Loan agreement between legal entities. A loan agreement between a legal entity and a legal entity. Requirements for the parties

Read also

1. THE SUBJECT OF THE AGREEMENT

1.1. Under this agreement, the Lender transfers to the Borrower the amount of an interest-free loan in the amount of rubles, and the Borrower undertakes to repay the specified loan amount within the period established by this agreement.

2. RIGHTS AND OBLIGATIONS OF THE PARTIES

2.1. The Lender transfers to the Borrower or transfers to his bank account the specified loan amount within days from the date of conclusion of this agreement.

2.2. The Borrower will repay the loan amount specified in this agreement no later than 2019. The specified amount of the interest-free loan can be repaid at the Borrower’s request in installments (in installments).

2.3. The amount of the interest-free loan specified in clause 1.1 of this agreement may be repaid by the Borrower ahead of schedule.

3. RESPONSIBILITY OF THE PARTIES

3.1. In the event of failure to repay the loan amount specified in clause 1.1 of this agreement within the period specified in clause 2.2 of this agreement, the Borrower is obliged to pay the Lender a penalty in the amount of % of the unreturned loan amount for each day of delay until the day it is returned to the Lender.

4. FORCE MAJEURE

4.1. The borrower is released from liability for partial or complete failure to fulfill obligations under this agreement if this failure was a consequence of force majeure circumstances that arose after the conclusion of this agreement as a result of extraordinary circumstances that the parties could not foresee or prevent.

4.2. If the circumstances specified in clause 4.1 occur, each party must immediately notify the other party about them in writing. The notice must contain information about the nature of the circumstances, as well as official documents certifying the existence of these circumstances and, if possible, assessing their impact on the party’s ability to fulfill its obligations under this agreement.

4.3. If a party does not send or untimely sends the notice provided for in clause 4.2, then it is obliged to compensate the other party for the losses it has incurred.

4.4. In the event of the occurrence of the circumstances provided for in clause 4.1, the deadline for the party to fulfill its obligations under this agreement is postponed in proportion to the time during which these circumstances and their consequences apply.

4.5. If the circumstances listed in clause 4.1 and their consequences continue to apply for more than , the parties conduct additional negotiations to identify acceptable alternative ways of executing this agreement.

5. PRIVACY

5.1. The terms of this agreement and agreements (protocols, etc.) thereto are confidential and not subject to disclosure.

5.2. The parties take all necessary measures to ensure that their employees, agents, successors, without the prior consent of the other party, do not inform third parties about the details of this agreement and its annexes.

6. DISPUTE RESOLUTION

6.1. All disputes and disagreements that may arise between the parties on issues that are not resolved in the text of this agreement will be resolved through negotiations.

6.2. If controversial issues are not resolved during negotiations, disputes are resolved in the manner established by the current legislation of the Russian Federation.

7. TERMINATION OF THE AGREEMENT

7.1. This agreement is terminated:

- fulfillment by the Borrower of the obligation to repay the loan amount;

- by agreement of the parties;

- on other grounds provided for by the current legislation of the Russian Federation.

8. FINAL PROVISIONS

8.1. This agreement is considered concluded from the date of transfer by the Lender of the loan amount specified in clause 1.1 of this agreement to the Borrower.

8.3. Any changes and additions to this agreement are valid provided that they are made in writing and signed by duly authorized representatives of the parties.

8.4. All notices and communications under this agreement must be sent by the parties to each other in writing.

8.5. This agreement is drawn up in two copies having equal legal force, one copy for each of the parties.

9. LEGAL ADDRESSES AND BANK DETAILS OF THE PARTIES

Lender

Borrower Legal address: Postal address: INN: KPP: Bank: Cash/account: Correspondent/account: BIC:

An agreement for the loan of certain valuables is concluded between two legal entities. This is an agreement in which the lender gives the borrower something of value, and in which it is stated that the debtor is obliged to return the value in accordance with the terms specified in the agreement.

