Dealing with general production expenses. General production expenses How general production and general business expenses are distributed

After all, total production costs include those costs associated with production that cannot be directly attributed to a particular type of product. Therefore, the answer to the question of whether general production costs can be attributed to indirect ones will be positive. After all, if the costs of general production are direct, then they should be taken into account directly as the costs of the main production, and not preliminarily collected on account 25 “General production costs” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). General production costs include only such other production costs, the relationship between which and a specific type of manufactured product is not obvious.

At the same time, a fixed part of the costs and variable overhead costs can be allocated as part of overhead costs.

Overhead budget

In we talked about the cost estimate for production, which is compiled to plan and manage the amount of costs. At the same time, in this estimate, the costs of the main production, general production costs and costs of a different nature can be separately allocated. The organization develops the form of an estimate of overhead costs independently based on the specific needs of detailing.

General and general production costs are a special category of enterprise costs that cannot be directly attributed to the main production. Learn how to properly organize accounting, what expenses are included in this group, and how to distribute them correctly.

Accounting for overhead and general business expenses

Costs that cannot be directly attributed to the main type of activity, but without such expenses, the conduct of the economic life of the enterprise is significantly more difficult, they are usually distributed among general production and general business expenses. Moreover, each organization independently determines the methods of distribution of overhead and general business expenses. Why? The specifics of the activities and accounting of each company are different, that is, they have a number of individual differences. Therefore, it is impossible to determine a general methodology for dividing the composition of the costs of OCD and ODA. The organization fixes its choice in the accounting policy, guided by the current RAS, as well as taking into account the volume of production, the number of personnel, types of activities and other indicators of financial and economic activity.

There is a single criterion for cost sharing, according to which:

- General production expenses include all expenses of the company that are associated with ensuring the smooth operation of the main and auxiliary productions. That is, this is maintenance, repair, adjustment of the main and auxiliary shops.

- The content of general business expenses includes expenses associated with the management of the company, which are not directly related to production, but are subject to inclusion in the cost of products and services.

Accounting for overhead costs

General production costs include the costs of maintaining and maintaining an uninterrupted production process. We specify the ODP:

- Depreciation and repair of equipment used directly for the production of finished products, the sale of products.

- Wages of personnel carrying out repair and adjustment work of production equipment and machines.

- Rent of premises and utilities for workshops, production and auxiliary purposes. For example, renting a workshop in Moscow or paying for electricity for the operation of machine tools, paying for the telephone and the Internet, paying for an advertisement.

- Spare parts and inventories used for the repair and restoration of machines, machine tools and equipment.

- Other production expenses include taxes, fees and insurance payments related to general production, paid to the Federal Tax Service and others. For example, insurance of property used in the OP.

The total of this type of costs of the company is the budget of overhead costs.

HMO should be recorded on a separate account 25, which is active. The costs incurred are accumulated in the debit of the account with simultaneous crediting of accounting accounts for payroll, insurance premiums, depreciation and other accounting accounts. When writing off the OPF, they are reflected in the loan in correspondence with the accounts of the main or auxiliary production.

Typical accounting entries:

Distribution of overhead costs

Some companies use a special coefficient to allocate OP costs to the cost of finished products, which is calculated by the formula:

Kopr \u003d OPRmes / Bopr,

- Kopr - the coefficient of expenses related to ODA;

- OPRmes - expenses for the reporting month;

- Bopr - the general base for the distribution of overhead costs.

This indicator helps to find out the amount of ODA (how many rubles) that falls on 1 ruble of the distribution base.

It is possible to allocate overhead costs by the volume of manufactured products by product types, by the amount of accrued wages of key personnel, by each type of GP, or by the cost of inventories directed to the EP.

For example, in March 2020, ODA amounted to 150,000 rubles. The accounting policy of the company states that ODA is distributed in proportion to the direct accrued wages of the main personnel in the context of types of finished products.

March salary:

- product number 1 - 500,000 rubles;

- product number 2 - 750,000 rubles;

- product number 3 - 250,000 rubles.

Total 1,500,000 rubles.

We calculate the coefficient:

Copr \u003d 150,000 / 1,500,000 \u003d 0.1.

