RKO form sample to fill out. Expense cash order: example of filling, form. Examples of filling out cash registers by an organization

Read also

The main form drawn up when issuing cash from the company's cash desk is a cash expense order (RKO). It must be filled out every time money is spent in the course of business or other activities. The procedure for conducting cash transactions allows only entrepreneurs who keep records in a simplified version not to use cash settlement services.

The regulatory act that came into force in 2014 determines that you can use not only the standard KO-02 form, but also your own forms developed taking into account the needs and characteristics of the activity.

An expense order can be drawn up by an accountant, including a chief accountant, a cashier, the head of a company (if there is no accounting department at the enterprise) or a hired specialist hired under a contract. In this case, all necessary signatures are affixed by the director of the organization.

A form purchased from a printing house or filled out using specialized programs can be used. The consumable must not contain any corrections, otherwise it is considered invalid. If an error is made, the document must be reissued in the correct version.

The basis for spending money, with the exception of salary, is the employee’s statement, signed by the director of the company, indicating the direction of spending.

The issued form is presented to the cashier, who accepts it and checks that it is filled out correctly and that all required signatures are present. Then he records it in the log book.

Before issuing cash, the official must request an identification document from the recipient. After checking with him, the cashier enters the details of the passport or other document in the appropriate fields. Then the cash register employee transfers the funds to their recipient, who needs to count them and, if the amount is correct, sign for the consumables.

Important! If money is issued to an authorized person, then the power of attorney is checked along with the passport, after which it is attached to the cash register.

Employees can be paid according to payroll or payslips. In this case, when closing them, expense orders for the total amounts are also drawn up. The document is then handed over to the cashier, who stamps it “Paid.” Together with the cashier's report at the end of the day, the cash register is submitted to the accounting department.

Please pay attention! Employees who were given money for or for business expenses must report on the fact of their expenditure. Acceptance of money at the cash desk is carried out on the basis.

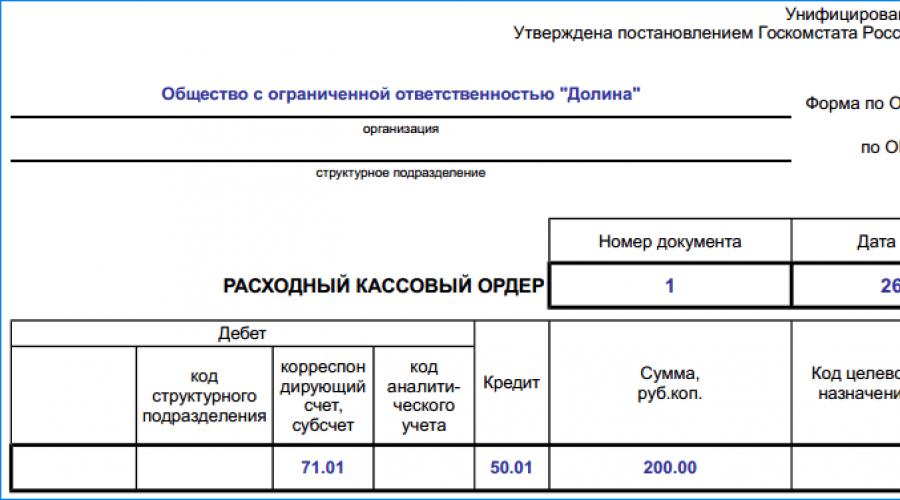

Expense cash order sample filling

Let's look at a sample of filling out the RKO.

At the top of the document is written the name of the company and its code according to the OKPO directory. If the form relates to a specific department, then its name must be indicated below. Otherwise, “-” is placed here.

To the right of the title of the document “Cash expenditure order” the serial number and the date of its execution are written down. The latter should look like DD.MM.YYYY.

The following table contains accounting data - corresponding debit and credit accounts, codes of structural divisions and analytical accounting - if they are used in the enterprise. Then the RKO amount is written down in numbers. The “Purpose Code” field should be filled in only if the company has developed and uses the necessary coding system.

