When to open an individual entrepreneur: is it worth registering a business when running an online store, renting out an apartment, fines for working without registration. How to open an individual entrepreneur - instructions and necessary documents

Read also

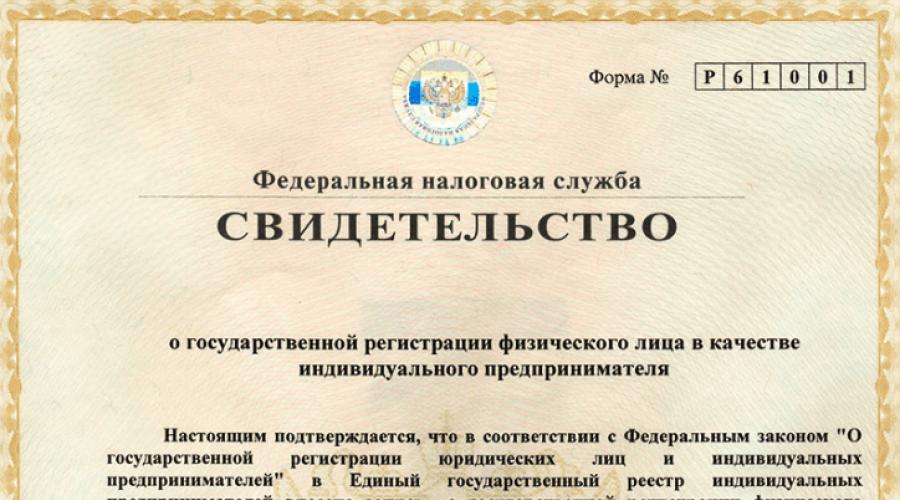

Registration of an individual entrepreneur takes place at the tax office. Like any other legally significant action, it is accompanied by the issuance of an official document. For a long time This document was a certificate of registration of individual entrepreneurs, but since 2017 it was no longer issued.

In this article we will look at several important issues:

- why does the Federal Tax Service no longer issue a certificate of state registration IP;

- what document now replaces the individual entrepreneur certificate;

- does it have legal force IP registration certificate issued before 2017.

Why did they stop issuing certificates?

The certificate of state registration of individual entrepreneurs was issued on a secure printed form with an official seal. This led to additional expenses Federal Tax Service, which, of course, were paid from the budget. In addition, secure forms required special conditions storage and control of their issuance, which delayed the registration procedure for individual entrepreneurs.

In the Order of the Federal Tax Service of Russia dated September 12, 2016 N ММВ-7-14/481, the main reason for refusing to issue and individual entrepreneurs is the increase in the efficiency of electronic interaction of all interested parties.

In addition, many state registers of the Russian Federation are now stored and maintained in in electronic format. To conduct a transaction or other legally significant action, you must obtain a current extract from the relevant register.

For example, a request for a fresh extract from the Unified State Register of Individual Entrepreneurs (unified State Register individual entrepreneurs) is a mandatory condition during the verification of the counterparty. Obtaining current information from the register allows you to verify that the individual entrepreneur certificate presented by the transaction partner is not fake.

A similar procedure has been in effect in the real estate sector for two years now. Instead of a certificate of registration of rights to real estate, an extract from the Unified State Register of Real Estate is issued, which confirms the rights and obligations of the owner.

Transition to electronic document management

After the certificate of state registration of individual entrepreneurs on a secure form was no longer issued, it was replaced by a USRIP registration sheet on plain paper. Another name for this document is form P60009.

The USRIP entry sheet does not replace an extract from the register and includes only the most necessary information. In essence, this is simply confirmation of the fact of registration of an individual entrepreneur and nothing more.

Paper documents on opening an individual entrepreneur were mandatory issued to applicants until April 28, 2018. But after the amendment to the law “On State Registration legal entities and individual entrepreneurs” the USRIP entry sheet is issued in electronic form.

