How to calculate depreciation of a car using the linear method example. Straight-line depreciation method

Read also

The linear method of calculating depreciation eliminates temporary differences according to PBU 18/02. The article contains formulas and calculation examples, complete reference books on fixed assets for free.

To always easily calculate depreciation, we recommend downloading:

Calculate depreciation

Step 1. Determine the period of use of the object (SPI).

SPI is the estimated time during which the object will be used in business. The SPI for a fixed asset is determined at the time it is put into operation and is confirmed by order of the manager.

In the future, the SPI can be changed only in cases directly provided for in the accounting legislation (completion, additional equipment, modernization, reconstruction).

The commission sets the service life for linear depreciation based on:

- the planned duration of use of the object in business to generate income;

- the period after which complete wear and tear of the fixed asset will occur - moral or physical. This period is determined by the conditions in which the object will be located, the intensity of its operation, the number of repairs, etc.

- other restrictions on the duration of operation - for example, the validity period of the lease agreement for the facility.

Example 1

Monolit LLC bought a company car for the financial director and plans to use it for 5 years. By order of the general director of Monolit, the SPI of the car was established in accounting for a period of 5 years.

If in accounting and tax accounting the SPI of a fixed asset are different, then temporary differences will arise according to PBU 18/02. This will create additional paperwork and new postings.

Example 2

Let's continue the first example and assume that in tax accounting the SPI of a car is from 7 years to 10 years inclusive. In this case, each month the accounting depreciation exceeds the tax depreciation. Different monthly expense amounts will result in temporary differences being reflected.

A sample order for different SPIs is shown in the window below, it can be downloaded.

To avoid additional labor costs, you can define the same SPI for accounting and taxation.

Example 3

Let's continue the second example and assume that the car is technically suitable for use for 20 years without any other restrictions. In such a situation, Monolit can indicate in the order the same period for linear depreciation in accounting and taxation - for example, 8 years.

Step 2. Determine the annual depreciation rate.

Example 4

Let's continue with the third example. If the SPI of a car is 8 years, then the annual rate of linear depreciation is 12.5% (1/8 years x 100%).

Step 3.

The cost of an object in accounting is determined when it is put into operation and is formed from all the costs of receiving the object and bringing it into working condition, including the cost of purchase, delivery, installation, non-refundable taxes, customs duties, etc. For more information about what the cost of an object is made up of, see Table 1.

Table 1. The cost of an object for depreciation using the straight-line method

|

Expenses |

Object cost |

|

|

Accounting |

Taxation |

|

|

Seller fee |

Include |

|

|

Costs of creating an object on your own |

Include |

|

|

Delivery charge |

Include |

|

|

Payments to intermediaries and consultants in connection with the purchase of the property |

Include |

|

|

Installation or setup costs |

Include |

|

|

Customs payments |

Include |

|

|

Refundable VAT, refundable excise taxes |

Not included |

Not included |

|

Non-refundable VAT and excise taxes |

Include |

|

|

Mandatory contributions to compulsory health insurance, compulsory medical insurance and compulsory social insurance |

Include |

|

|

Differences due to payment for an object in foreign currency |

Not included |

|

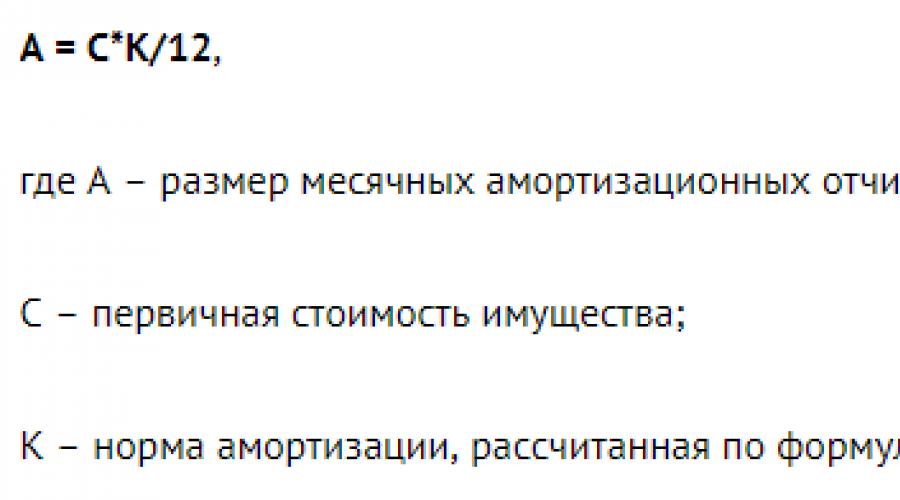

Step 4. Determine the annual amount of linear depreciation using the formula:

