Monetary policy of the Central Bank. The role of monetary policy at the present stage The role of the state in monetary policy

Read also

Monetary policy is the most important element of modern macroeconomic policy. Monetary policy refers to a set of activities carried out in the monetary sphere with the aim of regulating the economy.

Monetary policy at the macro level is a set of measures taken by the Central Bank (CB) in the field of monetary circulation and credit relations to give macroeconomic processes the direction of development desired by the state.

It is developed and implemented by the country's Central Bank, which at the same time acts in line with the economic policy pursued by the government. The objects of regulation are the money supply and related parameters. The main subjects of monetary policy are the Central Bank, commercial banks and other financial institutions. At the same time, it affects the position of almost every economic entity, be it a government agency, a company or a household.

The ultimate goals of monetary policy are: sustainable rates of economic growth; high level of employment; stable price level; equilibrium of the country's balance of payments.

It is impossible to achieve all goals at the same time, since while some of them are consistent with each other, others are in a state of contradiction. For example, ensuring high, sustainable rates of economic growth will undoubtedly lead to higher levels of employment. At the same time, actions aimed at stabilizing the price level may be accompanied by an increase in unemployment. It is therefore necessary to establish a hierarchy of monetary policy objectives, given that priority is usually given to maintaining a stable price level.

Intermediate goals are: money supply (money supply) and interest rate. Other possible goals may include: the exchange rate of the national currency; the difference between long-term and short-term interest rates; loan volume; commodity price indices.

It should be noted that the Central Bank does not adhere to the goals chosen once; it can change them depending on the state of the economy and the tasks facing society.

Thus, monetary policy is a government policy that influences the amount of money in circulation in order to ensure price stability, full employment and growth in real output.

The effectiveness of monetary policy depends on the choice of monetary regulation instruments. There are various classifications. They are divided into general, affecting the loan capital market, and selective, intended to regulate certain forms of credit.

The main instruments of monetary policy are:

1) change in the discount rate;

2) changes in the norms of required reserves;

3) open market operations.

Changing the discount rate (refinancing rate) is the oldest method of monetary regulation. It is based on the right of the Central Bank to provide loans to those commercial banks that have a strong financial position, but due to certain circumstances need additional funds. For the provision of funds, the Central Bank charges a certain percentage from the commercial enterprise. The rate of such interest is called the discount rate. Thus, the discount rate is the rate at which the Central Bank issues loans to commercial banks. The Central Bank uses this method to control the volume of money supply and, consequently, the supply of money. When the discount rate decreases, commercial banks' demand for loans increases. “By providing them, the Central Bank increases the reserves of commercial banks of borrowers by the corresponding amount. These reserves are excess because required reserves are generally not required to support such loans. Therefore, commercial banks can fully use the funds taken from the Central Bank for lending, thereby increasing the money supply.” An increase in the money supply leads to a decrease in the interest rate, i.e. the percentage at which loans are provided to entrepreneurs and the population. Credit becomes cheaper, which stimulates production development.

When the Central Bank increases the discount rate, commercial banks will strive to compensate for the losses caused by its growth (increase in the cost of credit) by raising rates on loans provided to borrowers. A change in the discount rate directly affects the change in rates on loans from commercial banks. The latter is the main goal of this method of the Central Bank’s monetary policy. For example, an increase in the official discount rate during a period of increased inflation causes an increase in the interest rate on credit operations of commercial banks, which leads to their reduction, since the cost of credit increases, and vice versa.

Thus, changes in the discount rate have an impact on the credit sector. Firstly, difficulty or facilitation of the ability of commercial banks to obtain a loan from the Central Bank affects the liquidity of credit institutions. Secondly, a change in the official rate means that commercial bank loans become more expensive or cheaper for clients.

Also, a change in the official rate of the Central Bank means a transition to a new monetary policy, which forces commercial banks to make the necessary adjustments to their activities.

The disadvantage of using refinancing in monetary policy is that this method only affects commercial banks. If refinancing is used little, then this method almost completely loses its effectiveness.

Changes in required reserve norms. Reservations arose as a need to guarantee depositors payment of money in the event of bank bankruptcy. But the crisis of 1929 - 1933 showed that mandatory reserves were ineffective in this role. Deposit insurance began to be used to guarantee the return of money, and mandatory reserves are now one of the main instruments of monetary regulation.

Currently, minimum reserves are the most liquid assets that all credit institutions are required to have, as a rule, either in the form of cash at banks' cash desks, or in the form of deposits with the Central Bank or in other highly liquid forms determined by the Central Bank.

Changing the norms of required reserves allows the Central Bank to regulate the supply of money and the interest rate, since it leads, firstly, to a change in the value of the money supply, and secondly, it affects the money multiplier, and therefore the ability of commercial banks to create new money through lending .

Required reserves perform two main functions:

firstly, they serve as security for the obligations of commercial banks on the deposits of their clients. By periodically changing the required reserve ratio, the Central Bank maintains the degree of liquidity of commercial banks at the minimum acceptable level depending on the economic situation;

secondly, they are a tool used by the Central Bank to regulate the volume of money supply in the country. By changing the norm of reserve funds, the Central Bank regulates the scale of active operations of commercial banks (mainly the volume of loans they issue), and, consequently, the possibility of their deposit issuance. Changes in the required reserve ratio affect the profitability of credit institutions. Thus, in the case of an increase in required reserves, there appears to be a loss of profit. This method serves as the most effective anti-inflationary agent.

The disadvantage of this method is that some institutions, mainly specialized banks with small deposits, find themselves in an advantageous position compared to commercial banks with large resources.