That is, after successful registration of an individual entrepreneur, a letter from the registration inspection is sent to the applicant’s e-mail. You no longer need to visit the Federal Tax Service to pick up paper documents. However, if an entrepreneur wants to have, in addition to the electronic version, also a document on on paper, you must submit a corresponding request to the inspectorate.

The request form for issuing a paper sheet of the Unified State Register of Entrepreneurs has not been officially established. We recommend that applicants in this matter be guided by letter dated May 21, 2018 No. 15-18/04830з@ Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46 for Moscow. In this letter, the tax office offered to obtain a Unified State Register of Legal Entities for organizations. Similarly, you can prepare a request for individual entrepreneurs.

Go to electronic document management made it possible to reduce the time required for registering an individual entrepreneur through the MFC. Previously, for the transfer of paper documents from the tax office to Multifunctional Center additional time was required. As a result, instead of three working days, the procedure was delayed to seven days.

Now it doesn’t matter where you submitted the documents - to the MFC or to the tax authority. In both cases, a response must be sent to the applicant electronically on the fourth working day after submission.

Differences between the individual entrepreneur certificate and the USRIP entry sheet

To understand that the individual entrepreneur registration certificate is practically no different from the USRIP entry sheet, it is enough to compare them visually.

Certificate of individual entrepreneur (sample 2016)

As you can see, both documents have approximately the same content:

- confirmation of the fact that an entry has been made in the register indicating that an individual has received the status of an individual entrepreneur;

- assigned to the main state registration number(OGRNIP certificate);

- the date of entry into the Unified State Register of Individual Entrepreneurs and the details of the tax office where the individual entrepreneur is registered is indicated;

- signature is affixed and full name official Inspectorate of the Federal Tax Service.

Legal validity of the individual entrepreneur registration certificate

The individual entrepreneur certificate, which was issued before 2017 on a secure printing form, is still a legally significant document. There is no need to change it.

At the same time, counterparties of an individual entrepreneur registered after 2017 have a question about documenting transactions based on the Unified State Register of Entrepreneurs record sheet.

Thus, in the letter of the Ministry of Finance of Russia dated April 27, 2017 N 03-07-09/25676, the issue of filling out an invoice was considered, in which it is necessary to indicate the number of the certificate of state registration of individual entrepreneurs. What to do in a situation where there is no evidence as such, but only a recording sheet?

From the department’s response it follows that these are two equivalent documents that contain the same information:

- date of entry into the register;

- issuing authority;

- main state registration number (OGRNIP).

The only additional details of the certificate are the series and number of the secure form. Thus, for entrepreneurs registered before 2017, the details of the certificate are entered into the invoice, and for the rest - the number and date of the entry sheet.

Let's summarize:

- Until 2017 individual entrepreneurs a certificate of state registration of individual entrepreneurs was issued on a secure form with an identification series and number. All issued certificates continue to be valid and have legal force.

- Since 2017, the fact of registration of an entrepreneur is confirmed by another document - the Unified State Register of Entrepreneurs (USRIP) entry sheet in the form P60009.

- From April 28, 2018, the USRIP entry sheet is issued to the applicant in electronic form. If you wish to receive a paper document, you must submit a request to tax office where registration took place.

- When documenting transactions involving individual entrepreneurs, you can indicate both the details of the certificate and the details of the record sheet.

The topic of tax deduction for individual entrepreneurs causes difficulties. Wording in official documents creates confusion in the minds of citizens. Many individual entrepreneurs do not have the education to “decipher” regulations. Let's look at the explanations of the Ministry of Finance and figure it out.

“Am I a trembling creature or do I have the right”?

In letter N 03-04-05/66945 dated November 19, 2015, the Ministry of Finance reports that deductions apply to the income of individuals (including individual entrepreneurs), taxed at a rate of 13%.

It follows from this that individual entrepreneurs who do not have income as individuals at the rate of 13% are deprived of the right to receive benefits. And it doesn’t matter whether the individual entrepreneur works according to the “simplified” or “imputed” method.

