Tax personal account of an individual login. Personal account of the taxpayer from the Federal Tax Service

The taxpayer's account of the Federal Tax Service (Federal Tax Service) is an online account that allows you to find out all the taxpayer's debt to the budget, track the amounts of paid and accrued tax payments, and also control all budget calculations.

Taxpayer personal account for individuals

Login to your account using this link

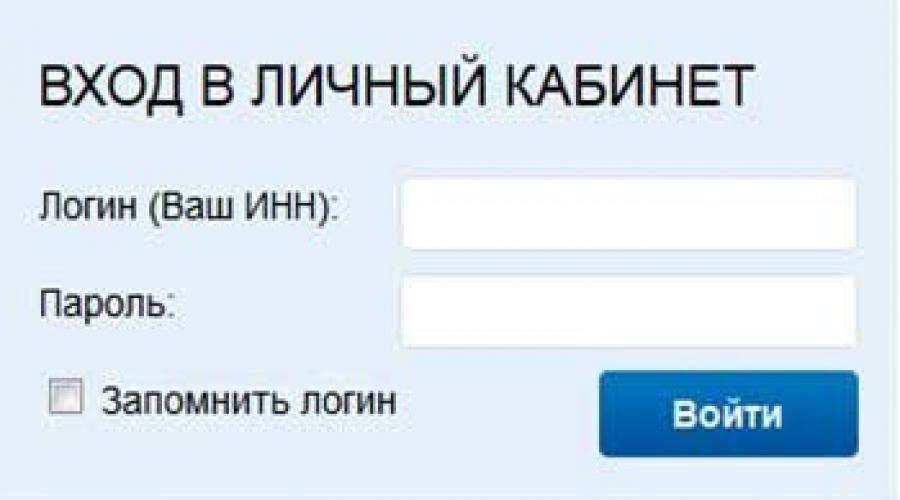

Login Personal Area taxpayer for individual carried out in three possible ways:

- Using your login and password, which can be found in the registration card

- Using an electronic signature

- By registering in the ESIA ( Unified system identification and authentication)

Individual's office

The taxpayer's account consists of several sections that allow you to manage and control all tax accruals of an individual.

Cabinet sections:

Objects of taxation

Work in the office begins with tax objects, which include:

- Real estate;

- Vehicles;

- Land.

When logging in for the first time, the taxpayer needs to check all data to ensure it is correct. If the data in your account is incorrect, you need to notify the Federal Tax Service using a special link (Check information about taxable objects). If missing data is not indicated, the taxpayer bears administrative liability and pays a fine.

Section "Accrued"

This section contains all tax notices that must be paid. You can print it for payment. payment document directly from your account and pay in any bank or online without additional fees. Within 10 days, this payment should appear in the “Paid” section

"Paid" section

The section indicates all amounts for payments that have been paid. You can see everything here tax obligations which were paid for the specified period. The “Credited” section displays all amounts that came to the account of the federal tax service. Here you can control the completeness of the credited amount and payment deadlines for all payments. The section has a custom filter by which you can display all payments by type of tax, type of payment and PD Index, payment amount, payment date, enrollment date, name of the Federal Tax Service.

Section “Overpayment and Debt”

This section indicates all the taxpayer’s debt, as well as the amount of penalties calculated for the period of delay. The amount of debt is broken down by type of tax and displayed as of a specific date. If there is an overpayment for some payments, it is displayed green, and debt in red.

Section "Income Tax"

In this section, a taxpayer can fill out an individual’s declaration online and track the status of a tax desk audit. After a positive decision, you can create an application for a refund in your account.

Section "Documents"

This section contains all the necessary documents for the taxpayer, indicating the type of document, date of sending, and description of the document. Electronic document management allow you to use a filter to display any required document for a certain period.

Overview of the capabilities of a taxpayer’s personal account for an individual

Cabinet overview

Login to the taxpayer's account

To get started, in order to enter your personal account, the taxpayer needs to visit the tax office once with a passport and TIN certificate. After contacting the inspectorate, the taxpayer will receive a registration card containing the login and password to enter the account and other information. Using this data, you can log into your account on the website lkfl.nalog.ru.

Video about how to gain access to the tax office.

Legislation in our country is constantly undergoing many changes, but we must remember that ignorance of the law does not relieve one from responsibility. To modern man to stay informed latest events, you don’t need to study thick volumes of codes and legislation, it’s enough to be an Internet user.

