Loan agreement between individuals at interest. Loan agreement between individuals: tax implications. Validity and special conditions

Read also

Often situations arise when, in order to solve life or domestic issues, citizens turn to their relatives, friends or acquaintances with a request for a loan of money (money). Such a transaction is defined (Civil Code of the Russian Federation Part 2) as personal loan. In order to avoid a situation where the borrower does not fulfill its obligations, it is necessary to conclude money loan agreement.

Loan agreement between individuals is concluded in writing and comes into force from the moment of transfer of funds (money). Notarization of the contract is not required.

Monetary obligations under a cash loan agreement must be expressed in rubles (Articles 317, 140 of the Civil Code of the Russian Federation)

Treaty

interest-bearing loan between individuals

G. …………………………. “…..” …………………. 20…..

……………………….……………………………………………………………………….,

(Full name)

passport ………. №………………… issued by …….……………….…………...………………………………………………….. 20…. city, subdivision code …………………………...………………

registered at:

hereinafter referred to as the "Lender", and

…………………………….……………………………………………………………………….,

(Full name)

passport ………. №………………… issued………….………….…………...……………………………………………….. 20…. city, subdivision code …………………………...………………

(name of the authority that issued the passport)

registered at:

city …………………… street …..…………..….………..… house …… building …… apt. …..

hereinafter referred to as the "Borrower" have hereby concluded as follows:

1. The Subject of the Agreement

1.1. Under this Agreement, the Lender transfers to the Borrower a loan in the amount of

………………………………………………………………………………. (………………..) rub.,

(in words/numbers)

a The Borrower undertakes to repay the specified loan amount within the period stipulated by this Agreement.

2. Rights and Obligations of the parties

2.1. Lender ……………………………………………………………..…………To the Borrower

(transfers the loan amount in cash / transfers the loan amount to the bank account specified by the Borrower)

up to "……" …………………. 20…..

2.2. Repayment of the loan amount produced according to the following schedule:

……………………………………………………………. before "….." …………………. 20…..

……………………………………………………………. before "….." …………………. 20…..

(Suma in cuirsive)

The Borrower undertakes to repay the loan amount at a time up to “….”………...……. 20…. G.

2.3. For the use of the provided funds, the Borrower undertakes to pay to the Lender interest on the loan amount in the amount of ………………...……… rubles.

2.4. Interest on the loan paid by the Borrower

……………………………………………………………………………………………………...

(on the day of repayment of the loan / until “….”…....……. 20….)

2.5. The borrower has the right to early return the amount of money specified in clause 1.1.

actual agreement.

2.6. The Borrower undertakes to notify the Lender in writing of the change of his place of residence.

3. Liability of the parties

3.1. In case of non-performance or improper performance by one of the parties of its obligations under this Agreement, it is obliged to compensate the other party for the losses caused by such non-performance.

3.2. In case of non-return of the specified in clause 1.1. the loan amount in the specified in clause 2.2. term, the Borrower shall pay a fine in the amount of …………………………………………….…. %

(in words)

from the loan amount for each day of delay until the day it is returned to the Lender.

3.3. The recovery of a penalty or damages does not relieve the party that violated the Agreement from the performance of obligations under this Agreement.

3.4. In cases not provided for by this agreement, property liability is determined in accordance with the current legislation of the Russian Federation.

4. Force - Major

4.1. The Parties are released from liability for partial or complete failure to fulfill obligations under this Agreement, if this failure was the result of force majeure circumstances that arose after the conclusion of this Agreement as a result of extraordinary circumstances that the Parties could not foresee or prevent.

4.2. In the event of the occurrence of the circumstances specified in clause 4.1, each party must immediately notify the other party in writing about them. The notice must contain data on the nature of the circumstances, as well as official documents certifying the existence of these circumstances and, if possible, assessing their impact on the ability of the party to fulfill its obligations under this Agreement.

4.3. If a party does not send or untimely sends the notice provided for in paragraph 4.2, then it is obliged to compensate the other party for the losses incurred by it.

4.4. In cases of the occurrence of the circumstances provided for in clause 4.1, the deadline for the fulfillment by the party of obligations under this Agreement is extended in proportion to the time during which these circumstances and their consequences are in effect.

4.5. If the circumstances listed in clause 4.1 and their consequences continue to operate for more than two months, the parties conduct additional negotiations to identify acceptable alternative ways to fulfill this Agreement.

