Instructions: how to correctly indicate the UIN code on the payment slip. What is a UIN and how to fill it out correctly in a payment form?

In many bank branches, when paying for services, it is necessary to indicate a unique identifier in documents. Most citizens don't even know what it is or where to get it. Before making a payment, you need to prepare and find out about it, because if an error is made, the paid amount will be returned back to the debit account. Therefore, when filling out documentation you need to be extremely careful.

What is UIN in payment?

Concept

UIN (not to be confused with) stands for a unique accrual identifier, consisting of 20 or 25 characters, which should not be equal to zero. This indicator is a mandatory detail, and it must be indicated in all payment documents, according to the resolution of the Ministry of Finance of 2014. Budgetary institutions form the UIN themselves.

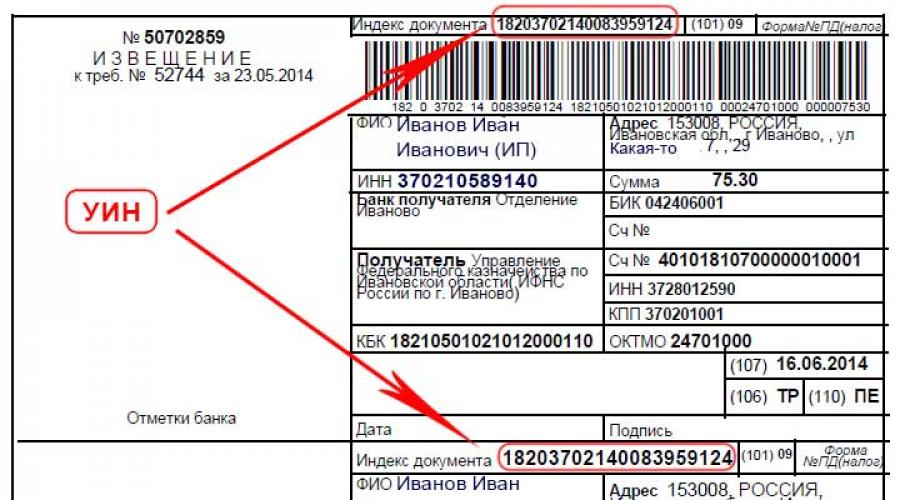

Receipt with UIN

Functions

What are the functions of the identifier:

- control of the correctness of receipt of transfers to budgetary organizations;

- simplification of the financial accrual system;

- reduce the number of uncleared revenues to tax, customs and other authorities.

When the UIN may not be indicated on payments:

- when paying taxes and;

- individuals;

- when paying for services received in some private medical centers.

In these cases, you must enter a zero in the appropriate column on the payment receipt.

The identifier number automatically details the payment of any payments to the budget. The State Information System on State and Municipal Payments, having received information, begins identification. If you specify an incorrect value, the payment will be considered not made.

Consequences of this:

- will appear ;

- penalties will begin to accrue.

Decoding

What do the numbers in the identifier mean:

- First three digits are indicated for recipients of a specific payment. For tax authorities, the identifier always starts with 182.

- Fourth digit has the designation 0, because not applicable yet.

- 5-19 – this order of numbers represents a fifteen-digit special payment designation or index in tax documents.

- 20th digit is a test value that is calculated using a specific algorithm.

In this form, the code is sent to the GIS GMP.

The unique identifier is equal to the document index only if it consists of 20 digits.

Where to specify the identifier

To find out the meaning of the identifier, you can contact the organization to which the transfer will take place with this problem. Since it is she who forms the unique meaning.

- In the payment document, the UIN is indicated in field 22, called “Code”. The bank employee must re-fill the identifier in the payment document.

- If payment is made by bank transfer, then entrepreneurs indicate 0 in the “code” column.

Not all organizations use UIN. Mainly the structures where it takes place a large number of payment For example, the tax office.

This video will tell you how the UIN code is indicated in payment order when transferring taxes (fees):

Samples of payment slips

For kindergarten

To pay for kindergarten, there is a special receipt with a UIN designation. Before transferring payment, it is better to clarify the identifier in the accounting department to avoid making a mistake, because Bank employees will not be able to provide this information.

In the future, this indicator will apply to subsequent payments and you will not have to find out the kindergarten’s UIN before each transfer.

Sample payment order with UIN for kindergarten

For tax authorities

Indications that making payments in the state budget through the tax authorities, in effect since 2014. From now on, a unique indicator is also indicated in such payments.

