Download the consumable form. Expense cash order: definition and nuances of filling. How to fill out RKO: difficult cases

Read also

A cash order is a document for the primary accounting of cash transactions, upon presentation of which cash is issued from the organization's cash desk.

Basic requirements of the Bank of the Russian Federation

Changes in the use of cash register systems, in particular, the introduction of online cash registers, entailed a number of adjustments in the procedure for recording cash transactions (instruction No. 4416-U dated June 19, 2017, which came into force on August 19, 2017). The procedure for conducting cash transactions with cash on the territory of the Russian Federation is established by the Bank of Russia. It is uniform and mandatory for legal entities.

It is necessary to establish a limit on the cash balance in the cash register by administrative document (order), which is calculated using a formula in accordance with the instructions of the Bank of Russia.

All cash transactions are documented using cash documents and reflected in the cash book. Operations for the receipt and expenditure of cash are recorded as receipt or expense cash orders (you can create one receipt and one expense order after the end of the shift).

Receipts and withdrawals of cash are reflected in the cash book, entries are made in it for each incoming and outgoing order. At the end of the working day, the cashier checks the cash in the cash register with the balance in the cash book and certifies the entries in it with a signature. If there is no movement of money through the cash register during the day, no entry is made in the book.

How are transactions processed?

According to the rules of the Bank of the Russian Federation, registration of cash settlements, cash registers and cash books is carried out on paper or in electronic form. Electronically executed documents cannot be corrected after signing. It is allowed to make corrections to paper documents by indicating the date of correction, signatures of the persons who compiled the corrected document with surnames and initials. The chief accountant oversees the maintenance of the book.

Individual entrepreneurs have the right not to draw up cash documents and not to maintain a cash book (clause 4.1 of Bank of Russia instructions 3210-U).

Cash transactions are carried out by a cashier appointed from among the employees of a legal entity or individual entrepreneur, or by the manager himself. Familiarization with responsibilities and rights is carried out against signature. The cashier has a seal with details (to confirm the transaction) and sample signatures of persons who are authorized to sign cash documents.

Let's take a closer look at the procedure for processing cash withdrawal operations from the cash register:

- depositing cash proceeds to a bank account;

- issuing wages and other payments to employees;

- issuance of accountable amounts, etc.

Procedure for processing transactions

|

Cash issuance report |

|

|---|---|

|

Delivery of cash proceeds to the bank |

|

|

Issuing cash for salaries |

|

|

Other issues |

|

All operations for issuing cash from the cash register are formalized with an expense order using a unified, optional for use from 01/01/2013, in accordance with Federal Law No. 402-FZ “On Accounting”, form No. KO-2. An expenditure order is issued with an entry made in the book on the day of the actual issuance of money.

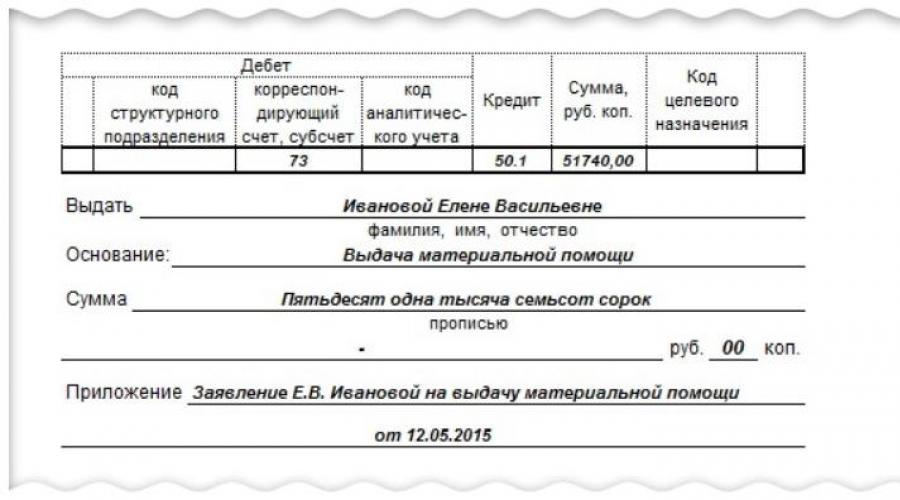

An example of filling out a cash receipt order

Order filling procedure

Now let's look at how to fill out a cash receipt order, step by step:

- In the line “Organization” the name of the legal entity is indicated in accordance with the data of the Unified State Register of Legal Entities. If an organization has branches, representative offices or other separate divisions, they are sometimes assigned codes. In this case, in the line “structural unit” the name of such unit is indicated in accordance with the constituent documents, and in the column “Code of structural unit” the code of such unit is indicated.

