All about VAT in the 1s program. Accounting info. Sales of imported goods

Read also

How to take into account VAT in the 1C 8.3 Accounting program?

VAT accounting in 1C 8.3 Accounting is based on accumulation registers. The chart of accounts and the journal of postings, of course, remain, but the main information is stored in the registers. Let's try to understand their structure.

VAT accounting registers in 1C 8.3

A general list of VAT registers can be obtained by clicking on the button in the main menu “All functions” - “Accumulation registers” (Fig. 1) (if you do not have the “All functions” button available, follow the following instructions).

A little about the design of registers.

As the name suggests, each register is responsible for a specific section. So, according to the “Purchase VAT” register, the “Purchases Book” report is generated, and according to the “Sales VAT” register, the “Sales Book” report is generated.

The structure of all registers is similar and resembles a library directory. The main purpose of registers is to store and systematize information.

Each of the registers is a list of strings (Fig. 2). All lines of the same register have the same format, that is, the same columns. The number and purpose of columns are different in different registers.

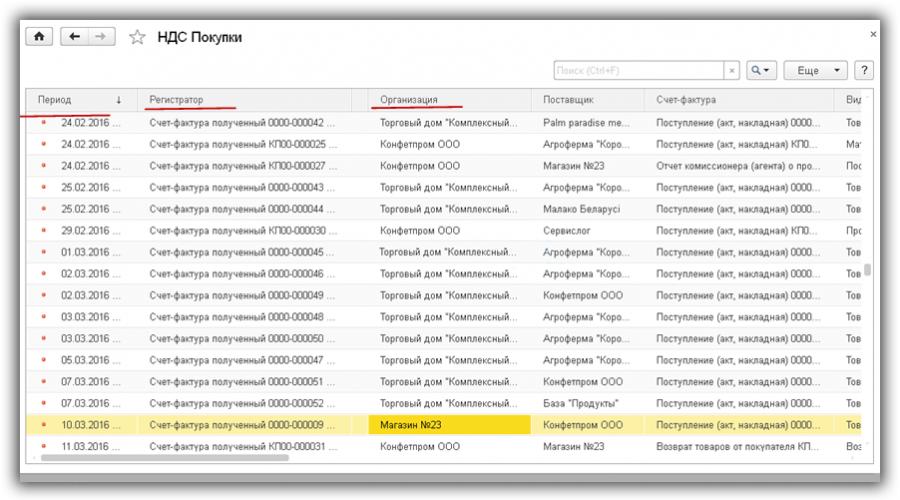

Figure 2 shows the contents of the “Purchase VAT” register. If the “Purchases Book” report displays data for one organization, then the “Purchases VAT” register contains data for all organizations at once.

The columns “Period” and “Registrar” are in each accumulation register.

Each line of the register is associated with a document (which one is shown in the “Registrar” column). You can double-click to open the document itself. The concept of “posting a document” in 1C is associated not only with the formation of transactions, but also with the creation of a line in a register (one or several at once). In 1C slang they say the document “moved” the register, “check the movement of the document.”

By clicking the “More” button (Fig. 3), you can output the contents of the register to a file, print it, filter the information, change the composition of the output columns (the register data does not change).

Preparation of an invoice to reflect VAT

You can change the information in the register from the registrar document.

Let's consider how registers change depending on the posting of documents. We will conduct experiments with the “VAT presented” register.

Figure 4 shows the invoice. Let's check the postings of this document (Fig. 5).

We see two bookmarks, each of which corresponds to one register. The first displays accounting and tax accounting entries (generally speaking, entries are also stored in the register, but this is a register of a different format; the structure and purpose of the accounting register is not discussed in this article).

On the second tab (Fig. 6) - data from the “VAT presented” register. This register is one of the 12 registers that relate to the VAT accounting system. Note that the type of movement is “Arriving”.

Now let's register the supplier invoice. For this, the receipt invoice below (Fig. 7) contains the necessary fields.

In the generated invoice, check the box “Reflect VAT deduction in the purchase book...” (Fig. 8) and check the movements of the document (Fig. 9).