The point of following these rules is that all required details must be filled out correctly, this also applies to the identifier. The UIN must be filled out in a separate column - “code”.

The ID for tax services must be equal to the document index. You can obtain a Federal Tax Service receipt from the tax office or create and print it yourself from the tax.ru website, where the document index will be indicated.

Enterprises that generate tax payments on their own can do without an identifier when filling out payments. The KBK can serve as a unique code for them, and for individual entrepreneurs it can replace the TIN.

Example of a payment to the tax office

For bailiffs

There is also a special payment for bailiffs. You can see her example below.

Payment to bailiffs

When accepting payments, bank employees ask you to indicate your UIN. Lack of value may prevent payment from being processed and funds will be returned to the applicant.

Dear readers! The article talks about standard methods solutions legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

It's fast and FOR FREE!

What are the features of the UIN number in 2019? payment receipt? When paying various payments through a bank, it is sometimes necessary to indicate a unique identifier in the payment order.

At the same time, many payers do not know what and how to write in the document, leaving the corresponding field empty. What features of the UIN in the receipt in 2019 do you need to know about?

What you need to know

When paying taxes, state duties, fines and other similar payments, you must indicate the UIN.

As a rule, banks refuse to accept payment documents without this value, and the terminal requires you to specify the value when entering data.

According to the legislator, the details should help in determining the purpose of the payment. Since 02/04/2014, rules have been in effect requiring that when transferring payments to the budget, it is necessary to indicate the UIN.

The UIN looks like a digital code, but for each individual payment the value will be unique. There are no tables where you can see the necessary details.

Get desired value only possible with the direct recipient of the payment. At the same time, the UIN can be called differently. It is for this reason that problems often arise when payers do not know what to indicate.

Basic Concepts

UIN stands for unique accrual identifier. The value is 20 digits separated from other information by “///”.

Each code symbol has its own interpretation:

The code is set by the body that acts as the recipient of the payment. Moreover, the formation of the UIN occurs automatically and the value will be unique for each individual payment.

Therefore, you cannot invent a code and indicate any numbers in order for it to be accepted. In this case, the payment simply will not reach the addressee and will be considered not completed.

In some cases, if you don’t know the code, you can specify the value “0”. Sometimes the UIN may contain letters of the Russian or Latin alphabet.

Wherein english letters are highlighted or underlined so as not to confuse them with Russian letters.

What is his role

The need to indicate the UIN is due to the need for the correct distribution of payments.

Bank and treasury employees, based on the specified value, determine for whom the payment is intended and to whom it should be transferred.

This is why the code is unique for each operation. But the need to indicate the UIN does not mean that a code is required for any payment through the bank.

This detail applies only to payments administered government agencies And budgetary organizations. That is, the code is needed to pay municipal and state bills.

Specifying the UIN simplifies the system of budget charges and fees. By using the identifier, the number of unidentified budget revenues is reduced to a minimum.

That is, by correctly indicating the UIN value, the payer can be sure that the payment will arrive exactly as intended.

Legal basis

For the first time, the UIN code was approved as a payment information. At that time, the abbreviation stood for “universal accrual identifier.”

The order came into force on January 24, 2014. As the requisites were applied, amendments were made to the legislative norms.

So, from February 4, 2014, the UIN was indicated in the “Purpose of payment” field, and from March 31, 2014, the value is entered in the “22” field. Since March 31, 2014, UIN stands for “unique accrual identifier.”

The need for mandatory indication of UIN arose after the formation of the GIS GMP system.

When paying tax

When you need to indicate the UIN when paying tax, required value you need to look in the document index.

But for identification, the payer must indicate the TIN. The bank does not have the right to require the indication of the UIN, provided that it is filled in with the symbol “0” when the TIN () is indicated.

Organizations can indicate both UIN and Taxpayer Identification Number. If an individual entrepreneur indicates a TIN, then the UIN is not required.

Payment of state duty

Payment of the state duty depends on the presence/absence of a receipt. If the payer received a document for payment at the place of application, then the UIN is indicated in it as “Document Index”.

It is enough to duplicate the value in the payment order. But more often the fee is paid before contacting the authorized bodies and before submitting documents.

In this case, get required code nowhere. When paying independently, as well as when paying current payments, “0” is written in field 22.