- Mandatory numbering of the expenditure order is not established by law. When deciding on numbering, the order should be established by a local act.

- The date of the order is the date the cash is issued from the cash register.

- The “Debit” column indicates the accounting accounts on which cash withdrawal transactions are to be reflected. Examples of operations are shown in the table below.

- In the “Credit” column, the cash flow account at the cash desk is indicated in accounting account 50.01 “Cash of the organization.”

- The amount of funds received is indicated in numbers in the column “Amount, rub. cop." and in words in the corresponding lines of the order. The entry is made from the beginning of the line with a capital letter.

- The column “Targeted Purpose Code” is filled in only if targeted funding has been received at the cash desk.

- In the “Issue” line, fill in your full name. recipient of the money.

- In the line “Base” - the content of the business transaction (for example, for crediting to the account of VID LLC in the bank PJSC Svet).

- In the line “Appendix” - the name and details of the primary documents (bill of lading, delivery and acceptance certificate, decision on the payment of dividends, order on the payment of financial aid, etc.).

- In the “By” line - the recipient’s passport details and details of the power of attorney (if any).

After issuing the money, the cashier signs the cash order and keeps it along with the original or a copy of the power of attorney (if the recipient acts on its basis).

An approximate list of entries reflecting the issuance of funds

Organizations that use special programs for accounting fill out the mandatory data on cash orders, taking into account the technical capabilities included in these programs. It is possible to fill out an expense cash order online using some online resources.

You can download the cash receipt order form in word and excel format from this article. We will also consider the filling procedure with RKO samples.

Read in the article:

The consumable is intended for processing the issuance of money from the cash register. All companies that pay in cash are required to compile it. This obligation does not depend on the legal form and taxation regime.

Expenditure cash order: form

RKO has the KO-2 form approved by law. Goskomstat established it on August 18, 1998 by resolution No. 88. Currently, the form looks like this:

Cash receipt form

Filling out a cash receipt order

The procedure for filling out the RKO form is established by the instructions of the Central Bank dated March 11, 2014 No. 3210-U (hereinafter referred to as the Central Bank Instructions).

Fill out the document in one copy. Compile it on paper and fill it out by hand, using a computer, or a combination of both. You have the right to use any ink for filling.

- A sample of filling out an expense cash order when depositing money at the bank

Please note: Central Bank instructions prohibit making corrections to cash documents.

The legislation does not strictly contain the order of numbering of RKOs. Therefore, you can use any continuous or non-continuous numbering method. As a rule, simple ascending numbering is used. The number can be supplemented with an alphabetic code or date.

Start filling in with the “Base” line. Enter a business transaction into it. For example, “Reimbursement of overexpenditure according to the advance report dated July 20, 2018 No. 198.”

The “Appendix” line must contain the number and date of preparation of the primary document and other documents (invoices, applications for the issuance of money, etc.).

Filling out the RKO lines “Base” and “Appendix”

Note: when issuing money to an employee on account, a cash order is drawn up on the basis of a written application from an individual in any form. In this case, the application must contain:

- the amount of money issued on account;

- the period for which the amount was issued;

- signature of the company director;

- date of application.

When issuing a general expense order, for example, for a shift, it is signed by the responsible employee, in particular the cashier. Enshrine this employee’s responsibility in the company’s local act.

The RKO form contains the signature details of the company director, chief or ordinary accountant and cashier. According to the Central Bank Directives, the document is signed by the director and accountant. But the manager may not put his signature when it is already on the appendices to cash register services (applications, invoices, etc.) and there is an accountant on staff. In the absence of an accountant, the director is obliged to endorse the expense order.