Finding errors in 1C for value added tax

The invoice “moved” 4 registers at once (in Fig. 9 we see 4 bookmarks). One of these 4 registers is already familiar to us “VAT presented”. But unlike the entry made by the document “Receipt (act, invoice) 0000-000249 dated 08/01/2016 18:00:00”, the type of movement in this case is different (“expense”).

What does this mean? Firstly, the total sum of all similar movements with different signs matters. Let’s filter such movements in the “VAT presented” register using the “Invoice” column (Fig. 10) and sum up the “Amount without VAT” column, taking into account the sign in the “Type of movement” column. Please note that the “Invoice” column indicates the basis document.

As a result, we get zero. This is equivalent to a zero balance on account 19 (for this counterparty and agreement). It would seem, why duplicate in the register what can be seen in the postings?

The fact is that in life there are a wide variety of situations. For example, they forgot to register an invoice; then there will be no line with “expense”, the total amount will not be equal to 0 and the program, when analyzing, will show an error for this counterparty and agreement (Fig. 11)

Conclusion - registers are needed for operational analysis and reporting.

VAT adjustments

Another situation is when you need to change the price of an already purchased product. Let's introduce an adjustment based on the receipt document (Fig. 12). Let’s assume that the price for one item “Low-fat cottage cheese” has changed.

Let’s carry out the adjustment document and check the movements in the “VAT presented” register:

As you can see, new lines have appeared in the 1C 8.3 register, which contain detailed information about all changes. Without a register, it is difficult to remember such data. But there may be several changes.

Conclusion - registers are used to store additional information.

In addition to adjustments, there is also accounting for separate VAT, VAT on fixed assets, VAT at a rate of 0%, VAT on advances, etc. For each such operation there is a separate register. Help for each register can be obtained by pressing the F1 button.

Thus, in order to understand how VAT accounting works in 1C configurations, it is necessary to study in detail the structure and relationships of VAT registers.

Based on materials from: programmist1s.ru

Filing VAT reports is one of the most important tasks of the accounting and tax department in a company. Particularly relevant are the tasks of issuing tax invoices and generating tax reporting during the VAT filing period. The work is divided into stages:

1) extracting documents in 1C

2) check

3) submission of reports to tax authorities

We will tell you step by step how to go through all the stages in the most practical way, without excessive expenditure of effort and energy.

1. Extracting documents in 1C

Tax documents (obligations) are issued based on one of the first events: payment, sale of goods. Depending on which of the events was the first, a tax invoice is issued based on it (VAT is charged). If the money was received first, the basis for issuing a tax invoice is the incoming payment order. If the first event was the actual shipment (sale of goods to the buyer), the tax invoice is issued on the basis of the document “Sales of goods and services”. Tax invoices for loans are entered into 1C manually, without nomenclature. In this case there is no automation.

But there is automation when issuing tax invoices.

1) The simplest automation is to enter a tax invoice based on a document available in the database.

2) Use the “Generation of tax invoices” processing to issue documents in bulk, for example, based on the results of the period.

Processing the formation of invoices consists of two parts: 1st - selections, 2nd extract. In the first part of the processing, it is necessary to set mandatory data selections, in the second part, work directly with the data. Processing details are required to be filled out: the period for which tax invoices will be generated, the organization, if not one, but several, counterparties (optional). In the upper left corner, the user is also given a choice of the total of invoice generation with options for posting, opening, printing, etc. Most often and most conveniently, use the mode of opening generated documents with further independent execution.

On the second tab, the processing area for issuing tax invoices is divided into 2 parts. Selected clients are displayed at the top, and those clients who have already received tax invoices are displayed in bold. Issued tax invoices are visible at the bottom of the processing in dark red font. Thus, processing provides the opportunity without forming report see unissued invoices. To issue a tax invoice, you need to go to the field at the top of the processing, click “selection”, select the basis document, click “generate”. Result - a tax invoice will be generated. There is no need to close processing after generating a tax invoice, as you will have to open processing again. For convenience, processing selection settings can be saved using the “save, restore report settings” icons so as not to configure processing each time.

2. Check

To check issued tax invoices in 1C 8.2 there is report"Checking the amount of liabilities for VAT". Using the report, you can check the amount of tax documents already issued. By looking in Excel accordingly, you can quickly find the difference between the columns. Rows can be grouped in the report by compressing to the client or expanding to document analytics. Thus, in the report at the top you can see how much is in the database primary documents, and how many tax invoices were issued.