If you leave the “Code” field completely empty, the payment will not be accepted. Sometimes, when paying through a terminal, it is not possible to pay the state duty by specifying the UIN equal to “0”.

In such a case, the field is left completely empty and then the “enter” key is pressed. The system accepts this input option as an indication of “0”.

For kindergarten

When paying for the services of a preschool educational institution, you also cannot do without a UIN. The bank will refuse to accept the payment, and if they do, it will be returned later due to the impossibility of identifying the recipient.

The peculiarity of payment for kindergarten is that payment requirements are usually not set. Parents only know the date by which payment must be made and the amount of payment.

To obtain a UIN when paying for, you should contact the institution’s accounting department. Here the payer is given a unique number.

In this case, the content of the code also includes the serial number of a particular child. This means that you do not need to obtain a UIN for each payment.

Once you know the code, you can use it to pay all subsequent payments. When a payment arrives at the institution's account, the accountant will immediately see it. Which child was paid for?

Payment for a child’s education is carried out in the same way. fee-paying school. A unique code is assigned to each student for whom payment is made.

Payment for housing and communal services

When paying for housing and communal services, you also need to correctly indicate the purpose of the payment. However, payments are accepted from management companies, that is, the funds are not intended to be included in the budget.

The management company distributes the payments received to pay suppliers, house needs and other expense items.

Identification of payments for housing and communal services is carried out on the basis of the subscriber’s personal data and a unique barcode.

If payment is made through terminals equipped with a scanner (Sberbank), then it is enough to bring the receipt to the reading device.

Video: barcode on a receipt

If payment is made through a bank, the personal account assigned by the settlement center and indicated on the receipt must be indicated as an identifier.Traffic police fines

When paying traffic fines, you can find out the UIN from the document on the basis of which the fine was imposed. A unique identifier is generated from the following parameters:

- Protocol serial number.

- Date of execution of the protocol or order.

In this case, each digit of the resulting value has its own meaning:

Thus, based on the code, you can accurately determine for which fine the payment is being made.

And given the procedure for forming the value, the payer does not need to know the UIN when paying a traffic fine.

If there is a resolution, the payer himself or a bank employee can generate the required number.

In what cases is the code not needed?

It is not always necessary to indicate the UIN. It is described above that a code is not required when paying current payments.

Thus, individual entrepreneurs and legal entities independently calculate the amounts of tax payments based on tax returns.

For example, legal entities are paid. The budget classification code (BCC) is used as an identifier, which is written in field 104 of the payment order.

When individuals pay the amount of property tax on the basis of a tax notice generated by the Federal Tax Service, the index of the document in the tax receipt is the UIN.

Basic rules that you need to remember regarding UIN when making payments to the budget:

- the “Code” field cannot be empty and if there is no UIN, “0” is entered;

- You can find out the UIN from the payment request or directly from the payee;

- when indicating the INN and/or KBK, the digital value of the UIN is not required for payment.

The general purpose of the UIN code is to identify the payment. But at the same time, an accidental error in the digital value will not lead to arrears.

Authorized bodies identify the payment using other details - TIN, KBK, treasury account. The absence of a UIN if other details are available will not interfere with the payment.

But by specifying a unique identifier, you can be sure that the payment will go through as quickly as possible and will not fall into the category of unknown payments.

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Since 2019, such details as UIN have appeared in payment documents. Its presence is immutable when transferring payments to the budget. What does the UIN indicated in payments mean in 2019?

The UIN helps determine the purpose of the payment received to the budget. Having one is necessary when transferring sums of money to budgetary institutions of any type. What is UIN and why is it needed in payment orders of 2019?

General information

From 02/04/2014, you must write the UIN in payment orders. This special code, which is determined directly by payment recipients. This value is used to determine the purpose of the payment.

The UIN indication is required when paying tax fees or other payments administered by the tax office. You must also write your UIN on payment slips when paying for any government services.

The code value is shown in a specially designated field of the payment order. When banks accept payment documents, they first check the presence of the UIN.

However, there are situations when specifying this detail is not required. There is no need for a UIN when independently paying tax payments by legal entities and individual entrepreneurs, the basis of which is tax returns.

In such a situation, the identification details of the payment become KBK, which is written in field 104 in the payment document.

Another point when you do not need to register a UIN is payment from individuals.

When the payment of tax payments is based on a tax notice sent by the tax service, the payment identifier is the index of the received document, which is identical to the UIN.

