Sanctions for late submission of tax reports. What is the penalty for late submission of a declaration?

Read also

The company does not conduct business activities, movements Money no bills. If I did not submit a single (simplified) declaration within the prescribed period, what consequences might this entail?

When is a single (simplified) declaration submitted?

According to paragraph 2 of Art. 80 of the Tax Code of the Russian Federation, a single (simplified) tax return is submitted to the tax authority at the location of the organization or place of residence individual no later than the 20th day of the month following the expired quarter, half-year, nine months, or calendar year.

It can only be submitted if the following conditions are met:

The organization (entrepreneur) does not have objects of taxation for taxes in respect of which it (he) is recognized as a taxpayer;

During the reporting period, there were no transactions that resulted in the movement of funds in bank accounts (at the organization's cash desk).

If at least one of these conditions is not met, a single (simplified) declaration cannot be submitted, and reporting must be done by filing returns for specific taxes.

The tax authorities do not monitor the taxpayer’s availability of taxable items in the current reporting period, as well as the movement of funds in his accounts (at the cash desk). Therefore, they do not know whether a company that is not in business should report current reporting period a single (simplified) declaration or is required to submit declarations for specific taxes. In this regard, the following situations are possible:

1) the company, after the expiration of the established deadlines, did not submit either “zero” declarations or a single (simplified) declaration;

2) the company submitted a single (simplified) declaration, but in violation of the deadline.

Declarations not submitted

In letter dated November 26, 2007 No. 03-02-07/2-190, the Russian Ministry of Finance indicated that in the case where the taxpayer is obliged to file tax return in relation to a specific tax has not completed and submitted a single (simplified) tax return, the tax authority has the right to require him to submit in the prescribed manner tax return for a specific tax. And in this case, failure to submit such a declaration is the basis for bringing him to justice under Art. 119 of the Tax Code of the Russian Federation.

Let us recall that Art. 119 of the Tax Code of the Russian Federation provides for a fine in the amount of 5% of the amount of tax not paid within the prescribed period on the basis of the declaration for each full or less than a month from the date established for its presentation, but not more than 30% of the specified amount and not less than 1000 rubles. Plenum of the Supreme Arbitration Court of the Russian Federation in paragraph 18 of Resolution No. 57 dated July 30, 2013 “On some issues arising when applying arbitration courts part one Tax Code Russian Federation» explained that the absence of a taxpayer’s arrears on the declared tax or the amount of tax payable under the relevant declaration does not relieve him of liability. In this case, established by Art. 119 of the Tax Code of the Russian Federation, the fine is subject to collection in a minimum amount of 1000 rubles.

Thus, if a company, after the deadline for filing specific tax returns for the corresponding period, has not submitted either a single (simplified) return or “zero” returns, the tax authorities may fine it for failure to submit “zero” returns in the amount of 1,000 rubles. for each.

Please note that if returns are not submitted to the tax authority within ten days after the deadline for filing returns for specific taxes, tax authorities have the right to suspend transactions on the organization’s accounts. This is provided for in sub-clause 1 clause 3 art. 76 Tax Code of the Russian Federation. Moreover, such a measure can also be applied in cases where the taxpayer does not have the amount of tax to pay based on the results of a specific tax period (resolution of the Federal Antimonopoly Service of the West Siberian District dated June 27, 2012 in case No. A45-16695/2011).

Simplified declaration submitted late

Now let's look at the consequences that occur when a single (simplified) declaration was nevertheless submitted, but in violation of the deadline.

