Kbk to pay the minimum tax. Where to find kbk tax. Single tax with simplification

Read also

BSC is a budget classification code. KBK codes for various taxes, including for 3-personal income tax, can be found on the official website of the Federal Tax Service of Russia.

Method number 1. How to find out the BCC tax on the site nalog.ru

A list of CSC codes can be found in the "Individual income tax" section or directly via the link https://www.nalog.ru/rn01/taxation/kbk/fl/ndfl/.

Method number 2. How to find out the CCC tax using an online service

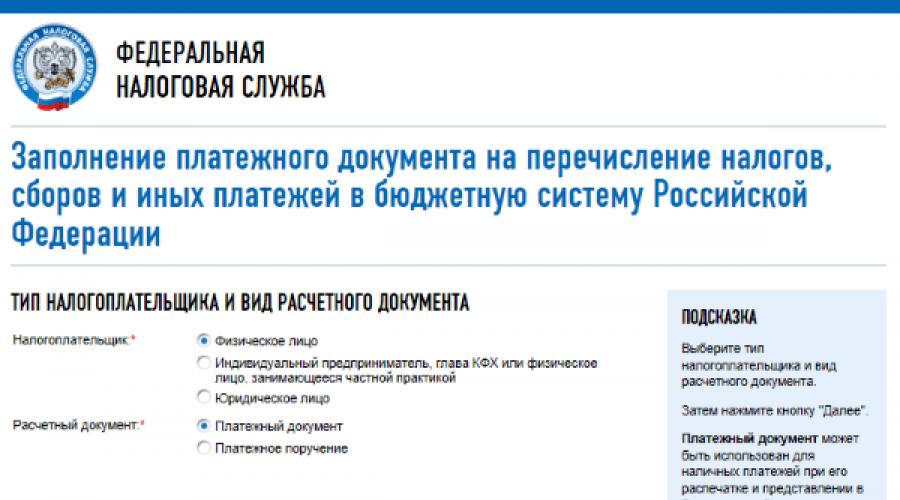

The KBK code can be found using the service https://service.nalog.ru/ This special service was developed on the nalog.ru website, with which you can generate and print a receipt for tax payment. Since now it is necessary to indicate the KBK in tax receipts, using this service you can not only prepare a receipt, but also find out the KBK code, as well as the IFTS code and the OKTMO code of the tax office you are interested in.

On the first page of the service, you will be prompted to enter information about the type of payer and the type of payment document. Then click the "Next" button.

The payer can be an individual, an individual entrepreneur, the head of a peasant farm or an individual engaged in private practice or a legal entity. The payment document can be used for cash payments when printed and submitted to the bank or for non-cash payments by electronic payment. The payment order can only be used for non-cash payments when it is printed out and submitted to the bank.

Next, you need to select the type of payment. Since we do not know the BCC, and just want to know it, we do not fill in this field, but first select the type and name of the payment, and then, if necessary, specify the type of payment. After that, the BCC will appear in the corresponding field automatically.

If the task is only to find out the KBK code, then, as can be seen from the figure above, we have learned it. If there is a need to fill out a receipt, then you need to continue. As a result, you will be able to print a receipt for cash payment at the bank or immediately pay the tax in a non-cash way through various electronic services.

Classification codes of the Federal Tax Service in 2018 for personal income tax (PIT)

182 1 01 02030 01 1000 110Personal income tax on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation (payment amount (recalculations, arrears and debts on the corresponding payment, including the canceled one)

182 1 01 02030 01 2100 110Personal income tax on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation (penalties on the relevant payment)

182 1 01 02030 01 2200 110Personal income tax on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation (interest on the relevant payment)

182 1 01 02030 01 3000 110Personal income tax on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation (the amount of monetary penalties (fines) for the relevant payment in accordance with the legislation of the Russian Federation)

182 1 01 02040 01 1000 110Tax on personal income in the form of fixed advance payments from income received by individuals who are foreign citizens engaged in employment on the basis of a patent in accordance with Article 2271 of the Tax Code of the Russian Federation (payment amount (recalculations, arrears and debts on the corresponding payment , including the canceled one)

182 1 01 02040 01 2100 110Personal income tax in the form of fixed advance payments from income received by individuals who are foreign citizens engaged in employment based on a patent in accordance with Article 2271 of the Tax Code of the Russian Federation (penalty interest on the relevant payment)