The legal basis of such an agreement is unilateral obligations to return certain valuables or their equivalent, if so specified in the agreement. The contract acquires legal force only after the transfer of value from one party to the other. That is, the lender gives away some value. Such an agreement is always considered compensated, unless otherwise specified in the text of the agreement.

Based on what the borrowed funds will be used for, they distinguish between a target agreement and a standard one. The target agreement is aimed at borrowing money or other valuables that will be used only for certain purposes (in the agreement form). Under a standard agreement, values can be used for any purpose of the borrower. Sample forms (2016) are available at the end of the page (for downloading).

Below we look at an example of a regular cash loan:

An organization provides money to a product procurement company to purchase raw materials from a manufacturing company. With the condition that after processing this raw material, most of it will be given to the lender.

Mandatory requirements that the parties must comply with.

For the borrower:

- the absence of legal prohibitions for a legal entity to conduct such operations;

- the absence in the statutory documents of organizations of a ban on the obligations or measures they carry out;

- the use of borrowed assets only in accordance with the statutory objectives, also applicable to non-profit organizations.

For the lender:

- absence of statutory and legal prohibitions on issuing loans;

- the existence of ownership rights to the occupied value.

Legal regulation

By observing all the clauses of the agreement (loan repayment period, transactions, return procedure, etc.), one party to the agreement undertakes to return the borrowed assets to the other.

In addition to cash and things, foreign currency, securities, and jewelry can be transferred to Russia. The latter must be expressed in foreign currency equivalents in full compliance with legal regulations.

According to the type of conclusion and type of contract, they are divided into:

- targeted;

- monetary;

- interest;

- interest-free.

The beginning of the full validity of the agreement is considered to be the transfer of all, without exception, valuables to the borrower.

Important! The signing of the agreement is voidable if the borrower has not received the loan in full. In this case, the testimony of witnesses, without other evidence of a failed transaction, is not enough.

A typical (written) contract form for 2016 is as follows:

- place and date of registration;

- all names of the parties established by law;

- type of loan (with or without interest, targeted or standard);

- terms for issuing and returning valuables;

- specified type of loan repayment (monthly, interest or fines imposed on the borrower under certain conditions);

- an indication of the parties' responsibilities in case of termination of the agreement or force majeure;

- details, signatures.

You can download the sample at the end of the page.

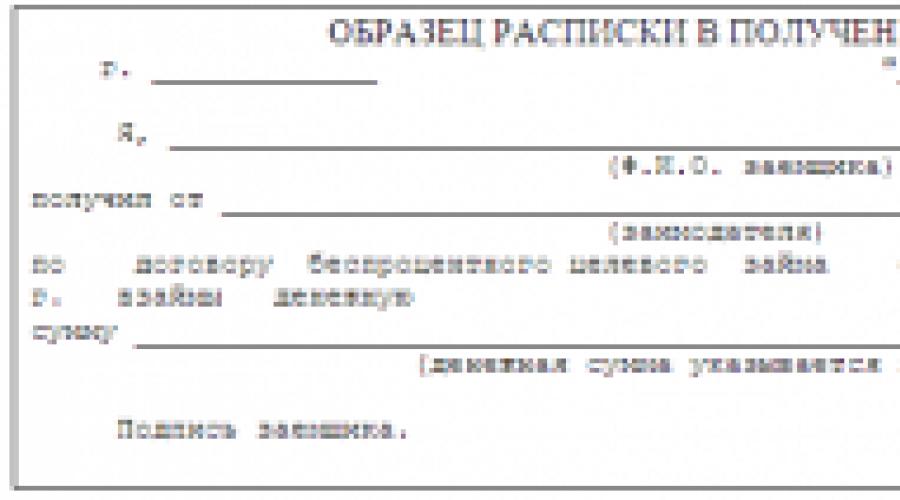

If there is no document drawn up on the basis of a loan agreement, you can use other types of written agreements (receipt, bill of exchange, etc.).