The director also has the right to delegate, by power of attorney, to sign the cash register on his behalf to another employee of the company.

The procedure for issuing money for consumables

This procedure consists of six stages.

At the first stage, the cashier checks the presence of all the necessary signatures in the cash register and their compliance with the samples available to him. He compares amounts in words and figures. They must match. Then he checks the presence of the documents specified in the consumables. After this, the cashier compares the recipient’s name in the order with his passport details.

The recipient's representative can also request money by proxy. Check with this person the power of attorney and passport. Make sure that the recipient's full name in the cash register corresponds to that specified in the power of attorney and passport details.

The power of attorney must be attached to the consumable. If it is issued for several payments or to receive money from several organizations, then make a copy of it. Certify the copy in accordance with the procedure established by the director of the company.

The second stage involves preparing the amount of cash for withdrawal and transferring the cash register to the recipient so that he puts his signature on it.

The third stage is the affixing of a signature by the recipient.

At the fourth stage, the cashier counts the money before issuing it so that the recipient can see this process. The cashier then gives the money to the recipient.

The fifth stage involves the recipient recalculating the money under the supervision of the cashier. Without this procedure, the recipient will be able to make a claim for the amount in the future.

At the last stage, the cashier puts his signature on the cash register.

Attached files

- RKO form in excel.xls

- RKO form in word.docx

- Sample of filling out RKO: matpomosch.xls

- Sample of filling out cash settlement when depositing money in a bank.xls

- Sample of filling out cash settlement when issuing money to an organization.xls

Every business owner must be aware of responsibility when using cash. The basis is the correct conduct of all actions with cash at the cash desk. In this regard, certain criteria must be strictly observed. Cash discipline provides for correctly executed documents and any cash flows of the enterprise. For example, to record all cash expenses, an appropriate document is used. Its significance is significant. This document is a cash receipt order. More on this later.

What is an expense cash order?

The answer to this question is simple. Among the main documents for recording cash movements, there are incoming and outgoing cash orders. They are absolutely not tied to the implementation of all accounting. For them, only paper media is used due to the fact that such papers require personal signature by responsible persons. This is important to know. Also, the cash receipt order must be signed by the entity receiving the funds. It should be noted that currently the law prohibits certifying these documents using an electronic digital signature.

Purpose

The expenditure cash order form is a certain stage in the registration of the issuance of funds from the cash register.

In this document, in addition to the amount, the identity of the recipient is also indicated, and the reasons for issuing the money are also noted. The form of this order (KO-2) is unique and approved for mandatory use by all individual entrepreneurs. It is used by organizations that have a cash register and carry out relevant operations using it. The expense order form does not apply to strict reporting and cannot replace it, however, it is subject to mandatory recording in the registration journal for expense and receipt cash orders.

Application

When filling out this document, you must adhere to certain rules. This action is regulated by Art. 14-21 “The procedure for conducting cash transactions in the Russian Federation.” It is possible to issue funds from the organization's cash desk only if the corresponding order is filled out in a certain way. It refers to invoices, payroll records and other related materials that are subject to strict accountability.

The cash receipt order must be signed by the persons responsible for maintaining this documentation. This is important to know. They mean the cashier, accountant and director of the company. It should be taken into account that the head of the organization cannot sign the specified form in the case when it is accompanied by certificates of work performed, invoices, statements and other materials that have his authorizing resolution. To receive funds under this order, the person issuing them (cashier) must present a passport or other document that identifies the recipient. This is an important condition. In this case, passport data is indicated in the KO-2 form. Also in this case, the recipient will be required to write a receipt for receipt of funds. Its presence is mandatory. If the specified order is issued without it, then the funds issued by the cashier will be considered a shortage, as a result of which they will be charged in full from the responsible person. Also, using the specified order, it is possible to receive cash by proxy. In this case, the form indicates the full last name, first name and patronymic of the recipient. According to form KO-2, money can be issued already on the day of drawing up this document. The specified form is completed in one copy. It is stored at the enterprise. It is also necessary to register the cash receipt order in the KO-3 journal.