According to the Ministry of Finance of Russia (letter dated July 3, 2008 No. 03-02-07/2-118), for failure to submit a single (simplified) declaration on time, you can only be fined under clause 1 of Art. 126 of the Tax Code of the Russian Federation. This provision provides for liability for failure to provide the tax authority with information necessary for tax control in the form of a fine of 200 rubles. for each document not submitted. The financiers justified their conclusion as follows. A single (simplified) tax return is inherently different from a tax return, which is a written statement by the taxpayer for a specific tax on the corresponding object of taxation, tax base, tax benefits, about the calculated amount of tax and (or) about other data serving as the basis for the calculation and payment of this tax. Article 119 of the Tax Code of the Russian Federation establishes liability for failure to submit a tax return for a specific tax in the form of a fine, a multiple of the amount of this tax, subject to payment (surcharge) on the basis of this declaration. Therefore, its provisions are not applicable to a situation where a single (simplified) declaration is not submitted on time.

The courts do not support the financiers' position. Thus, the FAS of the East Siberian District, in a resolution dated April 28, 2012 in case No. A69-1871/2011, considered the situation when tax authorities fined an organization under paragraph 1 of Art. 126 of the Tax Code of the Russian Federation for late delivery a single (simplified) declaration. The court considered the application of this rule unfounded. In his opinion, a single (simplified) tax return is a tax return of a simplified form for taxpayers specified in paragraph 2 of Art. 80 Tax Code of the Russian Federation. The Tax Code provides for a special rule on liability for failure to submit a tax return - Art. 119 of the Tax Code of the Russian Federation. Therefore, for failure to submit a single (simplified) declaration on time, it should be applied, and not Art. 126 of the Tax Code of the Russian Federation.

AS of the Volga-Vyatka District in the recommendations of the Scientific Advisory Council “Issues of the application of tax legislation” (approved by the decision of the Presidium of the AS of the Volga-Vyatka District, protocol dated June 17, 2015 No. 3) answering the question under which article of the Tax Code of the Russian Federation the offense is subject to qualification, expressed in the failure to submit a single (simplified) tax return within the prescribed period, gave a clear answer - this offense is punishable under paragraph 1 of Art. 119 of the Tax Code of the Russian Federation with a fine of 1000 rubles. A similar conclusion is contained in the decisions of the Moscow District Arbitration Court dated January 26, 2015 No. F05-16047/2014 in case No. A40-26633/2014, the FAS East Siberian District dated May 12, 2012 in case No. A69-1872/2011.

Please note: if a single (simplified) declaration is submitted after the deadline for submitting returns for specific taxes, but before the tax authority makes a decision to prosecute for failure to submit “zero” returns, the fine will also be 1,000 rubles. An analysis of arbitration practice shows that in such a situation, tax authorities will fine precisely for failure to submit a single (simplified) declaration on time, and not for failure to submit “zero” declarations (resolution of the Federal Antimonopoly Service of the North-Western District dated April 30, 2014 No. F07-2761/2014 in the case No. A56-63059/2013, dated 09/06/2010 in case No. A05-19520/2009).

M.G. Sukhovskaya, lawyer

Penalty for being late in submitting a zero declaration: how to reduce it or not pay at all

A sample petition to take into account mitigating circumstances can be found: section “Document Forms” of the ConsultantPlus systemAs you know, even if at the end of the tax period the amount of tax payable is zero, you still need to submit a return on time for those taxes for which the organization or entrepreneur is a taxpayer and clause 1 art. 80 Tax Code of the Russian Federation. Failure to submit it on time will result in a fine of 1,000 rubles. clause 1 art. 119 Tax Code of the Russian Federation; clause 18 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57 (hereinafter referred to as Resolution No. 57); Letter of the Ministry of Finance dated February 16, 2015 No. 03-02-08/6944 This is the minimum amount of the sanction established in the Tax Code. But it can also be reduced several times, and sometimes a fine can be avoided altogether.

For late submission of advance payments based on the results of reporting periods, you can't fine as for late filing of a declaration, even if the calculation is called a declaration (for example, as in the case of income tax b) paragraph 17 of Resolution No. 57; Letter of the Federal Tax Service dated August 22, 2014 No. SA-4-7/16692; Resolution 7 AAS dated 05/06/2015 No. 07AP-2591/2015. In this situation, a fine is imposed under paragraph 1 of Art. 126 Tax Code of the Russian Federation - 200 rubles. for each payment submitted too late.

