Indicators of efficiency of property use. Assessing the efficiency of using enterprise property. Need help studying a topic?

The efficient use of property is expressed through indicators of the efficiency of use of fixed assets and working capital and having your own working capital. The dynamics of growth of the enterprise's own working capital is assessed as a positive factor in financial activity.

The most important indicators of the use of fixed assets are capital productivity and capital intensity. The capital productivity indicator is analyzed over a number of years, so the volume of production is adjusted for changes in prices and structural changes, and the cost of fixed assets is adjusted for the revaluation factor.

An increase in capital productivity leads to a decrease in the amount of depreciation charges per ruble finished products or shock absorption capacity. The growth of capital productivity is one of the factors of intensive growth in production volume.

Another important indicator characterizing the efficiency of use is capital intensity. Capital intensity is an indicator inverse to capital productivity. When determining capital productivity and capital intensity, the volume of production is calculated in cost, natural and conditionally natural measures. Fixed production assets are determined by cost, by area occupied or by other measures, and their average chronological value for the analyzed period is taken into account.

The efficiency of using working capital is characterized by a system of economic indicators, the main of which should be considered the turnover of working capital.

Turnover refers to the duration of the complete circulation of working capital from the moment of their acquisition (purchase of raw materials, supplies, etc.) to the release and sale of finished products. Crediting the proceeds to the company's account completes the circulation of working capital.

The analysis of the turnover of working capital is of great importance, since the volume of products sold (work, services) is directly dependent on the speed of their turnover, and, consequently, the amount of profit received.

After completing the circulation of funds in profitable enterprises, the amount of advanced working capital increases by a certain amount of profit received. For unprofitable enterprises, the amount of advanced working capital decreases due to losses incurred.

Working capital turnover various enterprises depends on their industry affiliation, and within one industry - on the organization of production, sales of products and placement of working capital.

The working capital turnover ratio (CR) for a certain period is calculated using the following formula:

KO = Tpr./Act. (2)

Under these conditions, the higher the turnover ratio, the better the use of working capital.

The duration of one turnover of working capital is calculated using the following formula:

Odle. = (Sub. / Tpr.) / D (3)

where is Odle. - duration of turnover, in days;

Sob. - working capital balances (average or as of a specific date), rub.;

Tpr. - volume of commercial products, rub.;

D is the number of days in the period under review, days.

A decrease in the duration of one revolution indicates an improvement in the use of working capital.

The load factor of funds in circulation (Кз) is the inverse coefficient of the turnover ratio and is determined by the following formula:

Short circuit = Sob./Tpr. (4)

The return on working capital indicator can also be used , determined by the ratio of profit from sales of the enterprise's products to working capital balances.

The change in turnover is determined by comparing actual indicators with planned or indicators of the previous period. As a result of comparison of indicators, acceleration or deceleration of working capital turnover is revealed.

When the turnover of working capital slows down, additional funds are drawn into circulation, and when it accelerates, material resources and the sources of their formation are released from circulation.

The financial position of the enterprise is directly dependent on the state of working capital, therefore companies are interested in organizing the most rational movement and use of working capital.

To determine the profitability of investments in current assets, the profitability ratio is used, as well as the DuPont model, which, in relation to this type of asset, has the form:

Roa = Rrp x Ooa (5)

where Roa is the profitability of current assets;

Ррп - profitability of product sales;

Ооа - turnover of current assets.

As you can see from their formulas, the higher the turnover, the higher the rate of return. In turn, the turnover of current assets largely depends on the volume of funds invested in current assets.

ABOUT oa= Revenue / Current assets (6)

The less funds advanced into current assets, the higher the turnover rate. However, the reduction of funds should not negatively affect either the production process or the liquidity of the enterprise, i.e. the required amount of cash and highly liquid assets of the enterprise must be provided, taking into account the volume and schedule of upcoming payments.

Among the many factors influencing the efficiency of using working capital, one can distinguish a group of external factors that influence regardless of the interests and activities of the enterprise, and a group of internal factors that the enterprise can and should actively influence.

The set of external factors includes: the general economic situation, features of tax legislation, the possibility of targeted financing, conditions for obtaining loans and interest rates on them, participation in programs financed from the budget. Taking these factors into account, the enterprise can use internal reserves to rationalize the movement of working capital.

Accelerating the turnover of working capital at all stages of the circulation ensures an increase in the efficiency of their use.

An important element of enterprise working capital management is determining the enterprise's need for working capital. For this purpose, working capital is rationed. Working capital rationing refers to the process of determining the economically justified need of an enterprise for working capital to ensure the normal flow of the production process.

Indicators of the effective use of general fund include the following indicators: capital productivity, capital intensity, capital-labor ratio, technical equipment, profitability, coefficient of extensive use of general fund, coefficient of intensive use of general fund, coefficient of integral use of general industrial fund.

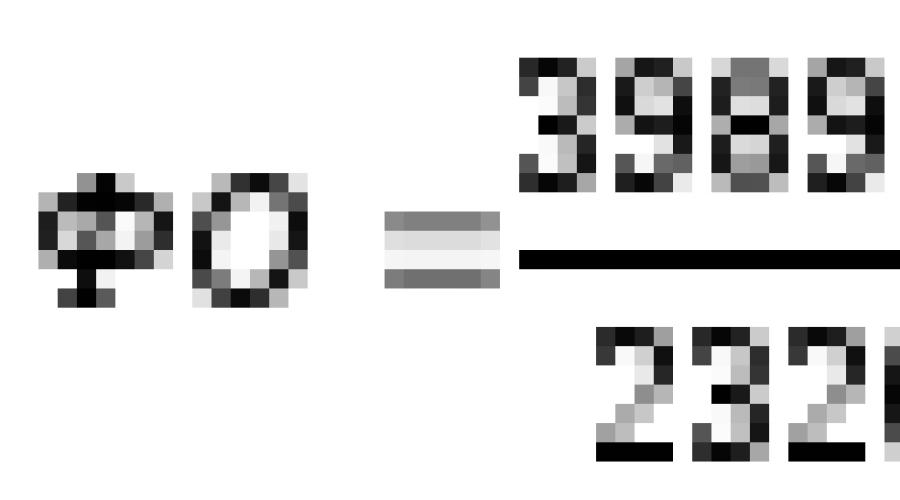

Capital productivity indicator (CR) calculated in natural and cost units of measurement. The value of the FO indicator shows the volume of transport work or the amount of income received by the enterprise from one ruble of the cost of the OPF. In this work, it is necessary to calculate the FD in cost units:

Where D– enterprise income, rub.;

– average annual cost of OPF rub.

![]()

Capital intensity indicator(FE) shows the cost of OPF necessary for an enterprise to receive 1 ruble of income. The inverse indicator of capital productivity.