5. Privacy

5.1. The terms of this Agreement and agreements (protocols, etc.) to it are confidential and not subject to disclosure.

5.2. The Parties take all necessary measures to ensure that their employees, agents, successors, without the prior consent of the other party, do not inform third parties about the details of this Agreement and its annexes.

6. Dispute Resolution

6.1. All disputes and disagreements that may arise between the parties will be resolved through negotiations.

6.2. If the disputed issues are not resolved during the negotiation process, then the disputes are resolved in the arbitration court in the manner prescribed by the current legislation.

7. Duration of the contract

7.1. This Agreement shall enter into force from the moment the Lender transfers the loan amount to the Borrower and is valid until the parties fulfill all obligations under it.

7.2. This Agreement may be terminated early in the following cases:

7.2.1. By agreement of the parties.

7.2.2. On other grounds provided for by applicable law.

8. Final provisions

8.1. Any changes and additions to this Agreement are valid provided that they are made in writing and signed by the parties or their duly authorized representatives.

8.2. All notices and communications must be in writing.

8.3. This Agreement is made in two copies, having equal legal force, one copy for each of the parties.

9. Addresses and details of the parties

Lender: Borrower:

(Full name) (Full name)

……………………………………….… ………….………………………………

(signature) (signature)

“……” …………………. 20….. g. “……” …………………. 20…..

Notes:

A loan agreement must be concluded in writing between individuals if the loan amount is ten times the minimum wage established by law;

In confirmation of the loan agreement and its terms, a borrower's receipt or other document certifying the transfer of a certain amount of money by the lender may be presented.

If the creditor refuses to issue a receipt for the receipt of funds, or return another debt document or note in the receipt the fact of its non-return, the borrower has the right to delay the fulfillment of his obligation to repay the debt (part of the debt). In these cases, the lender is considered to have delayed the acceptance of the debt through his own fault.

In the event of early repayment of the loan amount provided at interest in accordance with paragraph 2 of Article 810 of the Civil Code of the Russian Federation, the lender has the right to receive interest from the borrower under the loan agreement, accrued inclusively up to the date of repayment of the loan amount in full or in part.

With a loan of 10,000 rubles. a written agreement is drawn up between individuals with a mandatory indication of the loan amount. Other conditions (interest rate, term and procedure for repayment of the loan, etc.) should be specified in the agreement in order to clearly define the rights and obligations of the parties.

The maximum amount of an interest-free loan under an agreement concluded between citizens is 100,000 rubles, if the amount is more, then the percentage must be indicated.

Under no circumstances reflect that the loan is not for personal purposes!, only for personal purposes, no business, etc.

There are two types of agreement: interest-bearing and interest-free with obligatory receipts for receiving funds for both parties.

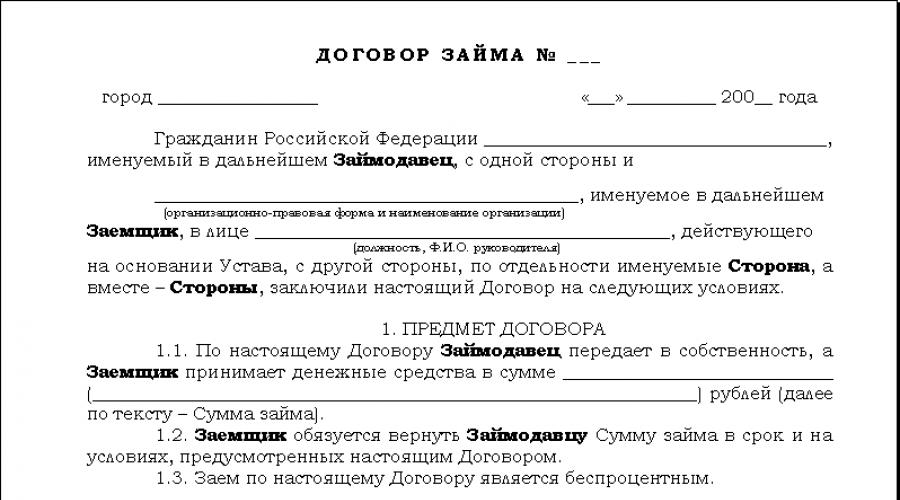

Excerpt from document:

Interest loan agreement

between individuals

1. The Subject of the Agreement

1.1. Under this Agreement, the Lender transfers to the ownership of the Borrower funds in the amount of _____ (__________) rubles (hereinafter referred to as the Loan Amount), and the Borrower undertakes to return to the Lender the Loan Amount and accrued interest on it in the amount and terms stipulated by the Agreement.