3. Submitting reports

1C contains built-in tools for generating and submitting reports electronically to the tax office. Reporting is generated on the basis of the entered documents and, as a result, displays the result of tax obligations and tax credits.

You can send the generated report to the State Tax Inspectorate using the 1C-Zvit utility or save it in *.xml format and upload it to MEDOC.

For more detailed advice on servicing accounting programs, please contact our support team.

We hope with the help of our article we saved your time and “pencil marks” on paper :)

The next VAT tax period is already coming to an end. To prevent the reporting campaign from becoming stressful, it is necessary to regularly and correctly keep records and make the most of the program’s capabilities. About what measures need to be taken in advance so that the process of generating a declaration in the program “1C: Accounting 8” ed. 3.0 did not take much time, and the data in the reporting was correct, read the material from 1C experts.

VAT accounting in the 1C: Accounting 8 program is carried out daily - records of purchase and sales books are generated when entering invoices. But for the correct formation of books of purchases, sales and declarations, it is necessary to check the entered data, perform routine operations, create books of purchases and sales and check VAT accounting. This must be done in the following sequence.

Stage 1. Check the correctness of the entered data and the presence of documents

All originals of primary documents received by the accounting department must be verified with the data already entered into the 1C: Accounting 8 database. This applies to all documents - for admission, for disposal, papers for payment and other transactions. Let's take a closer look at the accounting areas and what you need to pay attention to.

Bank and cash desk. When entering bank documents, make sure that VAT is indicated correctly in the appropriate column. This is necessary for generating advance invoices, since they are generated automatically in the program. If VAT is not indicated in the document Receipt to the current account, then an invoice for advances received will not be generated automatically. You need to pay attention to this same point when entering a document. Receipt at the cash desk.

Receipt of goods, works and services. In the document Receipt of goods and services you need to pay attention to filling out the columns % VAT, VAT. If the VAT amount is indicated incorrectly, the program will not be able to take into account the correct incoming VAT for this receipt. It is also important to register the invoice received from the supplier. The program will not include an unregistered invoice in the purchase book and will not generate accounting entries for deducting input VAT on this purchase.

To register an invoice for received goods, works and services, you must indicate its number in the field Invoice No. and the date in the field from, then click on the button Register. As a result, a document will be created and automatically posted Invoice received.

Sales of goods, works and services. When entering a document Sales of goods and services pay attention to filling out the columns % VAT And VAT, as well as the generation of an invoice based on it. If these columns are filled in incorrectly, the program will not be able to correctly calculate VAT payable to the budget for this document. Similar to document P transfer of goods and services you need to register an invoice. If this is not done, the program will take this operation into account when generating entries for the sales book, but the number and date of the primary document will be indicated in the sales book. This is not a violation of the procedure for issuing invoices if goods (work, services), property rights are sold to persons who are not VAT payers, and to taxpayers exempt from the duties of a taxpayer, with the written consent of the parties to the transaction.

For more information about processing operations for writing off inventory, putting into operation OS and intangible assets, read the section in IS 1C:ITS “VAT reporting” at the link.

How to check whether documents are entered correctly? There are two ways to do this:

- Each primary paper document must be verified with each electronic document in the database. The method is labor-intensive and is not suitable for companies with a large number of operations, but it allows for the greatest reliability;

- Create a register of documents entered into the database and check their basic details. Using the register, you can only check the basic details (name of the counterparty, date, amount, document number), but this saves time. You can create a register of documents entered into the database using the command List in any of the document journals.

Availability of invoices based on receipt documents. The next step in preparation for drawing up a VAT return is to check the availability of invoices according to receipt documents. For this check it is intended Report on the availability of invoices presented by the seller(chapter Reports - Accounting Analysis: Availability of invoices). The report allows you to obtain information about the availability of received invoices registered by the documents specified in the report settings. If the list of documents is not completed, then the availability of invoices for all documents to which they must be attached is checked.