182 1 01 02040 01 2200 110Personal income tax in the form of fixed advance payments from income received by individuals who are foreign citizens engaged in employment based on a patent in accordance with Article 2271 of the Tax Code of the Russian Federation (interest on the corresponding payment)

182 1 01 02040 01 3000 110Tax on personal income in the form of fixed advance payments from income received by individuals who are foreign citizens engaged in employment on the basis of a patent in accordance with Article 2271 of the Tax Code of the Russian Federation (the amount of monetary penalties (fines) for the relevant payment in accordance with the law Russian Federation)

Budget Classification Code (BCC) – well-known abbreviation for accountants, bank operators, as well as employees of budgetary institutions.

According to the Budget Code of the Russian Federation, namely No. 145-FZ, the CBC represents groups of expenses, incomes, as well as sources of budget deficits and operations of public legal entities.

Budget classification codes are twenty-digit combinations special digital code. They are used to group the articles of the state budget, their preparation and execution, as well as the formation of reports on their implementation.

Budget classification codes are twenty-digit combinations special digital code. They are used to group the articles of the state budget, their preparation and execution, as well as the formation of reports on their implementation.

Code structure in case of budget revenues:

- Administrator (1 to 3 digits represent the chief administrator of budget revenues).

- Types of income (digit 4 - group, 5 and 6 - subgroup, 7 and 8 - article, 9 to 11 - subarticle, 12 and 13 - element).

- Program / subprogram (from 14 to 17 digits - subtype of income).

- EPC (Economic Classification of Income, digits 18 to 20, classifies operations of the general government sector).

The first group of the CSC structure consists of three characters. The “Group” component of the types of income of the KBK is represented by one sign, the subgroup - by two.

The signs in the subgroup can be the following:

- 1 - taxes;

- 2 - receipts on a gratuitous basis;

- 3 - income from entrepreneurial activity.

An article is represented by two signs, a sub-article by three, an element by two, which determine the type of budget.

The structure of the element code and its meaning:

- 01 - federal budget;

- 02 - the budget of the subject of the Russian Federation;

- 03 - local;

- 04 - urban district;

- 05 - municipal district;

- 06 - PFR;

- 07 - FSS RF;

- 08 - FFOMS RF;

- 09 - territorial MHIF;

- 10 - settlement.

Subtype of income (program) is presented next:

- 1000 - payment of the main payment;

- 2100 - penalties;

- 3000 - fines;

- 2200 - deduction of interest.

ECD specifies the income code and can be represented by three values.

CBC spending represented by the following structure with five elements:

- The main manager of budgetary funds (from 1 to 3 digits, administrator).

- Section and subsection (from 4th to 7th digits, two characters each).

- Target item of expenditure (from 8 to 14 digits, 11 and 12 characters - program, 13 and 14 - subprogram).

- Type of expenses (from 15 to 17 digits, three characters).

- ECR, which classifies public sector transactions related to budget expenditures).

Section and subsection are specified:

- 01 00 - 15 subsections - issues of a national nature;

- 02 00 - 8 - national defense;

- 03 00 - 13 - law enforcement and national security;

- 04 00 - 11 - national economy;

- 05 00 - 4 - housing and communal services;

- 06 00 - 4 - environmental protection;

- 07 00 - 9 - education;

- 08 00 - 6 - culture, cinematography, media;

- 09 00 - 4 - sports and healthcare;

- 10 00 - 6 - social policy;

- 11 00 - 4 - interbudgetary transfers.

With the help of CBC determine payment information(their purpose, addressee). With the help of a correctly specified CSC, you can:

- Make payment transactions without errors.

- Be aware of the history of cash transfers.

- To facilitate the work of employees in the public service.

- Competent budget planning and financial flow management.

- Fixing loan debt.

- Guarantee the receipt of funds to the current account and the absence of penalties from the sender.

BCC is reflected in a special field of payment orders, which are intended for tax payments, insurance premiums, penalties and fines.

BCC is reflected in a special field of payment orders, which are intended for tax payments, insurance premiums, penalties and fines.

Among the CBCs, one can distinguish following: taxes (personal income tax, VAT, on property, etc.), state duties, fines and damages, simplified tax system 6% and 15%, UTII, oil, gas, water, minerals, subsoil use, insurance premiums.