Example 5

Let's continue the fourth example and assume that the book value of the car upon commissioning is 600,000 rubles. Then the annual depreciation on the car is 75,000 rubles. (12.5% x RUR 600,000).

Step 5. Determine depreciation per month.

To do this, the annual amount of linear depreciation is divided by 12.

Example 6

If we continue the fifth example, then depreciation per month will be 6250 rubles. (RUB 75,000/12 months). Let’s assume that the car was put into operation in September 2018. Monolit’s accountant will reflect the transactions in accounting.

As of the date of commissioning of the facility in September 2018:

Debit 01 Credit 08

Every month since October 2018:

Debit 26 Credit 02

Linear method of calculating depreciation in tax accounting

How to write off expenses for fixed assets in tax accounting is shown in the diagram:

The linear method of calculating depreciation in tax accounting is an algorithm of actions that includes four steps.

Calculate depreciation

Step 1. Determine the SPI of the object.

For tax purposes, the SPI of a depreciable fixed asset is determined based on:

- Classification according to Decree No. 1 dated 01.01.02, which contains a list of property objects divided into depreciation groups and the corresponding SPIs, indicating codes according to the All-Russian Classifier of Fixed Assets (OKOF);

- Manufacturer's passports;

- Other technical documents.

In total, the Tax Code provides for 10 depreciation groups; they are shown in Table 2.

Table 2. SPI for the straight-line depreciation method

|

No. |

Depreciation group |

|

|

1 year - 2 years inclusive |

||

|

2 years – 3 years inclusive |

||

|

3 years – 5 years inclusive |

||

|

5 years – 7 years inclusive |

||

|

7 years – 10 years inclusive |

||

|

10 years – 15 years inclusive |

||

|

15 years – 20 years inclusive |

||

|

20 years – 25 years inclusive |

||

|

25 years – 30 years inclusive |

||

The full current OKOF classifier is shown in the window below.

If the OKOF code for a fixed asset is in the Classification, then it must be depreciated over the SPI, which is given for its depreciation group.

Example 7

Let's continue the previous examples and assume that the engine capacity of the car that Monolit bought exceeds 3.5 liters. Such machines are indicated by OKOF code 310.29.10.24 in the 5th group. This means that the SPI for a car can be set for a duration from 7 years to 10 years inclusive, this is a period from 85 to 120 months.

Step 2. Determine the monthly depreciation rate using the formula:

Step 3. Determine how much the fixed asset initially costs.

For information on how the cost of an object is formed, see Table 1.

Step 4. Determine depreciation per month using the formula:

Example 8

If we continue the seventh example and assume that for a car worth 600,000 rubles. SPI for taxation is 8 years (96 months), then depreciation per month will be 6250 rubles. (1/96 months x 100% x RUR 600,000).

For enterprise expenses. Another advantage is that the legislation provides for the possibility of using this method both in accounting and tax accounting, which avoids the occurrence of differences under PBU 18/01. What features characterize linear depreciation in accordance with the Tax Code of the Russian Federation? What formulas are used in the calculations? Let's look at all the regulatory details in this article.

Linear depreciation method - legislative nuances of accounting

According to Art. 259 of the Tax Code for tax purposes, taxpayers can use one of the proposed methods when writing off depreciation - linear or nonlinear. If the linear depreciation method is used, the amounts of deductions are determined monthly and for each object separately (clause 2 of Article 259). The method for calculating depreciation amounts must be fixed in the company’s working accounting policy. At the same time, you need to remember that according to the property, out of 8-10 grams. (structures, buildings, intangible assets, transmission devices) it is allowed to choose only the linear depreciation method - the service life of the asset does not matter.