When using this method of monetary policy, it should be taken into account that even small changes in required reserve standards cause significant shifts in the volume of reserves, the scale and structure of credit operations. Frequent and significant changes in reserve norms can even lead to disruption of the monetary and financial equilibrium of the economy. Therefore, they are carried out during inflation, a decline in production, when potent drugs are needed. It should be noted that in developed countries, changes in reserve norms as a way of regulating the money supply are resorted to less and less often.

Open market operations. Gradually, the two methods of monetary regulation described above (changes in the discount rate and changes in required reserve norms) lost their primary importance, and the main instrument of monetary policy became Central Bank interventions, called open market operations.

This method consists in the fact that the Central Bank carries out transactions of purchase and sale of securities in the banking system. The purchase of securities from commercial banks increases the latter's resources, accordingly increasing their lending capabilities, and vice versa. The Central Bank periodically makes changes to the specified method of credit regulation, changes the intensity of its operations and their frequency.

Open market operations have become a decisive instrument of monetary regulation for the following reasons: firstly, by conducting them, the Central Bank does not depend on commercial ones; secondly, government securities can be bought and sold in different quantities, and therefore influence the supply of money to varying degrees.

According to the form of market transactions of the Central Bank with securities, they can be direct or reverse. A direct transaction is a regular purchase or sale, and a reverse transaction consists of the purchase and sale of securities with the obligatory completion of a reverse transaction at a predetermined rate. The flexibility of reverse operations and the softer effect of their impact make this regulatory instrument popular. If you look closely, you can see that in essence these operations are similar to refinancing secured by securities. The Central Bank invites commercial banks to sell it securities on terms determined on the basis of auctions, with the obligation to sell them back in 4-8 weeks. Moreover, interest payments accruing on these securities while they are in the ownership of the central bank will belong to commercial banks.”

Thus, open market operations, as a method of monetary regulation, differ significantly from the previous two. The main difference is the use of more flexible regulation, since the volume of purchases of securities, as well as the interest rate used, can change daily in accordance with the direction of the Central Bank's policy. Commercial banks, taking into account the specified feature of this method, must closely monitor their financial position, while avoiding a deterioration in liquidity.

Selective instruments of monetary policy are:

1. Control over certain types of loans;

2. Regulation of risk and liquidity of banking enterprises;

3. Margin required by law;

4. Exhortations.

Control over certain types of loans is often applied to loans secured by exchange-traded securities, mortgage loans, and consumer loans for the purchase of goods in installments. Here, the central bank can instruct financial institutions to make special deposits with the central bank in the event of an increase in the named types of credit.

Regulation of risk and liquidity of banking enterprises. There are many government regulations that govern the operations of banks. The primary focus of these provisions is on risk and liquidity in banking operations. The risk of banking activity is determined not through an assessment of the financial situation of debtors, but through the ratio of issued loans and the amount of the bank's own funds.

Legal margin. The stock exchange is a necessary institution of market economic relations. Stock exchanges are markets for the securities of companies. However, rampant speculation in the financial market is causing serious problems for the economy. A fall in stock prices can bankrupt both businesses and individuals, which in turn will reduce investment and consumer demand and push the economy into recession. As a measure against excessive speculation on the stock exchange, legal margins are used. Margin is the minimum proportion of the cost of purchased securities, which is paid from the buyer’s own funds. For example, with a margin of 60%, purchasing a package of securities worth $1 million, the buyer must pay $600 thousand with his own money and only $400 thousand can be funds received on credit. Margins increase when it is desirable to limit speculative buying of shares, and decrease when it is desirable to revive the market.

Exhortations. Monetary authorities may recommend that commercial banks follow certain policies. For example, limit the annual expansion of credit, as this could have negative consequences for the banking system and the economy as a whole.

Thus, modern states have a whole system of methods for regulating the economy, and its constituent instruments differ not only in the strength of their impact on the credit market, but also in the areas of their application, which, with a correct assessment of the situation, makes it possible to find an optimal solution that will lead the country out of a possible crisis.

Introduction..2

1. Monetary policy: basic provisions. 3

1.1. Objectives of monetary regulation. 3

1.2. Monetary policy instruments. 9

2. The main directions of monetary regulation in the Russian Federation. 17

2.1. Types of monetary policy. 17

2.2. Current trends and directions of monetary policy 18

Conclusion.. 20

Bibliography.. 22

Introduction

The set of government measures in the field of money circulation and credit is called monetary policy. Its main goal is to regulate economic activity in the country and fight inflation.

Monetary policy is aimed either at stimulating credit and money emission (credit expansion), or at restraining and limiting them (credit restriction). In the face of falling production and rising unemployment, central banks are trying to revive the market by expanding credit and lowering interest rates. On the contrary, economic growth is often accompanied by “stock market fever,” speculation, rising prices, and growing imbalances in the economy. In such conditions, central banks seek to prevent the “overheating” of the market by limiting credit, increasing interest rates, curbing the issue of means of payment, etc.

The purpose of this work is to consider the main goals, directions and instruments of monetary policy.

The relevance of the work lies in the fact that monetary policy consists of changing the money supply in order to stabilize the total volume of production (stable growth), employment and the price level.

Initially, the main function of central banks was to issue cash; at present, this function has gradually faded into the background, but we should not forget that cash is still the foundation on which the rest of the money supply is based.

When writing the work, the works of such authors as: Kosoy A.M., Harris L., Polyakov V.P., Lavrushin O.I. were used. and others.

Monetary policy: basic provisions

1.1. Objectives of monetary regulation

Monetary policy is understood as a set of measures taken by the government in the monetary sphere in order to regulate the economy. It is part of the overall macroeconomic policy. The main final goals of monetary policy are: sustainable growth rates of national production, stable prices, high levels of employment, balance of payments equilibrium. From their totality, we can identify the priority goal of monetary policy - stabilization of the general price level.