The following table contains accounting data - corresponding debit and credit accounts, codes of structural divisions and analytical accounting - if they are used in the enterprise. Then the RKO amount is written down in numbers. The “Purpose Code” field should be filled in only if the company has developed and uses the necessary coding system.

In the “Issue” field, write your full name. the person to whom funds are released from the cash register. It is not allowed to enter the name of the company here.

IN field "Base" the reasons for which the money is issued are indicated. For example, “Salary”, “Change to the bank”, “Daily allowance”, etc.

In the “Amount” field, enter the amount of the document in words.

IN "Application" field» the names of the documents on the basis of which this operation is carried out are indicated - the employee’s application, payroll, receipt, etc.

Then the document is signed by the head of the company and the chief accountant, who put their personal signature.

Important! Below, the recipient of the funds must manually write the amount received in words and without abbreviations, put the date of receipt and personal signature. Then indicate the full details of the identity document - passport, foreign passport, military ID, etc.

The cash order is signed by the cashier. Next, all expenditure and incoming cash transactions are entered into.

Nuances

If funds are issued to a legal entity, then the personal data of the representative employee is indicated in the “Issue” field. In the “Attachment” field, you need to write down the details of the power of attorney to receive money, which is attached to the expenditure order.

When depositing cash at the bank, you cannot write “Deposit of proceeds” in the “Withdraw” field, since this contradicts the procedure for conducting cash transactions. There you need to indicate your full name. The employee who performs this action also signs the document to receive the money.

Since 2012, tax services have been checking compliance with cash discipline. As practice shows, the availability of the necessary documents and their correct execution is the key to successful inspections. Cash documents also include a cash receipt order. In addition to the fact that it records the issuance of funds from the cash register, RKO is additionally the connecting link of accounting entries. We will provide an example of how to correctly fill out a cash receipt order and tell you about the nuances of its use.

RKO - form for issuing money from the cash register

In 2019, all organizations are required to draw up forms for expense cash orders (hereinafter referred to as RKO), regardless of their organizational and legal status and the taxation system used. This rule is indicated in clause 4 of article 346.11, clause 5 of article 346.26 of the Tax Code of the Russian Federation. Thus, a certain procedure for accounting and conducting cash transactions applies to:

- Organizations, regardless of the form of ownership (state, private, etc.);

- Enterprises and individual entrepreneurs who work with cash registers;

- Individual entrepreneurs who accept cash;

- Organizations and individual entrepreneurs using strict reporting forms.

- Individual entrepreneurs;

- Small enterprises and organizations with the status of microenterprises.

How to correctly fill out a cash receipt order

As noted above, this document indicates the disbursement of funds from the cash register. You can fill out the KO-2 form manually on printed forms or using computer technology (with mandatory output on paper).

How to write out RKO

A cash order is an accounting document that has a unified form OKUD 0310002 (according to Resolution No. 88 of August 18, 1998). The basis for spending cash, excluding the payment of wages, in accordance with current legislative norms, is considered to be:- Order from the head of the organization to allocate funds for the needs of the company;

- Application from an employee for the release of funds for reporting purposes;

- Issuance of cash for travel expenses;

- Issuance of money intended for an employee as financial assistance.

Peculiarities of working with cash for individual entrepreneurs

The document is signed by three employees: the manager, the chief accountant and the cashier. In some organizations (IP), positions can be combined, for example, a manager can act as a chief accountant, an accountant can act as a cashier. In this case, signatures are placed according to the duties performed: the chief accountant signs both for himself and for the cashier; the director signs for himself and for the chief accountant (cashier).

When dispensing money from the cash register, the cashier must follow the instructions. We list the points that are worth paying attention to:

- The cashier has no right to issue money without the prior signatures of the director and chief accountant.

- The cashier is obliged to check the document (passport) of the person receiving the money with the data in the consumables.

- The entire set of documents listed in the RKO must be checked.

- It is worth making sure that the recipient of the money carefully counts the cash received in the presence of the cashier.

Only now can a cashier with a clear conscience sign the cash register for the issuance of money.

