Download new version of taxpayer 4.54 3. Latest version of taxpayer yul

Good afternoon dear friends! Today I want to tell you how to update the Taxpayer LE. This procedure is very important, the Federal Tax Service is constantly changing forms and report templates. Therefore, if you do not update the program in a timely manner, then your report may simply not be accepted. You may have a correct report, but due to the fact that you have an old form, the tax office may simply reject the report. Let's get started!

How to update the Taxpayer LE

If you can't decide on your own this problem, then you can go to the section and our specialists will help you.

Now let's find out which version we have. We start the program and look at the version of the program in the header.

The version of the program is written after the words "Legal taxpayer". AT this case I have version 4.57. And the latest version is 4.57.1. So we need to update the Taxpayer.

How to correctly install versions of the Taxpayer LE

Now very important point!!! In order for the update to be correct, you must follow the sequence of versions. The first step is to install the full version. Then, an additional version. The full version always consists of three digits. In this case, those numbers are 4.57, the next full version will be 4.58, then 4.59, and so on. Minor versions consist of four digits. For example, now we will install version 4.57.1, then it will be 4.57.2, then 4.57.3 and so on. It happens that there are no additional versions at all, or vice versa, there are many. Recently it was such that there was version 4.56.6. That is, there may be many additional versions, or there may not be at all.

Now we will analyze which version to install on which. First of all, we always put full version, then more. For example: you have version 4.56.3, and now the latest is 4.57.1. So, first of all, install version 4.57. Then we launch our “Legal Taxpayer”, the database is reindexed and only after that we install 4.57.1.

If you start installing version 4.57.1, and you have version 4.56.3, then the "Legal Taxpayer" program will not be updated for you, or it will not update correctly!

Even if you have version 4.54.1 or 4.56, then a higher version, such as 4.57, can be safely installed. That is, the higher FULL version can be put on ANY previous one.

Now let's deal with additional versions.

How to properly install additional versions of Taxpayer LE

We will again analyze everything with examples. Now we will install version 4.57.1. In the future, a version will be released (or maybe not) 4.57.2.

Let's assume that we now have version 4.56.1. So we first install version 4.57, and then 4.57.1. But remember! After installing each version, you need to run the program so that the database is reindexed, only after reindexing, you can update the program further.

Now let's look at another option. You have version 4.57, and the update is 4.57.3. In this case, you do not need to install versions 4.57.1 and 4.57.2, but immediately install version 4.57.3. All clear? If not, then questions in the comments.

Step-by-step instructions on how to update the Taxpayer LE

Theory is over! Now let's move on to the update process!

I have version 4.57, the latest version is 4.57.1. Downloading Last update here . Let's unpack it. If you don't know how to unpack a file, then read my article here.

Now we must close the program of the legal entity taxpayer. Be sure a hundred times that you closed the program. Otherwise, you will lose all your data!

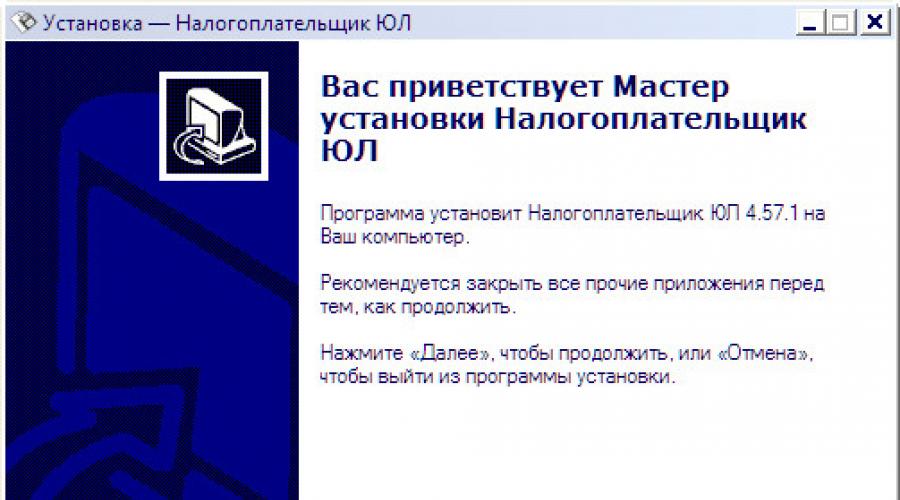

We start the update. We see the "Greetings" window. Just click "Next".

