Application form for personal income tax deduction. Application for a property tax deduction

Read also

The purchase and sale of an apartment is a transaction in which the buyer pays the cost of residential real estate to the seller, and the seller transfers ownership of this property to the buyer. Part of the funds that the buyer spent on purchasing an apartment can be returned through tax office.

The amount that the buyer can return, subject to certain conditions, cannot exceed 13% of 2 million rubles, this is the size of the property deduction when purchasing an apartment. If the cost of the apartment is less than 2 million rubles, then the buyer will be able to return personal income tax on the full cost of the property. If the cost exceeds 2 million rubles, then you will be able to return only 13% of 2 million rubles.

A personal income tax refund from the purchase of an apartment is possible if the buyer paid income tax from your income. And also if you have documents confirming payment for the apartment.

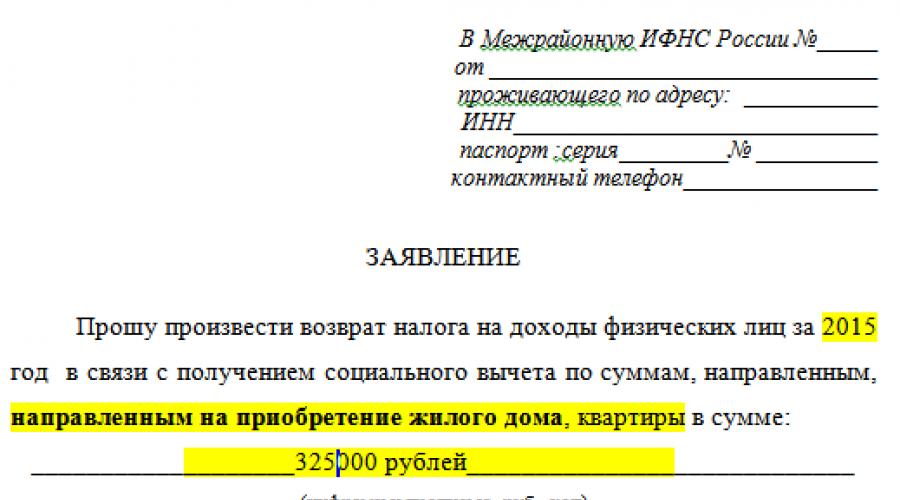

In order to return personal income tax when buying an apartment, you need to write an application for an income tax refund; we suggest downloading a sample of such an application at the bottom of the article in word format.

Who can NOT get a tax deduction when buying an apartment?

The figure below shows groups of citizens who can and cannot receive tax deduction according to personal income tax when purchasing an apartment. ⇓

Step-by-step instructions for filling out an application for a personal income tax refund

There is no standard application form, you can draw it up in free form, you can use the form provided by the Federal Tax Service itself. The application, along with other documents, is submitted to the tax office located at the taxpayer’s place of residence. In one year, you will be able to return only the amount within the personal income tax paid for that year. Unrefunded balances carry over to the next year. You can read more about income tax refunds when purchasing an apartment and property deductions in.

In this article we will dwell in more detail on the features of writing an application for personal income tax refund.

You may also find the sample application for income tax refund in connection with education expenses -, treatment - useful.

Application to the tax office for a personal income tax refund when purchasing an apartment

How to write an application for a personal income tax refund when buying an apartment?

In the right corner you should write that the application is being submitted to INFS No.__ (at the applicant’s place of residence). Next, it is written from whom it is drawn up (the buyer of the apartment, who is also the applicant) - full name in full genitive case, residential address, telephone number, series and passport number.

The main contents of the form contain a request to return personal income tax in connection with receiving a property deduction for amounts allocated for the purchase of residential real estate (apartment, residential building, room, share in an apartment). The amount of income tax that must be refunded to the taxpayer is written in words and figures.

In order for the tax office to be able to transfer money if a positive decision is made in providing a property deduction, it is necessary to indicate the account number and the name of the bank where it is opened in the application itself.

The state provides its citizens with official income with the opportunity to reduce the amount of taxes they pay. One of them is tax deductions. To reduce or refund tax payments, a certain package of documents is required to justify the reduction in the tax amount, and an application to the Federal Tax Service department at the place of residence or to the employer. In some cases, an additional tax deduction application will be required.