Indicator of capital-labor ratio (technical equipment) characterizes the technical equipment of one average vehicle or one employee.

where C ps– cost of rolling stock, rub.;

Ass– average number of cars;

Ngenerally– total average number of employees of the enterprise, people.

![]()

![]()

Return on fixed assets– shows the profit (rubles or %) received by the enterprise from one ruble of the cost of the general fund.

Where Pb– balance sheet or total profit of the enterprise, rub.

![]()

To characterize the technical condition of the OPF and the equipment of the enterprise, the OPF is determined the following types indicators: depreciation coefficient, serviceability coefficient, OPF renewal coefficient, OPF disposal rate.

Wear rate - shows what part of the OPF cost has already been transferred to the cost of finished products. Characterizes the degree of depreciation of the enterprise's capital assets for the period.

A– the amount of accrual of depreciation (wear and tear) of the general fund for the period, rub.;

– cost of open pension fund at the end of the year, rub.

– cost of open pension fund at the beginning of the year, rub.

23200000 rub.

Cost of newly introduced (received) OPF during the year, rub.;

Cost of OPF retiring in the current period, rub.

Usability factor- shows the cost of OPF suitable for further use. It characterizes the level of technical condition of the open pension fund and is determined by the ratio of the residual value of the open pension fund to their original value at the end of the year.

OPF update factor characterizes the degree of updating of the OPF during the year.

Table 5 – Results of calculating indicators of efficiency in the use of enterprise property

|

Index |

Indicator value |

|

Capital productivity | |

|

Capital intensity | |

|

Capital-labor ratio | |

|

Technical equipment | |

|

Profitability of OPF | |

|

Wear rate | |

|

Usability factor | |

|

OPF update factor | |

|

OPF disposal rate |

The dynamism of market relations determines the adoption extraordinary solutions related to financial performance results. To assess the level of operational efficiency, the resulting result - profit - is compared with the costs or resources used.

Profitability is a relative indicator, has the property of comparability and can be used when comparing the activities of different enterprises; characterizes the degree of profitability, profitability, profitability. Profitability indicators allow you to evaluate the profit from each ruble of funds invested in assets.

All entrepreneurial activity in market conditions is divided into three types:

Operating room (main),

Investment (investing in shares, other securities, capital investments),

Financial (receipt and payment of dividends, interest, etc.).

In accordance with this, the following groups of relative profitability indicators are used in the analysis of financial indicators:

Profitability of products, works, services,

Profitability of production assets,

Profitability of all property (all assets),

Return on investments (investments) and securities.

The profitability of products (works, services) is characterized by the following indicators:

Profitability of sales (turnover, sales),

Profitability of manufactured products,

Profitability of individual products.

Profitability of sales (turnover, sales) is determined by the ratio of profit from sales of products or net profit to the amount of revenue from sales of products without VAT and excise taxes, expressed as a percentage. This indicator characterizes the efficiency of entrepreneurial activity: how much profit does an economic entity have per ruble of sales, work performed, services rendered.

Productivity profitability and individual types of products is determined by the ratio of profit from the release of a product or product of a certain type to the cost of commercial output. This indicator characterizes the absolute amount (in kopecks) or the level (in percentage) of profit per ruble of funds spent.

Sources of information for analyzing the profitability indicators of products, works, and services are Form No. 2 of financial statements, accounting registers of a business entity.

Changes in the level of profitability of sales (turnover) occur under the influence of changes in the structure of products sold and changes in the profitability of certain types of products. The profitability of certain types of products depends on:

Sales price level,

Product cost level.

The analysis is carried out in the following sequence.

Determine the level of profitability of sales according to the plan actually for the reporting year, for the previous year. Then the object of analysis is determined: the planned level of profitability for the reporting year is subtracted from the actual level of profitability for the reporting year.

The change in the level of profitability of sold types of products (works, services) was influenced by the following factors:

1. Change in structure and product range

2.Change in cost.

3. Change in price level.

Then it is necessary to do a factor analysis of profitability for each type of product. The level of profitability of certain types of products depends on average selling prices and unit costs.

To assess the dynamics of the levels of profitability of commercial output of certain types of products, it is necessary to compare the actual indicators of the reporting year by type of product with the actual indicators for a number of previous years, which will allow us to determine the trend in the profitability of products, and, consequently, the phase of the product life cycle.

The efficiency of using consumed funds (costs) is characterized by the profitability indicator of production assets. This indicator, along with the return on sales indicator, is an estimate when studying demand for products.

The profitability of production assets can be determined by both balance sheet and net profit (remaining at the disposal of the business entity).

The profitability of production assets characterizes the ratio of the profit of the reporting year (net profit) to average cost fixed production assets and working capital.

The change in the level of profitability of production assets (Rpf) is influenced by the following factors:

Change in the level of capital productivity (Fo),

Change in turnover level (To),

Change in profitability (profitability) of the volume of products sold.

To determine the quantitative influence of the above factors on changes in the level of profitability of production assets, the following formula is used:

Rpf = Pb% / ((1 / Fo) + (1 / Ko)),

where Pb% is the amount of balance sheet profit as a percentage of revenue from product sales.

The main objectives of analyzing the profitability of production assets are:

Assessment of profitability indicator over time,

Identifying and Measuring Action various factors to the level of profitability,

Identification of measures and possible reserves for further growth of profitability.

Profitability indicators characterize profitability from different positions and are grouped in accordance with the interests of participants in the economic process. One of the profitability groups - return on capital (assets) indicators - determines the profitability and efficiency of use of property. It is calculated by the ratio of profit to various indicators of advanced funds: all assets; investment capital (equity and long-term liabilities); share (own) capital.

By comparing the return on assets calculated from net profit with the return on assets calculated from book profit, you can determine the impact of tax deductions on profitability.

Return on equity (Rck) allows you to evaluate the efficiency of using the funds invested by the owner and makes it possible to compare it with the possible income received from investing these funds in other securities. This indicator characterizes the amount of profit per 1 ruble of equity and is calculated as the ratio of net profit to the average annual cost of equity:

Rsk = Pch/Is.s · 100%,

where Pch is net profit,

Is.s – sources of own funds.

Comparing the profitability of property with the profitability of equity, calculated based on net profit, makes it possible to evaluate the attraction of borrowed funds. If borrowed funds generate more profit than paying interest on this borrowed capital, then the difference can be used to increase the return on equity.

The return on financial investments shows the amount of income (dividends, interest) received by the enterprise for each ruble of investments in securities of other enterprises and from equity participation; is determined by the ratio of income from securities and investments to the average annual amount of financial investments.

Questions for repetition and consolidation of knowledge

1. List the tasks and sources of information for analyzing financial results.

2. List the factors influencing profit from sales of products (works, services).

3. Describe the main profit indicators and the procedure for their calculation.

4. How is the analysis of operating and non-operating results carried out?

5. What factors determine the level of profit from product sales and how is their influence calculated?

6. Describe the main profitability indicators and the methodology for their calculation.

7. List the areas of use of net profit by the enterprise.

8. On what factors does the size of the enterprise’s current assets depend?

Analysis literally means dismemberment, decomposition of the studied object into parts, elements, into the internal components inherent in this object.