If money from the cash register is issued by power of attorney, then the cashier is required to attach a certified copy of the power of attorney to the cash register.

RKO is issued by the accounting department in a single copy. Registration of issued cash settlements is carried out in a special journal (form KO-3).

A journal for registering incoming and outgoing cash documents is required for all legal entities.

In cases where the documents (applications, invoices, etc.) attached to the cash vouchers have the permission of the head of the organization, his signature on the cash vouchers is not required.

Is it necessary to put a stamp on a cash receipt order?

There is no need to affix a seal (stamp) to the cash register. The columns “Base” and “Appendix” in the completed form KO-2 imply the presence of documents with seals. Thus, the RKO form has full legal force without a seal.

Learning to fill out cash registers: algorithm for an accountant (table)

| Field | What it contains |

| "Organization" | Name of the organization that issued the cash register. |

| "Document Number" | Serial number of the cash receipt order. When maintaining expense cash orders, their continuous numbering must be ensured. All RKO-2 forms are numbered according to the RKL register without omissions or duplication of identical numbers. Often, a registration book is opened at an enterprise with the beginning of a new calendar year. |

| "Date of preparation" | The date the cash receipt order was issued. |

| "Structural unit code" | Code of the department from which funds are spent. It makes sense to fill in this field if a structural unit is indicated. |

| “Corresponding account, sub-account” | Debit account of an accounting transaction formed on the basis of an expense order. |

| “Analytical Accounting Code” | Object of analytical accounting of the corresponding account. |

| "Credit" | Credit account for an accounting transaction generated on the basis of an order. As a rule, this field indicates accounting account 50 - “Cash”. |

| “Amount, rub. cop." | The amount spent from the cash register in numbers. |

| "Issue" | The person (full full name) to whom cash is issued. |

| "Base" | The purpose of using the issued funds, for example, to pay salaries. |

| "Sum" | The amount issued in words in rubles is indicated from the beginning of the line with a capital letter, while the word “ruble” (“rubles”, “ruble”) is not abbreviated, kopecks are indicated in numbers, the word “kopeyka” (“kopecks”, “kopecks”) is also not is shrinking. If the expense amount is denominated in the currency “ruble” is replaced by the name of the currency. |

| "Application" | List of attached documents indicating their details. |

| "Received" | The amount of funds issued in words. The field is filled in by the person who received the funds under the cash receipt order. The amount is indicated from the beginning of the line with a capital letter in words in rubles and kopecks. |

| "By" | Name, number, date and place of issue of the recipient's identity document. |

The completed document is signed by authorized persons (chief accountant, head of the organization or other officials authorized to sign financial documentation). Also, the organization’s stamp with the inscription “Paid” is placed on the accounting document.

Examples of filling out cash registers by an organization

Issuing money on account

The issuance of funds against a report from the cash register with the registration of cash settlement is done according to the rules:

- Issue money on account to an employee (or other person) only in the case of a complete report on funds previously taken from the cash register;

- It is mandatory to have an application from the accountable person for the issuance of money for urgent needs, where the amount must be indicated in numbers and in words. This statement is subsequently attached to the RKO.

Payment of wages from the company's cash register

When issuing wages, you should follow simple instructions:

- preliminary preparation of the required amount of money and pay slip;

- Before issuing money, the employee must sign the payslip;

- calculation by the cashier in the presence of an employee of the required amount;

- issuing money to an employee;

- mandatory recording of issued and deposited amounts in the payroll (if any);

- the amount issued is reflected in the cash settlement form (one is issued for the entire payroll);

- All cash documents are stapled and stored together.

Errors in RKO, as in other cash documents, are unacceptable. Correction of errors is allowed only in the form of a correctly revised KO-2 form.

If the error is noticed too late and it is not possible to correct it (for example, the serial number of the RKO is mixed up), then all hope is for the statute of limitations (3 years).

Is it possible to edit RKO

We list typical violations in the registration of cash settlements:

- issuing money from the cash register without proper signatures on the cash register form (fine 2-3 thousand for each fact identified);

- an uncertified copy of the power of attorney or its absence (fine of 2–3 thousand per official).

