If a bank is deprived of its license for deposits. The bank was deprived of its license, how to get the money back, how to get the money back from a salary card if the bank has been deprived of its license

Read also

Most people in our country prefer to keep their savings not at home, but in banking organizations. This is quite logical: firstly, deposits allow you not only to protect money from depreciation, but also to make a profit thanks to interest. Secondly, funds on deposit take non-cash form and are much easier to protect from theft. Finally, thirdly, in Russian Federation A deposit insurance program has been developed, which guarantees their payment to depositors upon the occurrence of certain insured events.

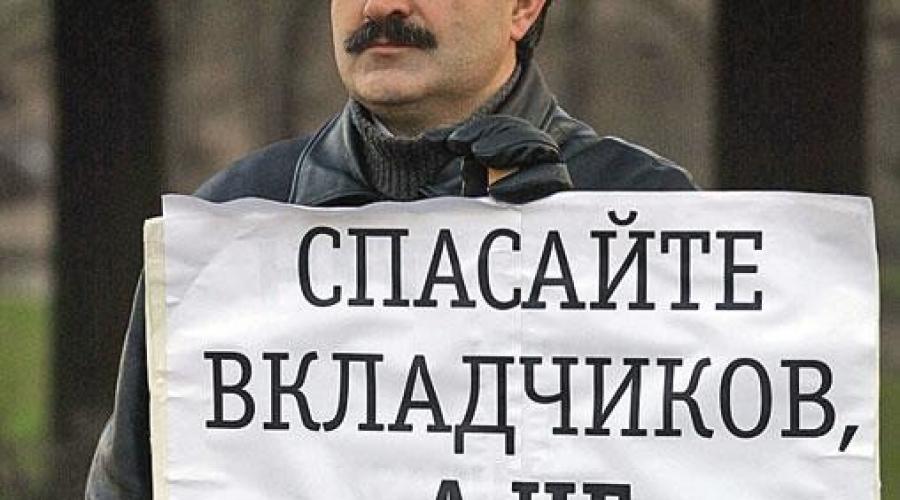

However, more and more often the news flashes information about the bankruptcy of one or another banking organization. And the depositor is concerned with only one problem: how to get a deposit from a bank that has been deprived of its license? You can search for the answer to this question yourself on the Internet, study laws and document forms.

But there is more convenient option- appeal to professional lawyers providing free legal assistance online.

You just need to fill out the form feedback and that's all difficult questions will be resolved within a few minutes.

All ordinary citizens, as well as individuals engaged in entrepreneurial activities (IP), are subject to the Federal Law “On insurance of deposits of individuals in banks of the Russian Federation”.

According to this normative act, only banking organizations that have the appropriate license and participate in the mandatory deposit insurance program can enter into agreements on opening deposits and accept money from citizens. If the bank’s license is subsequently revoked or it is declared bankrupt, the deposit is paid out by the insurer, the DIA (Deposit Insurance Agency). The deposit insurance program in the Russian Federation is quite simple and convenient: in order to get their money back, the depositor does not need to sign additional documents with the bankrupt bank - the insurance system is fully automated.

Important point! Federal Law No. 177 provides for the following restrictions on deposit payments:

- In 2017, a refund of money is made in the amount of one hundred percent only if the deposit amount is no more than 1,400,000 rubles. Previously, this figure was half as much, but in 2017, regulatory changes were adopted that significantly increased the insurance limit and thereby contributed to the flow of funds from the population to banking organizations.

- If a citizen has two or more deposits in one bank, then, regardless of their size, he can count on an insurance payment not exceeding 1,400,000 rubles. In this case, the percentage of compensation will be determined in proportion to the amount of each deposit.

- If an individual keeps money in different banks, then the maximum amount of compensation (1.4 million rubles) will be applied separately to each banking organization.

- If the deposit was opened not in rubles, but in another currency (for example, euros or dollars), then the calculation of the return amount is determined according to the official exchange rate of the Central Bank valid on the day of the insured event (license revocation).

- If a citizen received a loan or a loan from the same banking organization where the deposit was opened, then the balance of the debt is deducted from the amount of compensation.

Procedure for returning the deposit

Only the Bank of Russia (Central Bank) has the right to revoke a bank’s license. As soon as he makes such a decision, information about this appears on the following resources:

- on the official website of the bank declared bankrupt;

- on the website of the Deposit Insurance Agency;

- in the newspaper “Bulletin of the Central Bank of Russia”;

In addition, depositors must be notified of the occurrence of a certain insured event within 30 days from the date of deprivation of the bank’s license.

