How to restore KBM in an insurance company. How to restore cbm in the database of rsa rosgosstrakh if there are no old insurance policies. Mistakes that are costly

5/5 (4)

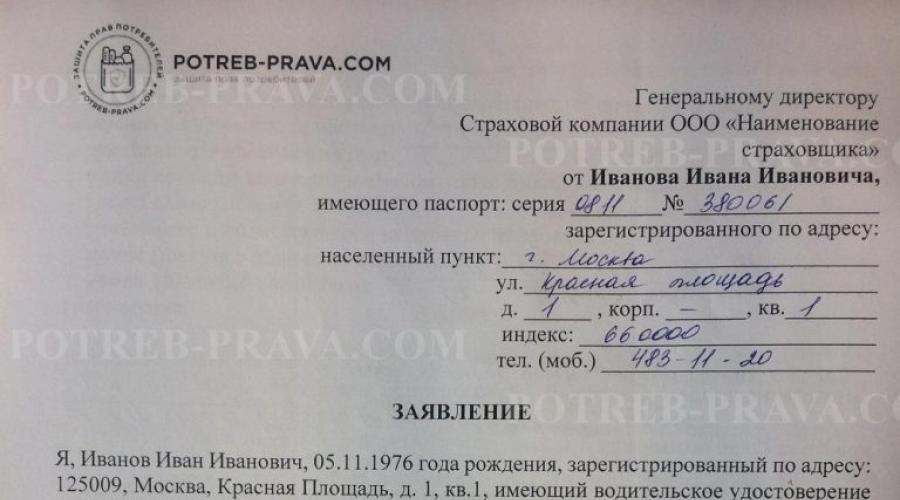

Sample applications for KBM for OSAGO

ATTENTION! Look at the completed sample complaint against KBM for OSAGO to the Insurance Company:

You can DOWNLOAD samples of complaints about KBM under OSAGO using the links below:

How to write an application for the restoration of KBM

First of all, it is necessary to establish for what reason the KBM was lost. After that, a written complaint should be made with a request to restore the discount for accident-free driving.

The text of the appeal must contain:

- Full name of the organization to which the complaint is directed.

- Applicant's details (full name, place of residence, telephone number).

- Request to make changes on KBM to the database.

- Information about the insurance policy (series, number).

- For what reason is it necessary to make changes to the KBM (for example, provide a certificate received from the UK, a previously concluded insurance contract, etc.).

- List of documents confirming the circumstances stated in the complaint.

- The date of preparation of the document and the signature of the complainant.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues.

Normative base

The procedure for insurance and its nuances are regulated at the federal level. The provisions of the Federal Law "On Compulsory Insurance of Civil Liability of Vehicle Owners" set out the requirements for organizations providing insurance services in the territory of the Russian Federation, the procedure for paying compensation in the event of an insured event, as well as ways to protect the rights of policyholders.

This normative act also regulates the procedure for compensation for damage caused by the insurer to a citizen.

The coefficients applied to insurance in the territory of our state are contained in the Directive of the Central Bank of the Russian Federation 3384-U “On the maximum sizes of the basic rates of insurance tariffs and coefficients of insurance tariffs, requirements for the structure of insurance tariffs, as well as the procedure for their application by insurers when determining the insurance premium for mandatory civil liability insurance of vehicle owners.

This document is accompanied by a table reflecting the procedure for assigning a coefficient for accident-free driving and its changes, taking into account the terms of insurance and the number of traffic accidents.

What documents are required

In order to restore the coefficient for accident-free driving, it is necessary to fill out an application for the restoration of KBM, as well as attach to it a list of necessary documentation, on the basis of which it is possible to make a decision on insurance and the level of accidents of the insured.

The list of required documents includes:

- Driver's license.

- An identity document of the complainant.

- Previous OSAGO policies.

- Copies of VU of all citizens who are included in the policy.

- Certificates from the UK about the lack of payments.