If the detected fact of an error entails a reduction in the tax base, then a fine of 10 thousand rubles is issued to the guilty person.

Article 15.11 of the Code of the Russian Federation on Administrative Offenses and Article 120 of the Tax Code of the Russian Federation.

Samples of filling out cash register forms

When paying wages to a group of employees, one cash settlement form is issued. In the case where the basis for receipt differs among different employees, it is more advisable to issue different cash registers.

Money is issued from the cash desk of the enterprise to be deposited at the cash desk of the servicing bank. In this case, the money is sent to the bank with the cashier or handed over to the collection service. RKO in this case may look like this.

If financial assistance is provided to one person, then it is not necessary to prepare a payroll. A signature on the RKO form is sufficient. It is possible to register the issuance of financial assistance to a group of persons under one cash settlement, for which it is necessary to prepare a payroll.

Expense cash order (KO-2) is a necessary document for proper cash accounting. A correctly filled out form will help you not only find possible shortcomings in the organization of cash flow, but will also reduce the risk of punishment during an inspection by regulatory authorities.

An expense cash order refers to documents for the primary accounting of cash transactions. It is used to issue cash from the cash register. A cash order is a settlement register; it is formed in one copy by an accounting employee and signed by the head of the budget organization, the chief accountant, the cashier and the person receiving the funds. The seal in this case is not mandatory and is used only if available in the organization.

The expense cash order must not contain corrections, otherwise it is invalidated. If an error is made, the cash order must be made again in the correct version.

The obligation to use form KO-2 is determined by Bank of Russia Instructions No. 3210-U dated March 11, 2014. For public sector organizations, this requirement is enshrined in Order of the Ministry of Finance dated March 30, 2015 No. 52n. Doing business also involves creating a cash order for mutual settlement between the accountable person and the company cashier.

Which form to use

In accordance with Decree No. 88 of August 18, 1998, the cash expenditure order must be of a unified form - form according to OKUD 0310002. You can print out the cash expenditure order form and fill it out by hand, or you can use a text editor.

How to issue a cash receipt order

You can’t just download the 2019 cash order form for free and fill it out. There must be a legal basis for this. For spending cash, with the exception of wages, and issuing a cash order, such a basis may be:

- order from the manager to allocate funds for the needs of the organization;

- an employee’s application for the issuance of a statement of funds;

- issuing cash for travel expenses;

- issuing money for financial assistance to an employee.

An expenditure cash order will become the basis for issuing cash from the cash register. Having received an expense cash order, the cashier checks the correctness of filling out (clause 6.1 of the Directive):

- presence of the signature of the chief accountant or accountant (if they are absent, the presence of the signature of the manager);

- compliance of amounts written in numbers and words, as well as compliance with supporting documents.

Before dispensing cash, the cashier must ask the recipient for identification. After checking with him, he enters the details of the passport or other document in the appropriate columns. Then transfers the funds to the recipient. He must count them and sign the cash receipt.

The Directive of the Bank of Russia dated March 11, 2014 No. 3210-U was amended by the Directive of the Central Bank of Russia dated June 19, 2017 No. 4416-U, which states that an employee’s statement can be replaced by an order of the manager. And an expense cash order can be issued electronically using an electronic signature.

How to fill out RKO

The cash order is filled out by employees of the budget organization related to the issuance of funds. There are sites on the Internet that offer to fill out an expense cash order online and then download or print it. We will use an example to show you how to correctly fill it out yourself.

Step 1. Fill out the header

In the line “Organization” the full name of the organization is written, and the column “Structural unit” is the name of the unit that issued the cash register. If there is no such structural unit, then a dash is placed in the column.

OKPO is filled out according to data assigned by the statistics body.

The document number is indicated strictly in order throughout the calendar year.

The “Date” line indicates the date of issue from the cash register.

Step 2. Fill out the “Debit” and “Credit” sections

These lines of the cash receipt order are filled in as approved.

In the “Purpose Code” line, enter a code that reflects the purpose of using the funds issued from the cash register. If such codes are not used at the enterprise, a dash is added.