According to one agreement, the transfer of cash should not exceed 100,000 rubles. If any norms are violated, a fine (up to 50,000 rubles) will be imposed in accordance with the Code of Administrative Offenses of the Russian Federation 15.1, plus if the company does not have a cash register, the case will be subject to separate consideration. Therefore, the transfer of funds is often non-cash.

It is possible to transfer a loan through the cash desk only if all legal norms are observed, with the initial provision of accounting entries.

The following aspects must be observed when concluding an agreement:

- checking the correct spelling of all factual data;

- reflection in the agreement of the fact of transfer of values;

- the transfer of the loan must be carried out only in the presence of a notary and witnesses.

Loan repayment procedure

There are no restrictions on the duration of the loan. But it is worth concluding agreements on acceptable terms for both parties.

In cases where there is a possibility that the borrower will not be able to repay the borrowed funds, it is possible to provide some guarantees (collateral, guarantors, etc.) to avoid possible consequences associated with litigation.

When the agreement expires, the debtor must immediately repay the funds he borrowed with interest. When returning, it is better to make the necessary receipt and destroy the agreement form so that both parties do not have any questions for each other.

Important! If the debtor is late in repaying the loan, the lender can sue him.

In accordance with the legislation of the Russian Federation, the lender may receive interest charges for the loan provided. It is necessary to indicate in the agreement the procedure for their accrual; if this is not the case, then accruals are made based on the calculation of the refinancing rate at the borrower’s place of registration.

If the subject of the loan is not money, but, for example, raw materials or goods, then the agreement can be defined as gratuitous (Civil Code of the Russian Federation, Art. 809). The agreement must specify the terms of repayment in the interest form, since the lender may lose benefits if the debt is repaid early. With an interest-free type of transaction, everything can be returned ahead of schedule without restrictions. The loan is considered paid when the funds or other valuables are fully returned to the lender’s account or to him personally; all this must be indicated in the postings.

The loan can be extended either if such conditions are present in the agreement form, or under certain circumstances provided for by law. Often it’s just a simple lack of money. By law, you can extend the loan as many times as you like, but in any case, it all depends on the lender. For periods of time in which the borrowed funds were not repaid, interest must be paid (if it was possible to extend the loan).

Interest loan

The agreement is concluded in writing; the presence of a notary is not necessary. The sample can be downloaded at the end of the page.

Article 808 of the Civil Code of the Russian Federation states that it is advisable to draw up a receipt certifying the transfer of valuables.

An interest agreement is an agreement that does not stipulate that it is free of charge. If the type of agreement is not defined, then it is considered interest-bearing by default and the borrower pays interest calculated at the refinancing rate.

The type of agreement is prepared based on the preferences for the choice of conditions of each party (a protocol of disagreements can be used).

A loan agreement between legal entities is an agreed upon transfer of valuables and the procedure for their return. If there is no evidence of consistency of the transfer, but the transfer was carried out, then it is considered an unjustified receipt of values that are subject to return with interest (Civil Code of the Russian Federation, Art. 395).

All valuables provided to the borrower are his property, and he can dispose of them as the rightful owner. The loan agreement may specify the return of equivalent funds borrowed.

Interest-free loan

You can enter into such loans without any legal restrictions, but it is worth remembering that such transactions on an ongoing basis can be classified as illegal banking activities. Basically, interest-free loans are common in non-profit environments. The sample can be downloaded at the end of the page.

The type of contract should always be standard. It is necessary to indicate its type, that is, interest-free loan payments; everything else is similar to other types of agreement.

A properly drafted agreement must clearly indicate the object of the loan. If it is not specified, such an agreement is invalid.

It is also necessary to indicate the point that no fee is charged for the use of valuables. Without this clause, the agreement is considered to be a percentage agreement. If there is no exact date for the return of funds, they are returned within 30 days after the request for return from the lender.