METHOD 1. Submit a petition to the Federal Tax Service or the court to take into account mitigating circumstances

If there is at least one such circumstance, the tax penalty must be reduced by at least two times clause 3 art. 114 Tax Code of the Russian Federation. And on minimum dimensions fines, as in our case, this rule also applies clause 18 of Resolution No. 57; Letter of the Ministry of Finance dated June 18, 2015 No. 03-02-08/35141.

We wrote in detail about what tax mitigating circumstances there are and how to claim them:Note that a double reduction of the fine is not the limit; the court has the right to reduce the fine by more than half clause 19 of the Resolution of the Plenum of the Supreme Court No. 41, Plenum of the Supreme Arbitration Court No. 9 of 06/11/99. There are solutions in which the 1000-rub fine for failing to pass a zero on time was reduced by 10 times (to 100 rubles). see, for example, Resolution of the AS UO dated 03/03/2015 No. F09-699/15; FAS North Caucasus Region dated April 30, 2014 No. A53-5736/2013, and even 20 times (up to 50 rubles) see, for example, Resolution 20 AAS dated March 18, 2014 No. A09-2661/2013. But the court is unlikely to agree to reduce the fine to zero, since this will actually be a release of the involved person from tax liability and Appeal ruling of the Supreme Court of the Republic of Karelia dated January 22, 2013 No. 33-199/2013.

As circumstances mitigating liability for such a violation, the following can be stated: clause 1 art. 112 Tax Code of the Russian Federation; Resolution 7 of the AAS dated September 17, 2014 No. A27-17853/2013; 2 AAS dated January 11, 2013 No. A82-7050/2012; 3 AAS dated May 30, 2013 No. A74-4605/2012, dated January 23, 2013 No. A74-1981/2012; 8 AAS dated July 10, 2015 No. 08AP-5698/2015:

- committing an offense for the first time and unintentionally;

- absence negative consequences for the budget;

- short period of delay;

- social significance of the offender’s activities;

- belonging to small businesses;

- difficult financial situation.

When applying to the Federal Tax Service or the court for the application of mitigating circumstances, it is better to declare them “in bulk”, in the aggregate. The more circumstances you indicate, the higher the chances that the fine will be reduced.

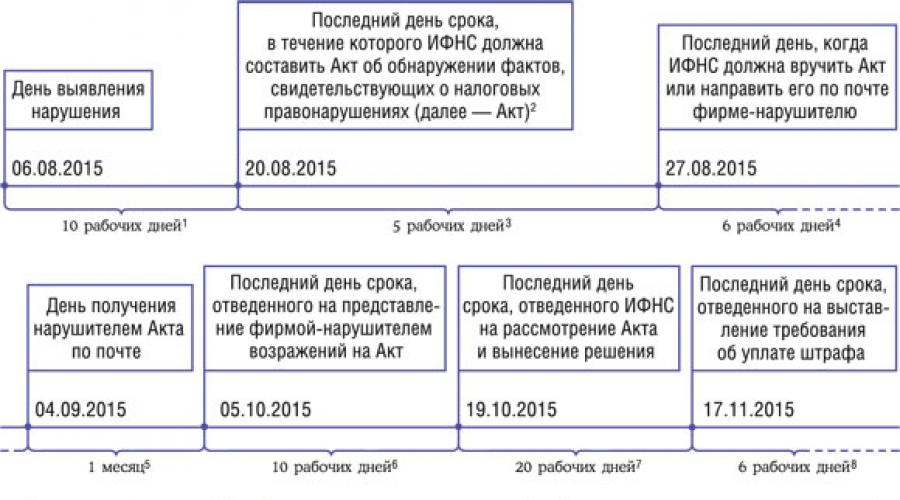

METHOD 2. Convict the inspectorate of violating procedural deadlines and, as a result, missing the total deadline for collecting a fine