Now the most important step. We need to choose in which folder to install the updates. Right-click on the shortcut with the program and select "File Location".

The folder with the Taxpayer will open. Let's look at the path. My Taxpayer is located along the path "C:\NP LE\INPUTDOC".

You may have another way! In the update program, we need to specify this path, only without the "INPUTDOC" folder. Here I have the path "C:\NP LE\INPUTDOC", which means that during the update process I specify the path "C:\NP LE". After specifying the path, click "Next".

After that, the update process will begin. After the update is completed, the following window will appear. Just click "Finish"

Immediately after the update, a window like this may appear. There is no need to panic, just click "This program installed correctly."

Now we launch our Taxpayer Legal Entity and see the reindexation that I told you about. We just wait without pressing anything, and without turning off the computer and the program, otherwise everything will break!

Now we look again at the program header to make sure that the update went through correctly and the latest version is installed.

We see that I now have version 4.57.1. So the update went well and correctly!

If you need professional help system administrator, to solve this or any other issue, go to the section, and our employees will help you.

Now you know how to update the LE Taxpayer.

If you have any questions ask them in the comments! Good luck and good luck to everyone!

To be the first to receive all the news from our site!

latest version Taxpayer legal entity for Windows will help those users who need to automate the preparation and execution of tax and accounting documentation. it software actively used by legal and individuals. It allows for automatic and manual mode form a variety of documents necessary for the conduct of activities, transfer to regulatory authorities.

Key Benefits

It is easy and convenient to download Taxpayer Legal Entity from our website. The software has become widespread, as it allows you to work productively and efficiently in the prevailing conditions. It is easy to use, has an intuitive interface. The developer of the application is the Federal Tax Service (Federal Tax Service). Among the advantages of the solution, it is worth highlighting:

- free and fast;

- prompt input of information;

- possibility Reserve copy, data transfer;

- the presence of directories and classifiers that simplify the work;

- there is a convenient and up-to-date "Accountant's Calendar".

Downloading and installing the Russian version of Taxpayer LE 2016 is easy. Setting up the software is also easy. This solution automatically checks the correctness of the entered information, indicates errors and inaccuracies. The user can upload ready-made documents, print files, keep reports on several enterprises.

System requirements

New version Taxpayer LE 2016 – one-stop solution, which can be installed on the server or Personal Computer. It will operate smoothly and accurately under the following conditions:

- one of the Windows solutions (Vista, 2000, XP, 7, 8 (32 bit or 64 bit));

- processor frequency is not lower than 1500;

- at least 600 MB of free disk space;

- the amount of RAM from 512 MB.

Treatment is not required. When downloading and installing, you must disable antivirus program. The application has a built-in update checking system, so it will notify users in a timely manner when they need to get a new version.

Functionality

Software Taxpayer LE in Russian supports a variety of forms for creating reports and documentation. Some documentation can be generated semi-automatically. For novice users there is convenient instruction on the application of the solution. The program contains various forms that will help for doing business. Having created reporting forms, the user can send them for printing or save them to a computer for further processing.

Software Taxpayer LE is indispensable for accountants, economists, representatives of the financial sector, individual entrepreneurs, outsourcing companies. This solution will become a reliable assistant for users who need to submit reports to regulatory authorities in in electronic format. Successful application.

« Taxpayer legal entity "- this is the official software developed by the tax service of the Russian Federation. Its main purpose is to facilitate the process of preparing documents for submission to FTS and automate this process. The software helps to prepare both electronic versions of documents, exporting them to office program formats, and print reports.

To get started, make sure you have the latest version of the program installed. Since the reporting requirements of individuals and legal entities to the Federal Tax Service are constantly changing, amendments are made to the sample documents or additional columns. If version " Taxpayer" is out of date, the documents you have prepared may not comply with applicable law.