Changes occurring in the tax code of the Russian Federation can be found at www.nalog.ru, on the website of the Federal Tax Inspectorate (FTS),

Timely acquisition of this information allows you to avoid many problems, since paying taxes is a mandatory norm for all citizens of the Russian Federation.

www. tax. ru personal taxpayer account for individuals and individual entrepreneurs

On its website, the Federal Tax Service presented a new unique service that allows you to monitor the status of payments sent to the budget, according to tax accruals, almost in real time - the taxpayer’s personal account. This offer can be taken advantage of by all taxpayers authorized on the website and registered in our country.

Individuals using the service will be able to track information about their existing debts to the budget, accrued payments, and overpayments that have occurred. It is possible to fill out and send declarations to the tax authorities in the form of personal income tax-3, as well as track the status of their desk audits. Users will receive information about the current enforcement proceedings. It is also possible to clarify information on registered taxpayers vehicles and other objects of property rights.

Individual entrepreneurs using their personal account can fill out and send various requests and complaints to the inspectorate, clarify information about payments, reconcile payments made, transmit information about changes that have occurred with the individual entrepreneur and make appropriate changes, in electronic format receive current extracts from the Unified State Register of Individual Entrepreneurs.

Services similar to those described above are available to legal entities registered in the system, also in your personal account.

However, one of the main advantages of using the service is the ability to pay taxes without getting up from your computer.

How to create or register in a personal taxpayer account for individuals

Login to your personal account is provided to users registered in the system after authorization on the Federal Tax Service website. Let's consider the question of how to open, create or create an account on this service.

The first thing that should attract you is that you can do everything yourself and there is no need to submit an application where you need to indicate various information. Connecting and filling out is all that is needed to move on and pay any tax debts.

User registration in your personal account is possible in the following ways:

- When visiting the Federal Tax Service in person and receiving a registration card, indicating a password to access the Internet service, you can obtain it at any inspection department by presenting a passport (or a document replacing it), as well as a certificate indicating the TIN (or a copy thereof). This password is the primary one and needs to be changed. Please note that you can contact any branch of the tax service;

- Through authorization on the government services website. This method registration is possible only for citizens who have confirmed their identity when visiting service centers.

After completing this procedure, you will be able to connect and log in to find out readings online, pay the bill and income,

How to log in or login to a taxpayer’s personal account for individuals, official website

Login to your personal account Russian Federation carried out in one of the following ways:

- The individual taxpayer number (TIN) is used as a login, the password is taken from the registration card.

- using an electronic signature (key or electronic card). The electronic signature is verified with a certified key; it can be issued at a Certification Center accredited by the Ministry of Telecom and Mass Communications of Russia; it is issued free of charge. Universal electronic card, a citizen can also obtain from an authorized organization.

The primary password, after receipt, needs to be changed within 1 month, otherwise it will be blocked account.

What should I do if it doesn’t work or I forgot my password?

If access to a service or program has become impossible due to the loss of a password, the procedure for obtaining a new password is similar to the registration procedure and requires a personal application to the Federal Tax Service. Similar actions should be taken if the password for your account has been taken over by unauthorized persons.

The taxpayer’s personal account is a service of the website of the Federal Tax Service of Russia, with the help of which you can receive information about your taxes on the tax service website, pay taxes, submit 3-NDFL returns (this service is similar to the State Services website, but is focused on tax information/services)

Why do you need a personal account?

Your personal account contains many convenient services. Among them it is worth highlighting possibilities:

- Receive information about the amount of accrued and paid taxes (property, transport, etc.);

- Pay tax;

- Submit a 3-NDFL declaration to the tax office;

- Send appeals to tax authorities;

- Monitor the status of the desk audit of the 3-NDFL declaration.

How to open a personal account on the Federal Tax Service website?

There are several ways to access your personal account:

1. At the tax authority. You can contact any tax authority and register a personal account. At the same time, if you apply to the tax office at the place of your permanent registration, you only need to have your passport with you; if to another, then your TIN certificate will be additionally required. After registration (usually registration takes place in front of you), you will be given a registration card, which will contain information for logging into your personal account.

If you want to save time, you can download and fill out the application in advance (in this case you will not have to fill it out at the tax authority): Application for opening a personal account.

Note: The password contained in the registration card is valid for only a month. During this time, you must definitely change it. If you do not change it, you will have to contact the tax authority again.

2. Using the registration data of the State Services portal. If you are registered on the State Services portal, and your identity was confirmed during registration (i.e. you registered at one of the places of presence of the ESIA operators, and did not receive data by mail), then you can log into the taxpayer’s personal account using the access details portal of state and municipal services.

3. Using a qualified electronic signature. If you have an electronic digital signature of an individual, you can use it to open a personal taxpayer account. At the same time, it is worth noting that digital signature is needed only for initial opening(digital signature is no longer required for further use).