Educational program. A tax deduction is an amount that reduces the amount of income on which a person is required to pay tax.

Example. Ivanov carries out business activities as an individual entrepreneur. He pays himself as director wages and deducts 13% personal income tax. Ivanov can take advantage of all the tax breaks that are available to individuals.

The question arises: “Is there any provision for tax deduction for individual entrepreneurs according to the simplified tax system? It is provided, but for businessmen who, as individuals, receive income with a 13% tax.

In Article 346.11 Tax Code it is said that individual entrepreneurs working under the “simplified system” should not pay personal income tax. This means getting deductions from commercial activities They can not.

Property deduction

IP purchased as individual real estate or spent money on housing construction. He has the right to property deduction, if you received income subject to a 13 percent tax.

Thus, benefits are provided:

- sale and purchase of real estate;

- purchase of property from an individual by a municipality or state;

- housing construction.

Example. Individual Entrepreneur Petrov works on a “simplified basis” without income as an individual. He buys an apartment. It will not be possible to get back some of the money spent. But the spouse who is paid the salary can provide documents for a refund.

The same principle applies to paying off a home loan. And it doesn’t matter in whose name the loan agreement is drawn up - the husband or wife. Both spouses receiving income with a tax rate of 13% have the right to a refund.

When selling any real estate that has been owned for more than 3 years, tax benefits are not provided. After the transaction there is no need to submit a declaration and pay 13% personal income tax.

Exception - commercial real estate ( non-residential premises, areas, technical networks). Regardless of the period of ownership of such property, after its sale you will have to file a declaration and pay 13% (clause 17.1 of Article 217 of the Tax Code). It will be possible to return some of the funds.

Social calculation

Article 219 of the Tax Code regulates the following types expenses for receiving social payments:

- charity (no more than a quarter of annual income);

- education (your own and your children’s);

- treatment (own, children, wife or husband, parents);

- pension contributions to a non-state fund;

- independent replenishment of the funded part of the pension.

Is an individual entrepreneur entitled to such a tax deduction? Valid general rule. Without taking into account the tax system under which a businessman works, he will receive benefits on income taxed at a rate of 13%.

Example. IP Sidorov spent a large sum on dental services and would like to return some of the money. He works under a simplified taxation system (income “minus” expenses) and, in order to reduce the “tax burden,” he pays himself a salary, holding the position of head of the logistics department. He receives money not only as an entrepreneur, but also as an individual. He pays 13% personal income tax monthly from his salary, so he will be able to return part of the money spent on crowns and fillings.

What about the “imputed people”?

Individual entrepreneurs paying UTII are freed from the need to pay 13% personal income tax. Can individual entrepreneurs receive a tax deduction in this case? No, because they do not pay 13% on their commercial income, and therefore there are no tax breaks for them.

But if an entrepreneur has, in addition to commercial income under UTII, other income at a rate of 13%, then he will be able to take advantage of the privilege.

On a note. If an individual has the right to two or more standard deductions, you can only use one (the more profitable one). That is, it is impossible to use several deductions by summing them up.

Practice shows that only a small part of individual entrepreneurs can take advantage of the relief and return part of the money earned through hard work.

Business has various shapes– individual entrepreneurship (ownership rights belong to one person), partnership (several owners) and corporate (association 2 and more companies and capital for mass production or provision of services). Building a small business and achieving the desired profit is based on individual entrepreneurship. Everything can start with a hobby and end with absolute success.

Many people believe that opening an individual entrepreneur is a complex procedure and is only available to people who already have above-average income. They are mistaken, the number of people who can be potential individual entrepreneurs is greater. There are restrictions on activities that need to be taken into account.

You can register as an individual entrepreneur:

People who have a certificate of state registration of individual entrepreneurs are allowed to conduct their activities. A business without the appropriate documents is considered illegal. It is punishable by a large fine or imprisonment.

Before submitting documents for registration, you need to complete a number of steps. This will help speed up the registration procedure and also eliminate related problems.