The DIA website promptly posts all vital information: which banking organizations will be appointed as agents for the payment of money, within what time frame and in which branches they can be returned, etc.

Step-by-step instructions for returning your deposit

Depositor actions:

- Upon learning that the bank has been closed, a citizen must contact the representative office of the Deposit Insurance Agency or the corresponding branch of the agent bank. This can be done at any time before the completion of the bankruptcy procedure of the organization in which the deposit is registered. The law does not specify a specific period, since everything depends on the financial situation of a particular bank, but in practice it is approximately two years. Meanwhile, you should not put off applying for a deposit for a long time: if you miss the application submission period, the depositor will have to prove to DIA representatives that this happened for good reasons. Only in this case can his application for compensation be accepted and the contribution paid.

- Then the individual needs to write an application for the return of the deposit by in the prescribed form and present a passport of a citizen of the Russian Federation. In many banks, applications are prepared by employees in advance to save time, so citizens only have to check all the data and sign them. If his representative acts on behalf of the investor, then a power of attorney is required at any notary office.

If in locality If the individual in which he lives does not have a representative office of the DIA or branches of agent banks, then the depositor can send an application for compensation in the form of a regular letter to the postal address of the Deposit Insurance Agency indicated on its website.

- The last step is to receive a deposit. This can be done in the following ways:

- in cash;

- by money transfer to a bank account specified by the depositor himself.

Law No. 177 guarantees that citizens have the right to return their deposits within three working days from the date of filing the relevant application, but not earlier than two weeks after the bank lost its license. Not only the initial deposit amount is compensated, but also the interest accrued on it in accordance with the terms of the agreement.

Deposits that cannot be returned under the insurance system:

- located in electronic wallets;

- opened in banking organizations located outside the Russian Federation;

- transferred by individuals to banks under a trust management agreement;

- opened by individuals for the purpose of carrying out professional activity(notaries, lawyers);

- open to bearer;

- confirmed by a passbook.

If the deposit amount is more than the limit

If a citizen’s deposit is less than 1.4 million rubles, then in this situation everything is clear: you just need to follow the instructions of the Federal Law No. 177. But what to do and where to go if the deposit is made for a larger amount than can be returned under the insurance program? In this case, the depositor receives from the agent bank the maximum amount of insurance in as usual, and then submits a written request for the return of the rest Money. The application must be accompanied by copies of the documents it has: an agreement on opening a bank deposit (one or more) and a certificate of payment of insurance compensation.

Since neither the agent bank nor the DIA can return money in excess of the insurance limit, these funds must be obtained through the sale of the property of the bank deprived of its license.

In other words, the depositor acquires the status of a creditor and is subject to entry into a special register. But there are also some nuances here: the claims of all creditors are satisfied in the order of priority provided for by civil law. Therefore, a situation may arise in which the proceeds from the sale of bank property are not enough to pay off all debts, and only those creditors who were first in the register will return their money. The rest of the depositors will have to come to terms with this state of affairs, because the bank will be declared bankrupt and it will be impossible to get anything from it even in judicial procedure. In order to exclude such unpleasant consequences, financiers advise storing large amounts money in different banks: firstly, the likelihood of license revocation from several banking organizations at once is unlikely. And, secondly, deposits of up to 1,400,000 million in each bank are a guarantee of returning your money in full.

It is generally accepted that the Central Bank’s revocation of a license from a financial institution should be of greater concern to holders of deposit, salary, current accounts and other clients who risk losing their financial assets. However, borrowers may well find themselves in a problematic situation. The loss of a bank’s license is not a reason for terminating loan obligations, but the continuation of their fulfillment must take into account changing circumstances.

Consequences of revoking a bank's license

IN last years The Bank of Russia actively uses its powers to revoke licenses from unscrupulous banks - those engaged in dubious or illegal transactions and activities. It should be noted that all the grounds that give the regulator such a right completely exclude their occurrence as a result of some technical errors or human factor. Revocation of a license is an exceptional measure, and if it is applied, it means that the bank will most likely face liquidation or bankruptcy.

The bank's lack of a license does not allow it to carry out transactions with non-cash and cash funds. Many borrowers know about this and, given the understanding that the bank will cease to exist anyway, they stop making regular payments. This is the most common and biggest mistake.