Note! The method established by the company for calculating depreciation according to NU can be changed, but only from the beginning of the next tax year. At the same time, you can change the non-linear method to the linear depreciation method once every 5 years (clause 1 of Article 259).

Depreciation is calculated from the 1st day of the month during the period of putting the object into operation, including fixed assets that require the state procedure. registration of rights (clause 4 of article 259). If there has been a complete write-off of an asset or a disposal has occurred for various reasons, the accrual of depreciation amounts ends on the 1st day of the month following the month of disposal (clause 5 of Article 259.1). The linear method of calculating depreciation in accounting is regulated by clause 18 of PBU 6/01 along with other methods provided for accounting purposes.

The straight-line depreciation method is applied both to newly purchased operating systems and to those that have already been in use. The essence of the calculations lies in the initial determination of the SPI of the object in accordance with the Classification according to Resolution No. 1 of 01/01/02. Then the NA is established - the depreciation rate using the linear method is calculated as a percentage based on the SPI assigned to the property (in months). Detailed rules for settlement actions are given below.

How is depreciation calculated using the linear method - calculation formulas

To calculate the monthly amount of depreciation, you will need the PS values of the initial cost (price) of the object and NA. According to paragraph 2 of Art. 259.1 NA is calculated separately for each property. The following formulas are used:

- Depreciation per month = PS x NA.

- Depreciation rate in a straight-line manner = (1 / n) x 100%, where n is SPI expressed in months.

Based on these formulas, it becomes clear that the main difference of this method is the uniform transfer of the value of property to the company’s costs. Thus, it is advisable to use the linear method of calculating depreciation if economic activity is stable, brings uniform profit and does not require rapid write-off of fixed assets. Linear calculation is not suitable for calculating wear on quickly worn-out objects, with high intensity of production processes, as well as with premature obsolescence of property.

If new production is being developed, it is recommended to slow down the write-off of wear and tear; and in cases where the organization does not lack cash and can promptly update obsolete assets, accelerated depreciation with the subsequent replacement of written-off equipment, machinery, tools, etc. would be optimal.

Straight-line depreciation method - example

Let's look at a specific example of how the linear depreciation method is used. Suppose a company purchased a new passenger vehicle for 400,000 rubles. excluding VAT. According to the Classification rules, the car is included in class 3, the SPI is set at 48 months. To calculate depreciation monthly/annual amounts, it is necessary to determine the HA and then the amount of depreciation.

ON monthly = 1/48 = 2.083%, the depreciation rate using the straight-line method is expressed as a percentage.

AT annual = 1/4 = 25%.

Monthly depreciation = 400,000 rubles. x 2.083% = 8332 rub.

Annual depreciation = 400,000 rubles. x 25% = 100,000 rub.

Calculation of depreciation using the straight-line method - postings

When calculating depreciation, the company's accountant makes standard monthly entries depending on the industry specifics of the activity. This is the attribution of depreciation to expenses:

- D 20 K 02 – reflects the write-off of depreciation of the main production facility.

- D 23 K 02 – reflects the write-off of depreciation of an auxiliary production facility.

- D 25 K 02 – reflects the write-off of depreciation of an object for general production purposes.

- D 26 K 02 – reflects the write-off of depreciation of a general purpose object.

- D 44 K 02 - reflects the write-off of depreciation of the facility of trading companies.

- D 91 K 02 – reflects the write-off of depreciation for an object leased.

1. Straight accrual method (linear) assumes that the functional utility of an asset depends on the time of its use and does not change throughout its useful life, i.e. A constant amount of depreciation is charged over the entire useful life of the asset.

With this method, monthly depreciation deductions are made in the same amounts throughout the entire useful life of fixed assets.

When applying the linear method, the amount of depreciation accrued for one month in relation to an object of depreciable property is determined as the product of its original (replacement) cost and the depreciation rate determined for this object.

When applying the linear method, the depreciation rate for each item of depreciable property is determined by the formula:

K = (1/n) x 100%,

where K is the depreciation rate as a percentage of the original (replacement) cost of the depreciable property;

n is the useful life of a given depreciable property item, expressed in months (years).

Example. An object worth 120 thousand was purchased. rub. with a useful life of 5 years. The annual depreciation rate is (1/5)x100%=20%.

The annual amount of depreciation charges will be:

120,000 x 20%: 100% = 24,000 (rub.)