To understand how to do this, you need to know the rules for calculating this cumulative period. Let’s say a company submitted a zero income tax return for 2014 not on March 30, as it should have clause 4 art. 289 Tax Code of the Russian Federation, and August 6. A violation such as failure to submit a tax return on time must be processed and processed in the manner provided for in Art. 101.4 Tax Code of the Russian Federation clause 2 art. 100.1 Tax Code of the Russian Federation; clause 37 of Resolution No. 57. Which means the chain procedural deadlines will look like this:

1clause 1 art. 101.4, paragraphs. 2, 6 tbsp. 6.1 Tax Code of the Russian Federation; 2Appendix No. 38 to the Order of the Federal Tax Service dated 05/08/2015 No. ММВ-7-2/189@; 3paragraph 29 of Resolution No. 57; pp. 2, 6 tbsp. 6.1 Tax Code of the Russian Federation; 4clause 4 art. 101.4 Tax Code of the Russian Federation; 5clause 5 art. 101.4, paragraph 7 of Art. 6.1 Tax Code of the Russian Federation; 6clause 6 art. 101.4 Tax Code of the Russian Federation; 7clause 2 art. 70, paragraph 10, art. 101.4 Tax Code of the Russian Federation; 8clause 6 art. 69 Tax Code of the Russian Federation; 9clause 4 art. 69, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation; 10clause 1 art. 115, paragraph 3 of Art. 46 Tax Code of the Russian Federation

And if the Federal Tax Service Inspectorate files a claim after 06/07/2016, then it will not be satisfied due to the missed statute of limitations for collecting a fine. clause 1 art. 115 Tax Code of the Russian Federation; Resolution of the FAS VSO dated November 18, 2013 No. A74-702/2013.

What do inspectors do? They follow the recommendation of the Federal Tax Service, according to which even if a tax violation consists only of submitting a declaration late, it must still be drawn up desk inspection report and Letter of the Federal Tax Service dated July 16, 2013 No. AS-4-2/12705 (clause 1.6).

Let us remind you that the inspectorate has 3 months and 10 working days from the date of submission of the declaration clause 1 art. 100, paragraph 2 of Art. 88 Tax Code of the Russian Federation. And to draw up an act in accordance with Art. 101.4 Tax Code of the Russian Federation - 10 working days from the date of discovery of the violation clause 1 art. 101.4 Tax Code of the Russian Federation(in this case, this is the day the declaration is submitted to the Federal Tax Service after the deadline). Do you feel the difference?..

ATTENTION

Arguments about tax authorities’ failure to comply with the deadline for drawing up a report can only be made in court about clause 31 of Resolution No. 57:

- <или>as an objection to the claim that the inspectorate filed according to the rules of Art. 46 Tax Code of the Russian Federation;

- <или>when challenging a request received by a taxpayer to pay a fine or a decision to collect it.

Drawing up a desk audit report seems justified only if the Federal Tax Service actually carried out such an audit, that is, checked the correctness of calculation of the tax declared in the declaration, requested explanations for identified errors or supporting documents, and carried out other control measures. In this case, the list of verified documents and information about the activities carried out must be indicated in the act clause 3.1 of the Requirements (Appendix No. 24 to the Order of the Federal Tax Service dated 05/08/2015 No. ММВ-7-2/189@).

If the “cameral” act only indicates a violation under paragraph 1 of Art. 119 of the Tax Code of the Russian Federation and there is no information about violations identified during the inspection and (or) about the implementation of measures aimed at identifying them, then you need to keep in mind the following.

According to the Tax Code, a desk audit report is drawn up only if violations of tax laws are identified during such an audit. clause 1 art. 100 Tax Code of the Russian Federation. The fact of violation of the deadline for submitting the declaration is revealed not during the chamber meeting, but directly on the day of its untimely submission to the Federal Tax Service. And identifying this fact does not require a desk audit (especially for a “zero”), because you just need to compare the deadline for submitting the declaration established in the Tax Code with the date of its actual submission.