Often, borrowers who are also holders of deposits in the bank hope that the deposit amount will be counted towards repayment of the loan, and if the amounts are proportionate, they stop paying the loan. Such offsets are not possible.

No matter how the situation develops in the future, the borrower will still have to bear obligations under the loan agreement and repay the loan in full.

What should a borrower do if the bank has lost its license?

Today, it’s hard not to find out that a bank’s license has been revoked—such news is traditionally widely covered in the media. In any case, as soon as you become aware of this, you must:

In most cases, borrowers' fulfillment of loan obligations as before does not create problems. But if non-cash payments do not go through, bank offices are closed or employees refuse to accept cash, there is only one thing left to do - deposit the funds with a notary.

When contacting a notary, an application is drawn up, which describes the circumstances, reasons for depositing funds, the amount of debt, information about the creditor and other relevant aspects. Such actions by the borrower are regarded as fulfillment of the obligation on time and properly. Next, the notary notifies the bank about the receipt of funds and issues them to the creditor when applying for them.

In situations where the bank has a successor or an assignment agreement is concluded, it is advisable to personally visit the new creditor. This is important from the point of view of confirming that the terms of the loan agreement have not changed, as well as to clarify the details and procedure for transferring funds.

After court decision When a bank is declared bankrupt, information on the details of debt repayment, as well as other data about the bank being liquidated, can be found on the website of the Deposit Insurance Agency (DIA) in the section “

Hello The bank has been deprived of its license, all operations have been suspended, and our funds are in the bank account. How in as soon as possible return the money to put it back into circulation? In addition, the same bank has salary cards open for current payments. How to return money stuck on the card?

Answer:

Hello! When we're talking about about the deposits of individuals, you must contact the Deposit Insurance Agency. According to the application, you will be returned money in the amount of up to 700 thousand rubles, since this amount is guaranteed by the state. The prevailing opinion is that to return the money, with salary card closed bank is impossible, does not correspond to reality. Funds on bank cards are insured in accordance with the law. Cash for debit cards, placed on the current account individual, open for calculations using bank card. Such an account is opened on the basis of a bank account agreement. Funds placed (based on a bank deposit or bank account agreement) by the depositor or for his benefit are considered a deposit. When the Bank of Russia revokes a credit organization’s license, an insured event occurs, since all banks are participants in the deposit insurance system. After 14 days from the date of revocation of the bank’s license, the card holder must come with a passport to the agent bank selected by the Deposit Insurance Agency (DIA) and fill out an application for insurance payment there. The money will be transferred to the account specified by the cardholder or paid in cash. At the same time, claims of individuals not covered by insurance, based on a court decision, are satisfied first of all, unlike legal entities, which according to Art. 855 Civil Code of the Russian Federation, Art. 50.36 of the Law “On the Insolvency (Bankruptcy) of Credit Institutions” is in fourth position in this line. Legal entities must keep in mind that: According to the Federal Law “On Banks and Banking Activities”, Art. 13, carrying out banking operations by a bank without a license entails liability. According to paragraph 4 of Art. 859 of the Civil Code of the Russian Federation, the basis for closing an account is termination of the bank account agreement at the request of the client. At the same time, based on the list of banking operations given in Art. 5 of the same law, closing an account is not a banking operation. In this regard, regardless of the revocation of the license, banks can withdraw funds in this manner. Accordingly, for this it is necessary to submit an application to close the account, and by virtue of Art. 859 of the Civil Code of the Russian Federation, the balance will be transferred to another specified account. What to do when the bank has no money at all. You need to submit an application to the temporary administration. During the period of activity of the provisional administration, creditors of a bank that has lost its license have the right to present their claims to this credit organization at any time. When such demands are presented, by virtue of clause 8 of Art. 22.1 of the Law “On Bankruptcy of Credit Institutions”, the creditor, along with the substance of the requirements, is obliged to indicate information about himself, including: full name, date of birth, documents proving his identity, and postal address (for an individual), location and name (for a legal entity), as well as Bank details(if any). Bank of Russia, within 15 working days from the date of revocation of the license to carry out banking operations by a credit organization, in accordance with the Federal Law “On Banks and Banking Activities” Art. 23.1, is obliged to apply to the arbitration court and present a demand for liquidation of the credit organization (except for cases where the credit organization, by the day of revocation of the said license, has signs of insolvency (bankruptcy), which are provided for by the Federal Law “On the Insolvency (Bankruptcy) of Credit Institutions”). Signs of bankruptcy, that is, the impossibility of satisfying the claims of creditors, are identified by the temporary administration, in accordance with Art. 22.1 “On the insolvency (bankruptcy) of credit institutions.” When they are established, bankruptcy is carried out instead of liquidation. This will need to be monitored on the website. arbitration court. The only problem is that the requirements of legal entities, by virtue of Art. 855 Civil Code of the Russian Federation, Art. 50.36 of the Law “On Bankruptcy of Credit Institutions” are satisfied in the fourth place, and there may be little or no money. It should be taken into account that debiting funds from the account for claims that relate to one queue will be carried out in the order of priority (calendar) of receipt of documents (Article 855 of the Civil Code of the Russian Federation). That is, the sooner the documents are submitted, the better. If you have any difficulties in returning funds from a bank that has been deprived of its license, our lawyers are ready to help in this matter as soon as possible.