2. Reducing balance method. With this method, the annual amount of depreciation charges is determined by the residual value of the fixed asset item at the beginning of the reporting year and depreciation rates calculated based on the useful life of this item and the acceleration factor established in accordance with the legislation of the Russian Federation. For movable property that constitutes the object of financial leasing and is classified as the active part of the operating system, in accordance with the terms of the leasing agreement, the acceleration factor cannot be higher than 3. Example. P The initial cost of the object is 100,000 rubles; useful service life - 5 years; annual depreciation rate - 20%; increasing factor - 2.

Depreciation calculation:

1st year: 100,000 x 40% (20 x 2) = 40,000 rub. (residual value - 60,000 rubles);

2nd year: 60,000 x 40% = 24,000 rub. (residual value -36,000 rub.);

3rd year: 36,000 x 40% = 14,400 rubles. (residual value -21,600 rub.);

4th year: 21600 x 40% = 8640 rubles. (residual value -12960 rub.);

5th year: 12960 x 40% = 5184 rubles. (residual value -7776 rub.).

After depreciation has been calculated for the last year, the fixed asset retains a residual value that is different from zero (in this example - RUB 7,776). Typically, this residual value corresponds to the price of the possible capitalization of materials remaining after the liquidation and write-off of fixed assets.

3. Depreciation method based on the sum of the numbers of years of useful life. This method is also accelerated and allows depreciation payments to be made in the first years of operation in significantly larger amounts than in subsequent years. This method is used for fixed assets, the value of which decreases depending on their useful life; obsolescence sets in quickly; the cost of restoring an object increases with increasing service life. This method is advisable to use when calculating depreciation on computer equipment and communications equipment; machinery and equipment of small and newly formed organizations whose load on fixed assets falls on the first years of operation.

When writing off the cost by the sum of the number of years of its useful life, the annual amount of depreciation charges is determined based on the original cost of the fixed asset and the annual ratio, where the numerator is the number of years remaining until the end of the service life of the object, and the denominator is the sum of the number of years of the service life of the object.

Example. An item of fixed assets was purchased at a cost of 350 thousand rubles, with a useful life of 6 years. The sum of the numbers of years of service life is 21 years (1+2+3+4+5+6). In the first year of operation of the specified object, depreciation may be charged in the amount of 6/21 or 28.05%, which will be approximately 98.18 thousand rubles; in the second year – 5/21 or 23.8% (83.3 thousand rubles); in the third year - 4/21 or 19.09% (66.82 thousand rubles), etc.

4. Method of calculating depreciation depending on the volume of output or work(proportional to production volume). In this case, the annual amount of depreciation is determined by multiplying the percentage calculated when registering a given object as the ratio of its initial cost to the expected volume of output or work over its useful life by the indicator of the actual volume of production or work performed for a given reporting period.

Example. The cost of the car is 65,000 rubles, the estimated mileage of the car is 400,000 km. In the reporting period, the car's mileage was 8,000 km, the amount of depreciation for this period will be 1,300 rubles (8,000 km x (65,000 rubles: 400,000 km)). The amount of depreciation for the entire useful life of the fixed asset is 65,000 rubles (400,000 km x 65,000 rubles: 400,000 km).

It involves gradual compensation of material resources that were spent on the construction or acquisition of assets by transferring their cost to the cost of manufactured products. Several depreciation methods are used.

The linear method is the most common and in demand. It is used in both accounting and . The main advantage is its simplicity, which is very convenient for accountants. The straight-line depreciation method is the write-off of the value of fixed assets in equal parts over the entire period of their operation. Due to the uniformity of the payment amounts throughout the entire period, it is also called uniform.

The concept of the linear method of calculating depreciation

When using this method, the amount of depreciation charges is determined depending on the initial cost of the fixed assets object and the value of the depreciation rate, which is determined on the basis of the useful life of the object. If the enterprise has undergone reconstruction or repair of assets, which led to a change in the value of assets, then instead of the initial cost, use .

Neither operating conditions, nor the degree of wear, nor the costs of maintenance and repair are taken into account. Moreover, it is not always possible to accurately determine the impact of these factors on an object. Therefore, this method is the most convenient, although not always profitable.