As you can see, even the minimum fine can be reduced to almost nothing, but this will require some effort.

Taxes make up a significant part state budget. Arrears threaten crisis situations V social sphere. The law provides penalties for those who refuse to submit timely reports on financial indicators. The types of punishment depend on the category of violation.

Why are declarations not submitted on time? This is facilitated by two factors: human and technical.

- Examples of the first are ignorance of the obligation to submit tax documentation, irresponsible attitude or forgetfulness.

- Technical factor. Submission of the declaration is postponed until last day and because of banal queues it is not possible to meet the last date.

However, neither one nor the other fact is a mitigating factor when imposing a fine for late filing of a tax return.

Responsibility for late submission of the declaration

Punishments are regulated by Art. 119 of the Tax Code of the Russian Federation. According to its rules, failure to appear with a declaration within the established period entails payment of 5% of the amount indicated in the unsubmitted report. It is paid for each month of delay. If there is an intermediate period, which in terms of days does not reach the calendar month, then it is also counted as a month.

The total amount of fines cannot exceed 30% of the tax amount. If the penalty amount is calculated to be more than 30%, then the payment is limited to the maximum allowable 30%. But the fine for late submission of the declaration cannot be less than 100 rubles.

Depending on the period of delay, the fines increase. If the delay period is more than 180 days, then more stringent measures are applied. In particular, you will have to pay 30% of the tax amount indicated in the declaration and for each month of delay 10% of the amount of tax lost by the state. The countdown starts from the 181st day of delay.

How to avoid a fine?

Reports to the tax authorities are accepted in two ways: on paper and in in electronic format. In what form to submit is at the taxpayer’s choice. However, this point will help save you from penalties legally.

Let’s say that the company “TriA” does not have an accountant and at the time of the deadline for submitting declarations it was not possible to generate reports. In this case, the head of the company can appear at the tax office with a basic declaration, check in with the inspector, and then “finish” full version electronically. Even correct option arrives later than the deadline, does not entail punishment or fines. According to the law, the penalty for late filing of a tax return affects only the filing deadlines, and not the form and methods.

What to do with a zero declaration?

A declaration with zero indicators also implies “zero taxes,” that is, there is no basis for their calculation. Accordingly, there is no basis for a fine for failure to submit a declaration. In practice, there are two opposing opinions.

- The taxpayer is obliged to pay a minimum fine of 100 rubles, since there is a fact of violation of the deadlines.

- Art. 119 of the Tax Code of the Russian Federation refers to the tax amount that the declaration reveals. If it is not there, then it is impossible to generate a fine.

Arguments taken from judicial practice and confirmed by official Resolutions of the relevant authorities. Following this logic, we can conclude that liability for failure to submit a tax return with zero indicators does not imply penalties.

Other nuances

There are taxpayers who have no debt, but on the contrary, the tax authorities “owe” them a certain amount. This situation occurs when you overpay. Could such a factor serve as a mitigating condition?

The method of calculating the fine deserves special attention. The law does not provide clear regulations, so in practice two opposing opinions have emerged.

- If the subject does not have tax debts, then Part 1 of Art. 119 of the Tax Code of the Russian Federation. According to it, the company is required to pay a fine of 100 rubles.

- Full implementation of Art. 119, according to which claims are directed at the deadline for delivery, and not at the indicators of the declaration. From this point of view, the company can be assessed a fine depending on the length of the delay.

However, business entities have the opportunity to prove their case and avoid paying a fine. The legal basis should be Letter of the Ministry of Finance 03-02-07/1-33 of 2008.