The tax authorities generate the notification itself and the payment document attached to it. But in any case, a field such as “Code”, intended to indicate the UIN, cannot be empty.

If the code value of the UIN identifier is not generated, then the attribute “0” is put in its place. It is separated from subsequent combinations by a triple slash (///).

What it is

UIN literally sounds like a unique accrual identifier. This represents a numerical combination of twenty digits, which is completed by the sign “///”.

The use of this requisite has become mandatory requirement after the introduction of new rules for processing payment orders in 2019.

Payers are provided with information about the codes as part of the payment request details. If the payer does not have a UIN for self-deductions, the UIN is replaced with the value “0”.

Which UIN to indicate in payment orders in 2019

In payment orders, the UIN in 2019 should be indicated by the one formed by the body requiring payment. That is, when requesting payment of taxes, it is enough to transfer the code value from the notification sent from the Federal Tax Service.

The UIN is also indicated when making payments at the request of other authorities. If it is impossible to specify the code, “0 ///” is set.

When an individual makes payments in cash through credit institution, for example, when filling out, the UIN and document index are not indicated.

However, the surname, name and patronymic of the individual, the address of his place of residence or place of stay must be written down. When paying taxes by individuals through other credit institutions, “0 ///” is put in place of the code.

At the same time, some authorities require mandatory indication of the UIN. For example, Rosreestr even created a special reminder for applicants generating a payment document using the portal, indicating the need to indicate the code.

If the UIN of Rosreestr is not indicated in the payment order, then the payment may not be displayed on the official website of Rosreestr, although it will be received using the correct details.

In this case, the sender of the payment will need to contact the accounting department of the territorial Rosreestr for a refund.

Decoding the code

In 2019, the UIN consists of four components:

It is important to note that the UIN can be identical to the index only when the latter consists of twenty digits. This is how it is easy to determine the UIN of the Federal Tax Service by looking at the payment index in the tax receipt.

Based on the previously used fifteen-digit indices of the Federal Tax Service, the UIN is now formed from:

- payment administrator;

- payment document index;

- calculated control block.

Where does it fit in

In the payment order, the UIN is written in field 22 “Code”. Previously, until 2019, this value was entered in the “Purpose of payment” field.

Today, UIN is not used in all organizations, but only in those where there is a significant flow of payment receipts. For example, the tax service or the traffic police.

But a unique code may also be present on receipts for payment for school or kindergarten. To clarify information about the identifier, it is advisable to contact the accounting department of the organization where the payment is made.

It is noteworthy that when making payments in educational institution there is no need to find out the UIN every month. All payments can be made using one code, since a unique value is determined for each student.

Other organizations can work on the same principle. Therefore, when contacting the administrator for a code, you need to clarify whether the UIN is one-time or personal.

UIN number on the payment slip

When filling out a payment order, the UIN is written in the “Code” field. However, there are some peculiarities of writing code. In particular, it is written “UIN”, always in capital Russian letters.

Next, without any spaces, the code value is entered. It is taken from the request, notification, or obtained from the authorities administering the payment.

That is, a total of twenty-three characters are entered in the “Code” field. Sometimes it is necessary to additionally indicate some information about the purpose of the payment.

In this case, after the digital code the sign “///” is placed and the necessary data is entered. If the UIN is missing, then a zero code is simply entered.

When paying taxes

When paying taxes, the taxpayer is not required to indicate the UIN, provided that the payment is made on time independently.

In such a situation, the received payment will be identified in a different way. If the payer independently transfers current payments and contributions, then he enters a zero UIN value.

Video: payment order to supplier

At the same time, you don’t have to worry that the payment will not reach its intended destination. Administrative authorities will determine the purpose of the payment using the payer’s INN, BCC and other details.

When a payment is made by an individual on the basis of a tax notice, the UIN is taken from the notice (payment document) attached to the request.

The UIN value corresponds to the notification index. An individual transferring tax payments to the budget without notification can independently generate a payment document.

For this, an electronic service is used on the Federal Tax Service website. Here a payment document is generated, which is automatically assigned an index.

When paying state duty

When paying the state duty, the payer, as a rule, does not know the meaning of the UIN. You can, of course, find out the code from the direct recipient of the payment.

But you can simply put “0///” when filling out a payment order at the bank. If such details are available, the bank will accept the payment document, but if the UIN value is completely absent, the bank may refuse to accept the payment document.