Tax consequences

If a loan agreement is concluded, it is necessary to take into account the reaction of the tax authorities. To avoid any consequences, it is better to enter into an interest-bearing loan. In this case, tax is paid on the amount of interest (recognized as expenses).

When the loan is gratuitous (interest-free) or the interest is below the norm, it is necessary to show the benefit received from the transaction to the tax authorities. The court, under such circumstances, is always on the side of the tax authorities.

Questions from tax organizations arise in connection with the possible benefit of one of the parties in the form of interest savings. Article 251 of the Tax Code does not accept the inclusion of such loans in the tax base, so the borrower may not pay all types of taxes.

The main thing in drawing up an agreement is a legally competent wording indicating all the points required by both parties.

Post Views: 519

in a person acting on the basis, hereinafter referred to as " Lender", on the one hand, and in the person acting on the basis of, hereinafter referred to as " Borrower", on the other hand, hereinafter referred to as " Parties", have entered into this agreement, hereinafter referred to as the "Agreement", as follows:1. THE SUBJECT OF THE AGREEMENT

1.1. Under this agreement, the Lender transfers to the Borrower the amount of an interest-free loan in rubles, and the Borrower undertakes to repay the loan amount within the period stipulated by this agreement.

1.2. The loan amount will be transferred in installments. The amount of the portion of the loan amount transferred to the Borrower is determined in additional agreements, which are integral parts of this agreement. Additional agreements must also determine the total amount of funds transferred to the Borrower from the beginning of the agreement until the signing of such additional agreement (taking into account the amount transferred under the signed agreement).

2. RIGHTS AND OBLIGATIONS OF THE PARTIES

2.1. The Lender transfers the part of the loan amount agreed upon by the parties to the Borrower’s current account within days after signing the corresponding additional agreement.

2.2. The Borrower may repay the loan amount in parts (in installments), but no later than months from the date of receipt of the first part of the loan amount.

2.3. The term and/or procedure for repaying the loan amount may be changed by additional agreement of the parties.

3. RESPONSIBILITY OF THE PARTIES

3.1. If the Borrower fails to repay the loan amount (part thereof) within the established period, the Borrower shall pay a penalty in the amount of % of the loan amount (part thereof) for each day of delay until the day it is returned to the Lender.

4. FORCE MAJEURE

4.1. The borrower is released from liability for partial or complete failure to fulfill obligations under this agreement if this failure was a consequence of force majeure circumstances that arose after the conclusion of this agreement as a result of extraordinary circumstances that the parties could not foresee or prevent.

4.2. If the circumstances specified in clause 4.1 of this agreement occur, each party must immediately notify the other party about them in writing. The notice must contain information about the nature of the circumstances, as well as official documents certifying the existence of these circumstances and, if possible, assessing their impact on the party’s ability to fulfill its obligations under this agreement.

4.3. If a party does not send or untimely sends the notice provided for in clause 4.2 of this agreement, then it is obliged to compensate the other party for the losses it has incurred.

4.4. In cases of the occurrence of the circumstances provided for in clause 4.1 of this agreement, the deadline for the party to fulfill its obligations under this agreement is postponed in proportion to the time during which these circumstances and their consequences apply.

4.5. If the circumstances listed in clause 4.1 of this agreement and their consequences continue to apply for more than months, the parties conduct additional negotiations to identify acceptable alternative ways of fulfilling this agreement.

5. PRIVACY

5.1. The terms of this agreement and agreements thereto are confidential and not subject to disclosure.

5.2. The parties take all necessary measures to ensure that their employees, agents, successors, without the prior consent of the other party, do not inform third parties about the details of this agreement and its annexes.

6. DISPUTE RESOLUTION

6.1. All disputes and disagreements that may arise between the parties on issues that are not resolved in the text of this agreement will be resolved through negotiations.