As an example, consider LLC "Vozmezdie", which conducts deductions in the event of an accident and prof. diseases in employees.

BCC in this case for 2018 will be the following:

- 393 1 02 02050 07 1000 160 - timely transfer of funds;

- 393 1 02 02050 07 2100 160 - payment of penalties;

- 393 1 02 02050 07 3000 160 - fines for mandatory payment.

Why introduced

Budget classification codes have been used for a long time, but only after the introduction of the Order of the Ministry of Finance of the Russian Federation No. 72n and the Instructions on the Application of the Budget Classification of the Russian Federation, 20-digit codes began to be used.

The created classification system allows you to quickly transfer and send funds to the recipient from the nomenclature of the state. CBCs are used not only by individual entrepreneurs in small businesses, but also by large enterprises.

Sometimes the BSC may change, in most documents the BSC is obligatory requisite.

Filling in payment documents

The payment document represents the settlement documentation on the basis of which the banking institution makes money transfers. Form No. 0401060 is used to pay taxes and contributions.

The payment document represents the settlement documentation on the basis of which the banking institution makes money transfers. Form No. 0401060 is used to pay taxes and contributions.

In 2018, the Federal Tax Service is responsible for transferring taxes and insurance premiums, and payers will have to submit a single report (No. 243-FZ).

Indicator of the budget classification code in line 104 is filled in the following way:

- Line 16- recipient - the territorial body of the Federal Tax Service is indicated.

- Line 22– unique accrual identifier (UIN) – 0 for current payments.

- Line 106- basis of payment - the code is set in accordance with the Annexes of the Order of the Ministry of Finance No. 107n.

- Lines 107, 108, 109(tax period, document number for making a payment, date of deduction) - filling out is similar to a payment order for taxes.

If the CCC is incorrect, then the "payments" are either returned to the taxpayer, or they are assigned the status "unclarified".

As a result, the accounting department is obliged to find the document, and return the payment amount to the current account. In this case, the deadlines for paying the tax will be violated, the payer will be charged penalties for late payment.

Also held tax repayment. There are situations that the company transferred the tax, but made a mistake in indicating the CBC.

As a result, the amount of the payment was received in payment of another tax - for one tax there will be an overpayment, for another - arrears. The situation is solved by compiling a letter and sending it to the tax authorities in order to transfer funds from one tax to another. This is preceded by a reconciliation. In this case, penalties will still be accrued, since the payment deadlines are overdue.

According to the Order of the Ministry of Finance of the Russian Federation No. 230n, in 2018 some budget classification codes were excluded, some were included minor adjustments.

CBC insurance premiums in 2018 for organizations and individual entrepreneurs have an administrator code of 182. The codes differ depending on the period for which the company pays.

All insurance premiums have been updated - for companies and entrepreneurs, at basic and additional rates. In addition, officials divided them into additional tariffs for employees in hazardous industries. For companies that have conducted a special assessment, the codes are not the same as for the rest.

Each merchant, natural person or organization fills out payment documents. And it doesn’t matter what payment documents are used, payment documents for the transfer of contributions, payment of wages to employees, all this must be filled out and sent according to the details.

For this, there are BCC codes that can be deciphered like this, the budget classification code. For this classification, we are indebted to Russian Legislation (Budget Code). Each code implies its own organization, which transfers money. All bank employees are familiar with this classification, because it is the KBK that is responsible for the receipt of funds. Consider what the KBK 00000000000000000130 is responsible for, who fills it out.

Structure of the CBC

The BCC consists of 20 digits, each grouping of numbers is responsible for its specific part (administrative, revenue, program, and classifying part)

- The first three digits are the admin arrived.

- One digit code-income groups.

- Two digits - income type.

- Five digits-item and sub-item of income.

- The two numbers are the budget level.

- The penultimate three digits are how the income was collected.

- The last three digits are the type of economic income.

As would be clear with the usual KBK codes, which, for example, look like this—182 1 01 01011 01 1000 110 (this is income tax to be transferred to the Federal budget). And what is this BCC 00000000000000000130 ? Some accountants of organizations are faced with such a CSC. Where are the funds transferred for this requisite?