If you have registered a personal taxpayer account, but the password has been lost, you can contact any tax office and receive a new password. When contacting the tax office at your place of permanent registration/registration, you must have your passport with you; when contacting another tax office, you must have your passport and TIN certificate.

2015-11-30T11:30:56+00:00

How to register a taxpayer’s personal account, how to create and gain access to a taxpayer’s personal account. If you open a taxpayer’s personal account, both for individuals and legal entities, the citizen will find there up-to-date information about the amount of accrued taxes, fines and penalties. Using the Federal Tax Service service, you can fill out documents online.

How to create a personal taxpayer account for individuals? Registration in the taxpayer’s personal account. From the provisions of paragraph 1 of Article 11.2 Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) it follows that the taxpayer’s personal account is information resource, posted on the website of the Federal Tax Service of the Russian Federation. It is intended for tax authorities and taxpayers to exercise their legal rights and obligations.

(click to open)

Citizens are given the opportunity to receive documents from tax departments through the taxpayer’s personal account. In addition, according to paragraph 2 of Article 11.2 of the Tax Code of the Russian Federation, data transfer to tax institutions through the specified service is provided. First, let's define its main capabilities.

Federal Tax Service: taxpayer’s personal account

It's easy to check. If you open a taxpayer’s personal account, both for individuals and for individuals, the citizen will find there up-to-date information about the amount of accrued taxes, fines and penalties. This information, in particular, will help verify the completeness and accuracy of data on objects subject to taxes. Promptly received information will allow tax departments to be informed in a timely manner about detected inaccuracies or unreliable data.

In addition to monitoring the status of settlements with budgets of various levels, the taxpayer’s personal account allows you to:

- Download programs designed for filling out Form 3-NDFL declarations. The service allows you to download a document form, as well as fill out a declaration online. By placing an electronic signature, a person can immediately, using the taxpayer’s personal account, send the completed document to the tax department.

- The service allows you to track the status of desk checks tax returns Form “3-NDFL”.

- Thanks to the taxpayer’s personal account, you can contact tax authorities without a personal visit. All requests are sent to the relevant department via the form for feedback. The response from the specified institution also comes in electronic form. Appeals sent, as well as responses received from tax departments, are stored in a special archive. They can be opened at any time using the user interface.

- The Federal Tax Service service allows you to pay tax payments, penalties, and also generate payment documents. The taxpayer’s personal account is interconnected with relevant electronic services that allow an individual to:

- generate receipts for the payment of a number of taxes even before receiving a tax notice;

- create payment documents for the payment of fines for violating the period for submitting a tax return form “3-NDFL”;

- generate receipts for payment of debts on various taxes;

- print created payment documents for subsequent transfer of payments through credit institutions. Now the web services of many banks allow you to pay the above payments by bank transfer.

How to register a taxpayer's personal account? Logging into your personal account allows you to enjoy all the above benefits of the resource. There are two ways to access it.

Method number 1.

Using data that protects your account (login, password). They are indicated on the registration card, which can be obtained from any tax office. If a person applies to an institution serving his place of residence, he must present a document confirming his identity.

When contacting others tax inspectorates In addition to your passport, you should have a document confirming the assignment of a TIN (certificate of acceptance of a person for tax registration).

The right to enter the personal account of a taxpayer who has not yet turned 14 years old can only be obtained by his legal representative. At the same time, he is obliged to present his passport to the tax office, as well as a document confirming his authority, for example, a birth certificate. If you lose the data that protects the entrance to the taxpayer’s personal account (login, password), you should contact any institution of the Federal Tax Service of Russia.

If a citizen applies to the department serving his place of residence, he submits a document confirming his identity. And when applying to other tax authorities, you must additionally have a certificate of assignment of a TIN (confirmation of the fact that a person has been accepted for tax registration). After this, it will be possible to log into the taxpayer’s personal account.

Method number 2.

You can gain access to the taxpayer’s personal account using a qualified electronic signature. Qualified certificates of keys for verifying electronic signatures are issued by certification centers that are accredited by the Ministry of Telecom and Mass Communications of the Russian Federation. They can be stored on any media, such as hard drives, USB drives or universal electronic cards. With their help, you can easily log into the taxpayer’s personal account.

However, it should be noted that tax departments send documents through the taxpayer’s personal account only after receiving notification from the citizen about the use of the above service.

As you can see, registering in a taxpayer’s personal account is quite simple.

Subscribe to the latest news

At the moment, Russian taxpayers have the opportunity to exercise their rights and obligations through the personal account (PA) of the Federal Tax Service (Federal Tax Service). The use of a personal account or account is carried out for the purpose of sending data and documents to the Federal Tax Service, as well as receiving them from the tax authority.