Along with the final goals, intermediate goals are identified. They are the volume of money supply and the level of interest rates.

The central bank of the country implements monetary policy. The process of monetary regulation can be divided into two stages. At the first stage, the central bank influences the supply of money, the level of interest rates, the volume of loans, etc. On the second, changes in these factors are transferred to the sphere of production, contributing to the achievement of final goals.

The fundamental goal of monetary policy is to help the economy achieve an overall level of output characterized by full employment and price stability.

With the help of monetary regulation, the state seeks to mitigate economic crises and curb the growth of inflation; in order to maintain the market situation, the state uses credit to stimulate investment in various sectors of the country's economy.

It should be noted that monetary policy is carried out both by indirect (economic) and direct (administrative) methods of influence. The difference between them is that the central bank either has an indirect impact through the liquidity of credit institutions, or sets limits on the quantitative and qualitative parameters of banks’ activities.

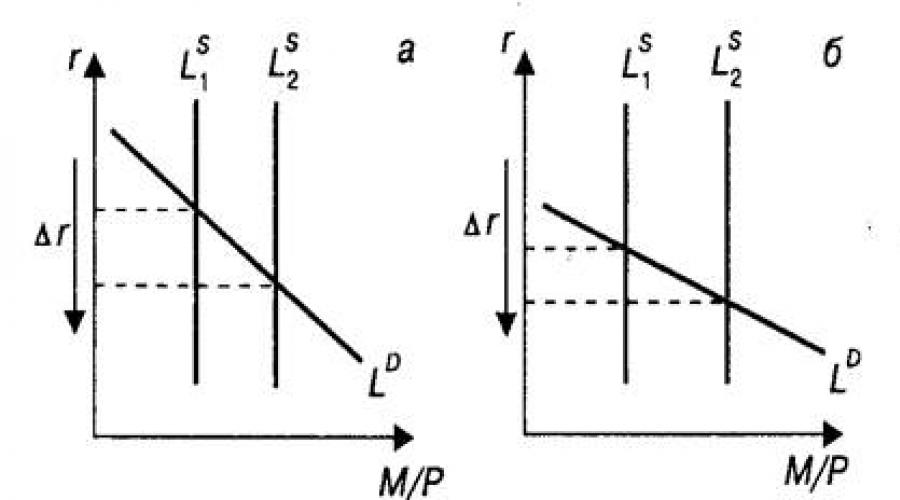

Monetary policy options are interpreted differently on the graph that displays them (Fig. 1). A tight money supply policy corresponds to a vertical money supply curve at the target money supply level. A flexible monetary policy can be represented by a horizontal money supply curve at the level of the target money supply. The intermediate option corresponds to a downward sloping money supply curve.

Fig.1. Monetary policy options: a – relatively tight; b – relatively flexible.

The choice of monetary policy options depends largely on the reasons for changes in the demand for money. If it is necessary to isolate the dynamics of real variables from unexpected changes in the velocity of money, then a policy of maintaining an interest rate linked directly to investment activity (a horizontal or flat money supply curve Ls) is likely to be preferable. Depending on the slope of the Ls curve, a change in the demand for money will have a greater effect on either the money supply M (Fig. 1, b) or the interest rate r (Fig. 1, a).

Obviously, the central bank is not able to simultaneously fix the monetary system and the interest rate. For example, in order to maintain a relatively stable rate when the demand for money increases, the bank will be forced to expand the supply of money in order to reduce the upward pressure on the interest rate from the increased demand for money (this will be reflected by a shift to the right of the money demand curve LD and a movement of the equilibrium point to the right along the Ls curve from point A to point B).

Monetary policy has a rather complex transmission mechanism. The effectiveness of the policy as a whole depends on the quality of work of all its links.

We can distinguish four links in the transmission mechanism of monetary policy:

1) change in the value of the real money supply (m/p) s as a result of the central bank revising the relevant policy;

2) changes in the interest rate on the money market;

3) the reaction of total expenditures (especially investment ones) to the dynamics of the interest rate;

4) a change in output in response to changes in aggregate demand (aggregate expenditures).

Between a change in the supply of money and the reaction of aggregate supply, there are two more intermediate stages, the passage through which significantly affects the final result.

A change in the market interest rate occurs by changing the structure of the asset portfolio of economic agents after, as a result of, say, the expansionary monetary policy of the central bank, they have more money on hand than they need.

Fig.2. Transmission mechanism of monetary policy.

The consequence, as we know, will be the purchase of other types of assets, cheaper loans, i.e. as a result, a decrease in the interest rate (Fig. 2, a), when the money supply curve shifts to the right from position Ls1 to position Ls2.

However, the reaction of the money market depends on the nature of the demand for money, i.e. on the steepness of the LD curve. If the demand for money is sufficiently sensitive to changes in the interest rate, then the result of an increase in the money supply will be a slight change in the rate. And vice versa, if the demand for money reacts weakly to the interest rate (steep LD curve), then an increase in the supply of money will lead to a significant drop in the rate (Fig. 2, c).

It is obvious that violations in any link of the transmission mechanism can lead to a decrease or even the absence of any results of monetary policy.

For example, minor changes in the interest rate in the money market or the lack of reaction of the components of aggregate demand to the dynamics of the rate break the connection between fluctuations in the money supply and the volume of output. These disturbances in the operation of the transmission mechanism of monetary policy are especially pronounced in countries with transition economies, when, for example, the investment activity of economic agents is associated not so much with the interest rate on the money market, but with the general economic situation and investor expectations.