We distribute overhead costs by manufactured products:

- product No. 1 = 500,000 × 0.1 = 50,000 rubles;

- product No. 2 = 750,000 × 0.1 = 75,000 rubles;

- product number 3 \u003d 250,000 × 0.1 \u003d 25,000 rubles.

The amounts are reflected in the accounting entries:

Accounting for general expenses

General business costs include management costs that cannot be directly attributed to the production cycle or process. Such expenses are accumulated on account 26 of accounting. This is an active account. That is, expenses are reflected in the debit of the account, and the corresponding account is recorded in the credit.

Unlike ORP, general business expenses are not divided by structural divisions of the company. Since in most cases there is only one management apparatus at the enterprise, there is no need to hide it. But it is quite possible to foresee the details.

General production costs are classified as indirect, indirect costs.

Their records should be maintained in each department of the enterprise.

General production costs are included in the production cost of manufactured products.

Such expenses include:

- Depreciation of fixed assets of production.

- Depreciation of other non-current tangible assets involved in the work of the management department.

- The cost of fuel and electricity used in the operation of the equipment.

- The cost of spare parts and materials needed to repair equipment. This item does not include expenditures related to the improvement and modernization of means of production.

- The cost of low-value and wear-out items that were used for production and management needs.

- Defective goods.

- Unforeseen and implicit labor costs.

Types and calculation of overhead costs

This type of cost can be variable or fixed.

The variable type includes costs proportional to the growth of production turnover.

This is due to an increase in the wear rate of equipment, the need to increase the power of the devices and the resulting energy costs.

Growth in costs can be in direct proportion to the increase in production volumes, inversely, or increase ahead of schedule.

Fixed overhead costs include expenses that are unchanged or little subject to change with an increase in the volume of activity, they are associated with managerial and accounting work.

The general indicator of overhead costs is the sum of the following indicators:

Annual depreciation of fixed capital.

It is determined by the amount of monetary assets spent on the complete restoration of all means of production and the administrative apparatus.

It is calculated by the formula:

A \u003d (PS * Na) / 100,

where A is depreciation, PS is the initial cost of equipment and other assets, Na is the depreciation rate.

The cost of raw materials and materials.

The formula is used to calculate:

P \u003d K * ∑ (N * C),

where P is the overall cost level, H is the cost rate, P is the price of the material needed to repair or maintain equipment (energy), and K are transportation costs.

Manufacturing includes many processes that help ensure the creation of finished products. In addition to direct production, an important role is played by the administrative sector, where all major management decisions are made. And the company's costs are associated with the manufacture of finished products, and not directly related to the manufacture, which are made as part of maintaining administrative and managerial functions.

The division of costs allows you to more correctly keep records at the enterprise and plan the amount of costs, which is a necessary moment in the organization of the production process.

General production and general business expenses

All production costs are divided into general production and general business expenses, their accounting is kept on accounts 25 and 26, respectively. General production costs include costs associated with the maintenance and management of production, including the costs of the main production, auxiliary and servicing.

General production costs include:

- The salary of workers who work in production (foremen, technologists, workers, and so on);

- Necessary repair of production equipment;

- Payment for raw materials and materials that are used in production;

- Rent for production premises and other rental payments for equipment and machinery;

- Other expenses associated with the operation of fixed assets, such as: expenses for fuel, electricity and others;

- Shortage, loss and damage to production property, etc.

Account 25 is active, so all accumulations are debited in correspondence with interacting accounts, such as 70 - when calculating salaries, 10 - when writing off materials from a warehouse, 02 - when calculating depreciation, 69 - when calculating contributions to off-budget funds from salaries and etc.

At the very end of each month, all expenses accumulated on account 25 are written off to the debit of accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and farms” in the manner that is established independently by the company and fixed in the accounting policy.

When we talk about general business expenses, they are not related to production, such expenses include the costs of managing enterprises, including salaries of office workers, depreciation and repair of household property, office rent, consulting, legal and other services, related to management. These expenses are accumulated on the debit of account 26 in interaction with accounts reflecting expenses - this is account 02 when depreciation is charged, 10 when writing off materials, 70 when calculating salaries.

