name of the taxpayer;

- type of reimbursement (in our case, this is the third option (reimbursable));

- size of the amount;

- in a special field (small square on the first sheet) you need to duplicate your personal information and certify with your personal signature the accuracy of the entered data;

- Name banking institution, account number and type;

- information about your passport or other document that confirms your identity;

- information about place of residence.

All items, especially the amount and bank account, must be entered very carefully.

Treatment minus

How to get money back for studying at a university or another educational institution? This can be done by submitting the above documents to the tax service at the place of registration of your place of residence, or through your employer.

Registration through the Federal Tax Service

You can submit documents either in person to the regional department of the Federal Tax Service, having previously made an appointment, or online through the official website of the department, having previously created a personal taxpayer account.

Please note that when submitting documents through the Federal Tax Service website, you must have an electronic digital signature. If it is not there, then you can get it on the same site. The declaration in form 3-NDFL can be filled out right away or downloaded ready-made. After this, you will need to upload scanned copies of documents and certify everything with a digital signature. The process of processing your request can be tracked in your personal account.

When contacting the department at the place of registration of residence, the process of submitting documents is similar - you need to come to the inspector at the appointed time and provide a complete package of documents. On site, the inspector checks whether everything is as it should be and registers the request.

Don’t forget to provide a certificate in form 2-NDFL, this is important for the Federal Tax Service. It looks like this:

Registration through the employer

In this case, you still need to contact the tax service. The deduction procedure is as follows:

- apply for a notification from the Federal Tax Service to receive a social deduction ( The sample can be downloaded on our website);

- collect a package of documents;

- submit a package of documents with an application for notification to the regional department of the Federal Tax Service;

- after 30 days, receive a notification from the Federal Tax Service about the right to receive a deduction;

- provide notice to the employer.

Important - if copies of documents are provided to the tax service, you still need to have the originals with you.

Deadlines for receiving the deduction

The time frame for receiving a decision on issuing a tax deduction will depend on the form of application. When submitting documents through the Federal Tax Service (in person or online), the review period is no more than 3 months from the date of registration of the application. If the deduction is issued through the employer - no more than 30 days.

Please note that you can only get a refund in the year following the payment. For example, if tuition was paid in 2018, then you can receive funds only in 2019.

The funds are transferred directly to the applicant within a month after the application is approved tax service. It should be noted that the relatively long period of consideration of an application for a tax deduction is associated with a thorough check by the Federal Tax Service of the documents provided.

Taking into account all of the above, the answer to the question “is it possible to get a tax deduction for education” will be in the affirmative. The main thing is to collect a complete package of documents, correctly calculate the amount and correctly fill out the declaration and application. The process of obtaining such compensation is lengthy and somewhat complicated, but it makes it possible to save money spent on training.