6.2. Disputes not resolved during negotiations are resolved in the manner established by the current legislation of the Russian Federation.

7. TERMINATION OF THE AGREEMENT

7.1. This agreement is terminated by agreement of the parties or on other grounds provided for by the current legislation of the Russian Federation.

8. FINAL PROVISIONS

8.1. Any changes and additions to this agreement are valid provided that they are made in writing and signed by duly authorized representatives of the parties.

8.2. All notices and communications under this agreement must be sent by the parties to each other in writing.

8.3. This agreement comes into force from the moment the Lender transfers the first part of the loan amount to the Borrower’s current account.

8.4. This agreement is valid until the Borrower fully fulfills its obligations to repay the loan amount.

8.5. This agreement is drawn up in two copies having equal legal force, one copy for each of the parties.

8.6. In all other respects not provided for in this agreement, the parties will be guided by the current legislation of the Russian Federation.

Interest rate loan agreement between legal entities sample 2018 free download standard form example form

AGREEMENT N _____

cash loan with interest (between legal entities)

g. _______________ “__”___________ ____ g.

We refer to hereinafter as "Lender",

(name of company)

represented by _____________________________________________________________________, acting

(position, full name)

based on ______________________________________________________________, on the one hand, and

(Charter, power of attorney)

We shall hereinafter be referred to as “Borrower”,

(name of company)

represented by _______________________________________________________________________, acting

(position, full name)

on the basis of ________________________________________________, on the other hand, jointly

(Charter, power of attorney)

referred to as the “Parties”, individually “Parties”, have entered into this Agreement

- SUBJECT OF THE AGREEMENT 1.1. The Lender transfers to the Borrower the ownership of funds in the amount of _____ (__________) rubles (hereinafter referred to as the “Loan Amount”), and the Borrower undertakes to return the specified Loan Amount together with the interest due in the amount and terms stipulated by the Agreement<*>.

An agreement is considered concluded if an agreement is reached between the parties, in the form required in appropriate cases, on all the essential terms of the agreement. The condition on the subject of the contract is an essential condition of the contract (clause 1 of Article 432 of the Civil Code of the Russian Federation).

The essential terms of the contract are the conditions that are named in the law or other legal acts as essential or necessary for contracts of this type (paragraph 2, paragraph 1, article 432 of the Civil Code of the Russian Federation). The loan amount is an essential condition of the loan agreement (clause 1 of Article 807 of the Civil Code of the Russian Federation).

1.2. The interest rate under this Agreement is _____% of the Amount

loan in ____________________.

(specify period)

- PROCEDURE FOR PROVIDING AND RETURNING THE LOAN AMOUNT 2.1. The Lender transfers the Loan Amount to the Borrower by transferring it to the Borrower's bank account specified in Section 9 of this Agreement. The date of transfer of funds is considered to be the date they are credited to the Borrower’s current account.

2.2. Confirmation of the transfer of the Loan Amount to the Borrower's bank account is a copy of the payment order with the bank's mark on execution.

2.3. The Borrower undertakes to repay the Loan Amount along with any interest due by “__”___________ ____.

2.4. The loan amount is repaid in accordance with the debt repayment schedule, which is an annex and an integral part of this Agreement.

2.5. The loan amount can be repaid by the Borrower ahead of schedule only with the written consent of the Lender.

- PROCEDURE FOR CALCULATION AND PAYMENT OF INTEREST3.1. Interest for the use of the Loan Amount specified in clause 1.2 of this Agreement is accrued from the day following the day of provision of the Loan Amount in accordance with clause 2.1 of the Agreement until the day of return of the Loan Amount in accordance with clause 2.3 of the Agreement, inclusive.

3.2. Interest for the use of the Loan Amount is paid no later than the _____ day of each month, starting from the month following the month of provision of the Loan Amount. Interest accrued for the last period of use of the Loan Amount is paid simultaneously with the repayment of the Loan Amount.