Step 3. Enter information about who the money was given to and why

The “Issue” line contains the last name, first name, and patronymic of the person to whom this money is issued.

The “Base” line displays the contents of the business transaction. For example, an advance for travel expenses, for the needs of the organization, etc.

In the “Amount” line, the amount is written in words.

In the “Appendix” line enter the information that served as the basis for issuing money from the cash register.

Step 4. Fill out the section with the personal data of the employee to whom the money was issued

The “Received” line is filled in by the recipient himself. He writes down the amount in words, puts the date and signature on the receipt. Below you need to indicate the details of the document presented for identification.

In the last line, the cashier or other responsible employee puts his signature and transcript.

Step 5. Manager's signature

The RKO is signed by the chief accountant and the head of the organization.

A ready-made example of filling out a cash receipt order for 2019 looks like this:

Filling Features

RKO is not always issued for cash withdrawal. The register is also formed in other cases, for example, when receiving funds by proxy or issuing wages.

Payroll settlements can be issued separately for each employee or for a group of persons. If the organization does not have many employees, then the register is compiled for each individual. If there are a lot of workers, then a single cash register is formed. A list of employees is compiled for the register, indicating the amount of wages to be paid for each employee.

The procedure for preparing the document is as follows. At the end of the validity period of the payroll or settlement statement, the cashier checks it, indicates the amounts to be deposited, signs it and sends it to the accounting department. The accountant also verifies all the data and signs the document. Then a settlement settlement is formed for the total amount of funds issued. The date of its preparation is the last day of payment of salaries. The statement contains the details of the expense register - its number and date.

If an employee receives cash by proxy, this must be reflected in the expense register. An accountant should not make duplicates; such cash registers are formed in one copy. Otherwise, the primary document for expenses under a power of attorney is filled out in the same way as in general cases.

How to keep records and how much to store

Registration and accounting of the cash receipt order is carried out in the KO-3 form, as well as in the cash books (KO-4). The serial numbers of the RKO are entered in the journal. This must be done after they are signed by the chief accountant or director. The journal must be kept in the accounting department of the enterprise or with the director.

Journal KO-3 (form according to OKUD 0310003) is a cover in which the registration data of the institution and a loose leaf are filled out. Two tables are formed on the loose sheet: the left one displays information on PKO, the right - on RKO.

Receipt and expense KOs are stored for 5 years according to the rules established by the management of the organization tions.

Sample of the RKO registration log according to the KO-3 form

Responsibility for violation of cash transactions

RKO is a primary document, which means it requires correct filling out. If the register is filled out incorrectly or not filled out at all, then the institution may be fined in the amount of 10,000 rubles (Article 120 of the Tax Code of the Russian Federation). The reason is incorrect accounting of the taxpayer’s income and expenses during one tax period.

If the taxpayer does not provide confirming expenses of the cash management company as part of the reporting to the Federal Tax Service, the inspector has the right to refuse to recognize such expenses for tax purposes.

An expense cash order (RKO) is a primary cash document on the basis of which cash is issued from the organization's cash desk.

Download a free form and sample of filling out a cash receipt order

Application of a cash receipt order

The form of the cash receipt order form is unified and is encoded KO-2.

An expense order is written out in one copy by an accounting employee, given to the head and chief accountant of the organization for signature, after which the cash register is recorded in the journal for registering incoming and outgoing cash documents (form KO-3).

RKO can be filled out either manually or electronically. When filling out a cash order, blots and corrections are not allowed.

How to correctly fill out an expense cash order in 2019

1. At the top, the name of the organization that issued the warrant, its OKPO code, and the name of the structural unit of this organization, if the order was issued in the unit, are indicated. If there is no subdivision, a dash is added.

2. The RKO number is indicated - serial, from the registration log KO-3 - and the date the order was issued (day, month, year)

3. In the tabular part:

- in the “Debit” column, write the code of the structural unit that issued the money (or put a dash); number of the corresponding account, subaccount, the debit of which reflects the cash outflow from the cash desk; analytical accounting code for the corresponding account, if the organization uses such codes. Or a dash is added.