Monetary policy has a significant external lag (the time from decision making to its result), since its impact on the size of GDP is largely associated through interest rate fluctuations with a decrease in investment activity in the economy, which is a rather long process. This also complicates the process, since a delay in the result can even worsen the situation. For example, a countercyclical expansion of the money supply (and a reduction in the interest rate) to prevent a recession can produce results when the economy is already on the rise and cause unwanted inflationary processes.

You can deepen your understanding of monetary policy using the aggregate demand-aggregate supply model (AD-AS model). Monetary policy, like fiscal policy, is constrained by factors contained in the supply curve.

In other words, the causal relationship presented in Figure 3 assumes that monetary policy primarily affects investment spending and thereby real output and the price level. The AD-AS model, and in particular the aggregate supply curve, explains how changes in investment are distributed between changes in real output and changes in the price level.

Fig.3. Monetary policy and the AD-AS model.

In determining the position of this aggregate demand curve, we assume that the money supply is fixed. An expansion in money supply shifts the aggregate demand curve to the right. A large money supply allows an economy to achieve large real output at any given price level. A reduction in money supply, on the contrary, shifts the aggregate demand curve to the left.

Thus, it can be observed that if the economy is in a recession and characterized by a nearly horizontal Keynesian segment of the aggregate demand curve, the "cheap money" policy will shift the aggregate demand curve from position ADl to position AD2 and will greatly affect real output and employment. However, it will cause a significant increase in the price level. In Fig. 3, this is shown by the shift in aggregate demand from position AD3 to position AD1 on the classic, or vertical, segment of the aggregate supply curve. It goes without saying that "cheap money" policies are clearly inappropriate when the economy has reached or is close to full employment. Figure 3 indicates the reason: it would lead to high inflation.

1.2. Monetary Policy Instruments

To conduct monetary policy, it is necessary to establish a link between the policy instruments used by a country's government and that country's objectives for economic growth, inflation, and balance of payments.

Often, instead of establishing a direct connection between tools and goals, an intermediate goal is considered, for example, money or credit. Using an intermediate target allows for a two-step process that focuses on determining the appropriate size of the money supply and using monetary policy tools to ensure that monetary aggregates do not exceed that size.

The effectiveness of monetary policy largely depends on the choice of instruments (methods) of monetary regulation. They can be divided into general and selective. General ones affect almost all parameters of the monetary sphere and affect the loan capital market as a whole. Selective methods are aimed at regulating certain forms of credit, lending conditions, etc. The main general instruments of monetary policy are changes in the discount rate and required reserve ratios, and open market operations. These are indirect methods of regulation.

Changing the discount rate is the oldest method of monetary regulation. It is based on the right of the central bank to provide loans to those commercial banks that have a strong financial position, but due to certain circumstances require additional funds. For the funds provided, the central bank charges the borrower a certain percentage. The rate of such interest is called the discount rate. Thus, the discount rate is the "price" of the additional reserves that the central bank provides to businesses. The Central Bank has the right to change it, thereby regulating the supply of money in the country.

When the discount rate decreases, commercial banks' demand for loans increases. By providing them, the central bank increases the reserves of commercial borrowing banks by an appropriate amount. These reserves are excess because required reserves are generally not required to support such loans. Therefore, commercial banks can fully use the funds taken from the central bank for lending, thereby increasing the money supply.

An increase in the money supply leads to a decrease in the interest rate, i.e. the percentage at which loans are provided to entrepreneurs and the population. Credit becomes cheaper, which stimulates production development.

When the discount rate increases, the reverse process occurs. It leads to a reduction in the demand for central bank loans, which slows (or reduces) the rate of growth, the supply of money and increases the interest rate. Entrepreneurs take out “expensive” loans less often, which means that less money is invested in production development.

It was believed that reserve requirements of commercial banks were necessary to guarantee that depositors would be paid in the event of bankruptcy. However, as practice has shown, they turned out to be an ineffective means of protecting deposits. Therefore, to guarantee the return of money, deposit insurance began to be used, and required reserves received a different purpose: with their help, they control the volume of money supply and credit.

Changing reserve requirement ratios allows the central bank to regulate the money supply. This is due to the fact that the required reserve ratio affects the volume of excess reserves, and therefore the ability of commercial banks to create new money through lending.

Suppose the central bank increases the reserve requirement." Commercial banks can, firstly, leave the required reserves the same and accordingly reduce the issuance of loans, which will lead to a reduction in the money supply. Secondly, they can increase the required reserves in order to meet the requirements of the central bank. For To do this, they will need free funds. To find them, banks will sell government bonds and demand the return of money on loans. Buyers of securities, borrowers whose loans have been reclaimed, will use their deposits and will demand the return of loans that they have given to others. This process will be carried out. to reduce deposits in current accounts and, therefore, reduce the ability of banks to create money. Typically, in response to an increase in the reserve ratio, banks simultaneously increase required reserves and reduce the issuance of loans.

On the contrary, lowering the reserve ratio transfers part of the required reserves into excess reserves and thereby increases the ability of commercial banks to create money through lending. It should be borne in mind that an increase or decrease in the required reserve ratio also changes the money multiplier.

The essence of open market operations is the purchase and sale of government securities by the central bank. To use this instrument, the country must have a developed securities market.

By buying and selling securities, the central bank influences bank reserves, interest rates, and therefore the money supply. If it is necessary to increase the money supply, he begins to buy government securities from commercial banks and the population. If securities are sold by commercial banks, then the central bank increases the reserves of commercial banks in their accounts by the amount of purchases. This allows commercial banks to expand their lending and increase the money supply.