- Certificates from the traffic police, confirming the driver's accident-free for the period of interest.

Thanks to the papers listed above, the citizen receives the right to demand the return of the previously established coefficient and can confirm that he has reasons for this.

Important! In order to get a positive decision on the complaint, the driver must prepare in advance photocopies of the required documents or their scans. You can apply for the restoration of KBM at a personal appointment or via the Internet.

Grounds for filing a claim

The term KBM means a discount for a driver for accident-free driving or an increasing coefficient for accidents while driving, which is valid during the period when the insurance contract is valid.

In what situations does it become necessary to apply for the restoration of the coefficient for accident-free driving?

Please note! As a rule, such cases arise under the following circumstances:

- Deliberate actions of an insurance company specialist - many insurance companies purposefully do not apply the bonus-malus coefficient, hoping to receive a large amount of money from the insured for concluding a contract.

- Making changes to the personal data of a citizen - together with the moment indicated above, an incorrect coefficient may be reflected directly in the PCA database. In this case, it should be borne in mind that the KBM in a single PCA database is recorded according to the personal data and the number of the citizen's driver's license. If the driver changes his driving license or last name, the old KBM does not apply to the updated data of the insured, and he needs to file a complaint with the UK in order to reissue the discount on the new personal data. Today, many do not know that any changes should be reported to the insurance company, as a result, citizens are issued a new OSAGO policy, for which previous discounts do not apply.

- The mistake made by the insurer - KBM may disappear due to the fact that the insurance company did not transfer information to the PCA or simply stopped issuing OSAGO policies, respectively, such a company does not transfer data to the PCA.

It does not matter what was the basis for not applying the coefficient for accident-free driving, in any situation, you must apply for the restoration of the previous MSC data.

Watch the video. Reduced bonus-malus and new tricks of insurers:

Where to go

According to the norms of the current legislation, applications for OSAGO in relation to KBM are accepted:

- Rospotrebnadzor.

- Central bank.

Note! Most complaints about the bonus-malus ratio are handled by the PCA. When the specified organization does not respond to the complaint filed, you should contact Rospotrebnadzor or the Central Bank of the Russian Federation.

If filing a complaint with the indicated authorities also did not bring results, or the satisfaction of the requirements was refused, the citizen has the right to apply to the court. This stage is a last resort, and it comes to it infrequently.

As a rule, PCA deals with complaints against MSC in the shortest possible time. As a result, the insurer recalculates the price of the policy using the CBM indicators established by the legislator.

How to file a complaint

A complaint against KBM under OSAGO is first presented to the insurer with which the citizen has concluded an insurance contract.

According to Russian law, only IC specialists can make changes to the database. In the past, such functions were performed by an RSA officer.

The ways to file a complaint with the SC are as follows:

- At a personal reception at the office of the company. The representative of the UK must make a note on the second copy that the application has been accepted for consideration (put on the document the incoming number, date of acceptance, signature and seal of the UK).

- Sending a registered letter by mail. The complaint is sent with a description of the attachment. A return receipt will help you find out when the insurer received the request.

- With the help of the official website of the UK. There is a special application form for this.

The IC must consider the complaint filed by the citizen within thirty days, during which the organization is obliged to respond in writing to the applicant.

The response is sent to the complainant by mail or by e-mail.

If the insurance company has not responded within the period established by law, the citizen has the right to file a claim with the PCA.

To file a complaint with the RSA, you must:

- Send a written application with the application of the necessary papers to the address 115093, Moscow, st. Lyusinovskaya d. 27 building 3.

- Send a complaint with documents to an email address [email protected]

- In the event that the PCA did not respond to the appeal, you should contact Rospotrebnadzor. There are no special requirements for a complaint by law, so the document is drawn up in an arbitrary form.

If such actions have not brought results, the citizen must contact the Central Bank, which regulates issues in the field of insurance.

You can contact the Central Bank of the Russian Federation using the Internet.