Option: Interest for using the Loan Amount is paid simultaneously with the repayment of the Loan Amount.

- RESPONSIBILITY OF THE PARTIES4.1. In case of failure to repay the Loan Amount within the specified period of clause 2.3 of the Agreement, the Lender has the right to require the Borrower to pay a penalty in the amount of _____% of the debt amount for each day of delay, but not more than _____% of the Loan Amount.

4.2. Collection of penalties does not relieve the Borrower from fulfilling obligations under this Agreement.

4.3. In cases not provided for by this Agreement, property liability is determined in accordance with the current legislation of the Russian Federation.

- FORCE MAJEURE5.1. The parties are released from liability for non-fulfillment or improper fulfillment of obligations under the Agreement due to force majeure.

forces, that is, extraordinary and unpreventable under given conditions

circumstances, which mean: ___________________________________

__________________________________________________________________________.

(list force majeure circumstances)

5.2. If the circumstances specified in clause 5.1 of the Agreement occur, the Party is obliged to notify the other Party about them in writing within _____ (__________) days. The notice must contain information about the nature of the circumstances, the expected duration of their validity and termination.

5.3. If a Party does not send or untimely sends the notice provided for in clause 5.2 of the Agreement, then it is obliged to compensate the other Party for losses incurred by it.

5.4. In cases of the occurrence of circumstances provided for in clause 5.1 of the Agreement, the period for fulfilling obligations under the Agreement is suspended for the time during which these circumstances apply.

5.5. If the circumstances listed in clause 5.1 of the Agreement occur,

continue to operate for more than _________________________, then each of the Parties

(specify period)

has the right to terminate the Agreement early.

- DISPUTE RESOLUTION6.1. The parties will strive to resolve all possible disputes and disagreements that may arise under the Agreement or in connection with it through negotiations.

6.2. Disputes that are not resolved through negotiations are referred to the court in the manner established by the current legislation of the Russian Federation.

- CHANGE AND EARLY TERMINATION OF THE AGREEMENT 7.1. Any changes and additions to this Agreement are valid if they are made in writing and signed by duly authorized representatives of the Parties. The corresponding additional agreements of the Parties are an integral part of the Agreement.

7.2. All notices and communications under the Agreement must be sent by the Parties to each other in writing.

7.3. The Agreement may be terminated early by agreement of the Parties or in another manner and on the grounds provided for by the current legislation of the Russian Federation.

- FINAL PROVISIONS

Along with the condition on the subject of the contract, as well as the conditions that are named in the law or other legal acts as essential or necessary for contracts of this type, the essential terms of the contract are all those conditions regarding which, at the request of one of the parties, an agreement must be reached (para. 2 clause 1 article 432 of the Civil Code of the Russian Federation). Thus, the parties have the right to define for themselves any condition as essential, in the absence of which the contract cannot be considered concluded.

8.1. This Agreement comes into force from the moment the Loan Amount specified in clause 1.1 of this Agreement is credited to the Borrower’s bank account specified in Section 9 of the Agreement.

8.2. This Agreement is valid until the Parties fully and properly fulfill their obligations under the Agreement.

8.3. This Agreement is drawn up in two copies, one copy for each of the Parties.

8.4. For all other issues not regulated by this Agreement, the Parties will be guided by the current legislation of the Russian Federation.

- ADDRESSES, DETAILS AND SIGNATURES OF THE PARTIES Lender BorrowerName: ______________________ Name: ______________________

Address: _____________________________ Address: _____________________________

OGRN _______________________________ OGRN ________________________________

TIN ________________________________ TIN ________________________________

Checkpoint ________________________________ Checkpoint ________________________________

Account ________________________________ Account ________________________________

at ___________________________________ at ___________________________________

C/s ________________________________ C/s ________________________________

BIC ________________________________ BIC ________________________________

OKPO _______________________________ OKPO ________________________________

______________ (___________________) ______________ (___________________)

The most important points that need to be reflected in the loan agreement:

- Amount (in numbers and words);

- Loan term;

- The procedure for repaying obligations by the borrower;

- General and special conditions: interest, pledge;

- Responsibility: amount of penalty;

- Details and addresses of the parties;

- Signatures of the leaders of both parties.