Analysis in more in a broad sense deals with the theory of ec. analysis; in professional - eq. analysis of economic and financial activities in relevant sectors: industry, agriculture, construction, catering and the sphere of social and consumer services.

Analysis - essential tool impact on increasing the efficiency of use of property, activating reserves for increasing labor productivity, improving the quality of products and services, reducing costs, improving all production indicators economic activity enterprises.

At the present stage of development of the national economy, technical, economic and social processes are closely interconnected and interdependent. Establishing relationships and interdependencies is the most important point analysis. Causality mediates all economic facts, phenomena, situations, processes. The same factor, being the cause of one phenomenon, often acts as a consequence of another. Factor analysis is used to identify such cause-and-effect relationships and the degree of mutual influence on the activities of the enterprise.

Factor analysis allows us to highlight the influence of certain factors on the property potential of an enterprise and the development of socio-economic technical processes.

Technical methods of analysis make it possible to facilitate and speed up the analytical work of assessing property and provide consideration of various factors influencing the activities of the enterprise in interrelation. The choice of technical methods is determined by the purpose of the analysis and the nature of the sources used.

The activities of the enterprise are multifaceted and characterized by various indicators. The performance of an enterprise can be assessed using absolute and relative indicators. Thus, using the indicators of the first group, you can analyze the dynamics of profit indicators (balance sheet, net, undistributed) over a number of years. The second group of indicators is practically not affected by inflation and represents different ratios of profit and invested capital (own, borrowed). The economic meaning of the values of these indicators (they are usually called profitability) is that they characterize the profit received from each ruble of funds invested in the enterprise.

The analyzed indicators must be organized in tables, graphs, diagrams showing their dynamics over certain periods, the dependence of new and actual data.

Currently, there is a need to analyze the value of an enterprise and real estate. Valuation of enterprise property has a very wide scope. This is the privatization of state and municipal property, corporatization, leasing of property and the need to justify rent during leasing operations, sale of property of all forms of ownership to legal, Russian, foreign persons, determining the tax base, determining the authorized capital, when corporatizing or creating joint ventures, preparing business development and analyzing the production activities of the enterprise, property insurance and other operations. In all of these operations, the concept of enterprise property appears.

Assessing the efficiency of an enterprise. When considering indicators for assessing current production activity, one should proceed, on the one hand, from an assessment of the increase in labor productivity ( technical aspect), and on the other hand, how this affects the overall production results. The first aspect is assessed using indicators such as:

- - enterprise productivity equal to the ratio volume of manufactured products to the mass of attracted resources;

- - material productivity equal to the ratio of the volume of production to the materials consumed;

- - equipment productivity is equal to the ratio of production volume to expended machine hours;

- - labor productivity - the ratio of production volume to labor hours spent.

The second aspect of activity is also assessed by a number of indicators. The most important of them are: the volume of marketable products, the level of production costs, product quality, and labor productivity. The volume of marketable products characterizes the possibilities of production activities. It shows the volume of the enterprise's products ready for sale outside the enterprise and is defined as the product of the enterprise's price of one unit of product by the number of units of this product produced. The level of production costs characterizes the degree of development of the production base, the level of progressiveness of the organization of production and labor, and its technical equipment. Reducing the level of production costs is the most important condition increasing the competitiveness of products and obtaining greater profits. An important indicator, the efficiency of production services is the quality of products. An increase in product quality is one of the conditions for increasing the price of a product, which leads to an increase in income and an increase in its competitiveness. Quality indicators are different for types of products for different consumer purposes.

An indicator characterizing the level of effectiveness of current production activities is labor productivity, an increase in which leads to a reduction in production costs, and most importantly, contributes to the achievement of the planned output of products with a minimum of costs for their production. Current production activity is multifaceted, therefore, a large group of technical and economic indicators is used to characterize its individual components. They characterize the technical, economic and organizational state of production at a certain point in time.

These include:

- - productive capacity;

- - output of products in physical terms;

- - production capacity utilization factor;

- - commercial products; - products sold (product sales volume);

- - cost of fixed production assets;

- - capital productivity;

- - number of industrial production personnel (employees);

- - labor productivity;

- - average monthly wage;

- - full cost of commercial products;

- - profit (loss) from the sale (sale) of products;

- - profit (loss) before taxation;

- - costs per ruble of products sold (sold);

- - profitability of products as a whole. The main indicators for assessing the results of commercial activities are profit, sales volume, as well as the amount of diversion of funds in material assets.

Ministry of Education and Science Russian Federation

Branch of the federal state budgetary educational institution higher professional education

"St. Petersburg State the University of Economics» in Pskov

COURSE WORK

in the discipline: "Company Economics"

on the topic: Assessing the efficiency of using enterprise property

Pskov 2013

Introduction

2 Key indicators for assessing the efficiency of using fixed assets of an enterprise

3 Main indicators for assessing the efficiency of using the working capital of an enterprise

Conclusion

Introduction

This course work examines the property of an enterprise and assessing its effectiveness.

The property of an enterprise is one of the most important factors in any production. Its condition and effective use directly affect the final results of the economic activities of enterprises.

The relevance of the topic lies in the fact that today in the formation of market relations it is assumed competitive fight between various manufacturers, in which those who most effectively use all types of available resources will be able to win. One of the most important criteria assessment of the activities of any enterprise aimed at making a profit is the efficiency of use of property and the disclosure of property potential. The role of fixed assets and working capital, their effective use in various economic relations is very important. This is due to the fact that the main source of profit for any enterprise is national wealth The country is skillful, reasonable and fairly complete use of them, with their timely modernization and renewal.

Fixed production assets, consisting of buildings, structures, machines, equipment and other means of labor that participate in the production process, are the most important basis for the company's activities. Without their presence, hardly anything could have happened. Naturally, for the normal functioning of each enterprise, not only fixed assets are needed, but also working capital, which is, first of all, cash that is used by the enterprise to acquire working capital and circulation funds.

Rational and economical use both fixed and working capital is the primary task of the enterprise.

The purpose of this course work is:

Ø reveal the theoretical concept of assessing the efficiency of an enterprise’s property;

Ø complete the practical task correctly.

To achieve the set goals, it is necessary to solve the following tasks:) to study the property of the enterprise and its composition;) to consider the sources of formation of the property of the enterprise;) to study the main indicators for assessing the effectiveness of the property of the enterprise;) to complete practical tasks.

The course work will consist of two chapters:

Theoretical ( Theoretical basis this topic)

Practical (Problem solving).