Filling procedure

There is a document that indicates all the features of filling out the form. The procedure for conducting cash transactions in the Russian Federation determines all aspects of the execution of cash orders. Only managers, senior accountants or individual entrepreneurs can fill out and sign the indicated banks. It is allowed to draw up a cash order using typewritten text. But the laws of the Russian Federation do not say about restrictions on the form of completion. This means that handwritten text is also allowed. Only it should be readable. If an order is filled out incorrectly, it is considered invalid. Particular attention should be paid to the “Bases” column. This is important to consider. Statistics show that it is often not taken into account. But it, like the others, is required to be filled out and forms a very important part of the order. If this column is based on salary, then all taxes and payments must be taken into account.

How to fill out an expense cash order?

There is nothing complicated here. Do you need to fill out an expense order? The form in this case contains the following columns:

As a rule, numbering starts from one from the beginning to the end of the year.

In the “Date of compilation” column, you need to enter the date when the money will be issued from the cash register.

- “Debit” - the number of the corresponding account taking into account the funds. Can take on different meanings depending on where the money goes.

- “Credit” is a cash account.

- “Amount” - the amount of cash to be issued (indicated in numbers).

- “Issue” - data and full name are indicated here. recipient.

- “Base” - the essence of the operation is displayed. That is, on the basis of what the money should be issued. For example, payment of salaries.

- “Amount” - the amount of cash to be issued (indicated in words).

- “Appendix” - a list of all additional documents is provided: those materials that are attached to this form are indicated. In this column you must indicate the document number and date in full.

The recipient is required to write down the full cash amount in words. You must also sign and date it. Then a document confirming the identity of the recipient is indicated.

Filling Features

Many sources provide step-by-step instructions on how to draw up a cash receipt order. However, not all entrepreneurs treat this with great responsibility, taking into account all the features of the process. For example, filling out a cash order occurs only before cash is issued. We must not forget that the required amount of money is recorded by the recipient himself. This point in most cases is violated by the individual entrepreneur himself. You should also remember that the indicated amount is entered in printed form. When receiving money by proxy, you also need to be careful when filling out the form. This process must be clearly described in the document. Under no circumstances should there be duplicate cash orders. It is made in a single copy. Corrections or erasures are strictly prohibited. Since the order is an official document, the seal is a mandatory attribute. But when creating a RKO, it is not necessary. Especially if other documents certified by a seal are attached to it (these may include primary accounting materials). The seal becomes unnecessary when funds are received from a legal entity.

Nuances

The salary cash order needs to be correctly filled out and drawn up. Each employee of the enterprise can be issued a salary according to an individual cash order. However, there is another option. It provides that a list of several recipient employees can be compiled for one order. But in this case, the amount available for payment is indicated for each of them. From such a correctly completed order, a corresponding statement can be created.

Results

We looked at the special aspects of drawing up such a document as an expense cash order. It will be useful for all individual entrepreneurs to have a ready-made sample with the fields correctly filled out. It is necessary to study all aspects of its design. Initially, correct preparation of this document will simplify calculations and avoid problems during inspections. This is one of the most important factors in doing business.

Expense cash order in form KO-2 is an accounting document with the help of which funds are issued from the cash desk of an enterprise (organization). A unified form of the cash register form is used, OKUD code 0310002. The document is drawn up depending on the procedure for conducting cash transactions at the enterprise. The order is filled out in a single copy by an accounting employee or another authorized person.

After completion, the document is registered (as well as) in the registration journal according to form KO-3. As a rule, documents that are the basis for issuing funds are attached to the cash order. However, it is worth noting that if the documents attached to the order bear the signature of the manager, then it is no longer required for RKO.