The list of KBK is very large, there is a special directory where all codes are entered for transfer to the state treasury. For each code, Russian legislation defines its own expense items for transferring amounts for certain operations. For example, article 226 of the RF BC provides a list of services, works that relate to BCC 00000000000000000130 in 2017. Let's see what it is below.

BC RF art. 226

Based on the instructions of the Russian Federation on the application of the CCC in Art. 226 includes the following types of services:

- Research work.

- Engineering and technical services, structural surveys.

- Land surveying.

- Standard design.

- Installation work. Installation of systems such as video surveillance, alarm buttons.

- Provision of insurance services.

- Ensuring security during secret events.

- Provision of services for the protection of electronic document management.

- Printing works (binder services, photocopying).

- Medical services.

- Services of collectors.

- Provision of paid services for vocational training.

- Services rendered to the organization for the meals of employees.

- Another similar range of services.

A complete list of services for the transfer of KBK 00000000000000000130 can be found in the classifying reference book. If a number of works or services have been carried out in your organization, after consulting the relevant directory, you can safely choose a CCC and transfer money. The main thing is not to make a mistake in the numbers and enter everything correctly.

Remember, the BCC code contains a twenty-digit value, if at least one digit is missing or the values \u200b\u200bare incorrectly specified, the payment will not reach the addressee. This will already impose a certain responsibility on the organization. If you transfer BCC 00000000000000000130, you will need to indicate the type of service provided in the payment order.

For example, you transfer payment to an employee who went to advanced training courses, which means that in the payment where the BCC is indicated, -00000000000000000130 (for training) is affixed. If another service, it is indicated. The bank teller will accept such a document without fail.

From November 30, 2016, "another person" (i.e. anyone) will be able to pay taxes for the organization. But at the same time, this person cannot demand a refund of the amounts paid.

Special Modes

USN

For payments: USN tax (simplified): KBK STS income - 182 1 05 01011 01 1000 110, KBK STS income-expenses - 182 1 05 01021 01 1000 110 (182 1 05 01050 01 1000 110 - STS minimum tax for 2012-2015, and for 2016 it is necessary to transfer one STS "income-expenses").

By the way, can you absolutely free form and send to the IFTS, a zero declaration of the simplified tax system.

In USN payments, indicate the period as follows:

for the 1st quarter - QA.01.2018

for the 2nd quarter - PL.01.2018

for the 3rd quarter - Q.03.2018

for the 4th quarter - DG.00.2018

UTII

For payments: UTII tax (imputation): KBK - 182 1 05 02010 02 1000 110

In UTII payments, the period should be indicated as follows:

for the 1st quarter - QA.01.2018

for the 2nd quarter - QF.02.2018

for the 3rd quarter - Q.03.2018

for the 4th quarter - Q.04.2018

Patent

Since 2013, new CSCs for the patent system (PSN) have appeared.

182 105 04010 02 1000 110 Tax levied in connection with the application of the patent system of taxation, credited to the budgets of urban districts (since 2013)

182 105 04020 02 1000 110 Tax levied in connection with the application of the patent system of taxation, credited to the budgets of municipal districts (since 2013)

182 1 05 04030 02 1000 110 Tax levied in connection with the application of the patent system of taxation, credited to the budgets of the federal cities of Moscow and St. Petersburg (since July 2013)

IP payment

IP payment for oneself

On February 22, 2018, a new BCC was introduced for payments over 1% of insurance premiums - 182 1 02 02140 06 1210 160 (order No. 255n dated December 27, 2017). However, later it was canceled (order No. 35n dated February 28, 2018). For an additional percentage, the BCF does not change.

There is no error in the table. BCC in 2017 in the FIU are the same for fix. parts and for incomes over 300 tr.

| Payment type | Before 2017 (for any year before 2016, 2015, etc.) | After 2017 (for any year - 2017, 2018, etc.) |

|---|---|---|

| Insurance premiums for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation in a fixed amount (based on the minimum wage) | 182 1 02 02140 06 1100 160 | 182 1 02 02140 06 1110 160 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation from incomes exceeding 300,000 rubles. | 182 1 02 02140 06 1200 160 | 182 1 02 02140 06 1110 160 |

| Insurance premiums for health insurance of individual entrepreneurs for themselves in the FFOMS in a fixed amount (based on the minimum wage) | 182 1 02 02103 08 1011 160 | 182 1 02 02103 08 1013 160 |

Specify the period in the FIU - DG.00.2018

Penalties and fines

We change the 7th digit on the right (for example, KBK USN income):

BCC for tax transfer - 182 1 05 01011 01 1 000 110 (initial)

BCC for the transfer of tax penalties - 182 1 05 01011 01 2 000 110 (this was the case until 2015). Since 2015, 182 1 05 01011 01 21 00 110 - for the payment of interest, 182 1 05 01011 01 22 00 110 - for interest.