If the report shows missing or unposted invoices, correct the error. Adjustments to documents can be made directly from this report. To do this, double-click on the document of interest, which will open the document form. After making corrections, the document must be re-posted, and then the report must be generated again.

Stage 2. Regulatory operations for VAT accounting

In “1C:Accounting 8”, records of purchase and sales books are generated when conducting “ordinary” accounting documents - an invoice issued, an invoice received, etc. But these operations are not enough - at the end of the tax period, it is necessary to carry out regulatory documents for VAT accounting . Regulatory documents for VAT accounting are created when performing routine operations for VAT accounting from the journal Regulatory VAT operations(menu Operations – VAT routine operations or from the form VAT Accounting Assistant(menu Purchase – Maintaining a purchase book - VAT Accounting Assistant or menu Sale – Maintaining a sales book - VAT Accounting Assistant).

VAT Accounting Assistant is a service tool of the program that allows you to perform regulatory operations for VAT accounting, as well as create a purchase book, a sales book and a VAT declaration (Fig. 1).

The assistant analyzes the state of VAT accounting registers and determines the composition of routine operations. All routine operations are displayed in the order in which they should be performed. The current routine operation is marked with an arrow. Each routine operation is highlighted with an icon in accordance with its current state:

- No surgery required;

- Operation required, not completed– in the current period, the corresponding document required to close the VAT period has not been created;

- Operation completed, current– the required document has been created and filled out correctly;

- The operation was completed, but is not relevant– the required document has been created, but it may need to be refilled and posted.

Let's consider the purpose of some regulatory operations for VAT accounting.

VAT distribution of indirect expenses. This operation distributes input VAT on purchased goods, works and services, the costs of which cannot be clearly attributed to a specific type of transaction. When an operation is performed, a document is created VAT distribution of indirect expenses. Based on the data in this document, the amounts of input VAT on indirect costs are distributed among specific types of activities, based on the share of revenue of a specific type of activity in total revenue.

The document can be filled out automatically.

Regular operation Confirmation of payment of VAT to the budget is performed to deduct input VAT paid when importing goods from member countries of the Customs Union.

When an operation is performed, a document is created Confirmation of payment of VAT to the budget. The document is filled in automatically according to documents Application for import of goods. For auto-filling, application documents for the import of goods must be entered before performing the regulatory operation.

When posting a document Confirmation of payment of VAT to the budget VAT paid to the tax authority when importing from member countries of the Customs Union will be accepted for deduction and a purchase ledger entry will be generated for the amount of the deduction.

Read more about all regulatory VAT operations in the subsection “ VAT reporting" section " Reporting".

Stage 3. Create sales and purchase books

To prepare a VAT return, you need, firstly, to create books of purchases and sales, and then check that they are filled out correctly.

The sales book in the program is generated using the report of the same name Sales book (Section Reports - VAT Reports: Sales Book). In the report form, you need to indicate the period for compiling the sales book and click on the button Form.

The formation of a purchase book in the program is carried out in a similar way using a report Book of purchases(chapter Reports - VAT reports: Purchase ledger). In the report form, you need to indicate the period by compiling the purchase book and click on the button Form.

If accounting in the information base is maintained for several organizations, then in the forms you need to select the organization for which the sales book is compiled. By default, the organization from the directory is indicated Organizations with sign Main.

You can check whether the purchase and sales books are filled out correctly using the report Analysis of the state of tax accounting by VAT (section Reports – Accounting analysis: Analysis of VAT accounting). The report reflects the amounts of VAT accruals and deductions by type of business transactions in general and with breakdowns by type of transaction. To generate a report, you must specify the period to be checked in the field Period, select an organization and click on the button Form. By default, the organization from the directory is selected Organizations with sign Main. If the infobase maintains records for only one organization, the organization field is not shown in the report form.

Each report block contains two indicators (Fig. 2): on a beige background – VAT calculated in the program; on a gray background – VAT not calculated in the program, i.e. potentially containing an error in the VAT calculation. To view the indicator and check the calculation, you can double-click on the amount of each block.

Step 4. Check your VAT accounting status

There is another way to check whether the purchase and sales books are filled out correctly - by processing Express check of accounting. Processing will allow (section Reports - Accounting Analysis: Express Check) test:

- compliance with general accounting policies;

- state of accounting;

- correctness of cash transactions;

- correct reflection of transactions related to maintaining the sales book;

- correct reflection of transactions related to maintaining the purchase ledger.