The program facilitates the process of preparing documents, due to the fact that it initially enters information about the organization into the database and saves them. When starting, you are prompted to fill in information about the taxpayer, the recipient's INFS, select the reporting form and period. All completed information will be saved, making it easier to fill out declarations in the future. You can easily make changes if necessary.

Documents that are prepared with the help of "Legal taxpayer" 4.61:

- Information on VAT

- All types of income tax reports

- Insurance calculations

- Registration of CCP

- Application of ESHN, USN

- Accounting for taxpayers

- Notification of OFR, etc.

The software is fully translated into Russian and is compatible with OS Windows XP or higher. On our website you can download the latest version of the program "Legal Taxpayer" 4.61 from 2019. Files are downloaded from the official website of the Federal Tax Service.

Screenshots

Free software package The Yul taxpayer will help you independently prepare all tax and accounting reports. The application generates reports in paper and electronic form for sending to the Federal Tax Service via communication channels (Tensor Sbis, Kordon, Kontur).

Opportunities Taxpayer Yul

- Automation of the calculation process and preparation of all necessary reports.

- Calculation and preparation of data on insurance premiums.

- Formation of documents of personal income tax.

- Printing of various applications, notifications and documents for registration of cash registers.

- Printing and downloading reports in a special format.

- In one database, you can manage several enterprises, entrepreneurs and individuals.

Installation and update

First, we make a backup copy of infobases, just in case, to do this, go to the "Tools" - "Saving information" menu.

Installing from scratch or updating the program is equally easy. We download the latest full version and updates (if any) from the links below, they lead to the official websites of the Federal Tax Service gnivc.ru and nalog.ru. Run the resulting NalogUL459.msi file and accept the license agreement.

During the initial installation, specify the folder (for example, C:\np\), and if this is an update, the installer will determine the path itself.

The PDF417 machine-readable form printing software will also be installed. Upon completion of the process, the reporting forms will be re-indexed (a rather lengthy process).

Attention. The main versions of Taxpayer Yul are indicated by two numbers, for example 4.60 and can be installed on any version. Update numbers consist of three digits, for example 4.60.1 and are installed only on the full version - 4.60.

Why is it important to keep the app up to date? The Federal Tax Service and the PFR are constantly making changes: in the methods of calculating taxes, appearance and reporting format. Most often, this happens towards the end of the reporting period (quarter or year). The developer, in turn, releases new versions and updates in accordance with these requirements.

After filling in the data and uploading the reports, you need to make sure that there are no errors. To check the final result, download the Tester program.

Before sending reports to control organizations, you need to make sure that you are using the latest version of the Yul Taxpayer program. Otherwise, the report will not be accepted.

Taxpayer LE - official software developed by the Federal Tax Service Russian Federation. The main purpose of this program is to automate the preparation various types documentation submitted by private entrepreneurs to local bodies of the Federal Tax Service. This solution makes it much easier to work with financial reporting, provides a lot of tools for filling out declarations, information and forms, and also allows you to export them to popular office formats.

Documentation

I use this software, physical and legal entities have the ability to calculate insurance premiums, generate all types of personal income tax reports, fill out special declarations, draw up requests for financial services from counterparties, create invoices and VAT information registers. Also, the Taxpayer of the legal entity helps in working with documents for the ESHN, USN, registration of cash registers and when working with powers of attorney. There are also components responsible for compiling notifications to FIUs (organizations financial market) and applications for accounting of taxpayers. In short, this is a multifunctional solution covering the full range of tax and accounting reporting.

Functional

From interesting opportunities programs that help automate routine processes, it is worth noting the function of calculating indicators and establishing the correct order for filling them out. There is also a shaping tool paper carrier(sending documents for printing), electronic forms for maintaining a list of employees and counterparties, as well as a section with the history of uploaded files. The latest version also has several step by step wizards needed to create particularly "complex" documentation.

The graphical shell of the program is quite pragmatic. For easy navigation, the developer has provided a special panel and several drop-down menus. System requirements Taxpayer legal entities are minimal. The software runs perfectly even on the weakest office PCs with outdated hardware and Windows versions.

Key Features

- assistance in the formation of a full range of tax documentation;

- several step-by-step wizards that automate work with the software;

- output of the created reporting to print, as well as export to popular office formats;

- pragmatic interface;

- very low system requirements.