Administrative responsibility

Imposing a fine on a company for late submission of a declaration does not relieve its managers from administrative liability. This aspect is established based on the provisions of the Code of Administrative Offenses of the Russian Federation. IN in this case Art. is enforced. 15.5. On its basis, the manager or other executive undertakes to pay a fine in the amount of 300 to 500 rubles. The case qualifies as execution official duties in an inappropriate manner. Also, the legal basis for holding managers accountable is the Letter of the Moscow State Tax Service dated August 2008 14/081895.

Fines in postings

Under what heading should the paid fine for late declaration be written off? The amount of the fine should be charged to the debit side of account 99 “Profits and losses”. The corresponding correspondence will be account 68 for the loan. Its name corresponds to the content - “Calculation of an enterprise for taxes and duties.”

In practice, a declaration is generated first, and the amount of the fine is determined later. Making appropriate adjustments to the declaration does not lead to a complete change in the accounting data indicators. If we consider the fine in part tax accounting, then the penalty amount is not taken into account as part of the income tax base.

Violation of deadlines for submitting reports to the inspection (or failure to submit reports at all) is a fairly common phenomenon, explained by constant changes in the deadlines and procedure for their submission.

IMPORTANT! Do not forget that if the last day for filing reports falls on a Sunday or a non-working national holiday, then it is shifted to the next working day following this weekend or holiday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Read more about the rules for determining the deadlines for paying various taxes in the material “What you need to know about tax payment deadlines” .

Amounts of fines for failure to submit reports to the tax authorities

Clause 1 Art. 119 of the Tax Code of the Russian Federation states that a delay in submitting a tax return or calculating insurance premiums threatens the taxpayer with a fine of 5% of the amount of tax or contribution that was not paid on time, for each full or partial month of delay. Wherein minimum amount fine - 1 thousand rubles, the maximum is limited to 30% of the unpaid amount of tax or contribution taken from the report data.

IMPORTANT! In the absence of tax activities that do not involve failure to submit reports in the absence of an object of taxation, a zero tax return must be submitted. Its absence will entail a fine of 1,000 rubles. (letter of the Ministry of Finance dated October 7, 2011 No. 03-02-08/108).

Is it necessary to submit a zero calculation for insurance premiums, read.

In addition, according to paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, inspectors can charge 200 rubles for failure to provide information necessary for the implementation of tax control functions (for example, a 2-NDFL certificate). (for each certificate not submitted). And for late submission of form 6-NDFL, the same article of the Tax Code of the Russian Federation provides for a fine of 1,000 rubles. for each month of delay.

IMPORTANT! Unlike other reports, which can be submitted on paper or via telecommunication channels (TCS), the VAT return since 2015 has been submitted only electronically. Now, even a timely prepared and submitted declaration for this tax in paper form is considered unsubmitted (clause 5 of Article 174 of the Tax Code of the Russian Federation). For other reporting forms, violation of the delivery method (on paper instead of TKS) will result in a fine of 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation).

The above penalties are imposed on the taxpayer. But the official also risks receiving a warning or a fine - it ranges from 300 to 500 rubles. (Article 15.5, 15.6 of the Code of Administrative Offenses of the Russian Federation).

The most unpleasant thing that can result from late submission of reports is the blocking of current accounts. This can happen if a tax return is not filed within 10 days of its due date. All current accounts are blocked, including foreign currency ones, even if they are in different banks. This right inspection is provided for in paragraph 3 of Art. 76 Tax Code of the Russian Federation.

NOTE! Tax officials do not have the right to block a taxpayer’s current account for unsubmitted calculations of advance payments for income tax (decision of the Supreme Court of the Russian Federation dated March 27, 2017 No. 305-KG16-16245).

Penalty for late submission of declaration established by current tax legislation. Responsibility arises in relation to persons who, for any reason, violate the deadlines for submitting documents of this kind. Let's discuss who has the right to apply such fines and what the size of the sanctions imposed for this violation is.

Who has the right to apply fines for failure to file a declaration?