Chapter 1. Theoretical foundations for assessing the efficiency of use of enterprise property

1 Enterprise property: concept, composition, sources of its formation

The property of an enterprise is a set of tangible, financial and intangible assets owned by the enterprise and intended to carry out the activities of the enterprise.

Property represents fixed assets and working capital, as well as other valuables, the value of which is reflected in the independent balance sheet of the enterprise. The enterprise has the right to sell and transfer to other enterprises, organizations or institutions, exchange, lease, lend, provide free temporary use or loan buildings, structures, equipment belonging to it, vehicles, inventory, raw materials, etc., as well as write them off the balance sheet, unless otherwise provided by law.

TO real estate include land plots, subsoil plots, isolated water bodies and everything that is firmly connected to the land, i.e. objects, the movement of which without disproportionate damage to their purpose is impossible, including forests, perennial plantings, buildings, and structures. Immovable things also include subjects state registration air and sea vessels, inland navigation vessels, space objects. The law may classify other property as immovable property.

The enterprise as a whole as a property complex is recognized as real estate (Civil Code of the Russian Federation (parts one and two) (as amended and supplemented on February 20, August 12, 1996, October 24, 1997), Section I, Subsection 3, Chapter 6, Articles 130, 132). Movable property - things not related to real estate, including money and securities. Registration of rights to movable things is not required, except in cases specified in the law (Civil Code of the Russian Federation (parts one and two) (as amended and supplemented on February 20, August 12, 1996, October 24, 1997), Section I, Subsection 3, Chapter 6, Article 130). General information the composition and size of the enterprise’s property can be obtained from an analysis of the enterprise’s balance sheet, which gives a generalized cost description of the enterprise’s assets (balance sheet asset) and the sources of their formation (balance sheet liability).

Information about the composition of the property and financial position of the enterprise as of a certain date is contained in the balance sheet of the enterprise, which consists of several tables. “The financial statements consist of a balance sheet, a profit and loss statement, appendices thereto and an explanatory note (hereinafter, the appendices to the balance sheet and profit and loss report and the explanatory note are referred to as “explanations to the balance sheet and profit and loss report”), as well as an auditor’s report confirming the reliability of the organization’s financial statements, if they are subject to mandatory audit in accordance with federal laws.

Accounting statements must provide a true and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position. Accounting statements generated on the basis of the rules established by regulatory acts on accounting are considered reliable and complete." Accounting Regulations "Accounting statements of an organization." PBU 4/99. Approved by the Ministry of Finance of the Russian Federation on July 6, 1999, No. 43-n. Document as amended: by order of the Ministry of Finance of Russia dated September 18, 2006 No. 115-n. The first and main one is Form 1, the structure of which is presented in Appendix 1. It has 2 parts: left side(asset) contains information about the composition of the enterprise’s property, and the right (liability) - about the sources of acquisition of this property. Since this is the same property, both the left and right parts must have the same total value, called balance.

Assets (property of an enterprise) consist of 2 parts: working capital and non-current capital. Non-current capital is the stable property of an enterprise that is not in constant circulation; includes fixed assets, equipment for installation, intangible assets, unfinished capital investments, long-term financial investments, etc. Its composition is shown in section 1 of the enterprise’s balance sheet.

TO intangible assets include patents, licenses acquired for a fee, trade marks and trademarks, rights to use production information, land plots and natural resources, buildings and equipment, as well as organizational expenses incurred prior to the registration of the enterprise.

Fixed assets are valuation fixed assets of the enterprise. “Fixed assets are part of the property used as means of labor in the production of products, performance of work or provision of services, or for the management of an organization for a period exceeding 12 months or the normal operating cycle, if it exceeds 12 months.

Fixed assets are means of production that participate in several production cycles, do not change their natural material form and transfer their value to the cost of finished products in the form of depreciation charges. In accounting, these include tangible property with a service life of more than 1 year. If fixed assets have not yet been put into operation, they are classified as Construction in Progress.

Profitable investments in material assets are investments of an organization in part of the property, buildings, premises, equipment and other assets that have a tangible form, provided by the organization for a fee for temporary use.

Capital investments are the costs of construction and installation work, the purchase of equipment, tools, other capital work and costs (design and survey, geological exploration and drilling work, etc.).

Financial investments are investments of an organization in government securities (bonds and other debt obligations), securities and authorized capitals of other organizations, loans provided to other organizations. Financial investments for a period of more than one year are considered long-term, for a period of up to one year - short-term. Non-current assets include long-term financial investments.

Along with fixed capital for normal operation An enterprise needs working capital or Working capital (FC) is money advanced into circulating production assets and circulation funds. The composition of working capital can be seen in section 2 of the enterprise’s balance sheet; consist of material current assets, cash, short-term financial investments and funds in settlements.

Material current assets are raw materials and supplies, fuel, semi-finished products, work in progress, animals for growing and fattening, deferred expenses, finished products intended for sale, i.e. in stock or shipped to customers.

Cash is generated from cash balances in the organization's cash desk, current account and other bank accounts.

Funds in the calculations include different kinds accounts receivable, which refers to the debts of other organizations or persons of this organization. Debtors are called debtors. Accounts receivable consists of the debt of customers for products purchased from a given organization, the debt of accountable persons for the amounts of money issued to them on account, etc.

The sources of acquisition of enterprise property, indicated in the liabilities side of the balance sheet, are divided into 2 large groups: equity capital and borrowed capital (liabilities). Equity capital and funds equivalent to them (Section 3 of the balance sheet) are funds that are placed at the disposal of the enterprise by the owners (authorized capital) and funds generated through the activities of the enterprise in past years (profit). The enterprise’s profit not used during the current year is directed, depending on plans for its further use, to various funds: reserve fund (to cover possible future losses), accumulation fund (further development of production), fund social sphere. Retained earnings are reported separately and can be used for any purpose.

Over time, the value of non-current assets ceases to reflect their real market value. To eliminate this contradiction, a revaluation is carried out. The difference in value before and after revaluation is indicated in a separate line - additional capital, since real investment funds associated with changes in the value of fixed capital do not occur. In addition to profit and authorized capital, there is another source of property acquisition - targeted financing and revenues (receipts of funds from the budget or specialized funds for specific purposes). These funds are called “equated to one’s own”, since in fact they are not them, but they are not subject to return.

As already noted, part of the value of the organization’s property is formed from its own capital, the other part from the organization’s obligations to other organizations, individuals, and its employees (borrowed funds).

The liabilities of organizations are short-term and long-term loans bank, borrowed funds, accounts payable, distribution obligations. They are in sections 4 and 5 of the balance sheet.

The organization receives short-term loans for a period of up to one year against inventories material assets, settlement documents on the way and other needs, and long-term ones - for a period of one year for implementation new technology, organization and expansion of production, mechanization of production, etc.

Accounts payable are the debt of a given organization to other organizations, which are called creditors. Creditors whose debt arose in connection with the purchase of material assets from them are called suppliers, and creditors to whom the enterprise owes money for non-commodity transactions are called other creditors.