1.2. The loan amount is provided in cash. 1.3. The amount of interest under this Agreement is _____ percent per annum of the Loan Amount.

2. The procedure for granting and returning the loan amount

2.1. The Lender transfers the Loan Amount to the Borrower within the period until "___" __________ ____. The fact of the transfer of funds is certified by the Borrower's receipt of receipt of the Loan Amount (Appendix No. ___) (hereinafter referred to as the Borrower's Receipt).

2.2. The Borrower shall return to the Lender the Loan Amount and the interest due no later than "___" __________ ____ 2.3. The loan amount is returned by the Borrower by _________________________ ________________________________________________________________________________. (transfer of cash, crediting funds to the account of the lender, or indicate another method).

2.4. The Loan Amount is considered returned from the moment the Borrower receives the Lender's receipt for the Loan Amount (Appendix No. ___) and accrued interest on it (hereinafter referred to as the Lender's Receipt).

2.5. The Lender gives (does not give) consent to the early repayment of the Loan Amount and interest without additional receipt by the Borrower of a written approval in this regard.

3. Interest on the use of the loan amount

3.1. For the use of the Loan Amount, the Borrower shall pay interest to the Lender at the rate of _____ percent per annum. Interest is accrued from the day following the day of granting the Loan Amount until the day of repayment of the Loan Amount inclusive.

3.2. Interest for the use of the Loan Amount shall be paid simultaneously with the return of the Loan Amount. (Option. Interest for the use of the Loan Amount is paid no later than the _____ day of each month, starting from the month following the month in which the Loan Amount was granted. Interest accrued for the last period of using the Loan Amount is paid simultaneously with the return of the Loan Amount.)

4. Liability of the parties

4.1. For untimely repayment of the Loan Amount (clause 2.2 of the Agreement), the Lender has the right to require the Borrower to pay a penalty (penalty) in the amount of _____ (__________) percent of the Loan Amount not paid on time for each day of delay.

4.2. For violation of the interest payment deadlines, the Lender has the right to require the Borrower to pay a penalty (penalty) in the amount of _____ percent of the amount not paid on time for each day of delay.

4.3. The collection of penalties and interest does not relieve the Party that violated the Agreement from the performance of obligations in kind.

4.4. In all other cases of non-fulfillment of obligations under the Agreement, the Parties shall be liable in accordance with the current legislation of the Russian Federation.

5. Force majeure

5.1. The Parties are released from liability for non-fulfillment or improper fulfillment of obligations under the Agreement, if proper fulfillment turned out to be impossible due to force majeure, i.e. extraordinary and unavoidable circumstances under the given conditions, which are understood as: _________________________ (prohibited actions of the authorities, civil unrest, epidemics, blockades, embargoes, earthquakes, floods, fires or other natural disasters).

5.2. In the event of these circumstances, the Party is obliged to notify the other Party within _____ days.

5.3. A document issued by _________________________ (authorized state body, etc.) is sufficient evidence of the existence and duration of force majeure.

5.4. If force majeure circumstances continue to operate for more than _____, then each party has the right to terminate the Agreement unilaterally.

6. Dispute Resolution

6.1. All disputes related to the conclusion, interpretation, execution and termination of the Agreement will be resolved by the Parties through negotiations. 6.2. In the event that disagreements are not settled through negotiations, the dispute is submitted to the court in accordance with the current legislation of the Russian Federation.

7. Final provisions<2>

7.1. The Agreement is considered concluded from the moment the Lender actually transfers the Loan Amount to the Borrower in accordance with clause 2.1 of this Agreement.

7.2. The Agreement is valid until the Borrower fully fulfills its obligations to repay the Loan Amount, which is confirmed by the Lender's Receipt.

7.3. All changes and additions to the Agreement are valid if made in writing and signed by both Parties. The relevant additional agreements of the Parties are an integral part of the Agreement.

7.4. The Agreement may be terminated early by agreement of the Parties or at the request of one of the Parties in the manner and on the grounds provided for by the current legislation of the Russian Federation.

7.5. For all other issues not regulated by this Agreement, the Parties are guided by the provisions of the current legislation of the Russian Federation.