To run a form check you need to select the period in the field Period from... to... and organization, then click on the button Show settings and use the checkboxes to mark the sections to be checked. By default, the check is performed for all sections and the entire list of checks.

The express check includes two blocks - checking the maintenance of the sales book and checking the maintenance of the purchase book.

Checking the sales book

In Fig. 3 shows section checks Maintaining a sales book for value added tax.

Express accounting check solves the following problems.

Checking the chronology of invoice numbering. In accordance with the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, invoices must be numbered in chronological order. The check monitors the chronology and reports violations in the chronology or omissions in the numbering of invoices.

Timely issuance of invoices based on sales documents. According to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, invoices for transactions involving the sale of goods (work, services) are issued no later than five calendar days, counting from the date of shipment of the goods (performance of work, provision of services). The audit monitors compliance with this requirement.

Completeness of issuing invoices based on sales documents. The methodology for accounting for VAT calculations implemented in the program provides that for organizations that are VAT payers, each posted sales document must be accompanied by a posted document Invoice issued. This check controls deviation from the methodology.

Checking the formation of advance invoices in the presence of advances received. Taxpayers are required to issue and register invoices in the sales book not only for sales transactions, but also in the event of receiving full or partial prepayment for the upcoming sale. When checking, it becomes clear whether invoices have been issued for all advance receipts.

VAT reporting section Reporting.

You can get information about the error by clicking on the plus sign to the left of the check name. For each check, its result, possible causes of the error, recommendations for correction are deciphered, and a detailed error report is provided.

Checking the purchase ledger

The purchase ledger audit covers the following issues.

Completeness of receipt of invoices based on receipt documents. The methodology for accounting for incoming VAT in 1C: Accounting 8 stipulates that each receipt document must be accompanied by a supplier invoice. This check controls deviation from the methodology.

Availability of document VAT distribution. If the taxpayer, in accordance with clause 4 of Art. 170 of the Tax Code of the Russian Federation must maintain separate VAT accounting; it is necessary to establish parameters in the accounting policy to support separate accounting. The check consists of the fact that if during the tax period the taxpayer (who indicated support for separate accounting in the accounting policy parameters) carried out sales transactions, then the presence of posted documents is checked VAT distribution.

Correctness of VAT distribution. The report verifies that the distribution is correct. The amount of input VAT to be distributed on received goods (works, services) for the tax period (receipt according to the register Separate VAT accounting), must be equal to the amount of VAT distributed between types of activities (expense according to the register Separate VAT accounting). If this equality is not maintained at the end of the tax period in the register Separate VAT accounting there is a remainder ( Main menu - All functions - Reports: Universal report - register Separate VAT accounting), then the system reports an error.

Availability of document Generating purchase ledger entries. Entries for the purchase book in “1C: Accounting 8” can be entered using the document Generating purchase ledger entries. The check controls the availability of documents of this type in the corresponding tax period.

To perform checks on maintaining the purchase ledger, you must click on the button Perform check. The results are presented in the form of a report, which reports the number of checks performed and errors detected (Fig. 6).

Read more about the tasks that express verification solves in the “VAT reporting” subsection of the “Reporting” section .

Printable form of the VAT return in 1C 8.2:

- Menu Reports → Regulated reports.

- Button<Добавить элемент списка>– choice of VAT.

- Period – reporting period.

Procedure for filling out a VAT return

The algorithm is as follows:

- Step 1. Fill in Title page;

- Step 2. Fill in Section 3 Calculation of the amount of tax payable to the budget for transactions taxed at the tax rates provided for in paragraphs 2 - 4 of Article 164 of the Tax Code of the Russian Federation;

- Step 3. Fill in Section 1 The amount of tax to be paid to the budget (reimbursement from the budget), according to the taxpayer.

Step 1. Filling out the title page

When filling out the title page, information about the taxpayer and the reporting period is filled in:

- In field Correction number– the primary report code corresponds to the value «0» , when submitting the updated calculation, the serial number of the adjustment is indicated;

- In field Tax period (code)– reporting period code:

- value "21" – declaration for the first quarter;

- value "22" – declaration for the second quarter;

- value "23"– declaration for the third quarter;

- value "24" – declaration for the fourth quarter.