General business expenses are written off in one of two ways:

1. When using the reduced cost at the end of the month from account 26 to subaccount 90.2 "Cost of sales".

2. When using the full cost, expenses from account 26 are written off to accounts 20, 23 or 29. The order of distribution of expenses is fixed in the accounting policy, they can be distributed in proportion to the costs of these productions.

Accounts 25 and 26 are completely closed at the end of the month, they have no balance.

Companies that are engaged in intermediary services (agents, brokers, commission agents) keep all expenses on the 26th account, no accounting is kept on the 20th account.

Other operating expenses

Other production costs include all other costs that are not related to the main types, these may be taxes, fees and charges, the amount of payments for compulsory insurance, the cost of warranty service and repair of products, and more. This type of expense is included proportionally in the cost of production.

Variable overhead costs

General production costs are divided into variable and fixed. The first type includes costs that change due to changes in the volume of production. The size of these costs also depends on the savings at the enterprise, for example, when technology or labor organization is modernized. The second type includes the costs of maintenance and production management, such costs do not change depending on the volume of production.

Often you can find mixed costs, they contain variable overhead costs and fixed. For example, maintenance costs are considered mixed because they consist of fixed costs and there are still variables, since production volumes matter. The list of expenses of the enterprise is established by itself, taking into account the specifics.

When included in the cost of production, you can make not all overhead costs, but only variables and part of the fixed ones. The remainder is credited to the sales account. The method of allocating costs depends on the characteristics of production and the ratio of output to production capacity.

Direct production costs include the cost of materials and raw materials, salaries of production workers, depreciation, components, and more. These include costs that directly affect production. Companies can independently determine the range of such expenses, taking into account activities, all this should be fixed in the accounting policy with a specific list attached.

Indirect costs are associated with the overall production process, and not with a specific product, they include general production and general business expenses. For example, equipment depreciation, administration salaries, utility costs, expenses for renting premises and equipment, etc.

General production, general business and selling expenses

Expenses for the maintenance and operation of equipment, workshop, general and commercial expenses are classified as indirect expenses. They are determined as a whole by the workshop (division), and are indirectly related to the cost of a unit of production.

To overhead expenses include:

equipment maintenance and operation costs:

depreciation of equipment and vehicles;

costs for the maintenance and operation of equipment;

equipment and vehicle insurance costs;

wages of workers servicing the equipment (with deductions for social needs);

expenses of all types of energy, water, steam, compressed air, auxiliary production services;

equipment repair costs, technical inspections, maintenance;

other costs associated with the use of equipment;

workshop expenses:

wages of the shop management apparatus (with deductions for social needs);

depreciation costs of buildings, structures, inventory;

rent for premises, machinery, equipment and other facilities used in production;

other costs associated with the management of production units.

To general expenses include:

administrative and management expenses;

depreciation deductions and expenses for the repair of fixed assets for management and general business purposes;

rent for general purpose premises;

payment for consulting, information and audit services, bank services (including interest on bank loans and interest on supplier loans for acquired inventory items);

training and retraining of personnel, recruitment costs;

payments for compulsory insurance of property of the enterprise and certain categories of employees, taxes, fees, payments and other mandatory deductions made in accordance with the procedure established by law.

To commercial (non-production) expenses include expenses:

other sales (storage, processing, sorting).

for containers and packaging;

product transportation;

commission fees and deductions paid to sales enterprises and organizations in accordance with agreements;

11.4. Accounting for overhead and general business expenses

In the production process, when reflecting operations in accounting, some costs can be directly and directly attributed to a specific type of product or cost object. Such costs are called direct costs. Other costs cannot be directly attributed to specific products, they are called indirect or indirect.

The division of costs into direct and indirect depends largely on the specific situation. If the organization produces one type of product (product), then all costs can be classified as direct. If the organization produces several types of products, then the consumption of materials is distributed for each type of product. Such distribution can be carried out in proportion to the consumption of material assets according to the norms established per unit of production; the established flow rate; quantity or weight of manufactured products, etc.