The state provides its citizens with official income with the opportunity to reduce the amount of taxes they pay. One of them is tax deductions. To reduce or refund tax payments, a certain package of documents is required to justify the reduction in the tax amount, and an application to the Federal Tax Service department at the place of residence or to the employer. In some cases, an additional tax deduction application will be required.

Types of personal income tax deductions

For payers of this tax, the legislation provides several opportunities for obtaining deductions (Tax Code of the Russian Federation, Articles 218 - 221). You can reduce your tax amount by paying for your studies, medical care or buying a home. Reduces the tax base and engaging in a certain type of activity.

All deductions are divided into 6 groups:

- Standard. This reduction in the tax base is provided to those who have minor children (including disabled children), participants in various military operations (their relatives), liquidators or victims of radiation disasters, bone marrow donors, etc. Its size depends on payer category and ranges from 500 to 12,000 rubles.

- Social. This type of deduction compensates the taxpayer for the costs of treatment, study and insurance for himself or his family members. You can declare a reduction in the tax base in the amount of no more than 120,000 rubles per year. Expenses paid with money from maternity capital or reimbursed to the payer under the insurance contract.

- Investment. Provided when selling various securities or depositing money into an investment account. Their maximum size is also limited and depends on many factors. For example, when replenishing your account, a maximum of 400,000 rubles will be taken into account.

- Property. When selling property, it can be obtained in two ways. Firstly, income from the sale, as a taxable base, is reduced by an amount depending on the type of property (maximum 1,000,000 rubles for movable property). Secondly, provide the tax authorities with documents confirming the costs of acquiring the property being sold. In this case, taxable income will be reduced by the entire purchase price.

When purchasing or building a residential property maximum size deduction depends on the origin of funds for the purchase of an apartment, house or land plot. Own money will give you the right to reduce the personal income tax base to 2,000,000 rubles, and a loan - to 3,000,000 rubles

- Professional. Those who are engaged in business can reduce their personal income tax base. private practice, lawyers, notaries, individual entrepreneurs, creators of various works. The size of the reduction depends on the amount of expenses that the person incurred in connection with his professional activities. Costs are taken into account in accordance with the documents provided or in a certain amount from the income received, if it is not possible to confirm them.

- Deductions when carrying forward losses from transactions with securities for future periods.

In order to be able to reduce the tax base, the personal income tax payer must take a number of actions.

Procedure for receiving a deduction

After committing an action or event that gives the right to reduce tax payments, first of all it is necessary to collect all the documents confirming the right to the deduction. These can be financial papers where the amounts of expenses are recorded, various agreements, as well as certificates (certificates) that indicate the basis for reducing the tax amount.

Then the payer turns to his employer, acting as a tax agent, or to the Federal Tax Service at his place of residence and asks to reduce the personal income tax base. The specifics of the procedure depend on the type of deduction.

When the right to standard deduction There is no need to go to the tax office. To receive it, you need to write an application at your place of work and provide certificates or certificates confirming the possibility of tax reduction. In some cases, additional documents may be required.

For example, when moving from one employer to another within a year, you will need a certificate of income from your previous place of work. And the child tax deduction in double size one of his parents can receive it by presenting a statement from the other to refuse to receive it.

IN tax service It is necessary to apply for this type of deduction only if it is received in a smaller amount than required by law.

For example, a mother quit her job to look after the children, but the parents did not know about the possibility of the father receiving a double deduction. In this case, after the end of the year, you can contact the Federal Tax Service and receive the missing amount in the form of a refund of overpaid tax.

After checking all the data, the tax refund will be sent to the account specified in the application.

In all other cases, the payer chooses how he wants to receive the deduction. Through the Federal Tax Service at the place of residence, the refund of overpaid tax is carried out after the end of the tax period (calendar year).

Currently, there is no need to write an application for a deduction to the Federal Tax Service.

The payer submits an income tax return, indicating the grounds for reducing the tax base and attaching all documents that give the right to a deduction. Then you need to provide the tax office with details of the bank account where the payer will receive the refund (application).

During the tax season, you can reduce your tax by submitting an application to your employer. In this case, the refund amounts will be taken into account each time income tax is calculated. However, in this case, you first need to go to the tax office to obtain a document confirming the right to the deduction and its amount. This notice is attached to the application for deduction.

Submitting an application for deduction

The employer has not developed a set form for applying for deductions. The appeal can be drawn up by analogy with other applications accepted in the office work of the organization where the payer works. Approximate sample You can also download it on the official website of the tax department.