So, the following factors need to be taken into account:

When all preparatory activities completed, the next question arises - what documents are needed to open an individual entrepreneur. The list can be obtained from tax service or find it on its official website.

So, the following documents are required:

In cases where a future businessman cannot submit documents for registration in person, authorized persons can do this for him. But everything must be certified by a notary.

After submitting all the necessary documents, the applicant is given 5 working days to wait. If there are no complaints or restrictions, after the allotted time, he becomes registered and receives an extract from the register. A document is also issued confirming that the entrepreneur is registered with the tax office.

List of people who should not open their own business:

It is also worth noting that registration of an individual entrepreneur is carried out at the place of residence. This means that you can run your business in any city in the Russian Federation, but you can only submit documents to open it by registration.

That is, if a future entrepreneur lives in St. Petersburg, then he must register in this locality. But at the same time, the application must indicate the city where the individual entrepreneur will conduct business.

Often people who hold positions in any organization have additional income. Initially, this is a part-time job in your free time from your main activity. Based on this, a problem arises - a person does not want to quit his job, but has a desire to open an individual entrepreneur. You can formalize your business and hold a position in another organization. At the same time, an individual entrepreneur is not obliged to inform the employer that he has his own business, but must comply with all clauses of the employment contract. The main thing is that one does not interfere with the other.

From the employer’s side, it is more profitable for him to hire an employee who has the status of an individual entrepreneur for several reasons.

These include:

When compiled correctly employment contract This cooperation can be beneficial for both parties. IP can have a full social package, employer – reduced tax rates and insurance premiums. The main thing is not to evade the laws and do everything right.

There is no such ban in the Russian Federation - open an individual entrepreneur and no longer work as a lawyer. That is, in principle, this is permissible. But also, according to the law and the rules of legal ethics, it is not allowed:

- Provide paid services, sell any goods, perform other work.

- Provide legal services outside the scope of legal practice.

Also, lawyers are not allowed to use simplified system taxation. Based on the above, running an individual entrepreneur and practicing law are incompatible concepts.

In case of violation of the code, persons providing legal services are deprived of their rights to work based on the conclusion of the qualification commission. This means that having registered an individual entrepreneur, a lawyer may forever lose the opportunity to work in his specialty. Lawyers must follow established ethics. Those persons who decide to work in another field must refuse to provide legal services. Only after this can they switch to another form of taxation.

Lawyers are allowed to hold positions in the field of legal education. This means that in addition to their direct activities, they are allowed to give lessons at schools, universities, colleges, etc.

Full step-by-step instruction to register a business may be of no use if the future entrepreneur has not studied all the existing prohibitions on registration.

Individual entrepreneurs are not allowed the following:

Also, individual entrepreneurs cannot engage in space activities, open pawn shops, organizations providing loans, etc.

Find out the list of restrictions, as well as what documents own business You can directly contact lawyers or representatives of the tax service.

Wanting to start a business and engage in entrepreneurial activity, the founder of a small or medium-sized business is faced with an inevitable procedure documentation your company. Complete and detailed information on how to register an individual entrepreneur, what papers to prepare and where to submit, is absolutely necessary for correct and timely registration.

According to the law Russian Federation, individual entrepreneurship (IP) is called this type economic activity, the subject of which is an individual. The staff of his company may consist of one person (founder and manager) or include several employees.

Preparatory stage: once again weigh the pros and cons

The decision to register is a responsible step. After its implementation, the entrepreneur will not be able to “reverse”, with at this moment it begins economic activity. By this time, the founder of the company is obliged to make a list of his economic goals, develop a strategy for future activities, that is, have a real business plan in hand. In the process of collecting information on how to correctly register an individual entrepreneur, as well as when studying various legal aspects In all activities, the entrepreneur should pay attention to his responsibility to the state. It consists of timely submission of reports, mandatory deduction of certain amounts to the budget and payment of taxes.