Direct costs usually include material costs and the cost of paying the main production personnel. Direct material costs include raw materials and basic materials that become part of the finished product, and their cost is directly and directly transferred to a specific product. Direct labor costs include labor costs that can be directly attributed to a certain type of finished product. This is the wages of workers employed in the production of products.

Indirect costs include general production overheads, which are a set of various costs associated with production, but which cannot be directly attributed to a specific type of finished product (product). These costs are difficult to trace during the manufacture of the product. At the same time, the production cost of the product, of course, must include general production costs. They are included in the cost of production using the method of distribution of costs (in proportion to the basic wages of production workers, direct costs, etc.).

Overhead costs arise in connection with the organization and maintenance of the production process and its management and include general production and general business expenses. General production (shop) costs are associated with the maintenance and management of production in the shops of the organization.

The main groups that form general production costs include:

auxiliary products and components;

indirect labor costs (wages of employees not directly involved in the production of one product, but associated with the production process within the organization as a whole: foremen, repairmen, auxiliary workers, as well as payment for vacations and overtime work);

other indirect overhead costs (expenses for the maintenance of workshop buildings, maintenance and current repairs of equipment, property insurance, rent, depreciation of equipment, etc.).

The composition and amount of overhead costs are determined by estimates for the maintenance and operation of equipment, management and business expenses of the workshop. Estimates are compiled for each workshop separately. The purpose of cost planning and the allocation of independent cost items in the actual cost of production is constant monitoring of compliance with estimates.

Planning and accounting for overhead costs are carried out according to the following nomenclature of items:

depreciation of production equipment and vehicles;

deductions to the repair fund or the cost of repairing production equipment and vehicles;

equipment operating costs;

wages and deductions for social needs of workers servicing equipment;

expenses for testing, experiments and research;

labor protection of shop workers;

losses from marriage, from downtime for internal production reasons, etc.

Synthetic accounting of overhead costs is maintained on the active collection and distribution account 25 "General production costs".

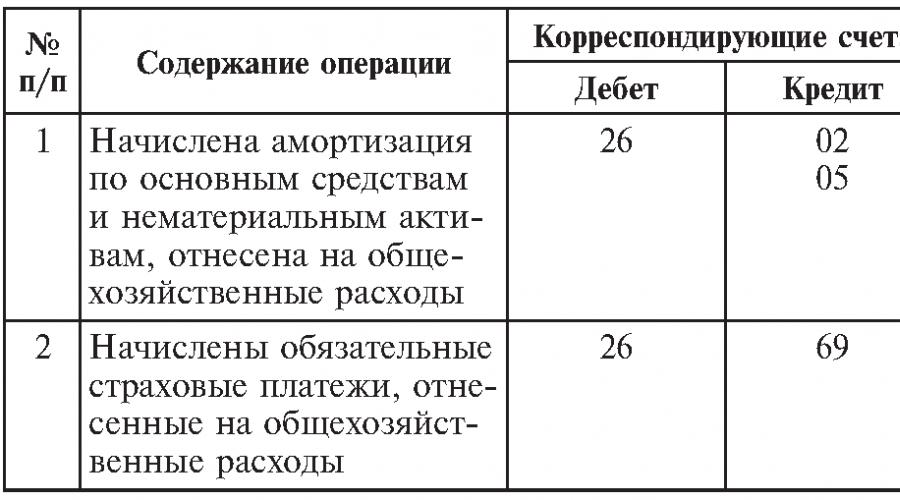

On the basis of primary documents confirming the fact and amount of overhead costs incurred, entries are made in the accounting accounts (Table 1).

Costs, costs, cost

At the end of the month, the amount of overhead costs accounted for in the debit of account 25 “General production costs” is debited by distribution to the cost of individual types of products in proportion to the amount of the basic wages of production workers (direct costs of materials, etc.).

Table 11.2 Typical correspondence of accounts for accounting for overhead costs

At the end of the month, the amount of overhead costs accounted for in the debit of account 25 “General production costs” is debited by distribution to the cost of individual types of products in proportion to the amount of the basic wages of production workers (direct costs of materials, etc.).

General business expenses are also included in overhead costs. They are related to the management and maintenance of the organization as a whole. The composition and size of these costs are determined by the estimate.