7.6. The Agreement is made in two copies, having equal legal force, one copy for each of the Parties.

7.7. Applications: 7.7.1. Receipt of the Borrower in receipt of the loan amount (Appendix No. ___).

7.7.2. Receipt of the Lender in receipt of the Loan Amount (Appendix No. ___).

8. Addresses and signatures of the parties

_____________/_____________________ (signature) (full name)

Information for information:

- <1>The contract is considered concluded if the parties, in the form required in the relevant cases, reach an agreement on all the essential terms of the contract. The condition on the subject of the contract is an essential condition of the contract (clause 1, article 432 of the Civil Code of the Russian Federation). The essential terms of the contract are the terms that are named in the law or other legal acts as essential or necessary for contracts of this type (paragraph 2, clause 1, article 432 of the Civil Code of the Russian Federation). The loan amount is an essential condition of the loan agreement (clause 1, article 807 of the Civil Code of the Russian Federation).

- <2>Along with the condition on the subject of the contract, as well as the conditions that are named in the law or other legal acts as essential or necessary for contracts of this type, the essential terms of the contract are all those conditions regarding which, at the request of one of the parties, an agreement must be reached (par. 2 paragraph 1 article 432 of the Civil Code of the Russian Federation). Thus, the parties have the right to determine for themselves any condition as essential, in case of inconsistency of which the contract cannot be considered concluded.

Sample receipt of the borrower in obtaining an interest-bearing loan

Receipt

in receiving the loan amount

_______________ "__" ___________ ____

I am ________________________________ (full name of the borrower), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at: _________ received from ________________________________ (full name of the lender), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at: _________

cash in the amount of _____ (____________) rubles (hereinafter referred to as the Loan Amount) and undertake to return to the Lender the Loan Amount and accrued interest on it in the manner prescribed by clause _______ of the Agreement dated "__" ______________ ____.

No. _____, up to "__" __________ ____

"__"___________ ____ G.

(signature) (full name)

Sample receipt of the lender on the return of the loan and interest

Lender's receipt for the loan amount

and accrued interest

______________ "___" _________ ____

I am ________________________________ (Full Name Lender), Passport: Series _____ No. ____________, issued by _________________ (when, by whom), residing at: _________ received from ________________________________ (Full Name Borrower), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at: _________

cash in the amount of _____ (________________) rubles, including interest in the amount of _____ (__________) rubles in accordance with paragraphs 1.1 and 1.3 of the Loan Agreement No. _____ dated "___" __________ ____

I have no claims against ________________________________ (full name of the Borrower).

This receipt is made in two copies, having equal legal force, one for each of the Parties.

"___"__________ ____ G.

Lender:

___________________/_____________________/

(signature) (full name)

Interest free loan agreement

between individuals

Citizen ____________________________________________________________, (full name) passport: series _____ No. __________, issued by _________________________________, (when, by whom) living __ at the address: ___________________________________________________, hereinafter referred to as __ "Lender", on the one hand, and citizen ____________________________________________________________, (F. I.O.) passport: series _____ No. __________, issued by _________________________________, (when, by whom) living __ at the address: ___________________________________________________, hereinafter referred to as __ "Borrower", on the other hand, collectively referred to as the "Parties", individually the "Party", concluded this Agreement (hereinafter referred to as the Agreement) as follows:

1. Subject of the contract General provisions

1.1. The Lender transfers to the ownership of the Borrower funds in the amount of ______ (____________) rubles (hereinafter referred to as the loan amount), and the Borrower undertakes to repay the loan amount to the Lender in the manner and within the terms stipulated by the Agreement. Funds that were received by an individual under a loan agreement are not income subject to personal income tax.

1.2. No interest is paid for the use of the loan amount (interest-free loan).

1.3. The Agreement is considered concluded from the moment the money is transferred to the Borrower.

2. Transfer and return of the loan amount

2.1. Transfer of loan amount

2.1.1. The loan amount is transferred to the Borrower in cash.

2.1.2. The transfer of the loan amount is confirmed by the Borrower's receipt, which is provided to the Lender. If the loan is disputed due to lack of money, the amount of the borrower's obligations is determined based on the amounts transferred to him (clause 3, article 812 of the Civil Code of the Russian Federation).

2.1.3. The parties agreed on the form of the Borrower's receipt (Appendix No. __ to the Agreement).

2.2. Repayment of the loan amount

2.2.1. The loan amount must be fully repaid to the Lender no later than "__" ___________ 20__.

2.2.2. The repayment of the loan amount is carried out in cash and is confirmed by the Lender's receipt, which is transferred to the Borrower.