If the contract does not contain the main points, it can be considered invalid. Commodity loan Organizations often issue loans in goods. For example, one company wants to take a brick from another and after a while pay in bricks. Then a commodity loan agreement can be concluded between the companies. It is no different from the version of a cash loan, only instead of rubles the subject of the loan is used - the same bricks, for the use of which the borrower undertakes to return 1 more brick.

Interest-free loan agreement between legal entities - sample

Liability may include financial consequences for the debtor, fines, etc. In this article we offer you a sample of what an interest-free loan agreement between legal entities looks like. Its form contains general points required for this type of document.

Attention

Formation of the contract When concluding a contract, it is assumed that the parties trust each other. It should be stated that this is not a financial service and does not entail making a profit. If this is not done, the lender will have to pay tax, since by default the presence of interest in the document is provided for.

Important

In the Civil Code, Chapter 42 “Loan and Credit” is devoted to loans. According to it, interest is regulated by the terms of the contract. However, in order for a loan to be considered interest-free, this must be explicitly stated.

Interest-free loan agreement between legal entities sample form

If controversial issues are not resolved during negotiations, disputes are resolved in the manner established by the current legislation of the Russian Federation. 7. TERMINATION OF THE AGREEMENT 7.1. This agreement is terminated:

- fulfillment by the Borrower of the obligation to repay the loan amount;

- by agreement of the parties;

- on other grounds provided for by the current legislation of the Russian Federation.

8. FINAL PROVISIONS 8.1. This agreement is considered concluded from the date of transfer by the Lender of the loan amount specified in clause 1.1 of this agreement to the Borrower.

8.2. This agreement will be considered fulfilled when the Borrower fulfills the obligation to repay the loan amount. 8.3. Any changes and additions to this agreement are valid provided that they are made in writing and signed by duly authorized representatives of the parties. 8.4.

Interest-free loan agreement between a legal entity and a legal entity

Additional agreements must also determine the total amount of funds transferred to the Borrower from the beginning of the agreement until the signing of such additional agreement (taking into account the amount transferred under the signed agreement). 2. RIGHTS AND OBLIGATIONS OF THE PARTIES 2.1. The Lender transfers the part of the loan amount agreed upon by the parties to the Borrower’s current account within days after signing the corresponding additional agreement. 2.2. The Borrower may repay the loan amount in parts (in installments), but no later than months from the date of receipt of the first part of the loan amount.

2.3. The term and/or procedure for repaying the loan amount may be changed by additional agreement of the parties. 3. RESPONSIBILITY OF THE PARTIES 3.1.

Interest-free loan agreement between legal entities: sample filling

According to the Treasury Department, the borrower has no tax consequences as a result of the interest-free loan. Arbitration practice confirms, in turn, that an organization that issues an interest-free loan also does not have income subject to taxation. VAT The Tax Code clearly establishes transactions that are subject to this type of tax.

Among them:

- sale of goods and services (as well as works);

- transferring them for one’s own needs (expenses are not deductible);

- construction and installation work for your own needs;

- importation of goods to Russian customs.

In addition, there is also an article that establishes transactions that are not subject to this tax. The list also includes an interest-free loan issued in cash. It turns out that this operation is not subject to VAT.

Loan agreement between legal entities (interest-free)

- City and date of signing the contract.

- Data about the borrower and lender: name, information about the executive body and the grounds for carrying out its activities.

- The subject of the agreement indicating the amount of funds (or the amount of valuation of other assets) provided to the borrower for temporary use.