Borrowed funds are loans received from other organizations against bills of exchange and other obligations, as well as funds from the issue and sale of shares and bonds of the organization. Loans received for a period of up to one year are short-term, and for a period of more than one year - long-term.

The sources of formation of the enterprise's property are monetary and material contributions from the founders of the enterprise, i.e. organizations, enterprises, persons who created it; income received from the sale of products and other activities, income from securities (their sale or dividends), bank loans, subsidies and allocations from budgets, gratuitous contributions from organizations, citizens, etc.

The organization’s economic assets are formed from sources, i.e. financial resources. There are:

Ø sources of own funds (equity capital);

Ø sources of borrowed funds (borrowed capital).

They can be represented schematically as follows (Fig. 1):

Rice. 1. Sources of formation of the organization’s property

Own capital is the source of part of the assets remaining after subtracting all liabilities from total assets; some use the term more broadly to include obligations. Own capital consists of authorized, additional, reserve capital; targeted financing and revenues, retained earnings. The structure of equity capital can be presented in the form of a diagram (Fig. 2).

Rice. 2. Structure of equity capital

In the composition of equity capital, the main place is occupied by the authorized capital.

Authorized capital- the amount of capital determined by the agreement and the charter of the organization, which is allocated by joint-stock companies and other enterprises to start operations. The authorized capital in organizations created at the expense of the owners is a combination of contributions from the founders (participants) of business partnerships and business companies (in the form of joint-stock companies, companies with limited liability etc.), municipalities, states. In accordance with the Civil Code of the Russian Federation, business partnerships and business societies are recognized as commercial organizations with authorized (share) capital divided into shares (contributions) of founders (participants).

Contributions to property can be cash, fixed and current assets in kind, securities, property or other rights that have a monetary value.

Reserve capital is part of own funds joint stock company and some other enterprises, formed on account of deductions from profits; used to cover operating losses; replenishment of fixed capital and payment of dividends in cases where current profits are not enough for this. Reserve capital is created as an additional financial internal resource of the enterprise. It is necessary to cover expenses and payments, losses, compensation for losses from unfavorable market conditions, payment of dividends on bonds, preferred shares (if there is a lack of profit), etc. The organization's reserve fund is formed in accordance with the law and constituent documents.

Doubtful debt is a receivable that is not repaid on time and is not secured by appropriate guarantees.

Reserves for future expenses and payments - a type of stable liabilities of an association or enterprise; is formed in the current year in order to evenly include future expenses in production or distribution costs. Reserves for future expenses and payments are formed as a result of the advance uniform inclusion of certain types of expenses in costs before they are actually incurred. Reservations are made with the aim of uniformly including one-time costs in the costs of production and circulation and thus equalizing the financial results of the organization throughout the year.

Targeted funding is a source additional funds received from the budget, industry and inter-industry funds special purpose, from other organizations, individuals to carry out targeted activities, for example, to expand their activities, finance research work, if there is not enough internal resources. These funds are non-refundable.

An important source own household assets is profit.

Profit is a positive financial result of the organization’s activities, a source of costs for production and social development of the enterprise, compensation for losses; source of state budget revenue in the form of tax payments.

Profit is generated mainly in the process of selling products, works, services and is defined as the amount of the excess of income over the expenses of the enterprise received from the beginning of the year to the reporting period, from the sale of products, work, services, material assets, fixed assets, including the excess of income over expenses.

Retained earnings of the reporting year is the difference between the final financial result (profit) identified on the basis accounting all operations of the organization and assessment of balance sheet items in accordance with the Regulations on accounting and financial reporting in the Russian Federation, and the amount of profit allocated for paying taxes and other payments to the budget according to relevant calculations.

Borrowed funds are funds that are issued by a bank in the form of a loan to an enterprise; they are of a targeted nature and are issued for a certain period and for a fee. Borrowed funds are provided to an organization for temporary use for a certain period, after which they are returned to the owners and appear in the form of:

· bank loans;

· borrowed money;

· accounts payable;

· distribution obligations.

The structure of borrowed sources can be presented in the form of a diagram (Fig. 3):

Rice. 3. Debt capital structure

The group of bank loans includes short-term and long-term bank loans. Loans are issued by the bank for strictly defined purposes, for a certain period and with the condition of repayment. Short-term bank loans serve as the main source of additional funds for an enterprise for temporary needs. These include loans for inventories of inventory, for temporary replenishment of working capital, for major repairs of fixed assets and other justified temporary needs.

Long-term bank loans are also a source of additional funds received by an enterprise for periods of more than a year; they are intended for capital investments related to the development, modernization, rationalization of production, as well as improving its organization and increasing intensity.

The group “borrowed funds” includes amounts borrowed from legal entities and individuals for various purposes with mandatory repayment. Borrowed sources of formation of economic assets also include accounts payable arising from settlement relations with other organizations.

Accounts payable are debts owed to suppliers and other creditors. It arises in cases when materials and goods arrive at the organization before payment for them is made, in other words, if the receipt of goods and materials precedes payment for them.

Distribution obligations include debts to workers and employees for wages, social insurance authorities and tax authorities for payments to the budget. They appear due to the fact that the moment the debt arises does not coincide with the time of its payment. Obligations to distribute according to your own economic content differ significantly from other attracted funds, since they are formed by accrual and do not come from outside.

All considered sources of economic funds constitute the liability side of the balance sheet.

The sum of the organization’s economic assets and the sum of the sources of their formation are equal, because the organization cannot have more economic assets than the sources of their formation, and vice versa.

1.2 Main indicators for assessing the efficiency of using fixed assets of an enterprise

To characterize the state and movement of fixed assets (fixed assets), organizations use the following indicators:

Ø the value of fixed assets at a specific date, usually the beginning and end of the reporting period. These indicators are interconnected:

OFk = OFn + OFinput - OFvyb,

where OFN, OFK - the cost of fixed assets at the beginning and end of the period, rub.

OFVVOD - cost of introduced fixed assets, rub.;

OFvyb - cost of retired fixed assets, rub.;

Ø rate of change in the value of fixed assets at the end of the year compared to their value at the beginning of the year

Tism.OF = OFk / OFn × 100%;

Ø average annual cost of fixed assets:

OFsr = OFn + OFvvod × m/ 12 - OFselect × (12 - m) /12,

where OFSR is the average annual cost of fixed assets, rubles;

m - the number of months of operation of introduced or retired fixed assets during the year;

Ø rate of change in the average annual value of fixed assets for a certain period (year, several years):

Tism.OFsr = OFsr.1 / OFsr.0 × 100%,

where OFsr.0;1 is the average annual cost of fixed assets for the corresponding periods, rub.;

Ø coefficient of input (renewal) of fixed assets:

Kvvod = OFvvod / OFk,

where OFVVOD is the cost of fixed assets introduced during the year, rubles;

OFK - value of fixed assets at the end of the year, rub. The renewal coefficient shows the share of fixed assets introduced in the reporting period in their value (initial or replacement) at the end of the year;

Ø fixed assets retirement rate:

Kvyb = OFvyb / OFn,

where Fvyb is the cost of fixed assets retired during the year, rub.;

OFN - cost of fixed assets at the beginning of the year, rub.