2.2.3. The borrower has the right to repay the loan amount ahead of schedule in whole or in part. Upon repayment of the loan amount in full, the Lender must return the Borrower's receipt. If it is impossible to return the Borrower's receipt, the Lender shall make an entry about this in the Lender's receipt. In case of partial return of the loan amount, the Lender's receipt is issued for each part of the amount.

2.2.4. The Parties agreed on the form of the Lender's receipt (Appendix No. __ to the Agreement).

3. Responsibility of the borrower

3.1. If the Borrower fails to repay the loan amount or part of it, the Lender has the right to demand payment of a penalty in the amount of ______ (___________)% of the amount not returned on time for each day of delay. Penalties are accrued from the day when the loan amount should have been repaid until the day it is returned to the Lender. Penalty payment is made within ___ (________) working days from the moment the Lender submits the relevant request.

3.2. The payment of the penalty does not release the Borrower from the repayment of the loan amount.

3.3. Penalty payment shall be made in cash and confirmed by issuance of the Lender's receipt for the amount of fines paid or a corresponding entry in the Lender's receipt. If the repayment of the loan amount was carried out in parts, then the corresponding entry is made in the last receipt of the Lender.

4. Final provisions

4.1. The Agreement is made in two copies, one for each of the Parties.

4.2. Attached to the Agreement:

- Borrower's receipt form (Appendix No. ___);

- Lender's receipt form (Appendix No. ___).

5. Addresses and details of the parties

Lender: Mr. ________________________________ (state of citizenship, full name of the citizen), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at: _________

_____________/_____________________ (signature) (full name)

Borrower: Mr. ________________________________ (state of citizenship, full name of the citizen), Passport: series _____ No. ____________, issued by _________________ (when, by whom), residing at: _________

_____________/_____________________ (signature) (full name)

Sample receipt of the borrower in obtaining an interest-free loan

Borrower's receipt

Place of compilation: ______________________________ "__" ____________ 20__

I, a citizen of the Russian Federation ______________________ (full name), passport of the Russian Federation series _____ number ______, issued by _________________ date of issue "__" _________ ____, place of residence: _____________________ (hereinafter referred to as the Borrower), received (a) ownership from citizen of the Russian Federation ______________ (full name), passport of the Russian Federation series ______ number ______, issued on _______________________ date of issue "__" ______ ____, place of residence: _____________________ (hereinafter referred to as the "Lender"), funds in the amount of _______ (______________) rubles (hereinafter referred to as the loan amount).

The loan amount is to be repaid no later than "__" __________ 20__ in accordance with the terms of the interest-free loan agreement dated "__" __________ 20__.

__________________/___________________________/

(signature) (full name)

Sample receipt of the lender for the return of an interest-free loan

Lender's receipt

Place of compilation: ____________________________ "__" __________ 20_

I, a citizen of the Russian Federation _____________________ (full name), Russian passport series ______, number _______, issued on _______________________ date of issue "__" ______ ____, place of residence: _____________________________________ (hereinafter referred to as the Lender), received (a) ownership from a citizen of the Russian Federation _______________________ (full name), passport of the Russian Federation series ______, number _______, issued on ________________ date of issue "__" ___________ ____, place of residence: ______________________ (hereinafter referred to as the Borrower), returned funds in the amount of ________ ( ______________) rubles.

The funds were to be returned on "__" _________________ 20_ in accordance with the terms of the interest-free loan agreement dated "__" ________ 20_.

If penalties were charged

I, the Lender, received from the Borrower the amount of penalties in the amount of ________ (______________________) rubles.

Penalties are accrued in accordance with the terms of the interest-free loan agreement dated "__" ________ 20_ for violation by the Borrower of the deadline for repaying the loan amount.

Calculation of the amount of penalties: ________________________________ (indicated in case of payment of a penalty for late repayment of the loan amount).

Borrower's receipt cannot be returned.

(Indicated if the loan amount is returned in full, if the Borrower's receipt cannot be returned)

__________________/___________________________/

(signature) (full name)

When transferring money or things from one natural person to another, a loan agreement is drawn up. Under the agreement, the party providing the value is the lender, and the receiving party is the borrower. The transfer of funds is regulated by law and has a certain procedure.

How to apply?

Any individual has the right to provide another loan. Such relationships are usually secured by a contract. It is necessary to clearly indicate the credit relationship of the two parties.

To increase the reliability of such a transaction, it is recommended that it be certified by a notary public or signed in the presence of two witnesses.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

The agreement must contain the passport and contact details of the two parties. It must be signed by individuals. Otherwise, the contract will be declared invalid.