In case of violation of the deadline for filing a tax return, liability arises under Art. 119 of the Tax Code (hereinafter referred to as TC). According to this rule of law, the body authorized to receive and process information reflected in tax returns has the right to apply sanctions to those responsible in the form fine for late submission of declaration.

Such punishment may be applied by territorial tax authorities in relation to taxpayers located within the territory of their jurisdiction.

When does liability arise for violation of deadlines?

The above-mentioned article of the Tax Code of the Russian Federation provides for the possibility of applying sanctions against taxpayers if they violate the deadlines for filing a declaration. What should be considered a violation of such deadlines? Based on this rule of law, only cases where the taxpayer fails to submit a declaration within the prescribed period fall within the scope of the article, as a result of which the requirements of the law are violated.

At the same time, the article does not provide for liability for submitting reports in an outdated (no longer valid) form. If the declaration was submitted, but was returned for redoing, then this is not considered a failure by the taxpayer to fulfill his obligation to meet the deadlines - which means that sanctions will not be applied either. If the taxpayer fills out the form improperly or does not provide reliable information in full (necessary for calculating the tax), his actions cannot be regarded as the timely fulfillment of his duties. Such a taxpayer can be held liable under Art. 119 of the Tax Code of the Russian Federation.

Important: specified legal norm applies provided that the obligation to file a tax return will still be fulfilled, albeit late, since liability for failure to file a return is already provided for in Art. 126 of the Tax Code of the Russian Federation.

The Ministry of Finance of Russia to cases of application of Art. 119 of the Tax Code also includes those when the taxpayer submits a tax return in violation of the established deadline, but the amount of tax payable is transferred in full and on time.

It should also be noted that the Ministry of Finance points out the need for timely submission of reports even when the organization actually has no tax to pay. Otherwise, even persons who are not debtors will be held liable in the form of a fine. And the reason in this case is similar - for violation of financial discipline.

It is necessary to point out one more feature: since 2014, the indication of the subject of the offense has been excluded from the article (previously, this was directly indicated in Part 1 of Article 219 of the Tax Code of the Russian Federation - the taxpayer). This, in turn, means that now it is possible to attract under this article both tax agents for VAT and persons who are not its payers, but highlight the amount of value added tax in the issued invoices.

What is the proper way to file a return?

Currently, in order to properly fulfill your obligation to submit a tax return, it must be submitted to the tax authority in one of the following ways:

- Personally (that is, tax reporting is submitted by a person who, by virtue of his position, is authorized to represent the interests of the taxpayer when filing returns).

- Through a representative, whose role may be any person authorized to submit a declaration by issuing him an appropriate power of attorney (or authorized in another manner provided by law, for example, by concluding a service agreement, etc.).

- By mail (registered by post). If you decide to submit your declaration by mail, you must send it not just by registered mail, but also with a notification of delivery and an inventory of the contents. Otherwise, it will be almost impossible to prove the proper fulfillment of one’s obligation to submit the declaration in a timely manner. In this case, the day of fulfillment of the obligation to submit this document should be considered the date of acceptance indicated on the postal stamp.

- Via electronic communication channels (if such a method is specifically provided for by regulations).

We have selected excellent electronic reporting services for you!

Amounts of fines for late submission of documents

The penalty for late filing of a tax return is 5% for each month (full and partial) of delay of the amount of unpaid tax due. Concerning maximum size fine, then it cannot exceed 30% of the amount of the accrued tax (but cannot be less than 1000 rubles).

If the calculation is not submitted to the tax authority on time financial result investment partnership by the managing partner (provided that he is responsible for maintaining tax records), he may be subject to a fine of 1,000 rubles for each full and partial month of delay.

It should be noted that penalties in the amount of 200 rubles are provided for in Art. 119.1 and 119.2 for persons who do not comply with the established electronic procedure for submitting reports (calculation) in cases stipulated by tax legislation. For managing partners who submitted a calculation with false information, the fine is 40 thousand rubles. If the same actions were committed intentionally, the fine increases to 80 thousand rubles.