- In field Reporting year– the year for which the declaration is submitted;

- In field Submitted to the tax authority (code)– code of the tax authority to which the declaration is submitted;

- In field by location (registration) (code)– code value 400 is indicated:

- The subsequent fields indicate Taxpayer name in accordance with the constituent documents, OKVED code, assigned to the taxpayer, taxpayer contact telephone number:

Step 2. Completing Section 3 of the VAT return

Section 3 of the Declaration is submitted by VAT payers if there are non-zero indicators for any line of this section.

Persons who are not VAT payers, but have issued an invoice indicating the amount of tax to their customers, do not submit this section as part of the Declaration, but only the title page and section 1.

- At the top Section 3 (lines 010 to 120) reflects the amount of VAT payable to the budget;

- In the lower part section (lines 130 to 220) reflects the amounts of VAT deductible, which reduce the amount of tax liability to the budget;

- As a result, according to the section(line 230 or 240) reflects the total amount of VAT payable or VAT reduction in a given tax period.

- The general rule for filling out this section is as follows:

According to column 3 lines from 010 – 080 indicates the amount of the tax base subject to taxation at a particular rate;

According to column 5 lines from 010 – 080 the amount of tax calculated by multiplying the tax base (column 3) by the VAT rate (column 4) on the corresponding line is indicated;

According to column 5 lines from 090 – 110 the amount of tax calculated by the taxpayer is indicated. Column 3 “Tax base” and column 4 “VAT rate” are missing for these lines.

- In lines 010 – 040 – tax base and tax for all sales in the expired tax period, which are subject to taxation at the appropriate rate indicated in column 4 of the same line;

Let's compare the data from the example: Tax base 1,610,532 rubles. VAT payable = RUB 289,896 set of postings Dt 90.03 Kt 68.02. The VAT amount on line 010 coincides with the control data.

- On line 050:

Column 3 – the tax base, which is determined separately for each type of asset of the enterprise (clause 1 of Article 158 of the Tax Code of the Russian Federation) and represents the book value of the property, multiplied by correction factor(Clause 2 of Article 158 of the Tax Code of the Russian Federation);

Column 5 – the amount of tax calculated by multiplying the cleared “Tax Base” (column 3) by a rate equal to the calculated rate of 15.25% (clause 4 of Article 158 of the Tax Code of the Russian Federation) for all types of property.

- In line 060 – tax base and tax when performing construction and installation work for one’s own needs, determined in accordance with Clause 2 of Article 159 of the Tax Code of the Russian Federation as the sum of all actual expenses of the taxpayer for performing these works, including expenses of the reorganized (reorganized) organization;

- In line 070 – tax base and tax upon receipt of prepayment amounts (including VAT) received in a given tax period;

Let's compare the data from the example: Tax base = 720,000 rubles. – set of postings Dt 51 Kt 62.02. VAT payable = RUB 109,831 set of postings Dt 76.AV Kt 68.02. The VAT amount on line 070 coincides with the control data

- In line 080 – tax base and tax with an additional increase in the tax base, i.e. taxable amounts that are not characteristics of independent objects of taxation in accordance with Article 162 Tax Code of the Russian Federation(for example, amounts of fines, penalties, interest received by the seller from the buyer, etc.);

- In line 090 – indicates the TOTAL amount of VAT subject to restoration for payment to the budget in a given tax period, which was previously accepted for deduction, for example: for goods (works, services), if this property begins to be used for carrying out transactions not subject to VAT (clause 2 of Art. .170 Tax Code of the Russian Federation); on advances paid to suppliers.

In our example, the amount is transferred to line 090 18,000 rub. from p.110.