The document must contain all the conditions, among which important points are interest, terms, return rules.

To draw up a document, it is better to contact a notary or a lawyer.

A qualified specialist will be able to correctly indicate all the wishes within the framework of the contract. When signing a document, you must have a passport with you.

If the parties are not ready to pay for the services of a lawyer, then it is better to use a standard loan agreement. In this case, you should be very careful, since the standard agreement does not contain individual conditions. For example, the size of the interest rate or the duration of the contract.

The next step after the conclusion of the transaction is the actual transfer of funds or things. These actions should be documented.

If the transfer of finance is carried out by bank transfer, then bank statements may serve as confirmation of these actions.

Sample loan agreement with interest

The parties to the agreement may be citizens who have the right under the law to enter into contractual relations. The borrower becomes a user of the property from the moment when it was received at his disposal.

As part of this transaction, the money can be transferred in cash or by bank transfer. From the moment the funds are credited to the borrower's account, the agreement is considered to have entered into force. The law allows lending not only rubles, but also foreign currency.

The written form of the agreement is obligatory if the loan does not exceed 10 times the minimum amount established by law. Otherwise, the agreement can be concluded orally.

As practice shows, the parties are mainly where they prescribe the main terms of the loan. But, it should be understood that the receipt cannot replace the main loan agreement. It is just a debt document.

As part of the transaction, you can specify the amount of interest that will be collected from the borrower. The parties can independently determine how they will be accrued: daily, every month, quarter.

It is also necessary to specify the conditions for the return of interest, all at once at the time of repayment of the debt or in parts. In case of untimely repayment of the debt, the lender has the right to demand the amount of the loan, taking into account inflation and interest for this period.

If an individual did not give the money in a timely manner, then he must pay a penalty. It can be movable and immovable property.

If the agreement does not specify the conditions, then the interest is charged according to the refinancing rate of the Central Bank.

sample loan agreement

The agreement is automatically considered interest-free in the following cases:

- if the subject of the contract were things, not money;

- if it was concluded for an amount that does not exceed 5 minimum wages and the money borrowed is not related to entrepreneurial activity.

Drawing up a loan agreement between resident and non-resident individuals

According to the law, such operations are carried out without restrictions. But, the Central Bank has a controlling function. Therefore, he can set limits on the amount, terms of the loan or put forward other conditions.

As a rule, the bank requires the opening of a special account to which the loan is transferred. If a non-resident provides a loan, then existing rules should be taken into account.

When issuing a loan for a period of less than 3 years:

- the amount is transferred to the resident's foreign currency account opened with an authorized bank;

- then the resident transfers funds from the transit account to a special account. At the same time, 2% goes to the reserve of the authorized bank for a year;

- money is transferred from a special account to a current currency account;

- at the end of the year, the authorized bank returns the amount of the reserve;

When drawing up a loan agreement for a period of more than three years, the procedure is significantly reduced. After transferring funds, the resident immediately transfers them to his current account.

When a loan is granted by a resident, the process changes somewhat and depends on the timing. To do this, a resident needs to transfer money to a special account, then they are transferred in foreign currency to a non-resident's account.

The reserve money is returned to the resident on the 16th day. As a formalization of the loan, the parties draw up a transaction passport.

Drawing up a payment schedule

Making a loan between individuals involves not only the conclusion of the main contract, but also various applications.

Among them are the main additions:

- Loan repayment schedule. It indicates how much money the borrower must return, and in what period. Within the framework of the document, you can indicate important information for the borrower, which amount will relate to the principal debt, and which to interest. These conditions are determined individually in each case.

- Interest return schedule. It also indicates the terms of payments, the amount of interest. Such applications are necessary for the borrower to have a document that he uses to fulfill his obligations.

If such additions have not been made, then the borrower can use a loan calculator. This service allows you to create a payment schedule for any time period.

To do this, you must enter data known to the borrower: the loan amount, interest per year, the term of the contract, the number of payments per year and the date on which the agreement entered into force. The calculator will perform the calculation and draw up a payment schedule.

Do I need to be notarized

The law does not require the parties to sign the agreement before a notary. When registering collateral, this form of registration is required.

According to experts, notarial registration will give the parties:

- the document will be prepared by a specialist, which means that it will take into account all the wishes of individuals. The agreement will be drawn up with knowledge of the legal framework;

- in case of conflict situations, for example, if the borrower refuses to repay the debt, you will not have to go to court. The executive service should begin to tighten the loan without any proceedings.