Sergey, hello!

I myself recently got into a story with the Pushkino Design Bureau, but I have already returned the money. To do this, you need, within seven days from the date of receipt of the register from the bank, in relation to

which an insured event occurred, Deposit Insurance Agency

will publish a special message in the press and post a special message in the bank (bank, in

in respect of which an insured event occurred is obliged to submit the register to

Agency within seven days from the date of its occurrence). In the message

the places where the investor should apply with an application for

obtaining insurance. As a rule, these will be banks operating

nearby. If suddenly you cannot get to the bank, you can apply

will be sent by mail in the order specified in the message. Payments you

You can also receive it by postal order. All details can be viewed at http://www.asv.org.ru/. According to experience, you will not receive the money faster than 30 days.

Was the lawyer's response helpful? + 0 - 0

Collapse

received

fee 30%

Zhiganova Yana Vyacheslavovna, Lawyer, Moscow

Hello.

If you are an individual, then the money will be returned to you upon application, in the amount of no more than 700 thousand, since this amount is guaranteed by the state.

But if you represent a legal entity, then everything is not so simple.

You will need to state your claims during the liquidation process. Before this, the media will receive information on how to submit demands to legal entities.

Article 16. Register of creditors' claims

1. The register of creditors’ claims is maintained by the arbitration manager or registrar.

The register of creditors' claims as a registrar is maintained by professional participants in the securities market engaged in maintaining the register of securities owners.

The registrar is obliged to carry out its activities in accordance with federal standards relating to the content and procedure for maintaining the register of creditors' claims.

Information about changes:

Federal lawdated December 30, 2008 N 296-FZ, paragraph 2 of Article 16 was amended

See the text of the paragraph in the previous edition

2. The decision to involve the registrar in maintaining the register of creditors’ claims and to select the registrar is made by a meeting of creditors. Before the date of the first meeting of creditors, the decision to involve the registrar in maintaining the register of creditors' claims and selecting the registrar is made by the temporary manager.

The decision of the meeting of creditors on the selection of the registrar must contain the amount of payment for the services of the registrar agreed with the registrar.

If the number of bankruptcy creditors whose claims are included in the register of creditors' claims exceeds five hundred, the involvement of the registrar is mandatory.

3. No later than five days from the date of election of the registrar by the meeting of creditors, the insolvency administrator is obliged to conclude a corresponding agreement with the registrar.

An agreement with the registrar can be concluded only if it has a liability insurance contract in case of losses to persons participating in the bankruptcy case.

Information about the registrar must be submitted by the arbitration manager to the arbitration court no later than five days from the date of conclusion of the agreement.

Payment for the services of the registrar is carried out at the expense of the debtor, unless the meeting of creditors establishes another source of payment for the services of the registrar.

4. The registrar is obliged to compensate for losses caused by non-fulfillment or improper fulfillment of duties provided for by this Federal Law.

If the maintenance of the register of creditors' claims is transferred to the registrar, the arbitration manager is not responsible for the correct maintenance of the register of creditors' claims and is not responsible for the registrar's commission of other actions (inaction) that cause or may cause damage to the debtor and his creditors.

Article 4 of this Federal Law.

6. Creditors' claims are included in the register of creditors' claims and excluded from it by the arbitration manager or registrar solely on the basis of judicial acts that have entered into force establishing their composition and size, unless otherwise determined by this paragraph.

Requirements for payment of severance pay and wages for persons working under employment contract, are included in the register of creditors' claims by the arbitration manager or the registrar upon the proposal of the arbitration manager.