If a taxpayer works for several employers at the same time, the deduction at his choice can be provided only with one employer. – ADD, THIS IS IMPORTANT

The statement states:

- Full name and position of the manager;

- Full name, position and contact details of the employee who compiled the appeal;

- a request for a deduction, indicating the basis for its provision (subparagraph of the article of the Tax Code of the Russian Federation);

- documents confirming the right to deduction;

- date of preparation and signature of the applicant.

The residential address in the application is indicated in accordance with the registration stamp in the payer’s passport.

When registering a reduction in the personal income tax base through the regional division of the Federal Tax Service, an application for deduction is not processed. In this case, the package of documents consists of a declaration and supporting papers. At the same time, you need to fill out an application for the transfer of overpaid amounts.

Its form was developed by the tax department and is filled out according to certain rules. It is filled in capitals in block letters by hand or on a computer.

Fill in the following information:

- Full name of the payer;

- his TIN;

- address and contact phone number;

- code of the department where the application is being submitted;

- basis for transfer (Tax Code of the Russian Federation, Art. 78);

- refund amount and reason (overpaid, collected, offset);

- type of budget payment (tax, fee, etc.);

- OKTMO and budget classification codes;

- the period for which the money is returned (calendar year);

- recipient of the return;

- banking institution where the account is opened;

- account type;

- details for transfer (BIC, account number, its affiliation);

- identification document.

When applying to the tax service to obtain a document certifying the amount of the deduction (other than the standard one), the application indicates:

- name and address of the Federal Tax Service division;

- applicant's details (full name, address, telephone);

- type of deduction and basis for its provision (subparagraphs of articles of the Tax Code of the Russian Federation);

- the amount of deduction for each basis;

- the employer(s) from whom the deduction will be made;

- list of documents confirming expenses;

- date and signature of the applicant.

Examples of application forms

When contacting the regional division of the Federal Tax Service to obtain a document justifying the reduction of tax payments, the application can be drawn up as follows:

In the Federal Tax Service for the Maloritsky district, Minusinsk

From Zheleznov Gennady Mikhailovich

TIN 365239874561

Passport 85 75 653265, issued by the Department of the Federal Migration Service for the city of Minusinsk on May 30, 2010

Date of birth 08/06/1983

Registration address: Minusinsk, st. Nizhnekamenskaya, 65

Mobile phone: 89032576164

Application for confirmation of the right to deduction provided for in paragraphs. 2, clause 1, art. 219 Tax Code of the Russian Federation

Please confirm my right to receive a social tax deduction in connection with paying the fee for studying at Ural state university my minor child to K. G. Zheleznov, in 2019 in the amount of 37,519 rubles 22 kopecks (thirty-seven thousand five hundred nineteen rubles twenty-two kopecks).

In the specified year I will receive a deduction from the employer:

Open Joint-Stock Company"Autodigest", TIN 986532158745, checkpoint 771102101, legal address: Minusinsk, Heroev Labor Avenue, 32.

Applications:

10/12/2018 Zheleznov (Zheleznov G. M.)

Then a statement with the following content is written to the manager or owner of the company where the payer works:

General Director of JSC "Mechanisms"

Rostovtsev R. G.

Merdiev Ruslan Nikolaevich

Chief specialist of the quality department

TIN (if available) 632587456321

living at the address: Nefteyugansk, st. Molodezhnaya, 36, apt. 17

Statement

Please provide me with a tax deduction based on subparagraph 2, paragraph 1, art. 218 of the Tax Code of the Russian Federation, as a participant in hostilities.

The right to a tax deduction, as well as the amount of income from previous place I confirm the work:

- A copy of the combat veteran's certificate No. 256324 dated 06/02/1998;

- Certificate of accrued wages and other payments No. 23/k, dated June 17, 2018.

07/03/2018 Merdiev (Merdiev R.N.)

After approval by the manager, this document is handed over to the accountant who calculates the employee’s salary for accounting when withholding tax.

Some types of expenses professional activity or expenses for study, treatment, insurance give the right to reduce the amount of income tax. A person must document them and write an application for a refund of tax payments. This can be done at the regional branch of the Federal Tax Service and at the employer. The procedure for receiving an overpayment and the frequency of reducing the amount of income tax depend on the chosen refund method.