It is convenient to pay the state fee through the State Services website. But often the state duty is paid through terminals, since it is more time-efficient.

Here you need to take into account some nuances. When entering data, the terminal requires you to enter your UIN. If you do not know this, put “0”.

But even in this case, some terminals do not accept payment. You can leave the field blank and just press Enter. Payment will be accepted.

When paying a fine

When paying fines to a tax or extra-budgetary fund, it is clear where the UIN is taken from - it is generated by the payment administrator himself and is indicated in the payment request.

Nuances with indicating the UIN arise, for example, when paying a fine to the traffic police. In such a situation, the payer can independently generate the code, knowing the scheme for its formation.

When paying a fine to the traffic police, the UIN value is “ serial number protocol + date of execution of the protocol or order.”

Moreover, each digit of the code when paying a fine has its own meaning:

Based on the code value, you can easily determine for which fine the payment is being made.

Sample filling

You can consider, as an example, how field 22 “UIN” is filled out in a document such as a payment order, a sample payment slip for payment of a fine for a traffic violation.

UIN is a unique accrual identifier, which is intended for faster posting of received payments to budget system Russia. If the administrator of the receipt of payments to the budget has a UIN, there is no need to enter additional data of the taxpayer company - KPP, INN, KBK. The assignment of unique tax codes will be carried out tax services, and codes for insurance premiums - FSS and Pension Fund.

Where to get UIN for a payment order

In accordance with Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for making transfers Money» in payment orders a unique accrual identifier is recorded if it was generated by the recipient of the funds, for example, the Pension Fund of the Russian Federation, the Social Insurance Fund or the Federal Tax Service. The UIN for those accruals that are formed by the Pension Fund of Russia, the Social Insurance Fund or the Federal Tax Service is received by the payer of taxes and insurance premiums as part of the details of notices of payment of arrears on taxes and insurance premiums, fines and penalties.

How to find out your UIN for legal entities when paying contributions and taxes

For insurance premiums and taxes calculated independently by legal entities and individual entrepreneurs Based on calculations and tax returns, the accrual identifier will be the budget classification code (BCC), reflected in detail 104 of the payment order. In the “Code” attribute, field 22, “0” (zero) will be indicated.

How to find out the UIN if it is not included in the requirement

If the taxpayer does not have a UIN code generated in the request for payment of fines and penalties, the value “0” will be indicated in the “Code” field.

It is important that the “Code” field cannot be left blank, because banks check its completion when making payments. An error in indicating the UIN or an erroneous indication of zero in the “Code” field will not lead to arrears: the payment can be qualified by the administrator of budget payments for the account of the Federal Treasury and KBK. But this may have certain consequences.

How to get a UIN

To obtain a UIN, a combination of four blocks is used:

There are resources on the Internet that allow you to check the correctness of the received unique accrual identifier using the last check digit.

UIN is used for identification in the State information system state and municipal payments (GIS GMP).

How to find out the UIN of an organization when paying taxes by an individual

Taxes can be paid in cash through a deposit with a credit institution.

When filling out a notice (payment document) in form N PD-4sb (tax) by an individual at a credit institution (for example, Sberbank), the UIN and document index are not indicated. Other information identifying an individual is indicated:

- Full Name;

- payer's TIN;

- address of registration or place of residence (if you do not have individual registration addresses).

Sometimes, to pay taxes, fines and penalties, the payment order or receipt contains the details UIN (Unique Accrual Identifier), which is not yet clear to us. I propose to consider the details of the description and use of this prop.

For whom is a UIN required?

It is not possible for entrepreneurs or legal entities to independently enter UIN data into a payment order, because this identifier is the prerogative of government agencies. Its number simplifies the distribution of funds received from individuals and legal entities.

The function of the UIN is as follows:

- In reducing unclear payments that are transferred to the state treasury;

- Reducing the risk of unknown payments.

Types and methods of payments with UIN

For legal entities and entrepreneurs, indicating the UIN in a payment order is only possible upon request from government agencies (IFTS, Social Insurance Fund, Pension Fund), indicating the identifier number. These may be requirements for the following payments:

- Payment of penalties. If you do not provide a code number, the tax office will identify the payment using other details. But in the payment document you still need to put “0” in field 22;

- When paying state duty;

- Payment of taxes, penalties on demands made by government agencies;

- Since 2017, the payment of insurance premiums has been supervised by the Federal Tax Service of Russia, which means the rules for filling out field 22 are identical to filling out other taxes.