The retirement ratio shows the share of fixed assets retired during the year from those available at the beginning of the year. The inverse of the retirement ratio characterizes the average service life of fixed assets;

Ø fixed assets renewal intensity ratio:

Kint.obn = OFselect / OFinput.

This coefficient to a certain extent characterizes the pace of technological progress. If the rate of disposal lags far behind the rate of introduction of new fixed assets, the service life of the existing machinery and equipment at the enterprise is extended, which may affect the quality of the products produced;

Ø depreciation rate of fixed assets:

Kizn = A/OFk,

where A is the amount of depreciation charges accrued for the entire period of operation of fixed assets, rubles;

OFK - cost of fixed assets (initial or replacement) at the end of the year, rub.;

Ø service life ratio of fixed assets:

Kgodn = OFost / OFk; Kgodn = 1 - Kizn,

where OFOST is the residual value of fixed assets at the end of the year, rub. Depreciation and serviceability rates of fixed assets are calculated at the beginning and end of the year and analyzed over a number of years.

Assessing the efficiency of using fixed assets has great importance in the practice of asset management of an organization. The efficiency of using fixed assets is determined using a system of indicators, divided into general and specific. The former characterize the efficiency of using the entire set of fixed assets, the latter - individual elements of fixed assets.

General indicators of the efficiency of using fixed assets include:

· capital productivity (Fo), which shows how many products (in value terms) are produced per 1 ruble. cost fixed production assets.

Fo = RP / OFsr,

where RP is the volume of sold (or marketed) products for the period, rub.;

OFSR - average cost of basic production funds for the same period, rub.;

· capital intensity (Fe), which shows the average annual cost of fixed assets per 1 ruble. commodity (or sold) products.

Fe = OFsr / RP, or Fe = 1/ Fo;

· return on fixed assets (ROF) shows how much profit is received from 1 ruble invested in the fixed assets of the enterprise.

Rof = P / OFsr,

where P is the profit of the enterprise for a certain period, rub.

Because the different types fixed assets play different role in the production process, calculated separately These indicators are also for the active part of fixed assets. The total capital productivity and capital productivity of the active part of fixed assets are interrelated:

Fo = FoA × OFA.sr / OFsr

where Фo is the total capital productivity, rub./rub.;

FOA - capital productivity of the active part of fixed assets, rub./rub.;

OFA.sr - average value of the active part of fixed assets for the period, rub.;

OFSR - average cost of all fixed assets for the period, rub.

From the above formula it is clear that the increase in total capital productivity is ensured by an increase in the capital productivity of the active part fixed assets and an increase in the share of the active part in the total cost of fixed assets, since it is the active part of fixed assets that is directly involved in the production of products and the performance of work.

To characterize the equipment of an enterprise with fixed assets, the following general indicators are used:

§ capital-labor ratio - the ratio of the average annual cost of fixed assets to the average number of employees;

§ technical equipment - the ratio of the average annual cost of the active part of fixed assets to the average number of employees.

These indicators have a strong impact on employee productivity.

Along with general indicators, the use of specific indicators of the efficiency of use of fixed assets in analytical work is of great importance. Private indicators characterize the degree of use of individual elements of fixed assets: equipment, production space.

To assess the degree of use of equipment, it is divided into available, installed, operating according to plan and actually operating. The ratio of the number of units of equipment of each group to its total quantity allows us to assess the degree of use of the equipment in the production process. For this, the following coefficients are calculated:

Ø coefficient of equipment involvement in the production process

(K1): K1 = Nset / Ntotal,

where Ntotal - total pieces of equipment; ust - number of units of installed equipment;

Ø coefficient of equipment operating according to plan (K2):

K2 = Nplan / Ntotal,

where Nplan is the number of pieces of equipment operating according to plan;

Ø coefficient of equipment actually working (K3):

K3 = Nactual / Ntotal,

where Nfact is the number of units of actually operating equipment.

The smaller the deviation between the calculated indicators, the higher the degree of equipment involvement in the production process.

To characterize the use of equipment, the following system of coefficients is used:

Ø equipment extensive load factor (Kext):

Kext = FVfact / FVmax,

where FVfact is the actual working time of the equipment for the reporting period, h;

FVmax - the maximum possible working time of equipment for the reporting period. This coefficient shows the degree of actual use of the maximum possible working time of equipment for the reporting period;

Ø equipment intensive load factor (Kint):

Kint = Mfact / Mp,

where Mfact is the actual achieved equipment productivity (actual output in natural units of measurement) per unit of time;

MP is the rated productivity of the equipment per unit of time.

The coefficient shows the degree of actual use of the equipment's rated capacity;

Ø coefficient of integral (total) equipment load

(Kintegra): Kintegra = Kext × Kint.

Ø The integral equipment load coefficient shows the degree of actual use of the enterprise's production capacity.

To characterize the operating time of equipment in discontinuous production processes, the shift coefficient (Kcm) is used:

Kcm = (N1 + N2 + N3) / Nset,

where N1, N2, N3 - the number of units of equipment operating in the 1st, 2nd and 3rd shifts, respectively; set - the number of units of installed equipment.

The given technical and economic indicators make it possible to assess the degree of use of individual types of equipment, therefore it is necessary to use general indicators of the degree of use of fixed assets as a whole, one of which is the production capacity utilization factor (Kpm):

Kpm = OPfact/ PMsr,

where OPfact is the actual volume of production for the year in natural units of measurement;

PMsr - average annual production capacity in natural units of measurement.

Along with assessing the use of production capacity, enterprises conduct an assessment of the use of production space.

The area of the enterprise is divided into the following types:

-the total, or available, area that the enterprise has;

-production area the area where the manufacturing process;

-area directly occupied by equipment.

1.3 Main indicators for assessing the efficiency of using the working capital of an enterprise

Like any type of economic resource, working capital must be used efficiently.