An application for a personal income tax refund when purchasing an apartment may be needed if the taxpayer did not take advantage of the opportunity to refund the tax from the employer and wants to return it through the Federal Tax Service immediately for the year. How and when can you return personal income tax when purchasing real estate? What documents are required for this? How to properly submit a return application? We will give answers to these and other questions.

Conditions for returning personal income tax when purchasing an apartment

In the case of purchasing an apartment, it is possible to return part of the invested funds through the use of property deductions (Article 220 of the Tax Code of the Russian Federation). They exist in two forms that can be used together:

- Direct costs of purchase or construction:

- their volume is limited to 2,000,000 rubles;

- the deduction can be attributed not to one, but to several objects;

- if the apartment is sold without finishing (and this is reflected in the contract), then it is permissible to include the costs of Finishing work and materials.

- Mortgage interest. This deduction is also limited in amount (RUB 3,000,000). Additionally, it can only be applied to one object.

Deductions can be used:

- in relation to income taxed at a rate of 13%;

- if there is a right to property, which will be confirmed by the corresponding certificate issued when purchasing the object, or an acceptance certificate for shared participation in construction;

- for expenses that have documentary confirmation and carried out by the taxpayer personally, not at the expense budget funds(or maternity capital funds) and not when purchasing from a related party;

- each of the owners for the full amount when purchasing in joint or shared ownership;

- when parents purchase housing registered for children under 18 years of age.

Read more about mortgage deductions in the material “Tax deduction when buying an apartment with a mortgage (nuances)” .

Ways to return tax

You can get your tax refund in the following ways:

- In the year the right to deduction arises, submit it to the Federal Tax Service at the location permanent residence the entire package of documents related to it, and receive from the tax office a notification of the right to a deduction for its use at the place of work. If this year the deduction amount is not used in full, then next year you must again contact the Federal Tax Service for notification of the remaining deduction. And so every year until full choice its amount.

- After the end of the year in which the right to deduction arises, submit a 3-NDFL declaration to the Federal Tax Service for last year, compiled taking into account the amount of possible deduction for the year. The amount of the deduction cannot be greater than the amount of annual income. The declaration must be accompanied by 2-NDFL certificates confirming the amount of income and the amount of tax withheld from it, a set of documents giving the right to deduction, and an application for a personal income tax refund for the past year. If there is a need to return the balance of the deduction in the following years, the taxpayer can choose one of 2 ways: receiving an annual notification for the current year for the employer or annually submitting a declaration for the past year to the Federal Tax Service. When choosing the first route, an application for a personal income tax refund to the employer is submitted together with a notification of the right to deduction received from the INFS. If you do not use the deduction at work, you will be able to submit the declaration again to the Federal Tax Service at the end of the year.

Sample application to the INFS to receive notification of confirmation of the right to property deduction you will find in the article “Application for a property tax deduction”.

Resubmission of the set of documents entitling the right to deduction will not be required with any of the applications relating to the balance of the deduction in subsequent years.

Return of personal income tax through the Federal Tax Service is possible only if a declaration is submitted for the tax period (clause 7 of Article 220 of the Tax Code of the Russian Federation), i.e. at the end of the year. The Federal Tax Service will check the submitted declaration within 3 months (clause 2 of Article 88 of the Tax Code of the Russian Federation) and after another 1 month (clause 6 of Article 78 of the Tax Code of the Russian Federation) will return the tax to the bank account that the taxpayer will indicate in the application.

Documents evidencing the right to return

The right to a tax refund for the purchased apartment will be confirmed by the following documents:

- certificate of ownership, and in case of shared participation in construction - an acceptance certificate;

- purchase agreement or share participation in construction;

- when purchasing for a child - a birth certificate;

- mortgage agreement, if any;

- documents on payment of interest;

- contract for finishing work, if the apartment was purchased without finishing;

- payment documents for payment of the cost of the apartment, and for finishing costs - building materials and finishing work performed.

Read about the nuances of applying deductions for equity participation agreements that provide for a breakdown of the cost into parts. “What is the size of the personal income tax deduction if the cost of an apartment in a residential building is divided into parts?” .

Filling out a return application

There is no need to fill out an application for a deduction for the purchased apartment. According to the Federal Tax Service, it is enough to submit a declaration, which plays the role of such a statement. However, to receive a tax refund, an application will still be required (Clause 6, Article 78 of the Tax Code of the Russian Federation). Moreover, it will contain the details of the account to which the money should be returned.