Important! For this you should:

- Go to the official website of the Central Bank (cbr ru);

- In the column on the left, indicate select "Information on OSAGO";

- Mark the item "Information on OSAGO"

- Go to the tab "Submit a complaint";

- In the pop-up list, select "Incorrect use of KBM";

- Fill in the form that opens, in which you need to write down: the name of the UK, the date the complaint was filed, the address of the applicant. The message should describe the situation in detail, indicating the data of the documents, including the application for the restoration of the KBM, filed earlier with the UK;

- Upload scans of the required documentation into a special window. If the claim is sent without proper paperwork, it will be left without consideration.

The specified procedure usually helps to return the previous KMB, even if the insurer did not respond to the appeal. If the above measures did not help to solve the problem, you need to file a claim with the judicial authorities.

Terms of consideration of the appeal on the merits

The insurer is obliged to consider the complaint against KBM within thirty days. The response is sent to the applicant by mail or to the email address indicated in the document.

Note! An application sent to the RSA is considered, as a rule, within 10-15 days. The presence of changes can be tracked on the RSA website in the section “OSAGO: Information of insurers and victims”.

To find out the status of the application, please provide your personal data and information about the VU.

Contacting Rospotrebnadzor. The complaint must also be considered within thirty days. If there are grounds for its extension, the applicant is duly notified of this. An application in electronic form is accepted for consideration and is taken within three days after it is sent.

The Central Bank considers applications in relation to the KBM under OSAGO within ten days.

To successfully resolve the problem in relation to KBM, it is necessary to maintain OSAGO policies. If the applicant has all previously issued policies, the issue is resolved fairly quickly.

The driver can monitor changes in the coefficient for accident-free driving on his own. To do this, you need to go to the official website of the PCA and go to the "OSAGO" section. To check the KBM, you must specify personal information: full name, date of birth, VU number.

Do you want to take a test on the materials of the article after reading it?

YesNot

The main purpose of introducing a system of bonus-malus coefficients for auto insurance is to reduce the number of accidents and encourage accident-free driving of citizens who strictly observe the rules of behavior on the roads. The idea of the OSAGO discount is to receive bonuses when concluding an auto third party liability insurance contract, however, sometimes you have to fill out a sample complaint against KBM for OSAGO in order to return your benefit. This happens when the coefficient is too high, and, unfortunately, in many cases - unreasonably.

Reasons for the loss of KBM

It is possible by law to demand that the calculation error be corrected and the bonus-malus coefficient restored, returning your hard-earned rubles. It is only necessary to fill out a complaint against KBM under OSAGO, and in order for the bonus-malus coefficient to be restored, then you need to follow the instructions in the article.

Be sure to contact the authorities in cases where you:

- are convinced that they did not inadvertently become a participant in a traffic accident;

- did not violate the rules of driving;

- during the reporting period, the driver's license was not replaced (for example, when changing the surname during marriage);

- we are sure that your independent check of the CMB was carried out flawlessly, there are no errors, and with almost one hundred percent probability it can be argued that the reason for the increase in the CMB of OSAGO is related to the human factor.

Most often, the change in indicators is caused by the following circumstances:

- Your data is recorded in several insurances. Perhaps one of your relatives or friends entered you into their policies, not attaching importance to the size of the bonus malus, and the representative of car insurers, without showing due care during the check, put everyone in the standard third class, nullifying your legal discount. In this case, it is necessary to clarify from which insurance the discount is set.

- Insurers did not transfer your data to an automated system. Not such a frequent case, given that the conclusion of contracts is carried out using a computer, which implies the automatic entry of all data into the PCA. This can happen if the insurance agent wrote out the policy by hand and lost his copy. And of course, if you were handed a fake - alas, it happens like that. on the corresponding page in the PCA database;

- Information about you entered the database with errors. Sometimes this happens by accident, and sometimes with malicious intent on the part of insurance agents. A single blot is enough, for example, an incorrectly spelled number in the date of birth or in the column where the class or driving experience is indicated. With such suspicion, you should request a break-even certificate for your insurance with all your data, and the situation will clear up.