The central bank pays for the purchase of government securities from the population by checks. The population brings checks to commercial banks, where current accounts are opened for the appropriate amount, and commercial banks present them for payment to the central bank. He pays for them by increasing the reserves of commercial banks. An increase in reserves expands the possibilities for banks to create credit money.

If the quantity of money in a country needs to be reduced, the central bank sells government securities. Commercial banks pay for their purchases by checks on their deposits with the central bank. The latter takes into account checks, reducing bank reserve accounts by the purchase amount. This leads to a reduction in credit transactions and the money supply.

The public, when purchasing securities, writes checks to commercial banks. The central bank honors these checks, reducing the commercial bank reserves held in its accounts and, therefore, the money supply.

Open market operations are the central bank's most important operational means of influencing the monetary sphere.

Thus, open market operations, as a method of monetary regulation, differ significantly from other methods of monetary policy.

The main difference is the use of more flexible regulation, since the volume of securities purchased, as well as the interest rate used, can change daily in accordance with the direction of the central bank's policy. Commercial banks, taking into account the specified feature of this method, must closely monitor their financial position, while avoiding a deterioration in liquidity.

Open market operations vary depending on:

Terms of the transaction - purchase and sale for cash or purchase for a period with mandatory re-sale - so-called reverse transactions (REPO transactions);

Objects of transactions - transactions with government or private securities;

Transaction terms - short-term (up to 3 months) and long-term (1 year or more) transactions with securities;

Areas of operations - cover only the banking sector or include the non-banking sector of the securities market;

Methods of setting rates - determined by the central bank or the market.

Establishing norms for required reserves of commercial banks - the next method, on the one hand, helps improve banking liquidity, and on the other hand, these norms act as a direct limiter on investment. Changes in required reserve norms are a method of directly influencing the amount of bank reserves. This method was first used in the USA in 1933.

Unlike open market operations and accounting policies, this mechanism of monetary regulation affects the foundations of the banking system and can have a strong impact on the financial and economic system as a whole.

In Russia, since March 19, 1999, the standards for contributions of credit institutions to the required reserves of the Bank of Russia were: for funds raised from legal entities in rubles - 7%; raised funds from legal entities in foreign currency - 7%; funds raised from individuals in rubles - 5%; funds raised from individuals in foreign currency - 7%; deposits of individuals in Sberbank of the Russian Federation in rubles - 5%.

Along with indirect instruments, administrative methods of regulating the money supply can also be used: direct limiting of loans, control over certain types of loans, etc. Direct limiting of loans consists of setting an upper limit on credit emission, limiting the amount of lending in certain industries, etc. The principle of limitation, as a rule, is used simultaneously with preferential lending to priority sectors of the economy.

Method of using quantitative credit restrictions.

This method of credit regulation is a quantitative limitation on the amount of loans issued. In contrast to the regulatory methods discussed above, credit provisioning is a direct method of influencing the activities of banks. Also, credit restrictions lead to the fact that borrowing enterprises find themselves in different situations. Banks tend to provide loans primarily to their traditional clients, usually large enterprises. Small and medium-sized firms are the main victims of this policy.

Also, the central bank can set various standards (ratios), which commercial banks are obliged to maintain at the required level. These include capital adequacy standards for a commercial bank, balance sheet liquidity standards, maximum risk per borrower standards, and some additional standards.

The listed standards are mandatory for commercial banks. Also, the central bank can establish optional, so-called assessment standards, which commercial banks are recommended to maintain at the proper level.

Selective methods of monetary regulation include control over certain types of loans (mortgage loans, secured by exchange-traded securities, consumer loans), establishing maximum limits on the accounting of bills of exchange for individual banks, etc. It should be emphasized that when implementing monetary policy, the central bank simultaneously uses a set of instruments.

Selective methods of monetary policy include the following.

Control over certain types of loans. It is often practiced in relation to loans secured by exchange-traded securities, consumer loans for the purchase of goods in installments, and mortgage loans. Regulation of consumer credit is usually introduced during periods of tension in the loan capital market, when the state seeks to redistribute them in favor of certain industries or limit the overall volume of consumer demand.

Regulation of risk and liquidity of banking operations. Numerous government regulations and documents (laws, acts, regulations, directives, guidelines, etc.) regulating the operational activities of banks focus on the risk and liquidity of banking operations. Government control over risk has increased over the past two decades.

It is characteristic that the risk of banking activity is determined not through an assessment of the financial situation of debtors, but through the ratio of issued loans and the amount of the bank’s own funds.

2. Main directions of monetary regulation in the Russian Federation

2.1. Types of monetary policy

There are two main types of monetary policy, each of which is characterized by specific goals and a set of regulatory tools. In conditions of inflation, a policy of “expensive money” is being pursued (the policy of credit restriction). It is aimed at tightening conditions and limiting the volume of credit operations of commercial banks, i.e. to reduce the money supply.

The Central Bank, pursuing a restriction policy, takes the following actions: sells government securities on the open market; increases the required reserve ratio; raises the discount rate. If these measures are not effective enough, the central bank uses administrative restrictions: lowers the ceiling on loans provided, limits deposits, reduces the volume of consumer loans, etc. The “dear money” policy is the main method of anti-inflationary regulation.

During periods of decline in production, a policy of “cheap money” (expansionary monetary policy) is pursued to stimulate business activity. It consists of expanding the scale of lending, weakening control over the growth of the money supply, and increasing the money supply.

To do this, the central bank buys government securities, reduces the reserve ratio and the discount rate. More preferential conditions are being created for providing loans to economic entities.

The central bank chooses one or another type of monetary policy based on the state of the country's economy. When developing monetary policy, it is necessary to take into account that, firstly, a certain time passes between the implementation of a particular event and the appearance of the effect of its implementation: secondly, monetary regulation can only affect monetary factors of instability.