Claims for payment of severance pay and wages for persons working under an employment contract are excluded from the register of creditors' claims by the arbitration manager or registrar solely on the basis of judicial acts that have entered into force.

If the register of creditors' claims is maintained by the registrar, judicial acts establishing the amount of creditors' claims are sent by the arbitration court to the registrar for inclusion of the relevant claims in the register of creditors' claims.

information mailPresidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 N 96

7. The register of creditors' claims shall contain information about each creditor, the amount of his claims against the debtor, the order of satisfaction of each creditor's claim, as well as the grounds for the emergence of creditors' claims.

When filing claims, the creditor is required to provide information about himself, including last name, first name, patronymic, passport details (for an individual), name, location (for a legal entity), as well as bank details (if available).

Information about changes:

Federal lawdated December 30, 2008 N 306-FZ Article 16 supplemented with clause 7.1

7.1. The claims of bankruptcy creditors for obligations secured by a pledge of the debtor's property are taken into account in the register of creditors' claims as part of the claims of third-priority creditors.

8. A person whose claims are included in the register of creditors’ claims is obliged to promptly inform the arbitration manager or the registrar about changes in the information specified in paragraph 7 of this article.

In case of failure to provide such information or untimely submission of it, the arbitration manager or the registrar and the debtor shall not be liable for losses caused in connection with this.

9. The arbitration manager or registrar is obliged, at the request of a creditor or his authorized representative, within five working days from the date of receipt of such a demand to send to this creditor or his authorized representative an extract from the register of creditors’ claims on the amount, composition and priority of satisfaction of his claims, and in if the amount of debt to the creditor is at least one percent of the total accounts payable, send to this creditor or his authorized representative a copy of the register of creditors' claims certified by the arbitration manager.

The costs of preparing and sending such an extract and a copy of the register are borne by the creditor.

10. Disagreements arising between bankruptcy creditors, authorized bodies and the arbitration manager regarding the composition, amount and order of satisfaction of creditors’ claims for monetary obligations or the payment of mandatory payments are considered by the arbitration court in the manner prescribed by this Federal Law.

Disagreements regarding the claims of creditors or authorized bodies, confirmed by a court decision that has entered into legal force in terms of their composition and size, are not subject to consideration by the arbitration court, and statements about such disagreements are subject to return without consideration, with the exception of disagreements related to the execution of judicial acts or their revision .

Federal law.

labor legislation and civil procedural legislation.

Was the lawyer's response helpful? + 1 - 0

Collapse

received

fee 30%

Zhiganova Yana Vyacheslavovna, Lawyer, Moscow

Creditors are legal entities, these are creditors of the 4th stage, therefore, satisfaction of their claims occurs after all mandatory payments (to individuals).

But, I want to note that the license was revoked, but the bank’s assets are about 80 billion, this is enough to satisfy the requirements.

Was the lawyer's response helpful? + 0 - 0

Collapse

received

fee 30%

Lawyer

- 7.9 rating

Hello!

If we are talking about an individual’s deposit, then you need to contact the Deposit Insurance Agency. The claims of individuals not covered by insurance are satisfied primarily on the basis of a court decision, unlike legal entities - they are in the fourth article. 855 Civil Code of the Russian Federation, Art. 50.36 of the Law “On the Insolvency (Bankruptcy) of Credit Institutions”.

If you are a legal entity, then you need to keep the following in mind. According to Art. 13 of the Law “On Banks and Banking Activities”, carrying out banking operations without a license entails liability for the bank. But, in accordance with paragraph 4 of Art. 859 of the Civil Code of the Russian Federation, a bank account agreement is terminated at the request of the client, termination is the basis for closing the account. At the same time, closing an account is not a banking operation, based on the list of such transactions given in Art. 5 of the same law. Therefore, regardless of the revocation of the license, the bank can withdraw funds in this manner. It is necessary, accordingly, to submit an application to close the account, and the balance, by virtue of Art. 859 of the Civil Code of the Russian Federation will be transferred to another account specified by you.

If the bank has no money at all, then so be it.

Submit an application to the temporary administration. Creditors of a credit organization have the right to present their claims to the credit organization at any time during the period of activity of the provisional administration. When presenting such demands, the creditor is obliged to indicate, along with the substance of the demands being made, information about himself, including last name, first name, patronymic, date of birth, details of documents proving his identity, and postal address for sending correspondence (for an individual), name, place location (for a legal entity), as well as bank details (if available) - clause 8 of Art. 22.1 of the Law “On the Insolvency (Bankruptcy) of Credit Institutions”. And it will be seen there.