For such a statement there is definite shape, approved by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/182@. Since 01/09/2019, it has been in effect as amended by the Federal Tax Service order dated 11/30/2018 No. ММВ-7-8/670@.

On our website you can also see a sample application drawn up on the current form.

Results

When purchasing (or acquiring through equity participation) an apartment, an individual can take advantage of two property deductions for personal income tax:

- in the amount of purchase or construction costs (within 2,000,000 rubles, but with the possibility of use for several objects);

- in the amount of interest on the mortgage (within RUB 3,000,000 and applicable only to one of the objects).

The right to deduction is checked and confirmed by the Federal Tax Service. And the tax itself can be reimbursed either at the place of work (by reducing current accruals), or by receiving the amounts overpaid for the year from the Federal Tax Service (after filing a declaration there at the end of the year of acquiring the right to deduction). Reimbursement of the full amount of tax may take several years. There is no need to write any application for reimbursement. But if you receive tax from the Federal Tax Service, you will need to submit an application for its refund. There is a specific form for such an application.

The buyer of residential real estate can use tax benefit in the form of a property deduction, which allows you to return part of the tax previously paid on income. This right arises when a number of criteria are met, and a mandatory action is the collection and preparation of a set of documents for submission to the Federal Tax Service or the employer, depending on the place where the deduction is used. In this article we will tell you how to prepare documents to obtain a property tax deduction in various situations.

The essence of the benefit is that there is no income tax on its value, thanks to which the buyer will be able to return part of the personal income tax on expenses incurred for the purchase of living space for a fee within the limits of this deduction. 13% of the actual cost of purchasing or constructing a residential property and repaying mortgage interest are subject to a refund. The maximum possible tax amount for refund is 13% of the property deduction established by the Tax Code of the Russian Federation (2 million rubles).

Who is NOT entitled to receive a property deduction in infographics

The infographics below discuss categories of citizens who are not entitled to receive a property deduction. ⇓

(click to enlarge)

Features of using property deduction

To apply the right to deduction provided for in tax laws, need to:

- Have taxable income, for example, salary in the year of purchase of the living space;

- Collect the necessary set of documentation confirming the availability of income, payment of personal income tax and the amount of money spent;

- Inform about the right to deduct the Federal Tax Service or the employer, depending on the chosen tax refund method.

If there is no taxable income at the rate of 13% in the year of spending on housing, the deduction can be applied for later upon the appearance of such income.

Two ways to receive a property deduction

An apartment buyer can go two ways:

- Contact the Federal Tax Service for registration with a set of documents at the end of the year in which you are registered in state order right to the acquired object. All personal income tax amount is returned immediately to the details specified by the buyer in the application (within the limits of the personal income tax withheld in the year);

- Contact the employer with a notification document from the Federal Tax Service about the presence of the right to deduction. The tax is returned gradually - the monthly salary is not subject to personal income tax until the deduction is fully taken out. Read also the article: → “”.

Documents for property deduction for the Federal Tax Service

If the buyer of an apartment decides to return personal income tax with the help of the Federal Tax Service, then the documents must be submitted upon completion of the year of state registration of the right to purchase and receipt of the corresponding certificate from the registration authority. Tax legislation does not stipulate specific deadlines for submitting documents. You can submit documentation later if there were no tax deductions on income.

The set of necessary documentation for transfer to the Federal Tax Service includes:

- Application for tax refund;

- 3-NDFL – declaration for individuals on the declaration of income and the corresponding amount of the transferred tax for the year;

- 2-NDFL - a certificate showing income and deductions, received at the place of work and necessary for preparing a declaration. Read also the article: → “”.

- A document confirming the completion of the registration procedure for rights to an apartment - a certificate, if registration was made before 07/15/16, or an extract from the Unified State Register, if this procedure was carried out after the designated date;

- An agreement signed by the buyer and seller on the alienation of an immovable residential property (purchase and sale), as well as a transfer act drawn up for it, confirming the fact of moving the apartment between the parties to the transaction;

- Payment documentation proving the existence of costs for the purchase of living space (receipt for the PKO, receipt, act of transfer of funds, checks, account statements for non-cash payments);

- A document confirming the identity of the applicant (passport or other).

The specified package may be supplemented with other documents; the exact composition of the package must be clarified at the tax office at the place of registration of the buyer. Documents from items 4-7 of the above list should be submitted in copies.

Methods for submitting documentation:

- Personally;

- Through a proxy;

- By mail;

- Through the Government Services Portal electronically;

- Through the taxpayer’s account electronically.