Payment methods:

- If you prepare a payment through the State Services portal, the system itself will automatically provide the identification number, but if you put “0”, this will not be considered an error;

- When paying through a payment terminal, the taxpayer has no place to find out the identifier code, so you can put “0” in the code field;

- Bank employees will not accept a payment document or receipt if field 22 is left empty; you must enter either the code itself or “0”.

Some payment receipts for individuals already contain an identification number. This number identifies the following payments:

- Payment for real estate registration;

- Payment to pay for administrative violations;

- To pay traffic police fines and state fees;

- When paying for the issuance of certificates;

- To receive an extract from the state register.

It is important to know that if a government agency indicates the payment UIN, then it must be included in the payment order, otherwise the transferred funds will end up in undetermined payments.

Situations where a UIN is not needed

If legal entities and individual entrepreneurs comply with the deadlines for paying taxes, fees and charges, then when filling out payment documents, an accrual identifier is not needed, because government institutions did not provide demands for payment of arrears and penalties. The Federal Tax Service system recognizes the taxpayer by INN, KPP, and KBK. And in field 22 you need to put “0” for the payment ID.

If individuals make payments on their own without submitting requirements from the tax office, the UIN is not included.

Payment order field for UIN

When filling out a payment order, field 22, intended for the identifier code, must be filled in. What to put in this field depends on the following situations:

- If we are filling out a payment order at the request of government agencies, then we put in field 22 the identifier number that appears in the document;

- If we fill out the payment document ourselves, then in field 22 we put the number 0.

An example of completed field 22 indicating the UIN:

Please note that the unique payment identifier code 22 must not be empty, otherwise banking institution may not accept this payment.

Example of using UIN

Zorka LLC did not pay on time insurance premiums to the FSS, in turn the Fund social insurance sent the debtor a demand for payment of contributions indicating the UIN. When filling out the payment document, the accountant of Zorka LLC entered the identifier number in field 22.

Consequences of incorrectly filling out 22 fields

When funds are received into the state treasury from taxpayers, the code number makes it possible to automatically determine payments, contributions and fees. If the ID is incorrect, this payment will be considered in default. This leads to unpleasant consequences:

- Formation of debt obligations of organizations and individuals to the budget and funds;

- For each day of delay, penalties are charged;

- The need to clarify the details of the payment order;

- The receipt of funds into the state treasury is late, resulting in the imposition of penalties.

From the above, we must conclude that making an error in filling out field 22 (UIN) can result in big trouble and wasted time.

UIN for an individual

Individuals don’t have to worry about where to get UIN code for a payment document. When paying any taxes (land, property) according to the notification provided, the code is already automatically included in the receipt.

The taxpayer can independently generate a payment document. You can create and print it in personal account official website of the Federal Tax Service of Russia www.nalog.ru, having first completed registration. When generating a receipt for payment, the system will automatically assign a UIN code.

You need to know that if an individual does not have an identification number in the “payment”, then you need to enter your TIN.

If a taxpayer finds it difficult to remember his TIN, then it can be found on the Federal Tax Service website through the “Find out TIN” service. You must fill out the form with your data: full name, passport details, date and place of birth. Next, enter the code from the picture and click “Send request”, and you will immediately receive a response to your request.

Many people think that the bank will always tell you the meaning of the UIN in a payment order. However, this is only possible in a situation where the recipient of the money/administrator of the corresponding payment has an agreement with this credit institution.

Sometimes the identifier number in a payment order can be clarified through the authority that acts as the payment administrator. That is, you need to visit his website or call, come in person.

Does the bank have the right to demand a UIN?

It is important to know that you need to fill out field 22 UIN in a payment order only when the transfer of payments is subject to government agencies; for other companies this detail does not need to be specified.

Cases have become more frequent when bank employees require individuals and legal entities to indicate TIN and UIN in payment documents. Due to changes in legislation, individual entrepreneurs, lawyers, notaries, heads of peasant farms must indicate the TIN in the “Payer’s INN” field or a UIN of 20-25 digits in the “Code” field.

If the TIN is specified, then 0 is entered in the “Code” field. In this case, banks can indicate the identifier number, but not fill in the TIN, which leads to a violation of the taxpayer’s identification.