- Your discount is deliberately hidden, wanting to reduce points and insure you more expensively. Here the client himself is already to blame, or rather, his financial illiteracy, using which he is not given discounts, for example, due to the lack of communication with the automatic database.

- Your insurer has been liquidated- she went bankrupt, her license was revoked, etc. However, this does not relieve her of the obligation to send all available information to the automated system.

Even if you change your insurance policy, the discount should not disappear - no one has the right to change your bonus-malus ratio without a good reason!

Moreover, there is no factor that increases MBM if you:

Moreover, there is no factor that increases MBM if you:

- you are the owner of several cars;

- having received a driving license, they did not drive for a long time, but regularly extended the policy;

- sold your car in order to buy a new one;

- became an unwitting participant in the accident in the absence of their own fault.

So, what to do if the OSAGO discount is missing?

How to restore the bonus-malus ratio?

There are several ways to restore the discount and increase classiness. They are based on official requests and complaints to the relevant authorities. Before taking action, you should:

Diagram of the recovery procedure

Complaint to an insurance company

The insurer is obliged to consider it and resolve the problem within thirty days. On the official website of any serious company there is a special form - you just need to upload the relevant electronic documentation here and send the complaint for consideration. In the absence of such, it is necessary to send an application by e-mail addressed to the head of the insurance company.

For fidelity, it does not hurt to duplicate the letter with the attached documentation as a regular registered letter. An approximate text of the appeal can always be found on the official portal of the Russian Union of Motor Insurers.

Complaint to the Central Bank of the Russian Federation

Did the insurers not respond to you within the established time frame? Then we complain to the next instance - the Central Bank. To do this, you need to find the page on its official website "Information about OSAGO" and go to the link to file a complaint.

Next, a page with the section "Insurance organizations" will open - here you need to click on the link "Incorrect use of KBM". And here a form opens in which you should click on the item “No, go to filing a complaint” and enter the content of the complaint into it, adding all the required information on the policy you are looking for, and then leave your personal and contact information on the next page. The term for consideration of such an appeal is 10 days.

There are no obstacles to sending a complaint in the usual way, by postal mail. The text of the appeal and documents should be sent to the address that you will find at the end of any page of the CBR website.

Complaint to RSA

As a rule, things do not come to this - the issue is already resolved in one of the institutions indicated above. The official website of the PCA will provide an e-mail for submitting a complaint, as well as all the necessary forms for download.

If the final verdict still does not suit the policyholder, he can file a lawsuit in court, where the chances of finding justice for the OSAGO insurance company are quite high. To do this, you should scrupulously collect all the accumulated documentation, including correspondence with insurance and other authorities.

Refund of funds paid for an incorrect CBM

And now let's talk about the debts of insurance companies, often reaching serious numbers. And they, as usual, should be returned. The first step on this path is the restoration of the KBM. If this process is successfully completed at the level of the insurer itself, you should offer him to recalculate and return the money you overpaid. Self-respecting firms have no reason to make a fuss, they quite easily go to the world and the issue is closed.

If it came to the intervention of the Central Bank, after considering the complaint, they send the applicant a letter with a recalculation and an indication of the amount that the company must reimburse. Based on it, you should write an application for the return of money to the company, attaching the following documents:

If it came to the intervention of the Central Bank, after considering the complaint, they send the applicant a letter with a recalculation and an indication of the amount that the company must reimburse. Based on it, you should write an application for the return of money to the company, attaching the following documents:

- original response from the Central Bank;

- own bank details.

Another copy of the package with certified copies must be prepared for yourself. Having taken all the documents with you, you need to go to the insurance company and submit an application with the documentation attached to it. Do not forget to get a written assurance from the responsible person about the acceptance of papers - he leaves information about this under the signature on your copies. This will be the end point - it remains only to wait for the transfer of your money. The law sets a two-week period for this.