2.2. Modern trends and directions of monetary policy

The main methods of monetary regulation in accordance with neo-Keynesian recommendations are changing the official discount rate of the central bank; tightening or weakening direct restrictions on the volume of bank loans depending on the size of aggregate demand and employment, the level of the exchange rate, and the scale of inflation; the use of transactions with government bonds primarily to stabilize their rates and reduce the price of government loans.

The fundamental difference between the technique of monetary control based on the monetarist approach is the introduction of quantitative regulatory guidelines, the change of which causes a change in the direction of monetary policy. The choice of one or another indicator as a guideline for monetary policy largely determines both the main objects and the technique of monetary control itself. Such indicators can be both the total money supply and its individual aggregates.

It should be especially emphasized that government agencies in countries with market economies have recently increasingly used “competition development policies” in the banking sector, i.e. stimulate competition and make way for it, including measures against anti-competitive cooperation.

Within the framework of this policy are the actions taken in recent years in many countries to liberalize domestic and international financial markets, abolish controls over interest rates and a number of restrictions on banks to conduct transactions in the securities markets and other types of financial activities. At the same time, wide access of foreign banks to local markets is often considered as a necessary factor in increasing the efficiency of the latter.

The following priority areas of government support can be identified:

Stimulation of foreign economic activity;

Investment projects in the development of advanced technologies and industries, primarily in export production and import substitution;

Ensuring restructuring and increasing efficiency of agriculture;

Lending for housing construction (mortgage).

Conclusion

In conclusion of the work done, it should be noted that the goal defined at the beginning of the study was achieved. The work examined the main tools and directions of modern monetary policy. Let's summarize:

Firstly, it is necessary to note the strengths and weaknesses of using monetary regulation methods in influencing the country's economy as a whole. The following arguments can be made in favor of monetary policy. Firstly, speed and flexibility compared to fiscal policy. It is known that the implementation of fiscal policy can be delayed for a long time due to debate in the legislative authorities. The situation is different with monetary policy. The central bank and other monetary authorities can make decisions on a daily basis to buy and sell securities and thereby influence the money supply and interest rates. The second important aspect is related to the fact that in developed countries this policy is isolated from political pressure; in addition, it is softer in nature than fiscal policy and acts more subtly and therefore seems more politically acceptable.

But there are also a number of negative aspects. A tight money policy, if pursued vigorously enough, can indeed reduce commercial bank reserves to the point where banks are forced to restrict lending. And this means limiting the money supply. A cheap money policy can provide commercial banks with the necessary reserves, that is, the ability to provide loans, but it cannot guarantee that banks will actually issue loans and the money supply will increase. In such a situation, the actions of this policy will be ineffective. This phenomenon is called cyclical asymmetry, and it can be a serious obstacle to monetary regulation during a depression.

Another negative factor is the following. The velocity of money tends to change in the opposite direction of the money supply, thereby inhibiting or eliminating policy-induced changes in the money supply, that is, when the supply of money is constrained, the velocity of money tends to increase.

It should be emphasized that with cheap money the velocity of circulation of money decreases; with the reverse course of events, the policy of expensive money causes an increase in the velocity of circulation. And we know that total spending can be thought of as the money supply multiplied by the velocity of money. And, therefore, with a policy of cheap money, as mentioned above, the velocity of circulation of the money supply falls, and, therefore, total spending is reduced, which is contrary to the goals of the policy. A similar phenomenon occurs with dear money policies.

Bibliography

1. Azriliyan A.N. Large economic dictionary. - M.: Legal Culture Foundation, 1994. – 793 p.

2. Money, credit, banks / Edited by O.I. Lavrushin. - M.: Finance and Statistics, 2004. – 354 p.

3. Dolan E., Campbell K., Campbell R. Money, banking and monetary policy. - M., - L., 1991. – 287 p.

4. Kosoy A.M. On the issue of price scale. (Money and credit). – 1998. – 260 p.

5. Loans, investments / Edited by A.G. Kulikova. - M.: Prior, 1994. – 178 p.

6. Course of socio-economic statistics. / Ed. M.G. Nazarova - M.: Finance and Statistics, 2003. - 306 p.

7. General theory of money and credit: Textbook / Ed. E.F. Zhukova. – M.: Banks and exchanges, UNITY, 1995. – 315 p.

8. Fundamentals of entrepreneurial activity (economic theory. Marketing. Financial management). / Ed. Vlasova V.M. – M.: Finance and Statistics. – 2001. – 452 p.

9. Polyakov V.P., Moskovkina L.A. Fundamentals of money circulation and credit. - M.: Infra-M, 1996. – 406 p.

10. Modern economics. Public training course. - Rostov-on-Don: “Phoenix”, 1999. – 524 p.

11. Financial and credit encyclopedic dictionary / Under the general. ed.A.G. Gryaznova. - M.: Finance and Statistics, 2002. – 291 p.

12. Harris L. Monetary theory. - M., 1990. – 152 p.

13. Economics: Textbook / Ed. Doctor of Economics Sciences Prof. A.S. Bulatova. – M.: Yurist, 2002. – 896 p.

General theory of money and credit: Textbook / Ed. E.F. Zhukova. – M.: Banks and exchanges, UNITY, 1995. – 315 p.

Harris L. Monetary theory - M., 1990. – 152 p.

Modern economics. Public training course. - Rostov-on-Don. "Phoenix" - 1999. – 524 p.

Economic theory / Ed. Bazyleva N.I., Gurko S.P. – Mn.: Book House; Ecoperspective, 2004. – 637 p.