- On line 100 – the amounts of tax previously accepted for deduction are indicated, and in respect of which a liability arises for those goods (works, services) that in a given tax period were used for operations, in accordance with clause 1 of Article 164 of the Tax Code of the Russian Federation, subject to taxation at a rate of 0%;

- On line 110 – the amounts of VAT that should be restored for payment to the budget are indicated in accordance with paragraph 3 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation. These are VAT amounts that were previously accepted for deduction from the prepayment made by the taxpayer to the supplier;

Let's check the data in the example: VAT payable = 18,000 rub. set of entries Dt 76.AV Kt 68.02 – restored VAT on credited advances to suppliers. The VAT amount on line 110 coincides with the control data.

- On line 120 – are indicated total VAT amounts accrued for payment. This line is equal to the sum of lines from 010 to 090 in column 5.

Let's check the data in the example: VAT payable (line 120) = 289,896 +109,831 + 18,000 = 417,727 rubles. Corresponds to the “cleared” credit turnover of account 68.02. Corresponds to the total amount of VAT payable in the Sales Book.

- On line 130 – indicates the amount of VAT charged to the taxpayer when he purchases goods (work, services, property rights) on the territory of the Russian Federation and is subject to deduction in accordance with Art. 171 and 172 of the Tax Code of the Russian Federation;

RUR 216,977 set of entries Dt 68.02 Kt 19. The VAT amount on line 130 coincides with the control data.

- On line 140 the amounts of VAT presented by contractors during construction (installation) by contract method and subject to deduction in accordance with clause 5 of Article 171 of the Tax Code of the Russian Federation are indicated;

- On line 150

Let's check the data in the example: VAT deductible = 18,000 rub. set of postings Dt 68.02 Kt 76.VA. The VAT amount on line 150 coincides with the control data.

- On line 160 indicates the amount of VAT deductible presented to the taxpayer-buyer when he transfers an advance payment for goods (work, services, property rights);

- On line 170 The amount of VAT paid when importing goods into the customs territory of the Russian Federation is indicated; it is determined by the formula:

- On line 180 indicates the amount of VAT paid to the customs authorities when importing goods into the customs territory of the Russian Federation for carrying out operations recognized as an object of taxation or purchased for resale;

- On line 190 indicates the amount of VAT paid by the taxpayer to the budget of the Russian Federation when purchasing goods of Belarusian origin in the Republic of Belarus for transactions recognized as an object of taxation or purchased for resale;

- On line 200 indicates the amount of VAT calculated by the seller on advances received, which is subject to deduction from the date of shipment of goods (performance of work, provision of services);

Let's check the data in the example: VAT deductible = RUB 67,469 set of postings Dt 68.02 Kt 76.AV. The VAT amount on line 200 coincides with the control data.

- On line 210 indicates the amount of VAT previously paid to the budget by the taxpayer as a tax agent and subject to deduction in accordance with Clause 3 of Article 171 of the Tax Code of the Russian Federation;

- On line 220 – the total amounts of VAT subject to deduction are indicated. This line is equal to the sum of lines 130, 150, 160, 170, 200 and 210.

Let's check the data in the example: VAT deductible (line 220) = 216,977+18,000 + 67,469 = 302,446 rubles. Corresponds to the “cleared” debit turnover of account 68.02. Corresponds to the final VAT amount to be deducted from the Purchase Ledger.

- If The calculated amount of tax accrued for payment to the budget (page 120)> VAT amounts subject to deduction (page 220), then line 230 is filled in, otherwise p. 240;

- On line 230 the total amount of VAT calculated for payment to the budget is indicated;

Let's check the data in the example: Page 120 > p.220= 417,727 > 302,446 rub. Line 230 = 417,727 – 302,446 = 115,281 rubles.

- On line 230 The total amount of VAT calculated for reimbursement from the budget is indicated:

Step 3. Completing Section 1 of the VAT return

- In line OKATO code (page 010) – code of the administrative-territorial entity (OKATO code) in accordance with the All-Russian Classifier, on the territory of which the tax is paid;

- In line Budget classification code (page 020) – budget classification code for VAT: 182 1 03 01000 01 1000 110 “Value added tax”;

On line 030 indicates the amount of VAT calculated for payment to the budget by NON-payers of VAT, i.e. This line is filled in by those who:

- apply a simplified taxation system;

- apply a taxation system for agricultural producers;

- apply a taxation system in the form of a single tax on imputed income;

- exempted from taxpayer obligations in accordance with Article 145 of the Tax Code of the Russian Federation.