- in the “Credit” column enter the number of the accounting account, the credit of which reflects the issuance of money from the cash register;

- the amount is indicated in numbers;

- the intended purpose code is written if the organization uses them; if not, a dash is added.

4.Under the table:

- enter the full name of the person receiving the money;

- for what reason or on what basis are funds issued (salary, for the purchase of consumables, for business expenses, based on an invoice, etc.);

- the amount is written from the beginning of the line with a capital letter, rubles - in words, kopecks in numbers. The remaining empty space in the amount line is crossed out;

- the attached documents and their data are entered in the “Attachment” line, on the basis of which money is issued (memo, receipt, invoice, application, etc.).

6. The “Received” line is filled in by the person to whom the money is given: in capital letters without indentation, the recipient enters the declared amount, rubles in words, kopecks in numbers. The remaining empty space is crossed out. The recipient puts the date and signs.

7. The last lines are filled in by the cashier after checking the correctness of filling out the cash register. They indicate what kind of document was presented by the recipient (usually a passport), its number, date and place of issue. After this, the cashier signs the order, deciphering his signature, and issues the money. The order itself remains with the cashier.

(works or services), as well as when issuing accountable amounts. Do not forget that all transactions must be noted in the book of income and expenses (KUDiR). The unified form of the KO-2 form was approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88 - do not confuse it with the unified form KS-2 (act of acceptance of completed work).

The absence, untimely execution or failure to submit cash receipts and expenditure orders to regulatory agencies entails tax and administrative liability. However, a special procedure is provided for the preparation of cash documents by individual entrepreneurs and SMEs.

Despite the fact that, subject to certain conditions, entrepreneurs are not required to formalize cash transactions with the appropriate cash documents, for some transactions it is advisable for entrepreneurs to continue their registration, including cash receipts and expenditure orders. Such operations, for example, include settlements with accountable persons for amounts issued to them “in hand” for reporting purposes.

Sample of filling out the unified form KO-2

The expense cash order has a unified form of form KO-2 and is filled out in one copy by an accountant or other authorized employee. Receipt and expense cash orders (PKO and RKO) are registered in the registration journal (form KO-3). As a rule, documents that are the basis for issuing money are also attached to the cash settlement.

In the header of the document you fill in the following information: name of the organization, OKPO form, number of this document, date of its preparation. PKO and RKO must be numbered. They are numbered in chronological order, separately incoming and outgoing orders; the numbering should not have gaps.

- The “debit” column is the code of the structural unit. You need to indicate the code of the department that spends the funds;

- Corresponding account, subaccount - enter the posting account (disposal of funds);

- Analytical accounting code;

- Credit – you must enter the account number for the loan for which the funds are flowing;

- Directly the amount to be paid;

- Target code.

- To whom the funds are issued;

- The basis on which funds are issued;

- Amount of money in words;

- Application;

- Position, signature, transcript of signatures of the chief accountant and manager.

The person receiving the funds also writes down the amount in words, puts the date, signature, and fills out the passport information. At the very bottom of the form there is information about who issued the funds.

Do not forget that liability is provided for the absence or failure to submit cash orders:

- tax and administrative - directly in relation to the organization;

- administrative, disciplinary and even in some cases criminal - regarding company officials;

- material – in relation to individual employees of the company.

Individual entrepreneur cash documents

Individual entrepreneurs may not fill out cash documents in 2016. This rule for small businesses and entrepreneurs was introduced in 2014 (Instruction of the Bank of Russia dated March 11, 2014 N 3210-U). Previously, the Central Bank practically equalized the rules for conducting cash transactions for individual entrepreneurs and legal entities. Now individual entrepreneurs are not required to maintain cash documents - draw up cash receipts and debit orders, as well as maintain a cash book. In addition, they are not required to set a cash balance limit. However, we must remember that this is an individual entrepreneur’s right, not an obligation. Therefore, if you are more comfortable making payments using cash documents, you can easily use them.

A sample of filling out a cash receipt order using the unified form KO-2.