Is it worth registering as an individual entrepreneur?

It is no secret that many entrepreneurs may try to run their business in the so-called shadow sector. This means that they do not have any permits to carry out their activities, do not reflect the income they receive in any way and do not pay taxes. The reason is the fear that you will have to collect a package of documents and interact with government agencies, as well as the desire to reduce your expenses.

In contrast to dubious savings, several arguments can be made in favor of a legitimate business:

- The entire period during which a person is engaged in entrepreneurial activity is taken into account when calculating the pension period.

- There is no need to hide from representatives of the law or conceal your source of income.

- The procedure for obtaining visas to some countries may be simplified.

- The range of opportunities and business contacts is significantly increasing, since many company owners prefer to cooperate only with individual entrepreneurs or legal entities.

- It becomes possible to make non-cash payments.

Thus, we can conclude that any growth and development of a company involves searching for information on how to register an individual entrepreneur independently or through the mediation of special companies.

How are intermediaries useful?

In the case when the future entrepreneur is well versed in the bureaucratic intricacies of domestic legislation and is able to understand numerous certificates, statements and reports, he may well begin to formalize his activities himself.

For the rest, those who have no idea how to register an individual entrepreneur on their own, the services of intermediary organizations are available.

Their staff will be happy to help you collect Required documents, make a stamp, open a bank account, and also tell you which government agency you should contact at what stage.

Of course, their work requires appropriate payment.

How to register an individual entrepreneur: step-by-step instructions in general terms

Knowledge of the procedure for registering an individual entrepreneur and the sequence of actions is necessary for both categories of citizens: those who carry out the procedure themselves, and those who turn to intermediaries.

All actions can be divided into several stages:

Today, there are several taxation options for individual entrepreneurs. You should decide on the choice of system before registering an individual entrepreneur.

The differences between the types are related to the type of activity of the entrepreneur and the amount of his planned profit.

Types of taxation and their characteristics: general system

This is the name given to the system that is used by default. That is, it comes into force when no other is selected. Its main condition is mandatory control of financial transactions, as well as quarterly reporting (submitted to the tax inspector).

Before registering as an individual entrepreneur and choosing common system, you should find out that the entrepreneur will be forced to deduct 20% of the profit (the difference between income and expenses).

Also on the list of mandatory deductions are:

- Property tax. It is paid when the organization owns any equipment, real estate or machinery.

- Value added tax. Its size is 18% of the amount of goods sold or services provided.

The general taxation system is beneficial to those entrepreneurs who conduct wholesale trade, or if their clients are large companies working with VAT.

Simplified system

This type of taxation combines all mandatory deductions into one item. The choice of the amount of future tax is left to the discretion of the entrepreneur himself. He can pay 6% of the amount of income received or from 5 to 15% of the profit.

The reporting period is one year, but tax must be paid quarterly. If an entrepreneur purchases an insurance policy, he can count on a tax reduction of 6%.

Entrepreneurs who raise livestock or grow plants can choose an agricultural tax. This system is similar to a simplified one.

Individual entrepreneur and single tax

Entrepreneurs choose this system most often. It attracts them because the amount of payments is set once and does not change as profits increase or decrease.

However, even before registering an individual entrepreneur, you should study the list of activities for which a single tax can be used.

The amount of deductions depends on the size of the business. It is paid every quarter.

Interestingly, an entrepreneur is not required to use cash machine to record transactions carried out in cash.

Patents and the patent system

Only some entrepreneurs are eligible for taxation under this system. The patent is relevant for companies with a small staff (up to 5 people) and an annual income of up to 60 million rubles.

The use of cash registers is also optional. An entrepreneur does not have to submit reports, he does not need to visit a tax inspector often, he just needs to pay for a patent (valid from one month to a year) and correctly keep records of income in a special book.

Code selection procedure

Each type of business activity corresponds to a specific individual code, which is indicated in the all-Russian classifier.

This document lists all the main industries and areas: food industry, Agriculture, different kinds trade and construction.