After transferring the papers to the tax office, you must wait three months, after which the Federal Tax Service, based on the fact of the desk audit, makes a decision on the existence of the right to a property benefit. If the decision is positive, the amount will be refunded within a month using the details provided by the buyer in the application.

If the decision is negative, the Federal Tax Service sends a desk audit report indicating the refusal. The buyer retains the right to agree with the decision of the tax authorities or try to achieve the truth by sending written objections to the tax office. You can challenge the decision of the Federal Tax Service within one month from the date of receipt of the act.

If appealing the decision to the Federal Tax Service does not yield desired result, the case can be transferred to court within three months.

The application is drawn up according to standard form, approved by the Federal Tax Service by order ММВ-7-8/90@ dated 03.03.15 ed. dated 08/23/16.

(click to enlarge)

The application must provide the following information:

| Data | Explanations for filling |

| Addressee information | Name of the place of filing - tax office, serving the territory residence of the applicant. |

| Information about the applicant | Data about the buyer of the living space who actually paid the cost of the apartment (full name, tax identification number, address). |

| Article of the Tax Code of the Russian Federation | Article 78 is indicated. |

| Tax name | The name of the tax requiring a refund is indicated - personal income tax, as well as the corresponding year of purchase of housing. |

| KBK | Code by which personal income tax is transferred ⊕ |

| OKTMO | Territorial code according to the classifier. |

| Sum | Amount of tax to be refunded (in words and figures). |

| Payment details | Data on the account number and servicing bank; it is to these details that the Federal Tax Service will transfer the tax amount. |

| Date and signature | Day of application and personal signature of the applicant. |

Documents for obtaining a deduction from the employer

If the buyer of an apartment does not want to wait until the end of the year to receive a tax refund through the Federal Tax Service, you can obtain a deduction from the employer. To do this, immediately after state registration of rights to an apartment and receipt of the corresponding paper confirming the completion of this procedure, a set of documents is prepared for the Federal Tax Service in order to receive a confirming notification of the existence of the right to a property deduction.

The notification is sent to the employer, who, from the month of receipt of this document, stops withholding income tax from the employee’s salary until the amount of tax specified in the notification is returned. The set of documents to be submitted to the Federal Tax Service in order to receive a notification is similar to the above with some exceptions:

- No need to submit 3-NDFL;

- Instead of applying for a tax refund, an application to receive a notification is submitted.

After receiving the papers, the Federal Tax Service considers the issue for a month, after which, if the outcome is positive, it issues a notification, and if the outcome is negative, it refuses to provide the notification. In the second case, the decision can be appealed to the Federal Tax Service and the court.

The notification is drawn up by the Federal Tax Service using a standard form and contains information about individual, the year for which the deduction is provided and information about the employer. The notification received is transmitted to the employer along with the application for the deduction. This notification paper is valid during the current year; if during this year the entire deduction amount is not taken, then the employee next year needs to contact the Federal Tax Service again to receive a new notification.

For registration, you can use the form from the letter of the Federal Tax Service BS-4-11/18925@ dated 10/06/16. This form is a recommended form.

The application must be filled in:

- Information about the tax authority where documents are submitted;

- Information about the applicant (individual);

- Contact number;

- Please confirm eligibility for the benefit for a specific year (notice issued will only be valid for the specified year);

- Name and details of the employer from whom the tax refund will be made (there may be several employers in the case of a combination of jobs);

- The name and address of the residential property in respect of which the applicant is making a request;

- The amount of the deduction for the costs of purchasing a home and the corresponding mortgage interest (if any);

- List of attached documents;

- Date and signature.

Sample application for property deduction

An application to the employer for using the deduction is drawn up in free form, and it is recommended to include the following data:

- Please provide a property deduction;

- Reference to Article 220 of the Tax Code of the Russian Federation, allowing such a request to be made;

- Year for which provision is required;

- The reasons for the request are the purchase of an apartment;

- Details of the notification paper from the Federal Tax Service;

- The amount of the deduction;

- Attached documents;

- Signature and date.

Documents for property deduction for mortgage

If a buyer takes out a targeted loan to purchase an apartment, then he has the right to a property deduction not only for the cost of paying for living space, but also for repaying mortgage interest. For housing, there is a limit on the amount of deduction of 2 million rubles, for interest - 3 million rubles. Read also the article: → “”.