Risks, taxes

The tax is not imposed on the lender, only if it is interest-free.

In other types of agreement, the creditor receives a direct benefit in the form of interest, so they are taxed. The borrower also pays it after he returns the entire amount to the lender.

The main risks when drawing up a loan agreement are not the return of funds. Therefore, the lender must insure, for example, conclude an agreement on bail or draw up a loan agreement between individuals with a guarantor.

If the debtor does not want to return the specified amount, then you will have to go to court and pay a state duty on the loan amount. If the decision is positive, you must contact the executive service.

If the borrower does not work anywhere or does not have property, then the contraction will occur only when he has an official income. At the same time, 25% monthly will be deducted from it.

One of the types of transactions in civil law is a loan.. It may have different varieties (for example, a bank loan, a loan), but the requirements of the law will be the same.

The parties to the loan should carefully study the norms of the law before concluding a transaction in order to protect themselves and not violate the rights and interests of the other party. Chapter 42 of the Civil Code of the Russian Federation is devoted to this type of transaction.

Article 807 of civil law prescribes the concept of a loan, which is understood as an agreement between the parties, which are the lender and the borrower.

The agreement implies the transfer of funds or other things from the lender to the borrower.

The borrower, in turn, undertakes to return the borrowed funds or other things that have distinctive generic characteristics.

Loan features:

- the transfer of funds to the borrower means that he acquires the right to freely dispose of them;

- if the lender decides to limit the rights of the borrower, an agreement on a targeted loan is signed between them. For example, the money transferred must be used to buy a car or real estate;

- the signing by the parties of the contract does not give rise to the fact of its conclusion;

- in order for the agreement to enter into legal force, the borrower must receive what is due to him under the agreement in the form of a loan;

- if funds are transferred as a loan, a receipt is issued, or the agreement itself must contain a condition that it also serves as a receipt.

Legislation allows written and oral forms of the transaction. To conclude an oral agreement, a condition is required that the loan amount does not exceed 1,000 rubles, which is equivalent to 10 minimum wages.

If the agreement does not contain a specific date for the return of the loan after the presentation of the demand, the loan is subject to return within 30 days from the date the borrower receives the notification.

In some cases, partial payment of the debt is allowed. Such a condition is recorded in a separate document, in the form of a payment schedule.

Download a sample loan agreement between individuals

The transfer of funds in the form of a loan between individuals is a fairly common type of transaction.. In most cases, citizens do not seek to draw it up in the form of a written contract, and legal relations are built orally.

The decision to transfer money to a third party without signing documents carries great risks and possible losses for the lender, since it will be quite difficult to confirm the fact that the loan has been transferred into the hands of the borrower.

It is not always necessary to draw up an agreement; it is allowed to sign a simple receipt for receiving money on a loan. If the parties decide to formalize the transaction in the form of an agreement, then it must contain the following conditions:

- date of conclusion of the contract or signing of the receipt;

- terms and conditions for the return of funds;

- accurate information about the parties to the transaction;

- liability for violation of the terms of the contract;

- in what form the money is transferred (for a fee or free of charge);

- other conditions, at the discretion of the parties and not contrary to law.

The parties can independently draw up a loan agreement, or download a sample on the Internet.

There is no unified form of the contract. Therefore, the parties should be guided by the general provisions on the loan. You can download a sample contract.

There are several ways to calculate depreciation. Read about how it happens at the link.

Loan between citizens and legal organizations

The legislation does not prohibit the conclusion of an agreement where the subjects are a legal entity and a citizen.

It is worth noting that the lender may be an employee working in the borrowing organization or be an outsider.

Deal Features:

- when transferring money to a loan at interest, the parties must prescribe its size;

- if there is no indication of interest, such interest will be calculated based on the current bank rate on the day the borrower fulfills obligations to transfer funds;

- interest received by a citizen - a lender under a transaction will be subject to mandatory taxation;

- the parties may include in the contract a condition that all costs, including taxation, are borne by the borrower;

- the transfer of money can be carried out at the cash desk of the organization, by transferring to the account;

- repayment of the loan is possible by transferring funds to the account of the lender or issuing money from the cash desk;

- conditions for early repayment of the loan must be prescribed in the contract;

- if the loan amount is large, the lender may require the inclusion of a pledge clause in the agreement, for example, property owned by the legal entity - the borrower.

The main task of the parties is a detailed description of the object of the loan. Before signing a loan agreement, the parties should carefully study its terms. For any difficult moments and questions, you should seek the help of specialists in the field of law.