By indicating the selected code when registering an individual entrepreneur, the entrepreneur determines which taxation system will be applied to him.

When thinking about how best to register an individual entrepreneur and selecting a code, you should use only the new classification (compiled in 2014). Additionally, the structure of this document may be subject to change, so you should pay close attention to any updates.

What documents will be needed for registration?

The package submitted to the tax office must include:

- Passport or a copy of it if registration is carried out by mail.

- A receipt certifying payment of the state fee.

- A copy of the identification code.

- Application with a request to open an individual entrepreneur (in the case when the package is sent by mail, the application must be certified by a notary).

- A document notifying which taxation system has been chosen by the entrepreneur.

The collected papers are submitted to the tax office branch at the place of registration or sent by mail. One day after receipt, the entrepreneur becomes the owner of a registration certificate, taxpayer identification number and an extract from the unified state register.

After this, information about the individual entrepreneur is automatically sent to the Pension Fund.

Current account and printing

Even before drawing up an agreement with an individual entrepreneur for the purchase or sale of goods, provision of services or other type of cooperation, many companies and firms are interested in the possibility of conducting financial transactions by bank transfer.

Often, the lack of an official account with an individual entrepreneur becomes an obstacle to making the most profitable transactions. Therefore, those entrepreneurs who are determined to receive large contracts and orders immediately after registration apply to Rosstat for OKVED statistics codes.

One day after submitting a receipt for payment for the services of this government agency, copies of the identification code and documents received upon registration with the tax office, the entrepreneur receives required codes in duplicate, as well as a letter certifying registration. Now you can open a current account, which will need to be notified to the tax inspectorate and pension fund.

A seal, like a bank account, is not mandatory requirement to individual entrepreneurs. However, with this attribute, the status of the company increases significantly and the possibility of promising cooperation with other organizations appears.

A stamp is also required to fill out work records hired workers. If the head of a small company needs information on how to register an employee as an individual entrepreneur, he should contact Labor Code and other administrative documents.

When hiring the first employee, the entrepreneur will have to comply with several mandatory rules and register as an employer (pension and social insurance funds).

In the future, the hiring procedure will practically not differ from standard employment.

Before planning an expansion of staff, the head of a small business should find out about the existing restrictions:

- Working according to a simplified system, the owner of a company can hire no more than one hundred people.

- For a tax system that provides single tax, the limit is the same (up to one hundred employees).

- Individual entrepreneurs who have paid for the patent can hire up to five workers.

It must be taken into account that we're talking about on the average number of employees. Therefore, if an entrepreneur has two employees and the shift of each of them is half a working day, then the timesheet indicators will be equal to the productivity of one person.

Knowledge of the rules and regulations governing the provisions of the law on how to register an individual entrepreneur for the work of performers and assistants will help to avoid fines and other penalties.

Conduct business activities from the moment of official registration legal status Any citizen, including foreign nationals, has the right (Article 23 of the Civil Code). The procedure for carrying out registration actions is regulated by Law No. 129-FZ of 08.08.01. It says here that state registration of entrepreneurs is carried out at the place of residence of citizens (clause 3 of article 8).

But what to do if a person changes his address? Or is a foreigner planning to do business in Russia? How, in this case, is the legalization of activities carried out? And is it possible to register an individual entrepreneur using temporary registration? You will find detailed answers to these questions in our article.

Registration of individual entrepreneurs - regulatory requirements

The exact mechanism for state registration of legal entities, as well as entrepreneurs, was approved in Law No. 129-FZ of 08.08.01 (hereinafter referred to as the Law). Opening a business involves making entries in a single register - the Unified State Register of Entrepreneurs for individual entrepreneurs. Among the mandatory details, data on the citizen’s place of residence in the Russian Federation is also named: indicate the full address, including the name of the city, streets, house numbers, apartments, etc., at which the individual entrepreneur is registered (registered) according to established order(subparagraph “e”, paragraph 2 of Article 5 of the Law).