In accordance with Art. 23.1 of the Law “On Banks and Banking Activities”, the Bank of Russia, within 15 working days from the date of revocation of a credit organization’s license to carry out banking operations, is obliged to apply to the arbitration court with a demand for liquidation of the credit organization, except if by the day of revocation of the said license The credit organization has signs of insolvency (bankruptcy) provided for by the Federal Law “On the Insolvency (Bankruptcy) of Credit Institutions.”

Signs of bankruptcy (impossibility of satisfying creditors' claims) are revealed by the temporary administration - Art. 22.1 “On the insolvency (bankruptcy) of credit institutions”, all of them are described in Art. 4 of this law.

If they are established, bankruptcy is carried out instead of liquidation. Will need to keep an eye on this. This can be done on the website of the arbitration court: arbitr.ru

The only problem is that the requirements of legal entities are satisfied in the fourth place - Art. 855 Civil Code of the Russian Federation, Art. 50.36 of the Law “On the Insolvency (Bankruptcy) of Credit Institutions”, and there may be little money.

Considering that the debiting of funds from the account for requirements related to one queue is carried out in the calendar order of receipt of documents (Article 855 of the Civil Code of the Russian Federation), the sooner you submit the documents, the better. In the same way, you need to hurry when you are included in the register of creditors that is formed in the arbitration court.

Was the lawyer's response helpful? + 1 - 0

Collapse

received

fee 30%

Zhiganova Yana Vyacheslavovna, Lawyer, Moscow

I believe that it is possible to close the account, but it is no longer possible to transfer money, since this is a banking operation.

This is the essence of license revocation.

Therefore, now we can only participate in the bankruptcy process. After the announcement of the start of the procedure, you need to state your requirements in order to be included in the register of requirements.

Was the lawyer's response helpful? + 0 - 0

Collapse

received

fee 20%

Lawyer, Moscow

- 7.4 rating

Hello!

According to paragraph 1 of Art. 845

According to the Civil Code of the Russian Federation, under a bank account agreement, the bank undertakes to accept and credit

funds received to the account opened for the client (account owner),

carry out the client’s orders for the transfer and disbursement of appropriate amounts from

account and carrying out other operations on the account. From the provisions of paragraph 1,

4 tbsp. 859

The Civil Code of the Russian Federation states that a bank account agreement is terminated at the request of the client

at any time, and such termination is grounds for closing the account

client.

According to Art. 13

Federal Law of December 2, 1990 N 395-1 “On Banks and Banking

activities! banking transactions are carried out only on

on the basis of a license issued by the Bank of Russia in the manner established by Law No.

395-1. At the same time, the implementation by a legal entity of banking operations without

license entails the recovery from such legal entity of the entire amount

received as a result of these transactions, as well as the collection of a fine

twice the amount of this amount to the federal budget.

List of banking

operations are found in Art. 5

Law N 395-1. This list is closed, while in paragraph 3 of part 1 of the said

articles to banking operations include only the opening and maintenance

bank accounts of individuals and legal entities.

Due to this,

Closing a bank account is not a banking transaction, which means

The bank can carry out this operation even after the license is revoked. Judicial

practice also confirms this (Resolution

FAS Moscow District dated August 14, 2006 N KG-A40/7271-06).

In case you have

You have funds in your account at the time of submitting an application to close the account,

then according to paragraph 3 of Art. 859

Civil Code of the Russian Federation, the balance of funds in the account is issued to the client or at his direction

transferred to another account no later than seven days after receipt

corresponding written statement from the client.

Specified actions

must be committed by the bank even if its license has been revoked

to carry out banking operations, since in this case transfer

or the issuance of funds is not an independent banking operation,

but are carried out as part of account closure, which, as mentioned above, is not

is a banking transaction.

Was the lawyer's response helpful? + 1 - 0

Collapse

received

fee 30%

Zhiganova Yana Vyacheslavovna, Lawyer, Moscow

It may be possible to get cash.

According to Art. 6 carrying out money transfers on behalf of individuals and legal entities, including correspondent banks, according to their bank accounts; - This is a banking transaction.

In practice, I'm not sure this is possible.

Was the lawyer's response helpful? + 0 - 0

Collapse

Ershov Denis

Lawyer

210 replies

38 reviews

According to Article 183.1 of the Federal Law the federal law“On insolvency (bankruptcy)” dated October 26, 2002 N 127-FZ