Being armed with the information received, it will only be a matter of technique to write a complaint against the KBM under OSAGO and return the bonus-malus coefficient. Good luck and may justice prevail!

OSAGO is a mandatory type of insurance, the tariffs for which are approved at the state level. When calculating the insurance premium under the OSAGO policy, employees of insurance organizations must take into account the KBM coefficient.

If, when calculating OSAGO, an employee of the insurance company did not use the individual KBM coefficient, or used, but incorrect, the insured should write a complaint to the relevant authorities and demand recalculation and return of the overpaid insurance premium. You can write a complaint both to the website of the insurance company, and to the PCA or the Central Bank of the Russian Federation. In this article, we will consider: how to correctly write a complaint against KBM under OSAGO and achieve the restoration of KBM and reimbursement of the premium paid?

What is MBM and why is a complaint filed?

MBM or bonus-malus coefficient is a discount for accident-free driving, or an increasing coefficient for emergency driving, valid for the duration of the insurance contract.

To account for the lower and higher class, there is a special table of KBM. A client who applies for a policy to an insurance company for the first time is assigned the initial 3rd class. A driver who accurately drives the insurance year receives a 5% discount for each insurance year without an accident. In the event of an accident, the driver class is calculated depending on the initial insurance class and the number of losses during the insurance period.

In what cases may it be necessary to file a complaint about the restoration of the KBM? Typically, these situations occur in the following situations:

- Intentional actions of an insurance employee - many insurance companies intentionally do not use the KBM coefficient in the hope of getting more money from the client for issuing an insurance contract.

- Change of the policyholder's personal data - along with the previous paragraph, an error in the value of the KBM may occur in the PCA database itself, where it is stored. In this situation, you need to take into account that the KBM coefficient in a single PCA database is stored by the name and number of the driver's driver's license. In the event of a change of rights or surname, the old coefficient will not be applied to the new data of the driver, and he should write an application to the insurance company to reissue the discount on new personal data. Unfortunately, many do not know that it is necessary to notify the insurance company of all changes, as a result of which they issue an OSAGO policy for a new surname and driver's license, losing any of their available discounts.

- The mistake made by the insurance company - the KBM discount may disappear even due to the fact that the insurance organization did not send the data to the PCA or completely stopped its CMTPL insurance activities and stopped providing information to the PCA.

It does not matter for what reason the insurer did not apply the KBM, in any case, it is worth writing a complaint and demanding the restoration of information in a single PCA database.

How to write a complaint to the insurance company?

The policyholder can file a complaint against the auto insurer in two ways - in person, by contacting the company's office, or through the official website. If you choose the first option, you will need to contact the central office at the location. To apply, you must have:

- valid OSAGO policy;

- driver license;

- the passport;

- personal account details;

- statement.

The application can be written in free form, addressed to the director or head of the branch, for example, in this form:

I ask you to look into the situation with my KBM. Until now, I have insured my 2007 Daewoo Matiz car without any problems. 51 hp Year after year, insurance companies gave me a discount for accident-free driving, because. for 9 years of experience, I have never been in an accident and have not contacted insurance companies about payments.

On May 18 of the current year, my OSAGO policy issued by Rosgosstrakh LLC expired, and from that day I cannot issue a new policy, because all insurance companies offer to purchase a policy at an unreasonably high price, citing the fact that now I have no discount for accident-free, and by default I have been assigned class 3 with CBM = 1. When I independently check my CBM on the PCA website, I get the same result - class 3 and KBM=1.

I ask you to check the correctness of my KBM and make appropriate changes to the PCA database. I am enclosing scans of the driver's license, as well as insurance policies for the past and the year before.

An employee of the insurance company must accept the entire package of documents, register and provide the client with a copy of the application, with a mark of acceptance. After accepting the application, the insurance company must make changes and notify the client about the change in the KBM in a single database.