The legal basis for the use of this method is Art. 259.1 Tax Code of the Russian Federation. An enterprise has the right to choose the method of depreciation calculations, and the chosen method must be reflected in the accounting policy of the enterprise.

Advantages of the linear method:

- uniform deduction of funds to the depreciation fund;

- stable and proportional impact on the cost of products;

- ease of use;

- exceptional accuracy of calculation results.

Depreciation begins on the first day of the month following the month in which the object was capitalized.

- This rule also applies to cases of return of objects (clause 4 of Article 259).

- Accrual stops from the first day of the month following the month in which the enterprise was founded (clause 5 of Article 259 of the Tax Code of the Russian Federation).

The linear method is usually chosen if it is planned that the object will generate the same income during its operation and will decline evenly.

If it is known that over time, the result of use increases in proportion to the frequency of its use, then the choice of the straight-line method becomes unreasonable from the point of view of calculating depreciation. can bring great benefits to the company.

How does the calculation work?

Step-by-step instruction

With the linear method, it is determined by multiplying the cost of an object by the value that is established for this object.

How is the calculation done:

- When calculating, the primary cost of the object is determined, that is, the costs of its acquisition or construction.

- An approximate one is established when the object is capitalized according to the classification list. If an object is not included in this list, then the enterprise independently predicts its service life. This depends on how quickly the object wears out, in what mode it will be used, and what the conditions of its operation will be.

- The depreciation rate is determined. You can use the formula:

Payments using the straight-line method should be made monthly, starting next month. Payments are made regardless of the financial situation of the enterprise. They are taken into account in the same period in which they were accrued.

In case of temporary conservation of an object for a period of more than three months or repairs for a period of more than one year, depreciation must be suspended. When these processes are terminated, depreciation resumes starting from the next month.

Depreciation continues until the cost of the asset is fully paid off or until it is removed from the balance sheet.

By the way, we must not forget that the amounts for depreciation are not real cash flows. There is nothing in common between money and depreciation amounts. Depreciation refers to accounting reporting, which involves the redistribution of the value of fixed assets without reducing the profit margin. But this does not mean actually setting aside a reserve of funds for repairs and the purchase of a new property. In practical terms, depreciation means the classification and write-off of fixed assets over a period of years.

Example of accrual during the year

- With a useful life of 5 years, with an initial cost of 300,000 rubles.

- The depreciation rate per year will be: 100%: 5 years = 20%

- Annual contributions to the depreciation fund: 300,000 x 20% = 60,000 rubles.

From this table it is obvious that:

- the amount of deductions remains unchanged throughout the entire period;

- the amount of wear increases evenly;

- the residual value decreases evenly.

When is this method used?

All fixed assets are divided into groups according to the duration of their operation. The linear method is mandatory for use in groups 8-10. For other groups, it is allowed to use any methods of the organization’s choice, including linear.

Changing the depreciation method used is not permitted at any time. Switching from to linear is possible once every 5 years. You can switch from linear to another method at the beginning of any new tax period. In this case, it is necessary to make changes to the accounting documents.

Disadvantages of the method

The linear method should not be applied to objects that are subject to rapid wear during operation. The write-off procedure for linear accrual does not meet the requirements for replacing or restoring an object.

The linear method should not be applied to objects that are subject to rapid wear during operation. The write-off procedure for linear accrual does not meet the requirements for replacing or restoring an object.

If the enterprise requires renewal of assets or reconstruction, it is recommended to use non-linear methods. In addition, the total lifetime property tax bill using the straight-line method will be higher than using other methods.

Online calculator

To facilitate and speed up calculations, you can use an online calculator for the amount of depreciation for tax purposes, according to Art. 259 NK. This is what an online calculator usually looks like, of which there are many on the Internet. All that is required of a person is to enter two numbers: the amount of the initial cost and. After a few seconds, the answer will appear on the screen.

The video below will tell you about linear and other depreciation methods:

Contributions resume immediately upon return to service;

- depreciation deductions cease on the 1st day of the month following the month of write-off due to wear and tear, withdrawal from the balance sheet or loss of ownership rights to the property.

Advantages and disadvantages of the linear method The main advantages of the linear depreciation method:

- Easy to calculate. The calculation of the amount of deductions needs to be made only once at the beginning of the operation of the property. The amount received will be the same throughout the entire service life.