Synthetic accounting of general business expenses is maintained on the active collection and distribution account 26 "General business expenses", and analytical - on account 26 "General business expenses" according to budget items in a separate statement.

Planning and accounting of general business expenses is carried out according to the following nomenclature of items:

expenses for business trips of the administrative apparatus;

entertainment expenses related to the activities of the organization;

depreciation of fixed assets for general economic purposes;

deductions to the repair fund or the cost of current repairs of buildings, structures and general household equipment;

expenses for the maintenance of buildings, structures and inventory for general purposes;

the costs of testing, experiments, research, the maintenance of general laboratories;

expenses for labor protection of employees of the organization;

training and retraining of personnel;

mandatory contributions, taxes and fees;

unproductive general business expenses, etc.

All actual costs are collected and reflected in accounting records (Table 11.3):

Table 11.3 Typical correspondence of accounts for accounting for general business expenses

Continuation of the table. 11.3

At the end of each month, general business expenses are written off on the credit of account 26. General business expenses are distributed between finished products and work in progress, remaining at the end of the reporting month. Then the costs attributable to finished products are distributed among its individual types in proportion to the chosen base or write-off method. These expenses can be written off in two ways:

1) inclusion in the costs of production of specific types of products by distribution similar to the distribution of overhead costs;

2) writing off general business expenses as conditionally fixed to the “Sales” account by distributing between types of products sold.

When writing off general business expenses to account 90 "Sales", they are distributed by types of products, works or services sold in proportion to the proceeds from the sale, the production cost of products or another indicator.

The choice of one or another method of writing off general business expenses should be reflected in the accounting policy of the organization. Of course, the second method greatly simplifies the write-off of general business expenses. However, it is applicable provided that all products, which include general business expenses, are sold or the share of these expenses in the cost of production is insignificant.

The actual data after accounting and distribution of overhead costs are entered in the statement of summary accounting of costs for the production of products (works, services).

Pages: …7071727374…| Table of contents

Ask a lawyer a free question!

Features of accounting for overhead and general business expenses of the organization

The costs of maintaining, organizing and managing workshops (other production units) of the main, auxiliary and service industries are included in general production costs. General production expenses include:

- the cost of materials, spare parts used for the maintenance and repair of production equipment;

- labor costs of employees involved in maintenance of production (foremen, heads of workshops, technologists, workers engaged in maintenance and repair of technological equipment), with deductions for social needs;

- depreciation deductions and expenses for the repair of fixed assets and other property used in production;

- the cost of dismantling equipment, the cost of materials, parts, purchased semi-finished products used in setting up equipment;

- rent for premises, machinery, equipment and other fixed assets used in production;

- expenses associated with the operation of fixed assets directly involved in production (gas, fuel, electricity, etc.);

- depreciation charges on intangible assets used in production;

- the cost of shortages and losses from downtime, damage to valuables in production and in warehouses, etc.

During the reporting period, general production expenses are reflected in the debit of account 25 of the same name. At the same time, expenses on account 25 are recorded in the context of each production unit. In accounting, overhead costs are reflected in the postings:

Dr. c. 25 Set of sc. 10 - written off the cost of materials, spare parts used for maintenance and repair of equipment;

Dr. c. 25 Set of sc. 70 - the salary of employees of general production personnel has been accrued;

Dr. c. 25 Set of sc. 69 - contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases were accrued from the salary of general production personnel;

Dr. c. 25 Set of sc. 23 (60, 76) - expenses for the maintenance of premises are written off (repair, rent for premises, equipment, utility bills, etc.);

Dr. c. 25 Set of sc. 02 (05) - depreciation was charged on fixed assets (intangible assets) used in the main (auxiliary) production. This accounting procedure for overhead costs follows from the provisions of clause 9 PBU 10/99, Instructions for the Chart of Accounts, Letter of the Ministry of Finance of Russia dated 08.11.2005 N 07-05-06 / 294.