In the absence of the possibility of a personal appeal to the representative office of the insurance company, you can leave a complaint on the official website. To make an appeal, you must register on the insurer's website and write an electronic application. When filing a complaint in electronic form, an e-mail address is indicated to which the result of consideration of the application of the insured will be sent.

If the insurance company does not want to change the CBM coefficient, you should contact the PCA or the Central Bank.

How to file a complaint with the RSA?

The Russian Union of Motor Insurers is an authorized organization, one of the tasks of which is to maintain a Unified Database, created for the correct use of KBM when drawing up insurance contracts and resolving disputes in the field of insurance.

To remotely send a complaint to the RAMI, you need to go to the official website http://www.autoins.ru, and in the "Contact the RAMI" section, download the approved form, fill it out according to the example indicated above and send it to the email address [email protected]

Also, a claim to the PCA can be submitted personally by contacting 115093, Moscow, st. Lyusinovskaya d.

A submitted complaint is usually reviewed within 10-15 business days. You can check the changes on the official website of the PCA, in the section "OSAGO: Information of policyholders and victims." To obtain information about the status of the complaint, you must provide personal data and a driver's license.

Your work experience (full years)

If you had an accident

The result may differ depending on the presence of an accident due to your fault.

When applying for OSAGO, many drivers are faced with such a problem as an incorrect KBM. Today we will talk about ways to restore the discount on OSAGO - KBM.

The discount disappears as a result of:

- An error occurred while filling out the form. For example, when providing information on the policy to a single database, a representative of an insurance company made a typo in the driver's full name or driver's license number.

- Change rights. Often drivers change their license due to expiration or loss. At the same time, no one even guesses that after changing the document number, the discount should be “outweighed” in a single database. This can be done independently via the Internet or in the office. As a result of ignorance, the earned bonus is not displayed when calculating new protection.

Consider several options for its restoration.

In person at the office of the insurance company

The easiest and most proven way to restore discounts on auto citizenship. This will require:

- take a issued policy with the correct discount;

- visit the branch of the insurer;

- to write an application.

It is best to contact the central office, since the employees of this unit have great powers.

As for the application, there is no exact sample. Here is an example in free form:

|

Director of LLC "Insurance Company" Ivanov I.I. From the insured Petrov P.P. Statement When concluding an OSAGO policy of series EEE No. 0101010101, a coefficient of 0.5 was applied (11 accident class). When concluding a contract for a new term, the 3rd class of accidents is determined on the basis of the PCA. I ask you to sort it out and restore the discount, because there were no insured events due to my fault during the period of validity of the auto-citizenship. Please reply to the email address at [email protected]. Decryption The completed application must be completed and submitted online via the feedback form.

In practice, the PCA makes changes within 2-3 business days after receiving the request. Through the Central BankIf the insurance company and the PCA refused, then you should file a complaint with the Central Bank. The appeal is filled out remotely, on the official website of the Central Bank.

The application must include:

The appeal will be accepted and considered within 5 business days. In practice, these changes are made 100% and the client receives the bonus earned under the policy. Through a brokerThis option is suitable for those who cannot remotely submit an appeal and contact the office in person. It should be understood that brokers are not charitable companies that are ready to spend their time and help everyone. In practice, the cost of a broker's services ranges from 500 to 1,000 rubles. Broker:

Calculator

|

The so-called "bonus-malus" coefficient is assigned to all drivers or car owners and must be taken into account when calculating the cost of an OSAGO policy. The value of KBM varies depending on the number of accidents made by the driver - the fewer there are, the lower the KBM and the cheaper the policy. All insurers must take this factor into account. If a particular insurer does not apply it, then you can file a complaint against the KBM under OSAGO with a special authority.

In what cases is a complaint filed?

KBM has been used since 2003, the algorithm for its application is prescribed in Law "On OSAGO". To calculate the value of the coefficient, the database of the Union of Insurers of Russia - AIS RSA is used, the data is entered into it exclusively in automatic mode. KBM when calculating insurance is not used only in two cases:

- when issuing a transit policy;

- if the car is registered in another state.