- Accurate recording of property write-offs. Depreciation deductions occur for each specific object (in contrast to non-linear methods, where depreciation is calculated on the residual value of all objects in the depreciation group).

- Uniform transfer of costs to production costs.

Calculation of depreciation amounts for tax purposes

- An organization that receives used fixed assets as a contribution to the authorized (share) capital or as a succession during the reorganization of legal entities has the right to determine their useful life as the useful life established by the previous owner of these fixed assets, reduced by the number of years (months) of operation of this property by the previous owner. Federal Law No. 144-FZ of July 27, 2006 supplemented Article 259 of this Code with paragraph 15, which comes into force on January 1, 2007.

- Organizations operating in the field of information technology have the right not to apply the depreciation procedure established by this article in relation to electronic computer equipment.

Linear method of calculating depreciation

In this case, from the month following the month in which the residual value of the depreciable property reaches 20 percent of the initial (replacement) cost of this object, depreciation for it is calculated in the following order: 1) the residual value of the depreciable property for the purpose of calculating depreciation is recorded as its base cost for further calculations; 2) the amount of depreciation accrued for one month in relation to a given object of depreciable property is determined by dividing the base cost of this object by the number of months remaining before the expiration of the useful life of this object.

Calculating depreciation using the straight-line method: example

PBU 14/2007) for fixed assets and intangible assets (clause 2 of Article 259.1 of the Tax Code of the Russian Federation) AM = C / SPI / 12 where C is the initial or replacement cost of the fixed asset; SPI is the useful life of the fixed asset in years AM = C / SPI where C is the initial or current market value of an intangible asset; SPI is the useful life of an intangible asset in months AM = C * K where C is the initial or replacement cost of an asset or intangible asset; K is the depreciation rate of the corresponding object And how to calculate the depreciation rate using the linear method in tax accounting? This norm, as in accounting, depends on the useful life. Therefore, calculating the depreciation rate using the linear method according to the rules of Ch. 25 of the Tax Code of the Russian Federation looks like this: 1 / SPI * 100%, where SPI is the useful life in months.

Formula and features of calculating depreciation using different methods

The formula for the calculation looks like this: A = (StOS- pA)*NA%, where StOS and pA are the cost of fixed assets at the beginning of the previous month and the amount of depreciation deducted. With the non-linear method, the cost and amount of depreciation are calculated monthly. These are not equal amounts, but decreasing ones. The principle is valid until the residual value of the asset becomes equal to 20%.

After this, linear method calculations are applied. You can also apply summary calculations in a non-linear way based on the amount of the depreciation group. For this, the formula A = B*NA/100 is used, where B is the total balance of a particular group, and NA is the depreciation rate according to legislative data. This video will tell you how to calculate depreciation with examples: What is needed for the calculation A simple linear method for determining the amount of depreciation usually does not cause difficulties.

Over time, the nonlinear calculation method becomes clear.

Straight-line depreciation method

Russia) It's fast and free! Formula for Calculating Depreciation There are several ways to calculate depreciation. In addition, depreciation is different for accounting and tax purposes. For tax purposes, there are two calculation methods: In accounting, in addition to the linear path, the reducing balance method is used, a method of writing off value according to the number of years of useful use or in proportion to the volume of production.

Attention

There is also now the concept of accelerated depreciation of fixed assets. In most cases, entrepreneurs can choose the method of calculating depreciation themselves, although the tax authorities allow only the linear method to be used for a number of fixed assets. The following formula for calculating the depreciation rate as a percentage is applicable to it: NA = 1/n*100%, while n is the number of months of the useful life of the OS.

The initial cost of the fixed asset is multiplied by the interest received.

Calculation of depreciation using the straight-line method

Primary cost of the object The primary cost of the object is used as the basis for calculation, which is calculated by summing up all the costs of its purchase or construction. If the value of the property was revalued, then an indicator such as replacement cost is used for calculation. 2. Operating period The operating period is established by studying the classification list of fixed assets, differentiating them into depreciation groups.

If the object is not recorded in the list, then its service life is assigned by the organization depending on:

- predicted time of use;

- expected physical wear and tear;

- expected operating conditions.