CBC for transferring a tax penalty - 182 1 05 01011 01 3 000 110

Wrong CBC?

Did you make a mistake in the CSC and incorrectly indicated it? We are writing for the Federal Tax Service Inspectorate or the Pension Fund of the Russian Federation: Application for the transfer of KBK.doc.

With the help, you can generate payments and receipts for the payment of any taxes of the simplified tax system, UTII and for employees in 2017, submit any reports via the Internet, etc. (from 150 r / month). 30 days free. At the first payment () three months as a gift.

BCC penalties for VAT 2019 - knowledge of such information is necessary when filling out a payment order for paying this payment. It is important to be careful when specifying the details in the payment order in order to avoid litigation with the tax authorities regarding non-payment. Consider what budget classification codes to fix in the payment order when paying VAT, as well as penalties or fines for this tax.

BCC for VAT payment for legal entities in 2019

Budget classification codes are used to structure revenues, expenditures and sources of replenishment of the state budget deficit. Each code consists of 20 digits, in which data on the ownership of income or expense is encrypted. From 01/01/2019, the CSCs were put into effect by order No. 132n dated 06/08/2018 on the procedure for the formation and application of budget classification codes of the Russian Federation.

Using the example of VAT on goods sold on the territory of the Russian Federation, we will show how to use this order to find the required CSC.

Appendix 1 contains a list of income types and analytical group codes. We find in it the code corresponding to the selected tax: 000 1 03 01000 01 0000 110. Using Appendix 3, we determine the income administrator - this is the federal tax service, code 182. The amount of the VAT payment has the code 1000 in place of 14-17 digits, and the amount, for example, penalties - code 2100. The code of the Federal Tax Service, according to the subsection "General Provisions" of Section II "Classification of Income", should come first. Thus, we get the desired BCC - 182 1 03 01000 01 1000 110.

For more information on late payment of VAT, read the article. “What is the responsibility for late payment of VAT?” .

Legal entities indicate the BCC when preparing payment orders for transfers to the budget in field 104 of this document.

BCC for VAT in 2019 remained the same as last year:

- value added tax on goods (works, services) sold in Russia - 182 1 03 01000 01 1000 110;

- value added tax on goods imported into Russia (from Belarus and Kazakhstan) - 182 1 04 01000 01 1000 110;

- value added tax on goods imported into Russia (payment administrator - FCS of Russia) - 153 1 04 01000 01 1000 110.

CBC for payment of penalties and fines for VAT in 2019

According to Art. 75 of the Tax Code of the Russian Federation, a penalty is charged and paid by the taxpayer if he is late in paying the tax. In this case, the organization can either independently calculate the penalty, or receive a requirement from the tax authority.

A tax penalty is a sanction for offenses (Article 114 of the Tax Code of the Russian Federation), one of which is non-payment or incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation).

Below are the BCCs for paying interest and fines for VAT in 2019. They remain the same as the previous year.

If the taxpayer made a mistake in indicating the CCC, Art. 78 and 79 of the Tax Code of the Russian Federation give the right either to return the amounts paid, or to make a set-off with other taxes in the presence of arrears on them. Also in paragraph 7 of Art. 45 of the Tax Code of the Russian Federation, it is possible to clarify the payment if a mistake was made in the CCC, but the money was received into the account of the Federal Treasury.

In 2019, the amount of penalties must be calculated according to the new rules (they are effective from 10/01/2017).

Having trouble calculating penalties? Use our auxiliary service "Fee Calculator".

Results

The correct use of CCC is important in dealing with tax payments. You can always specify any desired code in the current regulatory document. Before issuing a payment order for the transfer of penalties, specify the appropriate CCC code (there are 3 types of them), and also check the correctness of the calculation of the amount of penalties - now they are calculated using a special algorithm.