The main indicators of the efficiency of using working capital are the following:

· The speed (coefficient) of funds turnover (Kob) characterizes the number of funds turnover for the period under consideration period and is calculated as the ratio of the volume of products sold (RP) to the average amount of working capital (OBSSR) for the period (for example, year, quarter, month) according to the formula:

Kob = RP/ObSsr

· The circulation time of working capital (T) characterizes the duration of one turnover in days and is calculated as the ratio of the average cost of working capital (OBCSR) for the period under review (year, quarter, month) to one-day sales of products (RPd) according to the formula:

T = ObSsr/RPd

· The circulation time can be calculated based on the length of the period in days (D) and the circulation rate (turnover ratio):

· Coefficient of consolidation (loading) of working capital (Kz). This is an indicator inverse to the turnover ratio - the ratio of the average amount of working capital for a period to the volume of products sold for this period. The coefficient shows what amount of working capital (in thousand rubles) is needed in order to ensure the volume of production and sales of products worth 1 thousand rubles:

Кз = ObSsr/RP

· Return on working capital (Robs) is calculated as a percentage of the amount of profit (P) for a certain period to the average annual amount of working capital for the period under review (in percent):

Robs = P/ObSsr*100%

For rational use working resources, it is necessary to determine their minimum value, ensuring uninterrupted operation enterprises. A shortage of working capital leads to downtime in production, and a surplus leads to a decrease in the efficiency of using the enterprise's capital. At each enterprise, the total amount of working capital and the amount of its individual types are determined at the beginning of each month, quarter, on average for the year. To determine the need for working capital, it is recommended to calculate their standards. Traditionally, regulated working capital includes productive reserves, work in progress, deferred expenses and finished goods in stock.

For industrial inventories, the purpose of rationing is to establish the optimal balance of raw materials, fuel and other material assets in warehouses from the moment the materials are received until they are transferred to production. In many industries, assets in industrial inventories account for more than 60% of all working capital; therefore, the rationing of this element of working capital must be carried out most carefully, since the presence of unreasonably high inventories leads to a slowdown in the overall turnover of working capital of the enterprise. If production inventories are too small, this may cause interruptions in the supply of raw materials and necessary materials to production.

Rationing of work in progress and semi-finished products of own production is important for industries with a long technological cycle. Required amount of finished products in warehouses depends largely on the type, characteristics of the product, its permissible shelf life, transportation conditions, availability required areas, storage tanks, etc. An accurate calculation of the enterprise's need for working capital is carried out on the basis of studying the time spent by working capital in the sphere of production and circulation according to the stages of their circulation. The residence time of working capital in the production sector covers the period during which working capital remains in the state of inventory and in the form of work in progress. The period of stay of working capital in the sphere of circulation covers the period of their presence in the form of remnants of unsold products.

Rationing of working capital is the justification of the norms of individual elements of working capital, usually in days, taking into account indicators production program enterprises. Working capital norm (Tnorm) is the minimum requirement, expressed in days, for certain types of material working capital, ensuring an uninterrupted production process. Working capital standard (OSnorm) is the estimated value of the need for working capital in monetary terms, which is determined as follows:

OSnorm = Rd × Tnorm,

where Rd is the average daily consumption of raw materials, supplies, and other material assets, rub.

In practice, the following methods of rationing working capital are used:

· direct account (technical and economic calculations);

·analytical;

·coefficient.

The most accurate and reasonable calculations are obtained on the basis of establishing standards for individual elements of material current assets using the direct counting method.

The direct counting method is associated with a large volume of calculations, therefore the norms determined on its basis usually used for a long time, updating when significant changes occur in the production program or technology. A simpler is the analytical method, based on the analysis of working capital and the efficiency of their use in the reporting period, taking into account changes in technology and production organization. With the coefficient method, the working capital standard of the previous period is adjusted taking into account the acceleration of working capital turnover and changes in production volumes in the planned period.

Chapter 2. Solving practical problems

Task 2.1. There is data from the balance sheet on the composition of the enterprise’s property:

Explanations Name of indicator 2As of December 31, 2011As of December 31, 2010 ASSETS<#"justify">I. NON-CURRENT ASSETS Intangible assets 0.88 Results of research and development Fixed assets 97306.8884328.64 Income investments in tangible assets Financial investments Deferred tax assets Other non-current assets Total for section I?? II. CURRENT ASSETS Inventories 26512.6410394.16 Value added tax on acquired assets 467.281107.92 Accounts receivable 11909.047019.76 Financial investments (excluding cash equivalents) 20.240 Cash and cash equivalents 1635.92914.8 Other current assets Total Section II??BALANCE??

Calculate:

1)Missing values of the active part of the balance sheet;

Draw conclusions.

) When calculating the totals for sections I (Non-current assets) and II (Current assets), you need to sum up the values of the indicators for a certain period. When calculating the balance, the results for sections I (Non-current assets) and II (Current assets) for a certain period are summed up.

) Table with specific weights and growth rates of property elements.

The growth rate is calculated as the ratio of the level of something in the current year to the level of last year, multiplied by 100%.

Specific gravity is the share of an individual part in the total volume, expressed as a percentage.

Table 2.2. Fixed assets.

Indicators As of December 31, 2010 As of December 31, 2011 Share, % Growth rate, % Growth rate, % Deviations of 2011 from 2010 As of December 31, 2010 As of December 31, 2011 In rubles In % I Non-current assets 84,329 ,597306.8100100115.415.412977 Intangible assets 0.880.001 Fixed assets 84328.697306.899.999100115.415.4129780.001

Ud. weight of fixed assets = OS item for 2010 / SAI item for 2010 = 84328.64 / 84329.52*100% = 99.999%

Growth rate = OS rate for 2011 / OS rate for 2010*100% = 97306.88 / 84328.64*100% = 115.4%

OS growth rate = 115.4% - 100% = 15.4%

Based on the results of the analysis of non-current assets, it can be seen that their amount during the analyzed period increased by 15.4%. The growth of non-current assets occurred due to an increase in the indicator Fixed assets for 12978.24 rubles. Largest specific gravity in the structure of non-current assets in this organization, fixed assets accounted for 99.9% in 2010, and 100% in 2011. As part of non-current assets, fixed assets play a significant role; with an increase in fixed assets in the property of an enterprise, depreciation of fixed assets and the share of fixed costs increase. The company focuses on creating material conditions for expanding its core activities.

Table 2.3 Current assets.

Indicators As of December 31, 2010 As of December 31, 2011 Share, % Growth rate, % Growth rate, % Deviations 2011 from 2010 As of December 31, 2010 As of December 31, 2011 In rubles In %II. Current assets 19436,640545,1100100208,6108,621108 Inventories 10394,126512,653,565,4255,1155,11611811,9 Value added tax on acquired assets 1107,92467,285,71,242,2-57,8- 640.64-4.5 Accounts receivable 7019, 7611909.03629.4169.769.74889.2-6.6 Financial investments (excluding cash equivalents)020.240.0520.240.05 Cash and cash equivalents914.81635.924.74178.878.8721.15-0.7

Ud. inventory weight = Inventory item for 2010 / OA item for 2010 = 10394.16/ 19436.64*100% = 53.5%

Growth rate = Stock of reserves for 2011 / Stock of reserves for 2010 * 100% = 26512.64 / 19436.64 * 100% = 255.1%

Inventory growth rate = 255.1% - 100% = 155.1%

When analyzing current assets, we see that in the composition of current assets, reserves have the largest share, which amounted to 53.5 at the beginning of the period and 65.4% at the end of the period. During the analyzed period, inventories grew by more than 155%, and their share in current assets increased by 11.2%. Increasing inventory levels can:

· on the one hand, indicate a decline in the activity of the enterprise, since large inventories lead to the freezing of working capital, a slowdown in its turnover, the damage to raw materials and supplies increases, and warehouse costs, which negatively affects the final results of operations.