Receipt will be possible only after sending a notification to the Federal Tax Service about the use of your personal account.

If you are already registered on the Federal Tax Service website, you can log into the personal account of an individual taxpayer using a direct link:

The Federal Tax Service system provides two other options for logging into your personal account:

Registration of a personal account of the Federal Tax Service for individuals

Registration on the tax service’s web resource lasts a few minutes (to fully use all the capabilities of your personal account, you will have to visit the tax service to verify your identity).

To connect online opportunities, you should go to the registration page for a new user on the official website of the Federal Tax Service and fill out the form.

Other options for gaining access to a taxpayer’s personal account

There are two ways to gain access to an account on the nalog.ru portal:

1. Via a universal electronic card. The issuance of electronic signatures is carried out by a Certification Center, which has been accredited by the Ministry of Telecom and Mass Communications of the Russian Federation. The resulting signature can be recorded on a flash or smart card, HDD, to the Universal electronic card.

2. Using the login and password specified in the registration card. By visiting a Federal Tax Service office, you have the opportunity to acquire this card. It can be issued by any inspection agency operating on the territory of the state, both in its own city and in a neighboring one.

A registration card at the tax authority at the place of residence is issued only if you have a passport. It is allowed to use other identification documents. Their list should be clarified with the Federal Tax Service. It is possible to obtain this card at any other inspection office in the country by providing not only a passport, but also a TIN certificate. Moreover, it is necessary to have both the original and a copy of the Identification Number certificate.

Possibilities of a taxpayer’s personal account (PA)

1. Monitor payments to the budget:

- for land, car, house or apartment tax. By opening your account, you can see current information about the taxable items on your balance sheet, as well as accrued amounts, fines and penalties. Thanks to this information, short time you can identify inaccuracies and report them to the Federal Tax Service;

- on personal income tax. It is possible that over the past year, Federal Tax Service employees did not withhold calculated amounts from an individual’s income. personal income tax amounts. Information about this must be submitted before March 1, following the reporting tax period, to the Federal Tax Service. Having a personal account makes it possible to see whether an individual has personal income tax debt. The amount of this debt and penalties for late payment are also indicated.

2. Use the program to fill out the 3-NDFL declaration

Each account owner has the opportunity to receive a 3-NDFL declaration by downloading it to the computer memory. It is also proposed to fill it out directly on the computer and certify it using an electronic card. The signed documents can be immediately sent to the Federal Tax Service.

3. Monitoring the status of desk audit of 3-NDFL tax returns

If the 3-NDFL tax has been overpaid, you can contact the Federal Tax Service for a recalculation.

4. Contacting the tax authorities without visiting the Federal Tax Service

Each request to the tax authority is located in the “Taxpayer Documents” menu. The responses sent by the Federal Tax Service are also stored in this place.

5. Generation of payment documents and payment of taxes

Your personal account is synchronized with the “Pay Taxes” electronic service. Thanks to it, as well as the “Payment of taxes for individuals” service, it is possible to:

- create documents for payment of various taxes in advance. That is, until the moment when the envelope with the tax payment receipt is sent;

- create documents for the payment of personal income tax, as well as other documents for the payment of a fine if a tax return was submitted late;

- print receipt documents for payment at the nearest bank branch. It is also possible to pay taxes online;

- preparation of documents for payment of debts to the Federal Tax Service.

Login to the personal account (FTS) of a taxpayer - a legal entity

The personal account system also provides everything necessary tools for legal entities, through which the organization exchanges documents with the Federal Tax Service, sending them via the Internet. In addition, it tracks tax calculations.

How to register in your personal account for legal entities

Login to the Federal Tax Service personal account for legal entities is possible if:

- obtain a qualified electronic signature (EDS);

- register on the Federal Tax Service website;

- sign an electronic signature Agreement on creating a personal account.

Read more about all the details and technical points- on the page of the official website of the Federal Tax Service.

Having access to your personal account, you can send to the tax service:

- an application for a refund of the amount that was paid in excess of the required tax amount;

- certificates on the status of settlements with the budget;

- requests for the issuance of a reconciliation report;

- certificate of absence of debts to the Federal Tax Service;

- messages about the start of work or liquidation of separate units.

The Federal Tax Service, in turn, can send various documents directly to your personal account. Also make demands for payment of tax debts.

Documents sent to your personal account have the same legal force, as well as paper documents.

If a company receives a demand for payment of tax debt, it must be fulfilled within the strictly established deadlines.

The date of receipt of the document in your personal account is the day after the day when it was sent by the Federal Tax Service.

Each organization has the right to decide for itself about the need for a personal account. Its presence is not mandatory.