Legally, what does the concept of “place of residence” mean? To answer, let us turn to the provisions of stat. 20 of the Civil Code, where it is determined that the place (address) of residence is considered permanent place residence of an individual. For persons under 14 years of age or persons under guardianship, this is the place of residence of official representatives or guardians. Thus, since it is logical to assume that a person spends most of the time at his place of registration, this is the address that will be the registration address of the individual entrepreneur. And even the presence of a temporary certificate does not in any way affect the procedure for creating an individual entrepreneur, provided there is a permanent registration stamp in the passport.

But what about those who do not have permanent residence in Russia? Is it possible to register an individual entrepreneur using temporary registration? In accordance with Russian Law No. 5242-1 of June 25, 1993, individuals are required to undergo the registration procedure in our country if they reside in the territory for more than 90 days. Moreover, if a person does not have registration in his passport, he can open a business on the basis of a temporary certificate.

Is it possible to open an individual entrepreneur with temporary registration?

Therefore, it is possible to register an individual entrepreneur using temporary registration if the citizen does not have a permanent registration in his passport. This is typical, as a rule, for foreign nationals or stateless persons. If an individual has a permanent registration in their passport, it will not be possible to open an individual entrepreneur at a temporary residence address.

For example, an individual lives in Pskov, but intends to do business in Moscow. Submission of documentation for opening an individual entrepreneur must be carried out to the Pskov Federal Tax Service, but in fact, you can conduct business in any territory of Russia. The exception is PSN and UTII; to work in these modes, you will additionally need to register for tax purposes at the addresses where the special modes are applied. If you submit an application to the Moscow tax office, if you have a permanent residence permit in another city, the documents will be refused, and you will not be able to obtain the status of an entrepreneur in the capital.

It's a different story with foreigners. Such citizens have the right and must register an individual entrepreneur with temporary registration, since the activity is carried out in Russia. But the registration period must be more than six months, and upon expiration of the specified time period, the business activity loses its legal force, that is, an extension of the temporary certificate is required. The authority for submitting documentation for obtaining status is the territorial division of the Federal Tax Service at the temporary registration address of the foreigner.

Note! If the registration of a foreign individual entrepreneur was carried out in one territorial division of the Federal Tax Service (at the address of the corresponding temporary registration), and the activities are carried out in another region, taxes under this regime must be paid to the region where the activities are carried out. The same requirement is true for submitting reports under the special regime.

Registration of individual entrepreneurs at the place of temporary registration - procedure

What is the procedure for registering an individual entrepreneur for temporary registration? The mechanism of action is no different from opening an individual entrepreneur with permanent registration. Current requirements are specified in Law No. 129-FZ. The list of required forms includes the submission of the following documents:

Unified statement f. P21001 - when entering information on the page with the place of residence, the temporary address is reflected (according to the certificate).

Payment document on the transfer of state duty for 800 rubles.

Copies of an identity document, TIN (if available), temporary certificate.

An application for the use of a simplified taxation system is provided if this special regime is used.

Power of attorney for an official representative - notarized confirmation of authority is necessary if the documentation is submitted not by the entrepreneur personally, but by his authorized representative.

Other forms on request.

Note! Maximum term state registration of individual entrepreneurs should not exceed 3 days (working days) in accordance with clause 3 of the stat. 22.1 of the Law, subject to the provision of reliable data.

The value of the IP registration address

In the legal sense, the address of the entrepreneur, which is indicated during registration, is the main legal address of the business. It is this detail that is indicated in Unified register, contracts with counterparties, invoices for calculating VAT, contacts with government agencies, etc. Accordingly, you need to carefully fill out the data and ensure that they do not contain errors or inaccuracies.

Conclusion - in this article we figured out how you can open an individual entrepreneur by temporary registration and to whom. The list of documents for creating a business in the Russian Federation is listed in Law No. 129-FZ, which also defines the regulations for such a procedure.