The costs associated with the management of the company, the organization of its economic activities, the maintenance of its common property, are classified as general business expenses. General expenses include:

- labor costs of administrative and managerial and general business personnel (with deductions for social needs);

- rent, depreciation, expenses for the current repair of buildings, structures and inventory of general company and management purposes;

- security costs;

- expenses for training and recruitment of personnel;

- entertainment expenses;

- expenses for payment of communication services;

- Communal expenses;

- stationery and postal and telegraph expenses;

- labor protection costs, etc.

During the reporting period, general business expenses are reflected in the debit of the account of the same name 26:

Dr. c. 26 Set of sc. 10 (21) - written off materials (semi-finished products of own production), spent on general business needs;

Dr. c. 26 Set of sc. 70 - the salary of administrative and managerial and general economic personnel has been accrued;

Dr. c. 26 Set of sc. 69 - contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases were accrued from the salaries of administrative and managerial and general economic personnel;

Dr. c. 26 Set of sc. 60, 76 - the cost of work (services) performed by third parties (for example, audit, consulting services) is included in general business expenses;

Dr. c. 26 Set of sc. 02 (05) - depreciation was accrued on fixed assets (intangible assets) for general economic and management purposes.

General production and general business expenses are associated with the release of different types of products (works, services), i.e. they make the organization work as a whole. Therefore, unlike direct (main) costs, these costs are considered indirect (overhead).

At the end of the reporting period, accounts 25 and 26 are closed. The expenses accumulated on them are written off to the debit of accounts: 20 "Main production", 23 "Auxiliary production", 29 "Service production and farms" or 90 "Sales" in proportion to the indicators that must be set in the accounting policy for accounting purposes (clause 7 PBU 1/2008).

The basis for the distribution of indirect costs between the main, auxiliary and service industries can be, for example, the following indicators:

- wages of the main production workers;

- direct costs in the shop structure of the organization;

- the number of machine-hours worked for the operation of the equipment;

- size of production areas;

- material costs;

- the volume of production in natural or value terms.

for example, in industries with a significant share of labor costs, it is advisable to distribute indirect costs in proportion to the wages of the main production workers. Indirect costs are distributed in proportion to material costs (the cost of raw materials, materials, spare parts, etc.) if they make up a significant share in the cost of production.

Consider an example of the distribution of indirect costs associated with the execution of a production order. The organization uses the order-by-order method of costing. In January 2010 Stroytekhnologiya LLC accepted and completed two production orders (N N 1 and 2) for the manufacture of special equipment. The accounting policy of the company stipulates that general production and general business expenses are distributed in proportion to the salary of production workers involved in the implementation of each order.

In January 2010, the actual amount of expenses amounted to: general production - 100,000 rubles. and general business - 125,000 rubles.

Direct costs for order No. 1 amounted to:

- the cost of the materials used - 82,300 rubles;

- salary of production workers - 68,500 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases from the wages of production workers - 18,427 rubles.

Total for order N 1 - 169,227 rubles.

Direct costs for order No. 2 amounted to:

- the cost of the materials used - 151,500 rubles;

- the amount of accrued wages of production workers - 55,000 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases from the wages of production workers - 14,795 rubles.

Total for order N 2 - 221,295 rubles.

The total salary of production workers for both orders amounted to 123,500 rubles. (68,500 rubles + 55,000 rubles). At the same time, the share of the wages of production workers in the total amount of their wages under order No. 1 is equal to - 55% (68,500 rubles : 123,500 rubles), and under order No. 2 - 45% (55,000 rubles : 123,500 rubles) .

Thus, the cost of order No. 1 includes a part of overhead costs in the amount of 55,000 rubles. (100 thousand rubles x 55%) and part of general business expenses in the amount of 68,750 rubles. (125 thousand rubles x 55%). As a result, the actual cost of order No. 1 amounted to: 169,227 rubles. + 55 000 rub. + 68 750 rub. = 292,977 rubles.

In turn, the cost of order No. 2 also included a part of overhead costs in the amount of 45,000 rubles. (100,000 rubles - 55,000 rubles) and part of general business expenses in the amount of 56,250 rubles. (125,000 rubles - 68,750 rubles). As a result, the actual cost of order No. 2 amounted to: 221,295 rubles. + 45 000 rub. + 56 250 rub. = 322,545 rubles.