On lines 040 and 050 indicates the amount of VAT to be paid or reimbursed from the budget. The tax amount indicated on line 040 is subject to payment to the budget.

Let's check the data from the example:

- Amount of VAT payable = 115,281 +0 = 115,281 rub.

- Amount of VAT to be reimbursed = 0 rub.

- Amount of VAT payable > Amount of VAT refundable = 115 281 > 0 – fill in page 040

- Page 040 = 115,281 – 0 = 115,281 rubles:

VAT accounting in 1C 8.3 Accounting is based on accumulation registers. and the journal of transactions, of course, remain, but the main information is stored in the registers. Let's try to understand their structure - let's look at the entire accounting process step by step.

A general list of VAT registers can be obtained by clicking the button in the main menu “ ” - “ ” (Fig. 1) (if the “All functions” button is not available to you, follow).

A little about the design of registers.

As the name suggests, each register is responsible for a specific section. Thus, according to the “Purchase VAT” register, the “Purchases Book” report is generated, and according to the “Sales VAT” register, the “Sales Book” report is generated.

The structure of all registers is similar and resembles a library directory. The main purpose of registers is to store and systematize information.

Each of the registers is a list of strings (Fig. 2). All lines of the same register have the same format, that is, the same columns. The number and purpose of columns are different in different registers.

Figure 2 shows the contents of the “Purchase VAT” register. If the “Purchases Book” report displays data for one organization, then the “Purchases VAT” register contains data for all organizations at once.

There are columns “Period” and “Registrar” in each.

Each line of the register is associated with a document (which one is shown in the “Registrar” column). You can double-click to open the document itself. The concept of “posting a document” in 1C is associated not only with the formation of transactions, but also with the creation of a line in a register (one or several at once). In 1C slang they say: the document “moved” the register, “check the movement of the document.”

By clicking the “More” button (Fig. 3), you can output the contents of the register to a file, print it, filter the information, change the composition of the output columns (the register data does not change).

Preparation of an invoice to reflect VAT

You can change the information in the register from the registrar document.

Let's consider how registers change depending on the posting of documents. We will conduct experiments with the “VAT presented” register. Accounting accounts are set in .

In Fig. 4 the receipt invoice. Let's check the postings of this document (Fig. 5).

Get 267 video lessons on 1C for free:

We see two bookmarks, each of which corresponds to one register. The first displays accounting and tax accounting entries (generally speaking, entries are also stored in a register, but this is a register of a different format; the structure and purpose are not discussed in this article).

On the second tab (Fig. 6) there is data from the “VAT presented” register. This register is one of the 12 registers that relate to the VAT accounting system. Note that the type of movement is “Arriving”.

Now . For this, the receipt invoice below (Fig. 7) contains the necessary fields.

In the generated invoice, check the box “Reflect VAT deduction in the purchase book...” (Fig. 8) and check the movements of the document (Fig. 9).

Finding errors in 1C for value added tax

The invoice “moved” 4 registers at once (in Fig. 9 we see 4 bookmarks). One of these 4 registers is the already familiar “VAT presented”. But unlike the entry made by the document “Receipt (act, invoice) 0000-000249 dated 08/01/2016 18:00:00”, the type of movement in this case is different (“expense”).

What does this mean? Firstly, the total sum of all similar movements with different signs matters. Let’s filter such movements in the “VAT presented” register using the “Invoice” column (Fig. 10) and sum up the “Amount without VAT” column, taking into account the sign in the “Type of movement” column. Please note that the “Invoice” column indicates the basis document.

As a result, we get zero. This is equivalent to a zero balance on account 19 (for this counterparty and agreement). It would seem, why duplicate in the register what can be seen in the postings?

The fact is that in life there are a wide variety of situations. For example, they forgot to register an invoice; then there will be no line with “expense”, the total amount will not be equal to 0, and the program, when analyzing, will show an error for this counterparty and agreement (Fig. 11)

Conclusion - registers are needed for operational analysis and reporting.

VAT adjustments

Another situation is when you need to change the price of an already purchased product. Let's introduce (Fig. 12). Let’s assume that the price for one item “Low-fat cottage cheese” has changed.