· on the other hand, the reason for an increase in the size of inventories can only be an increase in their value due to quantitative or inflationary factors.

The presence of financial investments indicates the investment orientation of the enterprise's investments.

During the analyzed period, there was an increase in accounts receivable by more than 69%. An increase in accounts receivable may indicate an imprudent credit policy of the enterprise in relation to customers, or an increase in sales volumes, or the insolvency and bankruptcy of some customers.

The smallest share in the structure of assets is occupied by cash (0.9% at the beginning of the year and 1.2% at the end), which in principle is a good sign, since cash in accounts or on hand does not generate income; it is needed be available within a safe minimum. Having small amounts is the result correct use working capital. A slight change in cash balances in bank accounts is due to the balance of cash inflows and outflows.

The total assets of the enterprise during the analyzed period increased by 34,085.84 rubles. (or their growth rate compared to the beginning of the period was 32.8%). An increase in the size of the enterprise's property (i.e., non-current and current assets) indicates a positive change in the balance sheet.

A higher growth rate of current (mobile) assets compared to non-current assets determines the tendency to accelerate the turnover of the entire aggregate of the enterprise's assets.

Task 2.2

The cost of fixed assets on 12/31/2005 - 570000 rubles, the fixed assets were introduced on 05/21/2009 - 150000 rubles, the fixed assets were withdrawn on 01.09.2006 - 75000 rubles, the fixed assets were withdrawn on 10.2006 - 29660 rubles, the volume of manufactured and sold products - 2100,500 rubles, The average annual number of employees is 69 people, the balance sheet profit for the year amounted to 380,070 rubles.

Determine indicators of the condition and use of fixed assets:

1)Cost of fixed assets at the end of the year (December 31, 2009)

2)Average annual cost of fixed assets (in two ways: simplified and taking into account the period of input/output)

)Coefficients of input, renewal and retirement of fixed assets

)Capital productivity, capital intensity, capital-labor ratio

)Profitability of fixed production assets

Note: when calculating the average annual cost of fixed assets, taking into account the period of their commissioning (disposal), it should be remembered that they are determined by the number of months of operation (or inactivity) of fixed assets, starting from the first month following the date of commissioning (disposal) of the object.

Table 2.4

Given: Solution: OFinit = 570 thousand rubles. OFVV = 150 thousand rubles. in May OFvyb = 75 thousand rubles. in September OFvyb = 29.66 thousand rubles. in October Q = 2100.5 thousand rubles. Chsrg = 69 people Pbal = 380.07 thousand rubles 1) OFcon = OFnach + OFvv - OFvyb = 570 + 150 + (75 + 29.66) = 615.34 thousand rubles. 2) a) OFsrg = (OFinit + OFkon)/2 = (570 + 615.34)/2 = 592.67 thousand rubles. b) OFsrg = OFnach + OFvvod × m/ 12 - OFselect × (12 - m) /12 = 570+ 150 × 7/12 - (75 × 3/12 +29.66 × 2/12) =633.807 thousand roubles. 3) Kvv = OFvv/OFkon = 150/615.34 = 0.24 ×100% = 24% Kobn = OFvv/OFkon = 24% Kvyb = OFvyb/OFinach = (75 + 29.66)/570 = 0.18 ×100% = 18% 4) Fotd = Q/OFsrg = 2100.5/633.807 = 3.3 thousand rubles. Femk = 1/Fotd = 1/3.3 = 0.3 thousand rubles. Fvoor = OFsrg/Chsrg = 633.807/69 = 9.2 thousand rubles. Rof = Pbal/OFsrg = 0.6 ×100% = 60% Determine: 1) OFkon 2) OFsrg (in two ways) 3) Kvv, Kobn, Kvyb 4) Fotd, Femk, Fvoor 5) Rof

Conclusion

In this course work, through the study, analysis and synthesis of educational and scientific literature, an assessment of the efficiency of use of enterprise property was revealed.

During the course work, the following tasks were solved:) the property of the enterprise was studied in detail;) the sources of formation of the property of the enterprise were considered;) the assessment of the efficiency of use of the property of the enterprise was studied;) completed practical part course work.

It is obvious that any enterprise should strive to improve the efficiency of use of its property. This is the key to increasing product output, which ultimately leads to increased income and, consequently, increased profitability. Therefore the problem maximum efficiency enterprise property should become one of the key for any organization. In addition, when effective use of the enterprise's assets, the need for them decreases, which leads to savings, that is, minimization of costs, and this in turn again affects the increase in profitability. At the present stage of development of our economy, the issue of assessing the efficiency of an enterprise’s property is very relevant. The success of its activities largely depends on the property status of the enterprise. Therefore, much attention should be paid to the analysis of the property status of an enterprise.

property economic profitability

List of used literature

Main literature:

·Economics of an enterprise (organization): Textbook / O.V. Baskakova, L.F. Seiko. - M.: Publishing and trading corporation Dashkov and Co., 2013. - 372 p.

·Economics of an organization (enterprise): textbook. allowance / I.A. Mukhina. - M.: Flinta: NOU VPO "MPSI", 2010. - 320 p.

·Economics of an organization (enterprise): Textbook / M.D. Magomedov, E.Yu. Kulomzina, I.I. Chaikina. - M.: Publishing and trading corporation "Dashkov and Co", 2011. - 276 p.

·Enterprise economics: Textbook for universities. 5th ed. / Ed. acad. V.M. Semenov. - St. Petersburg: Peter, 2010. - 416 pp.: ill. - (Series “Textbook for Universities”).

·Article 130, Chapter 6, Section I, (as amended and supplemented on February 20, August 12, 1996, October 24, 1997), Civil Code of the Russian Federation (parts one and two).

·Article 132, Chapter 6, Section I, (as amended and supplemented on February 20, August 12, 1996, October 24, 1997), Civil Code of the Russian Federation (parts one and two).

·PBU 6/01 Accounting for fixed assets Approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n.

·PBU 4/99 Financial statements of the organization Approved by the Ministry of Finance of the Russian Federation on July 6, 1999, No. 43-n. Document as amended by: Order of the Ministry of Finance of Russia dated September 18, 2006 No. 115-n.

Tutoring

Need help studying a topic?

Our specialists will advise or provide tutoring services on topics that interest you.

Submit your application indicating the topic right now to find out about the possibility of obtaining a consultation.