Economics: Textbook / Ed. Doctor of Economics science prof. A.S. Bulatova. – M.: Yurist, 2002. – 896 p.

State monetary policy

The policy of any state requires constant monitoring of financial turnover and timely identification of the presence of financial difficulties. This allows us to maintain the stability of the economy and life. The main area that is being particularly closely monitored is the financial sector. A monetary policy (MP) has been developed for monitoring.

It allows you to influence the volume of cash in circulation to maintain price stability, ensure employment of citizens and increase national production. The monetary policy is intended, first of all, to create conditions for strengthening the exchange rate of the national currency and achieving a stable balance of payments of the state.

What is the government's monetary policy?

It is part of a country's economic policy, the main goal of which is to stabilize economic growth and welfare. The levers of regulation are supply and demand in the financial market, bank reserves, exchange rates, and interest rates. Different monetary policy measures are used at different stages of the economic cycle.

In conditions of economic revival, in order to avoid an oversupply of goods, the state can limit the volume of credit transactions, raise rates, and restrain the growth of the mass of money in circulation. In a crisis cycle, on the contrary, economic stimulation begins: interest rates on loans are reduced, preferential lending conditions are introduced in order to increase trade turnover.

Monetary policy is determined by the state, and its conductor is the Central Bank. It is he who, using the available tools, influences the volume of money in circulation. Basically, mechanisms are used here to influence interest rates on deposits and loans. Almost all influence tools are used in combination, enhancing each other’s effect.

Methods of influencing monetary policy.

There are three main methods:

- Changing the required reserve norm. As this indicator increases, banks' credit resources begin to decrease, which leads to a decrease in the volume of borrowed funds in circulation. The reserves of all banks are kept in the form of non-interest bearing deposits in the accounts of the Central Bank.

- Change of discount rate. If the discount rate decreases, this leads to a reduction in the cost of credit and contributes to an increase in the supply of credit in circulation. People are starting to actively take out loans. The discount rate is related to the liquidity of government securities. An increase in the SS contributes to an increase in the yield of government securities.

- Operations on the world market. Most often, the Central Bank carries out repo transactions when it sells securities with an obligation to repurchase at a higher price.

Rigid monetary policy is to maintain a certain money supply in circulation, while flexible monetary policy is aimed at maintaining interest rates.

Thus, monetary policy is tied to economic policy and is an integral part of it. It takes into account the interrelation of significant economic components and contributes to the growth of the state’s well-being. The effectiveness of monetary policy depends entirely on the qualifications of the country's leaders, branches of government and the literacy of the Central Bank.

Who determines the country's monetary policy?

Russian monetary policy is regulated by Federal Law No. 86 of June 27, 2002 “On the Central Bank”. Every year, before submitting the budget draft, the Central Bank prepares a document on the directions of monetary policy. As it is reviewed, the project may be adjusted and supplemented. The final version must be prepared before December 1 of the current year. The project reflects the concepts of the fundamentals of monetary policy, a description of the state of the country's economy, the results of the past period, and a forecast of developments for the next year. The calculations include oil prices, the volume of exported goods, inflation, the size of the money supply in circulation, the amount of gold reserves, etc.

In its draft, the Central Bank must clearly indicate a plan for future measures to stabilize the economy and implement an effective monetary policy. According to the latest project, the main directions of the Central Bank’s work are related to achieving sustainable growth, overcoming the consequences of the global crisis, reducing inflation, reducing the impact on the national currency exchange rate, but at the same time its volatility should remain under the control of the Central Bank.

Russia's monetary policy still has a number of imperfections, which is why financial difficulties constantly arise. The situation is also aggravated by the cyclical asymmetry of economic processes and their rapid change. While the state is using some methods to stimulate the economy, in reality others are required. The efforts of the Central Bank and the authorities are now aimed at solving these problems.

Aimed at controlling the exchange rate, inflation, employment, and stability of economic growth. Central banks are generally responsible for conducting monetary policy.

In world practice, depending on the stage of the economic cycle, monetary policy is aimed at stimulating or restraining processes. Thus, in the event of an increase in crisis phenomena, central banks reduce refinancing rates and the amount of required reserves, increase the money supply, and weaken the national currency in order to gain trading advantages in international markets. For example, the US Federal Reserve's discount rate for the summer of 2011 is close to zero, which indicates an attempt by regulators to stimulate the economy.

On the contrary, when the rate of economic growth is too fast, measures are taken to reduce the rate of economic growth in order to avoid collapses in the future. To achieve this, monetary policy becomes more stringent: first of all, measures are taken to increase interest rates. Operations are carried out to sterilize the money supply, that is, debt securities are issued in order to remove excess free financial resources from the market, etc. In addition, certain legislative restrictions may be introduced.

In Russia, monetary policy, according to Federal Law No. 86-FZ of June 27, 2002 “On the Central Bank of the Russian Federation (Bank of Russia)”, is determined and carried out by the Central Bank.

The law defines the main tools and methods that can be used:

1) interest rates on Bank of Russia operations;

6) establishing guidelines for the growth of the money supply;

7) direct quantitative restrictions;

8) issue of bonds on its own behalf.

Every year, the Bank of Russia, before the government submits a draft budget for the next year to the State Duma, prepares a document called “Draft of the main directions of the unified state monetary policy.” The final version must be prepared by December 1st.

The “Main Directions” should reflect the conceptual principles underlying monetary policy and a brief description of the state of the economy of the Russian Federation. As well as the results of the past year, a scenario forecast for the development of the Russian economy for the coming year, indicating prices for oil and other Russian exports, targets, inflation indicators, monetary base, money supply, interest rates, changes in gold and foreign exchange reserves.