- The rights and obligations of the borrower and lender, indicating the terms for the return of funds or other assets, the need to pay interest on the loan amount.

- Responsibility of the borrower and lender.

- Procedure in case of force majeure circumstances.

- The procedure for resolving disputes regarding the subject of the agreement.

- The procedure and duration of the contract, as well as the conditions for its early termination.

- Obligations of the parties regarding non-disclosure of confidential information.

- Other essential information regarding the contract.

Loan agreement between legal entities persons

Interest-free loan agreement Interest-free loan between legal entities Interest-free loan agreement between legal entities: design features and sample Interest-free loan agreement between LLC and LLC Interest-free loan agreement The loan agreement (Article 807 of the Civil Code of the Russian Federation) is considered initially interest-free if (clause 4 of Article 809 Civil Code of the Russian Federation):

- parties to the agreement - individuals (including individual entrepreneurs) with a loan amount of no more than 100 thousand rubles;

- The subject of the contract is not money, but things defined by generic characteristics.

In the document on the terms of an interest-free loan between legal entities or between individuals for an amount greater than 100 thousand rubles, it is necessary to include language stating that interest is not charged on this loan (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Blanker.ru

A loan agreement between legal entities is a document under which one legal entity (lender) transfers to another legal entity (borrower) a certain amount of money (or other assets) for temporary use, and the borrower undertakes to return these funds within a specified period. The loan can be either interest-free or provide for the payment of financial compensation to the lender for the use of borrowed funds. The agreement is drawn up in writing in 2 copies for both parties to the transaction and certified by the signatures (seals) of the lender and borrower.

The execution and use of loan agreements between legal entities is regulated by the Civil Code of the Russian Federation.

Loan agreement between legal entities interest-free sample

You can refer to the lack of grounds for paying tax on an interest-free loan in accordance with Letter of the Ministry of Finance of Russia dated July 14, 2009 No. 03-03-06/1/465. It says that only those benefits, the concept of which is spelled out in the Tax Code of the Russian Federation, are considered income. However, none of the articles of the code provides a clear distinction and assessment of how to benefit from an interest-free loan.

The Civil Code in Article 196 states that the lender can legally collect the debt from the borrower in case of violation of the terms of the contract. What does a sample interest-free loan agreement between legal entities look like? The legislation does not provide for a standard form of such an agreement. Therefore, it may be different for each organization - some have more sections, others have fewer.

Interest-free loan agreement between legal entities sample 2013

After all, banks will never provide them with such a service. But others, both individuals and legal entities, can do this. Features An interest-free loan between legal entities is a fairly common transaction. It is used by companies that are in partnership or friendly relations.

There are even special organizations involved in issuing loans. The transaction must be accompanied by the conclusion of an agreement, and it can be either unilateral or bilateral. In addition, it is possible to involve another party in order to guarantee the return of funds to the lender. An official organization may be accepted as such. The agreement clearly states the term of the loan, as well as the amount. It must be certified by a notary.

Interest-free loan agreement between legal entities sample 2016

Important! If a loan is provided by a non-credit institution for an amount equal to or greater than 600,000 rubles, such transactions are subject to mandatory state control (paragraph 7, subparagraph 4, paragraph 1, article 6 of the Federal Law “On combating the legalization (laundering) of proceeds from crime, and financing of terrorism" dated August 7, 2001 No. 115-FZ). The credit institution is obliged to report to the Federal Financial Monitoring Service information about the loan provided or received. At the same time, the bank tracks loan payments on an accrual basis if the amount under the agreement as a whole is more than or equal to 600,000 rubles.

(Clause 3 of the Bank of Russia information letter dated September 1, 2009 No. 16). Failure to comply with these requirements is an administrative offense in accordance with Part 1 of Art. 15.27 Code of Administrative Offenses of the Russian Federation (resolution of the 9th Arbitration Court of Appeal dated December 11, 2014 No. 09-AP-50597/14 in case No. A40-120479/14).