- For new drivers "by default" there is a coefficient equal to one.

A complaint about the calculation of the bonus-malus coefficient for OSAGO can be filed in two cases:

- if the insurance company does not apply it at all;

- if the CBM is calculated incorrectly.

There is a special table that indicates the value of KBM depending on the class. Drivers should carefully study it in order to be able to protect their rights and file a complaint against the OSAGO insurance company, which KBM does not calculate correctly.

The owner of the car can also make a claim if the driver who drives the vehicle by proxy has incorrectly calculated the amount of insurance. In both cases, the algorithm for considering a complaint is absolutely the same.

Most often, a complaint is filed against KBM for OSAGO on Rosgosstrakh and other large companies that take advantage of the ignorance of drivers and overestimate the cost of their policies.

Who takes the complaint

According to the legislation, three instances are involved in processing complaints against insurers:

- Russian Union of Motor Insurers;

- Rospotrebnazdor;

- Central bank.

Since 2015, the complaint procedure has been simplified. Now it is enough to go to the rgs.ru website and file a complaint against the KBM under OSAGO electronically. The claim will be sent by e-mail and processed in the general manner. You will need to attach scans or photographs of the necessary documents to it.

On the same site, you can download a sample complaint against an insurance company for KBM and print it for review. If you wish, you can download a blank form and fill it out according to the proposed sample. A completed complaint can be sent by mail to the PCA or brought in person to any branch of the organization. The document is filled either by hand with a pen with blue ink, or typewritten.

Most of the issues related to the appointment of KBM are dealt with by the union of insurers, lawyers advise to apply there. If there is no reaction, then you can send a complaint from the KBM filled out according to the same model to the Central Bank or Rospotrebnadzor.

In the absence of a reaction on their part or an unsatisfactory decision, one thing remains - an appeal to the court. But usually it doesn't come to that: PCA reacts quite quickly to such requests, forcing companies to recalculate the cost of the policy using legal coefficients. Some send a complaint to Rosgosstrakh on OSAGO KBM, the sample of which will be the same.

It makes sense to apply not only to the head office of the insurance company, but also to the RSA, too, since the center often protects regional offices and may not respond to the complaint properly.

How to file a complaint

In order to fill out a sample complaint against KBM under OSAGO, you must first prepare the documentation on which the applicant will rely. It:

- a copy of the driver's passport;

- a copy of the driver's license;

- a copy of a valid or expired OSAGO policy;

- a copy of the passport of the owner of the car (if he submits a complaint).

All documents must be certified by a notary or at the local office of the PCA.

The CMTPL complaint itself regarding the bonus-malus coefficient is filled out according to the established model on the official form. So, you need to specify:

- name, patronymic and surname of the applicant;

- home address;

- index;

- phone number and other contact details;

- information from the driver's license and passport data (series, number and date of issue);

- case number in the company with which the conflict arose;

- policy number.

Next, you need to briefly formulate the essence of the claims against the insurance company, if necessary, make references to the law. The KBM complaint sample provides for the possibility of attaching evidence of the applicant's rightness - for example, it can be a dictaphone recording of a conversation with a company representative or a certificate on the calculation of the cost of the policy without applying the bonus-malus coefficient.

A complaint can be sent after purchasing a policy without KBM or immediately after contacting the insurance company and finding out that its cost is too high. In the first case, after a positive decision, the insurer will either return the money or extend the insurance for a certain period, taking into account the funds paid, in the second, provide a correct calculation.

Thus, a sample complaint against the KBM for OSAGO can be found on the official website of the domestic union of motor insurers, where you can also send an application in electronic form. The application must be accompanied by personal documents of the applicant, certified by a notary or a representative of the PCA. With a positive decision, the insurance will be recalculated as it should, at a lower cost.

Video: Complaints from car owners about KBM under OSAGO