In addition, the document must contain an action plan of the Bank of Russia for the coming year to improve the banking system of the Russian Federation, banking supervision, financial markets and the payment system.

Currently, the “Main Directions of State Monetary Policy for 2011 and the period of 2012 and 2013” are in effect. According to this document, the main tasks are “overcoming the consequences of the global financial crisis”, “keeping inflation at the level of 5-7%” and “entering a sustainable growth path”.

In quantitative terms, the Central Bank of the Russian Federation plans the following indicators. Inflation: 5.5–6.5% in 2011, 4.5–5.5% in 2012 and 4–5% in 2012. Money supply growth (M2 aggregate according to the Bank of Russia): in 2011 – 11–23%, in 2012 – 14–20%, in 2013 – 13–17%. In addition, the plan reflects the Bank of Russia’s desire to reduce its influence on the ruble exchange rate. At the same time, it is expected to direct the main efforts of the Central Bank to control the volatility of the national currency.

Monetary policy is associated with the regulation of the money supply in circulation. Implements the monetary policy of the Central Bank. The Central Bank regulates both cash and non-cash money circulation. Monetary policy is an effective tool in the fight against inflation.

Measures that the Central Bank uses to reduce the money supply in circulation: 1. monetary reforms, 2. Increase in interest rates on loans, 3. Increasing the reserves that banks must keep in the Central Bank. Operations to increase the amount of money in circulation: 1. Introduction of new banknotes (for example, a 5000 ruble bill)2. Reduction of interest on loans, 3. Reducing the size of bank reserves that must be kept in the Central Bank. The instruments at its disposal implement the goals of monetary policy, the main types of which are maintaining the money supply at a certain level (tight monetary policy) or interest rates (flexible monetary policy). Tight policy involves maintaining the monetary base in line with the target money supply. Flexible monetary policy corresponds to maintaining a certain target interest rate. In practice, some intermediate option is usually implemented.

The choice of monetary policy options depends largely on the reasons for changes in the demand for money. For example, if the increase in demand for money is associated with inflationary processes, a strict policy of maintaining the money supply would be appropriate. If it is necessary to protect the economy from unexpected changes in the velocity of money, then preference may be given to maintaining the interest rate.

The central bank cannot simultaneously fix the monetary system and the interest rate. To maintain a relatively stable rate when the demand for money increases, the bank will be forced to expand the supply of money and vice versa.

Monetary policy mechanism. There are usually four main parts of the monetary policy mechanism. These are: 1) a change in the value of the money supply; 2) change in interest rate; 3) the reaction of total expenses to the dynamics of the interest rate; 4) a change in output in response to changes in aggregate demand - aggregate expenditures.

Between a change in the money supply and the reaction of aggregate supply, there are two more intermediate links that provide an influence on the final result. The interest rate changes by changing the structure of assets of economic entities. For example, if the Central Bank expands the supply of money, then economic entities will have more money at their disposal. The consequence of this will be the purchase of non-monetary assets and a reduction in loan rates. But the reaction of the money market depends on the nature of demand. If the demand for money is sufficiently sensitive to changes in the interest rate, then the result of an increase in the money supply will be a slight change in the rate and vice versa. If the demand for money reacts weakly to the interest rate*, then an increase in the supply of money will lead to a significant drop in the rate. It is obvious that violations in any link of the mechanism can lead to a decrease in the effectiveness of monetary policy.

It should be borne in mind that monetary policy faces a number of restrictions, among which the following are often noted: 1) excess reserves resulting from the “cheap money” policy may not be used by banks to expand the supply of monetary resources; 2) a change in the money supply caused by monetary policy can be partially compensated by a change in the velocity of money; 3) the impact of monetary policy will weaken if the demand curve for money becomes flat and the demand curve for investment becomes steep; in addition, the demand curve for investment may shift without neutralizing monetary policy.

Trends in monetary policy. The main methods of monetary regulation in accordance with neo-Keynesian recommendations are: changing the official discount rate of the Central Bank; tightening or weakening direct restrictions on the volume of bank loans depending on the size of aggregate demand and employment, exchange rate and inflation levels; the use of transactions with government securities to stabilize their rates and reduce the price of government loans.

The fundamental difference between the technique of monetary control based on the monetarist approach was the introduction of quantitative regulatory guidelines, the change of which also determines a change in the direction of monetary policy. The choice of one or another indicator as a guideline for monetary policy began to determine both the main objects and the technique of monetary control. Such indicators can be both the total money supply and its individual aggregates.

Government bodies of countries with market economies have recently increasingly focused on “policy for the development of competition” in the banking sector, stimulate competition, and take measures against anti-competitive cooperation. In many countries, domestic and international financial markets are being liberalized, controls over interest rates of commercial banks, and restrictions on banks on conducting transactions in the securities markets and on other types of financial activities are being abolished. Wide access of foreign banks to local markets is often seen as essential to improving the efficiency of the banking sector.

More on topic 40. monetary policy:

- 1.1. Monetary regulation and monetary policy

- 7.2.Monetary policy.\r\nMethods of monetary regulation

- The Central Bank, its tasks and functions. Monetary policy of the Central Bank

- Copyright - Advocacy - Administrative law - Administrative process - Antimonopoly and competition law - Arbitration (economic) process - Audit - Banking system - Banking law - Business - Accounting - Property law - State law and administration - Civil law and process - Monetary law circulation, finance and credit - Money - Diplomatic and consular law - Contract law - Housing law - Land law - Electoral law - Investment law - Information law - Enforcement proceedings - History of state and law - History of political and legal doctrines - Competition law - Constitutional law - Corporate law - Forensic science - Criminology -