Legal relations between legal entities in terms of concluding a loan agreement are fully subject to civil law, respectively, general rules apply to them.

The main feature of this type of agreement is that it is always concluded in writing, regardless of the size and type of loan. Since the parties are legal entities, the contract must contain information about their details.

The signed contract is sealed.

Violation of the terms of the contract

If the parties violate the terms of the contract, they are subject to civil liability. First of all, this includes responsibility for the outdated repayment of the loan.

The parties have the opportunity to independently prescribe liability in the form of interest for delay in the terms of the contract. If such a condition is not provided, the parties are guided by the general provisions of Article 395 of the Civil Code of the Russian Federation.

Requirements for the elimination of violations must be declared in the form of a claim, indicating the timing of their satisfaction.

If the party that violated the terms of the transaction does not satisfy the requirements or ignores the claim, the other party has the right to go to court.

To apply to the court, you will need to draw up a statement of claim with a full calculation of the loan amount required for repayment and interest for the delay in fulfilling the obligation.

The loan agreement, as a separate legal institution of civil law, is quite simple to draw up. All that is required of the parties to the transaction is to carefully study the norms of the law, correctly execute the transfer of the loan and, of course, not violate the rights and interests of each other.

See this video for more information on how to collect funds on a receipt:

The interest-bearing loan agreement is drawn up taking into account both the interests of the Lender and the Borrower. There are 4 options to choose from. They stipulate the contractual jurisdiction of the dispute - in the court at the place of residence of the Lender, since situations when the Lender has to "run" for the Borrower in order to repay the debt occur much more often than when the Borrower is looking for ways to repay the debt to the Lender, and he evades accepting the debt 🙂 . Therefore, consideration of the dispute closer to the place of residence of the Lender, and not in another city where an unscrupulous Borrower can move, is a completely reasonable clause of the contract.

The need for receipts when transferring money

When transferring funds, it is recommended to draw up receipts: the first one is written by the Borrower stating that he has received a loan, and transfers it to the Lender. The second and subsequent ones are drawn up and signed by the Lender, with subsequent transfer to the Borrower, in that he received a refund (of the loan amount or part of it, interest). It is strongly recommended to write receipts instead of inscriptions on the loan agreement. According to the law, instead of receipts, it is possible to make inscriptions on the contract (for example: the loan amount in the amount of 10,000 rubles was received, the borrower received a signature, received interest) In court, there were cases when an honest Borrower regularly paid interest, returned the loan, but the Lender simply tore off that part the sheet where the inscriptions were made and submitted the contract to the court. The court, in the absence of other evidence of return, ordered the Borrower to return the loan (again).

An exception to this rule is if the repayment (or transfer of the loan to the Borrower) occurs through a bank account. Here it is simply necessary to indicate in the field “purpose of payment”: “transfer of the loan amount in accordance with loan agreement No. 1 of 01/01/2014” or “payment of interest for using the loan in accordance with loan agreement No. 1 of 01.01.2014” or “partial repayment of the debt of 10,000 rubles . and payment of interest for the period from 01/01/2014 to 02/01/2014 in the amount of 1000 rubles. according to loan agreement No. 1 dated 01.01.2014”. In the event that you additionally draw up receipts for the same money, there is a risk that the Borrower will say in court: “I returned 10,000 rubles through the bank, and then another 10,000 rubles in cash.” and the court can accept his point of view, although in reality, the payment was one. The confirmation of the payment will be the payment order of the sender's bank, in the event of a lawsuit, it is not difficult to obtain this document from the bank.

Compound interest

The loan agreement also provides for the accrual of compound interest in the event that the borrower violates the monthly interest payment schedule. That is, this is when interest is added to the loan amount (capitalized) and the calculation of interest in the next month is already on the "loan amount + unpaid interest in the previous month." Also, the payment of increased interest does not exempt from paying a penalty, which is also scrupulously prescribed in the proposed contract. The borrower must be disciplined (for the first time, a delay of a couple of days can be completely forgiven, but warned that this should not be done again). He should make it clear that you are a rather tough person and compliance with the payment schedule is sacred, like to work without delay. First of all, he saves money from his salary to pay for a loan agreement, and then for his own needs.

Sample money loan agreement (with payment of interest):

You can download three versions of the loan agreement, with payment of debt and interest at the end of the term, or monthly payment in installments. The choice of the contract form depends on the individual preferences of the lender and the borrower.