When writing off overhead costs (after their distribution), the following posting is made:

Dr. c. 20 (23, 29) 25 - general production expenses for the reporting month are written off.

General expenses can be written off in one of two ways:

- to account 20 "Main production" (23 "Auxiliary production", 29 "Serving production and farms");

- to account 90-2 "Cost of sales".

The chosen method of writing off general business expenses must be fixed in the accounting policy for accounting purposes (clause 7 PBU 1/2008, clause 20 PBU 10/99).

It should be noted that in the first case, general business expenses form the "full" cost of finished products and are written off at the end of the month.

The composition of general and general production expenses

In this case, the write-off of general business expenses (after distribution) is reflected in the posting:

Dr. c. 20 (23, 29) 26 - general business expenses related to the activities of the main (auxiliary, servicing) production are written off.

In the second case, a "reduced" cost of finished products is formed, and general business expenses are fully written off for sale, regardless of how many products were sold in the reporting period.

At the time of transfer of ownership of the shipped products (results of works or services) to the buyer, the proceeds from its sale are reflected, and the cost of the sold products (works, services) is written off:

Dr. c. 62 Set of sc. 90-1 - reflected the proceeds from the sale of products;

Dr. c. 90-2 Set of sc. 43 - the actual cost of shipped products (work performed, services rendered) was written off;

Dr. c. 90-3 Set of sc. 68, sub-account "VAT settlements", - VAT is charged on products sold.

At the end of the month, the amount of general business expenses is written off:

Dr. c. 90-2 Set of sc. 26 - general business expenses are included in the cost of sales. Such rules are established by paragraphs 5 and 12 of PBU 9/99 and the Instructions for the Chart of Accounts (accounts 20, 25, 26).

In practice, the question may arise: how to reflect general business expenses in accounting if the organization does not receive income from its activities?

General business expenses (for example, salaries of management personnel, office rental expenses and other expenses associated with the development and development of a business), as well as other expenses, must be taken into account regardless of whether they will lead to income generation or not (clause 16 - 18 PBU 10/99). Therefore, even if the organization does not receive income from its activities, these costs should still be fully reflected in the accounting accounts.

General business expenses, which are reflected on account 26 of the same name, are taken into account either on account 20 "Main production", or immediately in the cost of production, i.e. on account 90 "Sales", or are taken into account on account 97 "Deferred expenses".

In the first case, general business expenses will be taken into account as part of the costs of the main production, i.e. in the debit of account 20, forming the full cost of finished products, in the second - they will directly form the financial result (loss) of the reporting period, i.e. accounted for in the debit of account 90-2.

In the third case, expenses will not be taken into account in the cost (form a loss) until the organization begins to receive income. As soon as the organization begins to receive income, these costs will need to be transferred to the cost of products (works, services) with the production of which they were associated. The organization must determine the procedure for transferring deferred expenses to the cost price on its own (clause 65 of the Regulations on Accounting and Reporting). for example, such expenses can be written off evenly during the period approved by the order of the head of the organization, or in proportion to the income received from the sale, or in other ways. At the same time, the specific procedure for writing off deferred expenses is fixed in the accounting policy for accounting purposes (clause 4 PBU 1/2008).

It should be noted that the procedure for recognizing indirect costs of production in accounting and tax accounting may differ. Discrepancies in accounting for indirect costs lead to the appearance of permanent or temporary differences (clauses 4, 8, 12, 15 and 18 of PBU 18/02).

Bibliography

- Regulation on accounting "Accounting for settlements on income tax of organizations" RAS 18/02: Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n.

- Regulation on accounting "Expenses of the organization" PBU 10/99: Order of the Ministry of Finance of Russia dated 06.05.1999 N 33n.

- Regulation on accounting "Income of the organization" PBU 9/99: Order of the Ministry of Finance of Russia dated 06.05.1999 N 32n.

- Regulation on accounting and financial reporting in the Russian Federation: Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n.

- http://www.lgl.ru

- http://www.consultant.ru

- http://www.garant.ru

M.V. Bespalov

departments of accounting,

analysis and audit

Tambov State University