The procedure for registering an expense cash order in 2020

Several employees of the enterprise involved in the issuance and receipt of funds take part in filling out the cash receipt order. So, when filling out an order, you should adhere to the following instructions:

- the “Organization” field must contain the name of the business entity, and the “Structural unit” column - its unit that issued the order. If there is no such structural unit, then a dash is placed in the column;

- in the lines “Document number” and “Date of compilation” the order number is entered according to the registration journal in the KO-3 form, as well as the date of its compilation in the format DD.MM.YYYY;

- the “Debit” column contains the code of the structural unit in which funds are issued (if there is none, a dash is placed), the number of the corresponding account, subaccount, the debit of which shows the expenditure of funds from the cash register, as well as the analytical accounting code for the corresponding account (a dash – if such codes are not used in the organization);

- the line “Credit” displays the number of the accounting account on the credit of which funds are issued. As a rule, this is a 50 "Cash" account;

- In the “Purpose Code” field, a code is entered that reflects the purpose of using the funds issued from the cash register. If such codes are not used at the enterprise, a dash is added;

- the line “Issue” contains the last name, first name, patronymic of the person to whom this money is issued;

- the line “Base” displays the content of the business transaction. For example, an advance for travel expenses, provision of financial assistance, etc.

- the amount of funds issued is displayed in the “Amount” line and must be entered in words. If after entering there is still free space on the line, you should put a dash;

- the “Appendix” field displays the details of the primary documents that serve as the basis for issuing funds from the cash register.

After filling out the above information, the signatures of the chief accountant and the head of the enterprise are affixed with their transcripts. Then follow the lines filled in by the person who receives these funds. In the line “Received” the amount of funds received from the cash register is indicated in words, the date of receipt and the signature of this person are indicated under it.

After issuing the money, the cashier of the enterprise, in the lines provided for this, indicates the name, number, date, and place of issue of the document that identifies the person who received the money from the cash register. Below is the cashier's signature with its transcript. The cashier of the enterprise is obliged to check the document for correctness and cancel the attachments to it with the “Paid” stamp or the stamp of the enterprise with a date. After repayment, the expense cash order remains in the enterprise's cash desk. When repaying overexpenditures, the basis for issuing the amount of money for cash settlements from the cash desk is the report of the accountable person.

Cash transactions in the Russian Federation are regulated by Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. The procedure for settlements with accountable persons is set out in paragraph 6.3 of the Instructions. The basis for issuing cash from the company’s cash desk may be:

- administrative document of the manager;

- statement of the accountable person, certified by the signature of the manager.

RKO form

To issue cash from the organization's cash register, an expense cash order is issued. From January 1, 2013, in connection with the entry into force of the Law on Accounting No. 402-FZ, the approved forms of the State Statistics Committee of the Russian Federation are not mandatory for use. But there are exceptions for documents that are approved by authorized bodies in accordance with other federal laws (Information of the Ministry of Finance of Russia No. PZ-10/2012). Thus, the exception includes forms of cash documents, the use of unified forms of which is prescribed in Directive No. 3210-U.

Form RKO 0310002 was approved by the State Statistics Committee of the Russian Federation in Resolution No. 88 dated August 18, 1998 and is mandatory for use for processing expense cash transactions.

Cash receipt form

RKO for report. Sample

Let's look at the example of filling out cash registers in a sub-report.

LLC "Company" sends manager Pyotr Aleksandrovich Vasechkin on a business trip. Based on Order No. 110 of September 11, 2017 on sending on a business trip, the employee must be given money for travel expenses in the amount of 5,000 rubles.

RKO can be filled out by hand or using software and hardware:

- document number and date;

- name of the organization and its structural unit;

- FULL NAME. the employee to whom the funds are issued;

- basis for issuance;

- amount to be disbursed;

- identification document of the recipient;

- accounting and analytical accounts.

When receiving funds, the employee must fill out the amount received by hand, sign and date it received.

Sample of filling out RKO in a report

Reimbursement of expenses to an accountable person

When making settlements with accountable persons, situations are not uncommon when the accountable person spent more money than he initially received on account. Situations also arise when an employee was forced to spend his own money without initially receiving an advance for travel expenses.

In such a situation, after the employee’s advance report has been received, verified and approved by the manager, the overexpenditure must be reimbursed. This can also be done by issuing funds to the accountable person from the cash register according to an expense cash order, indicating in the basis “reimbursement of overexpenditure according to the advance report.”